- DEX trading volume’s drop signaled declining activity, but growing unique addresses hinted at potential re-engagement

- On-chain indicators such as the MVRV ratio and SOPR suggested Ethereum may be undervalued

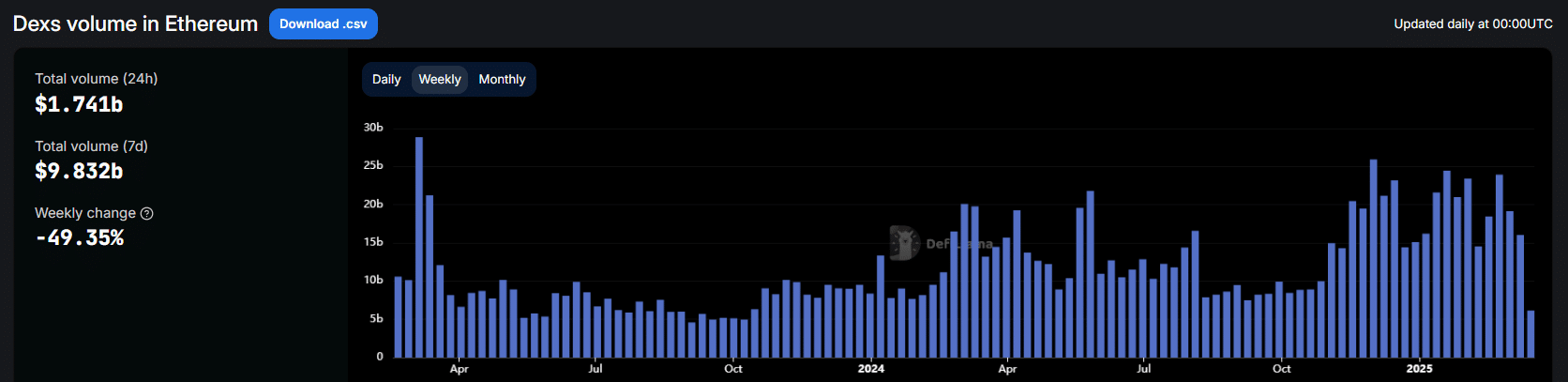

Ethereum DEX volumes drop 50% in a week

Ah, Ethereum’s DEX market, once a bustling bazaar of digital coinage, has taken a sharp turn for the worse, with trading volumes plummeting by nearly 50%. It’s like watching a balloon deflate, only with more numbers and less fun.

In the past month alone, the decline has been as steep as a mountain goat on roller skates, with total volume nosediving from a staggering $86.02 billion in January to a mere $14.54 billion in February. That’s an 83% reduction in activity, or as we like to call it, a “whoopsie-daisy” moment.

This fall in trading interest is a sign of weakening engagement, raising eyebrows and perhaps a few cups of tea about Ethereum’s broader market participation. 🧐

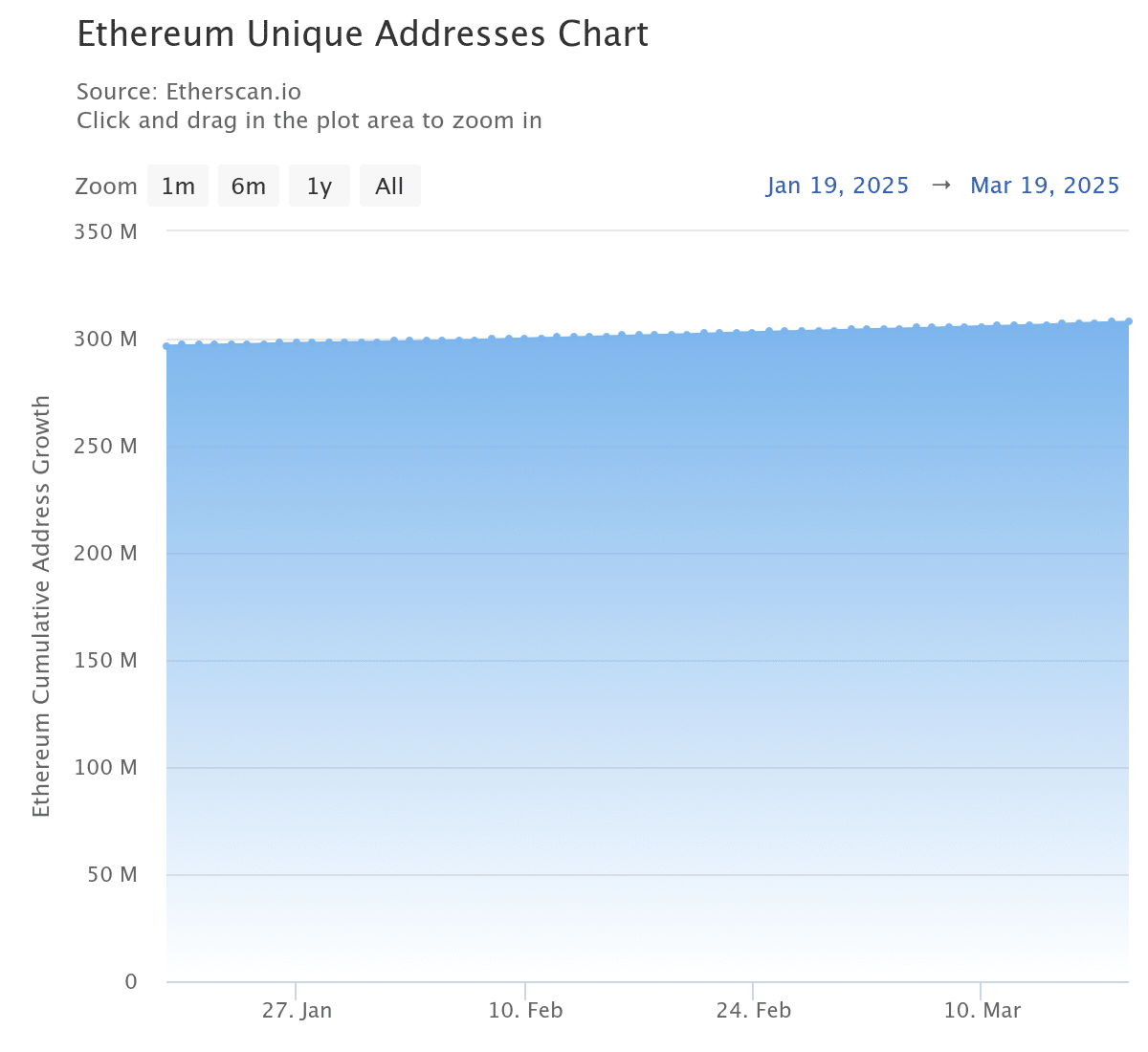

But wait! Despite this decline, Ethereum’s unique address count has been growing like weeds in a garden, increasing by 11.93% from January to March. It seems new users are entering the network, while the old-timers are off somewhere, perhaps knitting or contemplating the meaning of life.

This trend suggests that while new users are joining the party, the veterans might be opting for a quieter evening in, perhaps shifting towards holding or staking rather than active trading. Who can blame them? Sometimes it’s nice to just sit back and watch the chaos unfold.

To understand this better, we need to examine the data further, preferably with a cup of tea in hand.

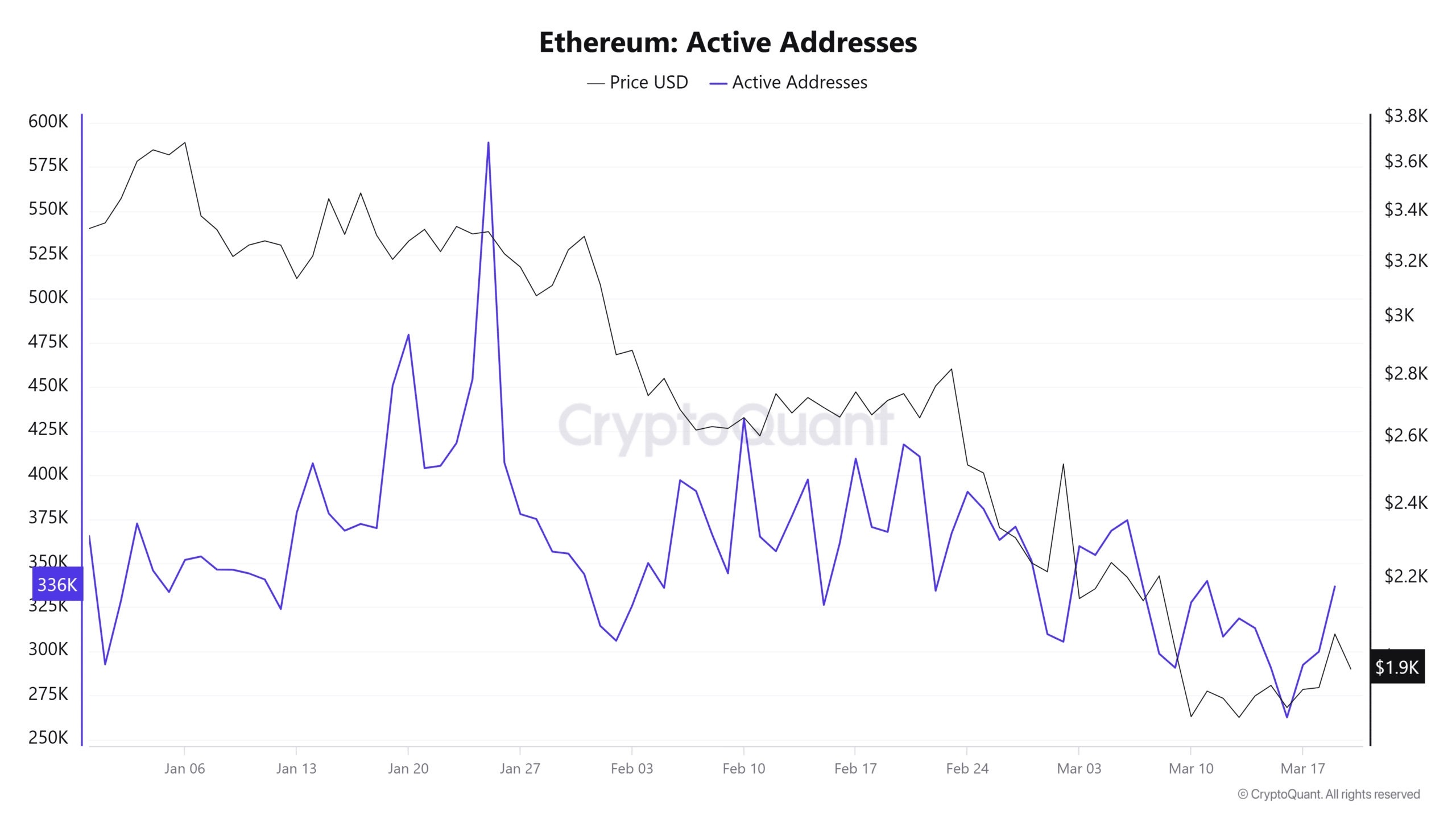

Fewer hands on deck – On-chain data signals a cooling market

Ethereum’s network activity has taken a nosedive, with active addresses dropping by 55.4% from 588,782 on January 25 to a mere 262,466 by March 16. It’s like a party where everyone suddenly remembers they left the oven on.

The price mirrored this decline, falling by 43.7% from $3,353 to $1,887. It’s a classic case of “what goes up must come down,” but with more drama and less gravity.

Historically, lower address activity can be interpreted as weaker demand, raising concerns over Ethereum’s ongoing downtrend. It’s like watching a slow-motion train wreck, but with more spreadsheets.

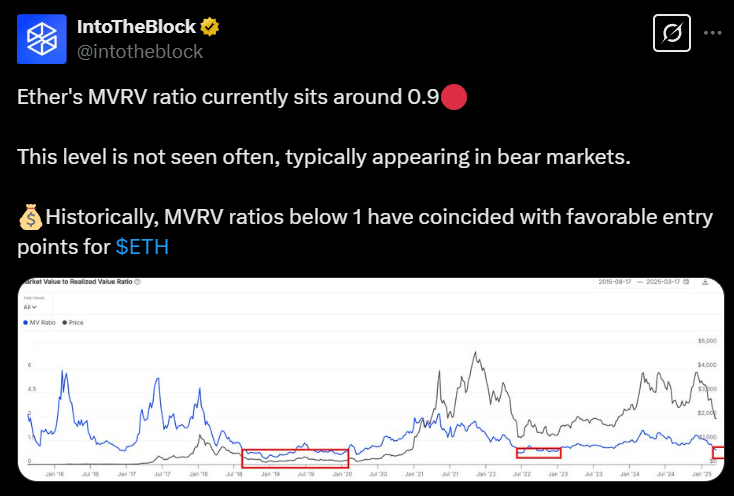

MVRV sounds the alarm – Is Ethereum undervalued?

Amid the declining network activity, Ethereum’s Market Value to Realized Value (MVRV) ratio has plummeted to 0.9 on the charts. It’s like finding out your favorite restaurant has suddenly decided to serve only tofu.

A ratio below 1.0 has historically signaled that Ethereum is undervalued. Previous occurrences of such levels have coincided with bear market bottoms. What does this mean? Well, it’s a bit like finding a penny in the couch cushions—unexpected but not entirely unwelcome.

Ethereum’s MVRV ratio dropped 30% from 1.32 in February, mirroring past market corrections in 2018, 2020, and 2022—periods that have preceded recoveries on the price charts. It’s like a rollercoaster ride, but without the safety harness.

Capitulation or a hidden accumulation play?

Another key metric,

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2025-03-21 10:37