🚨 Ethereum‘s Darkest Hour? 🤔

- Oh, Ethereum, how the mighty have fallen! 🤦♂️ A 55% plummet in 14 months, amidst a relentless sell-side onslaught.

- And yet, the $1,800 support level stands firm, a beacon of hope amidst bearish sentiment and price volatility 🙏

The Plot Thickens 📊

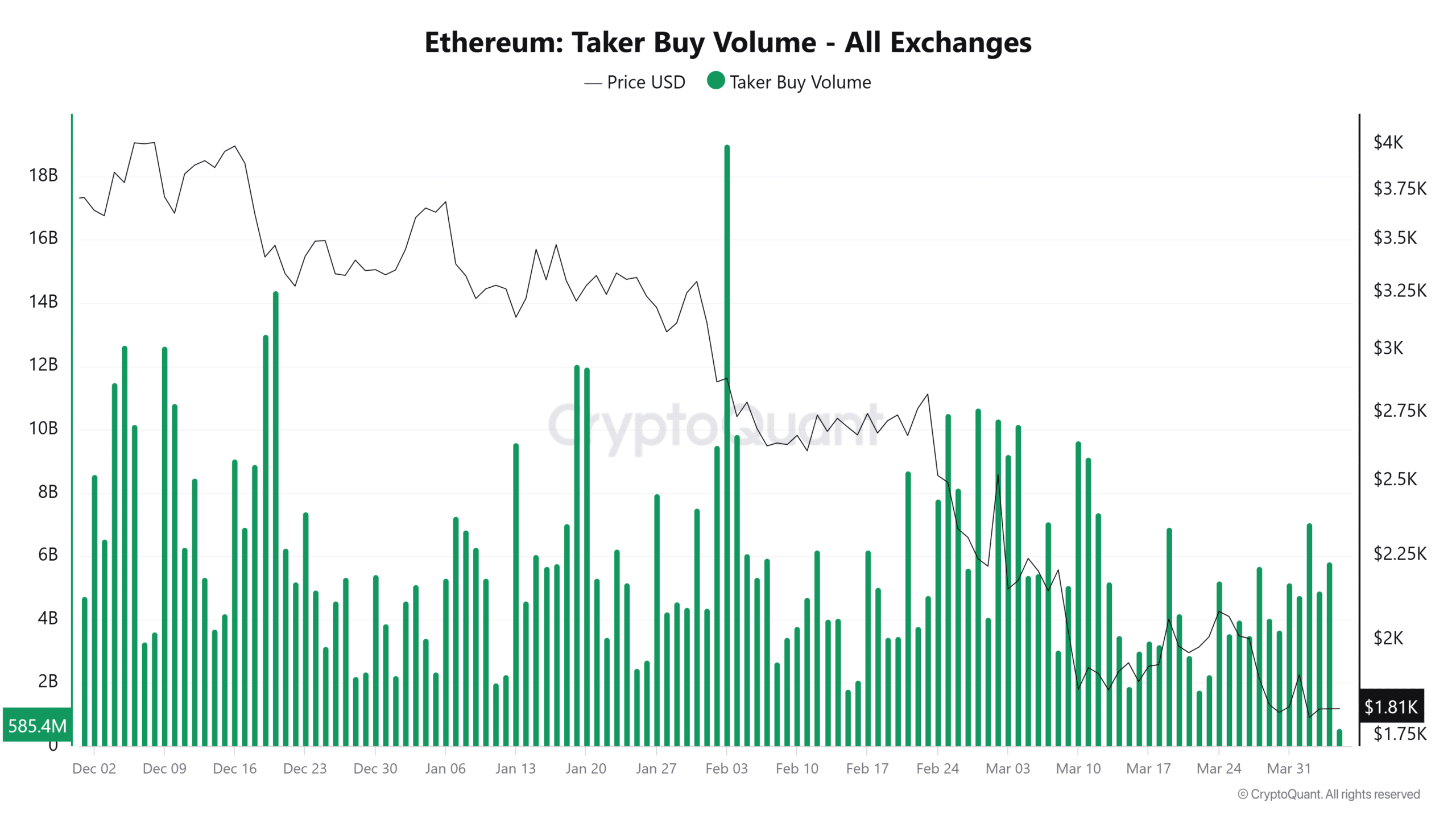

Between December 2024 and April 2025, Ethereum’s Taker Buy Volume experienced erratic yet significant surges 🚀.

Witness the $19 billion spike on February 3rd, as ETH hovered around $2,882.93 🤑. Alas, the price didn’t rally, but buyers valiantly attempted to absorb the sell-side pressure 🛡️

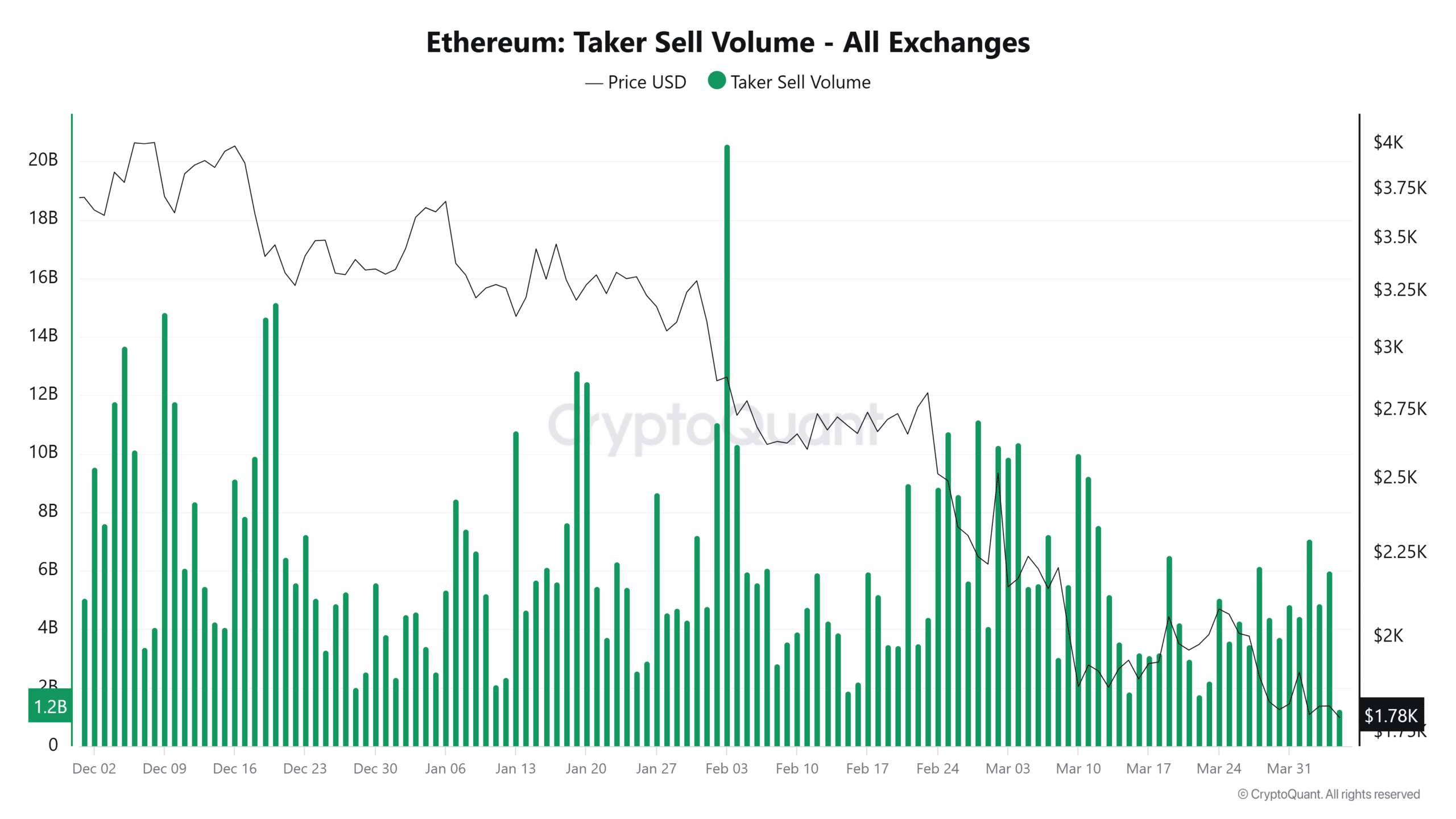

Meanwhile, Taker Sell Volume has been tapering down 📉.

Sell volumes plummeted from $601.6 million in December to a mere $4 billion by April 1st 📆, indicating a decline in panic-driven sell-offs 😌

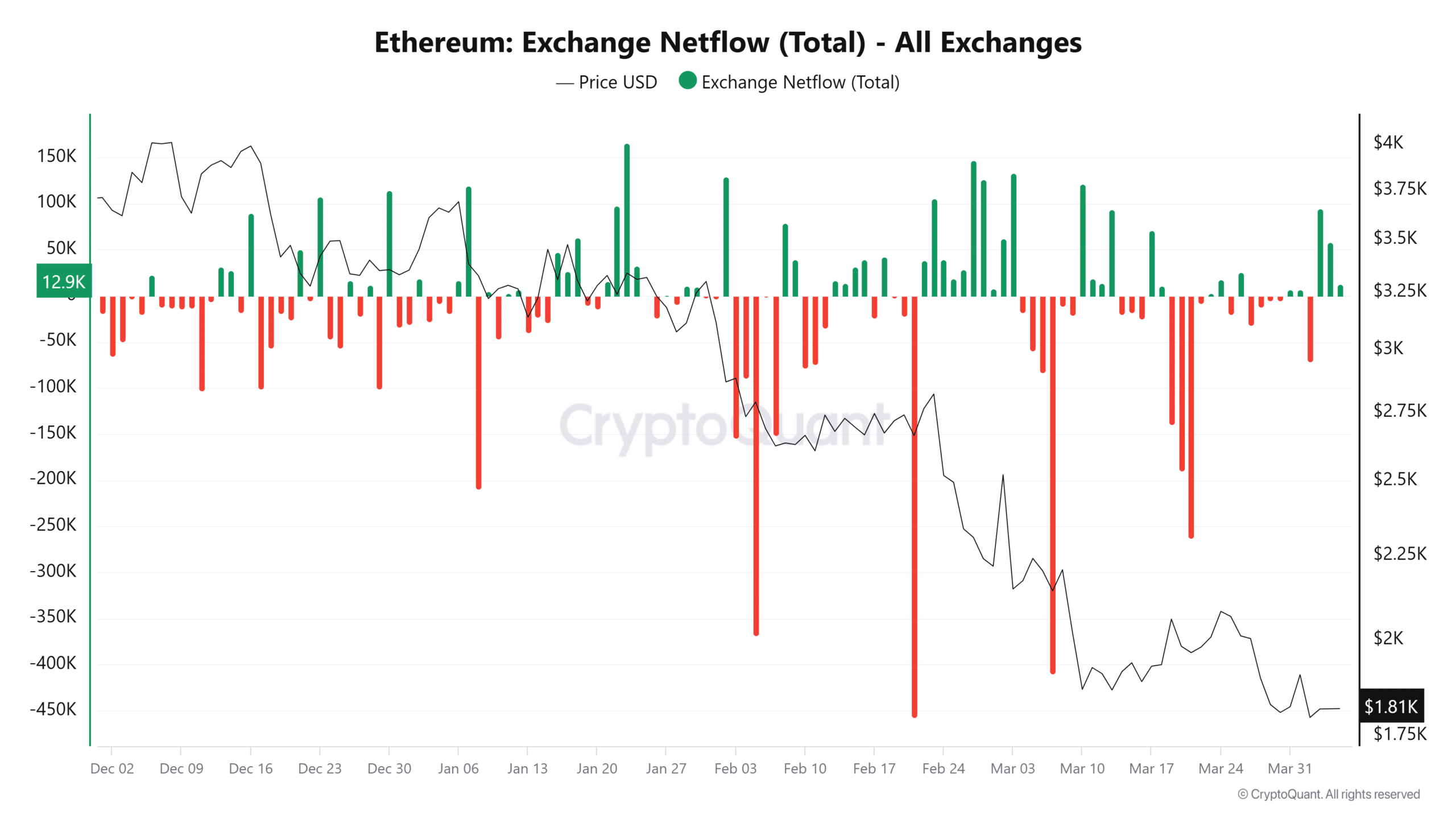

And, if you will, behold Ethereum’s exchange netflows, providing additional insight into shifting market dynamics 🔍.

From December to March, as ETH tumbled 45%, withdrawals from exchanges increased 📈. A notable exception, however, occurred on March 10th, with 120,900 ETH flowing in, likely representing short-term traders liquidating 📉

Accumulation: The Silver Lining 🌫️

Technically, Ethereum remains mired in a downtrend 📉. Price action clings to the underside of its Simple Moving Average (SMA), dynamic resistance since January 2025 📊

Failed rallies to $2,700 in February and $2,000 in March demonstrate persistent overhead pressure 🚫. Yet, there’s a twist 🤔

Ethereum has consistently held the $1,800 support zone, with each rebound indicating sellers may be losing momentum, rather than gaining steam 🔴

The flattening OBV, exchange outflows, and cooling taker sell volume suggest $1,800 might be developing into a critical accumulation zone 🌀. Reclaiming $2,000–$2,200 could signal a trend reversal 🔄. For now, $1,800 remains the central battleground, poised between bearish continuation and bullish buildup 🤺

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2025-04-06 08:10