- Oh dear! Ethereum’s appetite for risk has taken a nosedive, signaling a cautious market and a snail’s pace ahead.

- The Bybit hack? A mere tickle on the nose, overshadowed by the grand circus of market shenanigans!

Ethereum’s [ETH] resilience is being put to the test, like a tightrope walker on a windy day, as the whispers of the Bybit hack send ripples through the market pond.

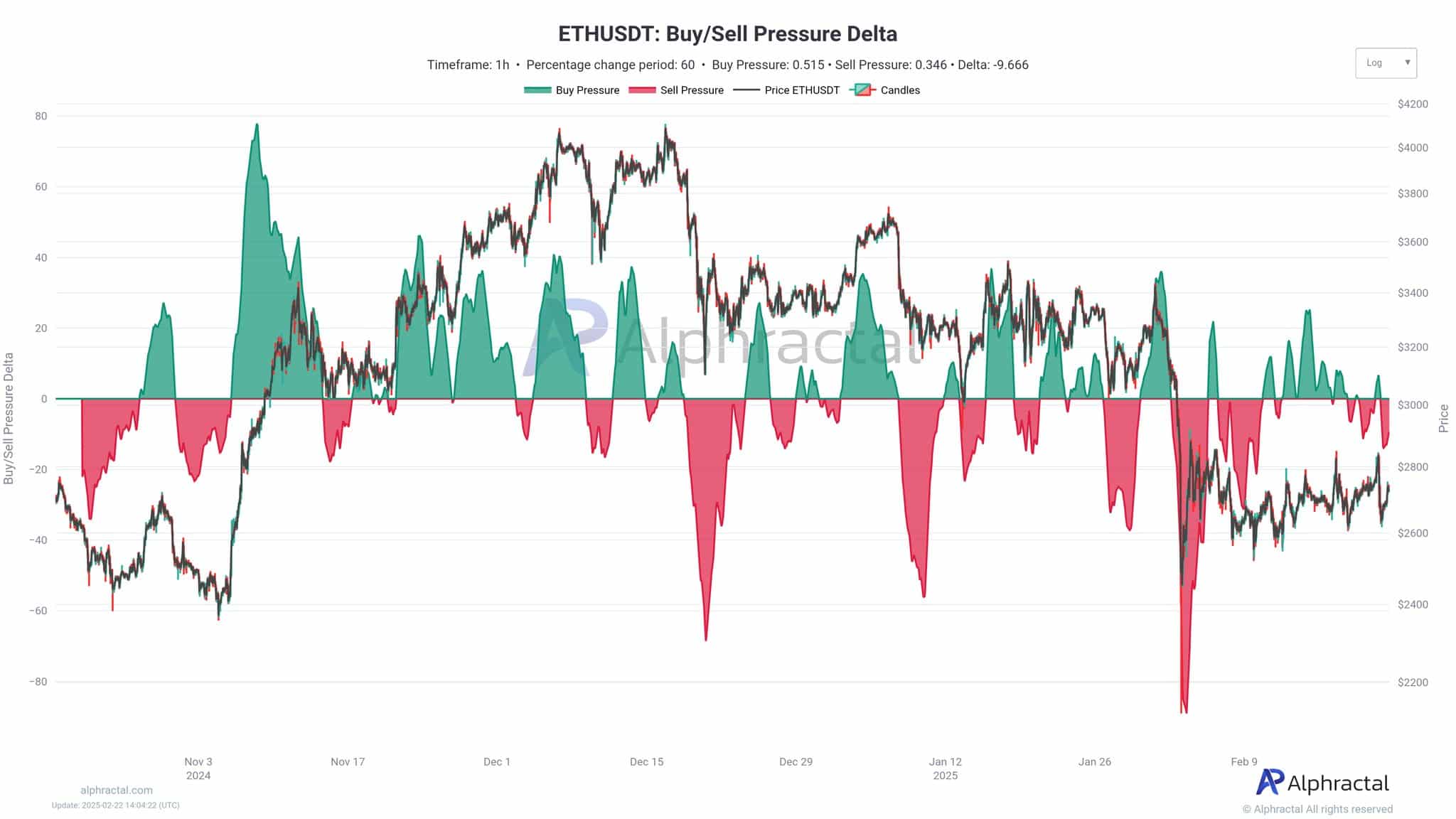

Surprisingly, the sell-off that followed this potential security breach was as impactful as a feather landing on a marshmallow, far less than the dramatic plunge on the 3rd of February, which still looms large like a grumpy giant despite its mysterious origins.

But wait! Beneath these short-lived ups and downs, a more serious concern is brewing: Ethereum’s risk appetite has been on a steady diet of caution since March 2024. Yikes!

While this newfound caution might mean fewer liquidations and a chance for accumulation, it also spells a sluggish market. With ETH teetering around crucial levels, one must wonder: can it hold its ground or will it tumble into the abyss of uncertainty?

The Bybit hack: A blip in the grand scheme?

Despite the hullabaloo over the Bybit hack, data suggests that ETH’s sharpest declines in recent months were more about the market’s mood swings than any single event. Talk about drama!

There was a notable price drop in late January and early February, long before the hack made its grand entrance. How rude!

The sell-off on the 3rd of February, which was more severe than the hack’s impact, is a clear sign of deeper liquidity issues and a market that’s as moody as a cat on a rainy day.

With risk appetite dwindling since March 2024, Ethereum is seeing less action from leveraged traders. While this might mean fewer liquidations, ETH’s sluggish recovery is like watching paint dry—oh, the suspense!

Ethereum: Is the declining risk a cause for concern?

Ethereum’s risk appetite has been on a downward spiral since March 2024, reflecting a broader shift in sentiment. The NRM chart shows a clear downtrend—investors are becoming as cautious as a cat near a dog park.

Historically, a higher risk appetite led to speculative surges, but now the market feels more like a sleepy tortoise than a racing hare.

Regulatory uncertainty and a drop in leveraged participation have added to this trend, making the market feel like a game of musical chairs—who will be left standing?

While lower risk metrics might reduce volatility and create a more stable environment, they also dampen the potential for explosive price movements. Boring!

Unless risk appetite makes a comeback, Ethereum may continue to waddle along in a more controlled and less speculative manner.

The risk-reward paradox

As Ethereum’s risk appetite wanes, the market enters a phase of reduced volatility and fewer liquidations. Yawn!

This stability could encourage long-term accumulation but may also lead to stagnation, as price appreciation slows without the thrill of speculative momentum. Snooze fest!

Historically, lower Sharpe Ratios have coincided with sideways movement, requiring patience from investors. Patience? What’s that?

If Ethereum’s risk-adjusted returns remain as flat as a pancake, the market could face an extended accumulation phase instead of an imminent breakout. Oh, the agony!

Ethereum: The battle of supply and demand

Ethereum’s price is increasingly influenced by institutional inflows, retail sentiment, and regulatory developments. It’s like a soap opera!

BlackRock’s recent $3.6 billion investment signals institutional confidence, potentially stabilizing prices and boosting adoption. Hooray!

Meanwhile, retail sentiment remains divided, with some accumulating on dips and others tiptoeing around due to

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-02-24 01:16