- ETH appeared to be forming an inverse head-and-shoulders pattern, which often precedes a significant upward move.

- Selling pressure was steadily increasing, potentially delaying any price recovery.

Over the recent four weeks, the price of Ethereum [ETH] has experienced a setback, decreasing by approximately 12.08%. However, there was a brief recovery last week with an increase of around 2.69%, but this positive trend appears to be weakening now.

Considering the confluence of chart patterns and the prevailing market mood, as indicated by a surge in Ethereum deposits into exchanges, it seems plausible that the 0.35% drop experienced over the last 24 hours might continue to deepen.

A bullish pattern is emerging, but…

As per analyst Ali Charts’ analysis, Ethereum appears to be developing an inverted head-and-shoulders configuration on its daily chart. This structure comprises a left shoulder, a peak (the head), and a right shoulder.

A well-known optimistic chart pattern, the inverted head-and-shoulders, often indicates a phase of price stabilization followed by a substantial price increase.

As an analyst, I’m observing that Ethereum (ETH) is in the process of forming the right shoulder of a potential pattern. This right shoulder resembles the left one, with the price moving downward along a descending trendline. If this downward trajectory persists, Ethereum could potentially dip towards the $2,800 region.

At this stage, it could potentially stay put for up to 37 days, much like a frozen left shoulder, before eventually pushing past the descending resistance barrier.

Finishing off this trend may pave the way for Ether (ETH) to encounter its primary resistance level ranging from $3,850 to $4,100. If it manages to surpass this barrier, ETH could strive for a fresh record high, possibly breaching the $6,750 threshold, as suggested by the chart.

According to AMBCrypto, the current atmosphere indicates that Ethereum’s short-term potential for a price decrease is quite significant.

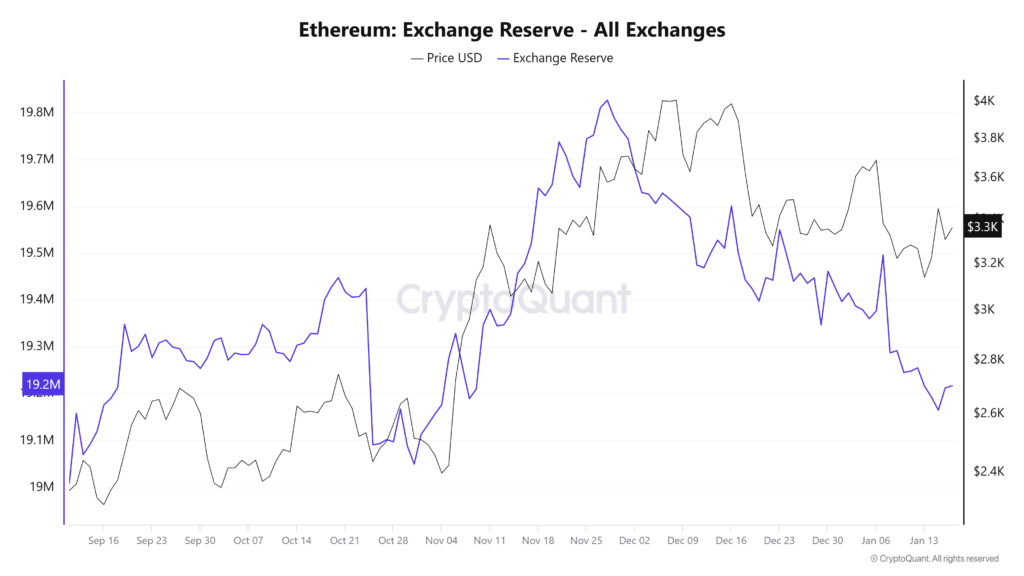

Rising exchange supply could trigger ETH’s decline

As a researcher studying the crypto market, I’ve noticed an ongoing trend: the growing availability of Ethereum (ETH) on cryptocurrency exchanges. This increase in supply raises questions about potential price impacts, as it might lead to increased selling and downward pressure on ETH prices.

On January 15th, there was a substantial rise in the Ethereum held on exchanges. The amount increased from around 19,164,848 ETH to 19,214,253 ETH at the time of reporting, equating to an additional 49,405 ETH.

An increase in assets held on exchanges often suggests that traders are building up to sell their possessions, as they might be gearing up for a sale.

As a cryptocurrency investor, I find the analysis of exchange netflow data incredibly valuable. This data helps me understand the balance between incoming and outgoing transactions on these platforms, which in turn informs my investment decisions based on whether money is flowing into or out of the market.

In the last day, about 47,761 Ether (ETH) was transferred into more wallets than out, signaling a possible rise in selling activity among traders. Such a pattern might lead to a decrease in ETH’s value.

If the selling pressure continues, it’s possible that Ethereum (ETH) might drop towards the $2,800 area, based on the trends shown in current chart analyses.

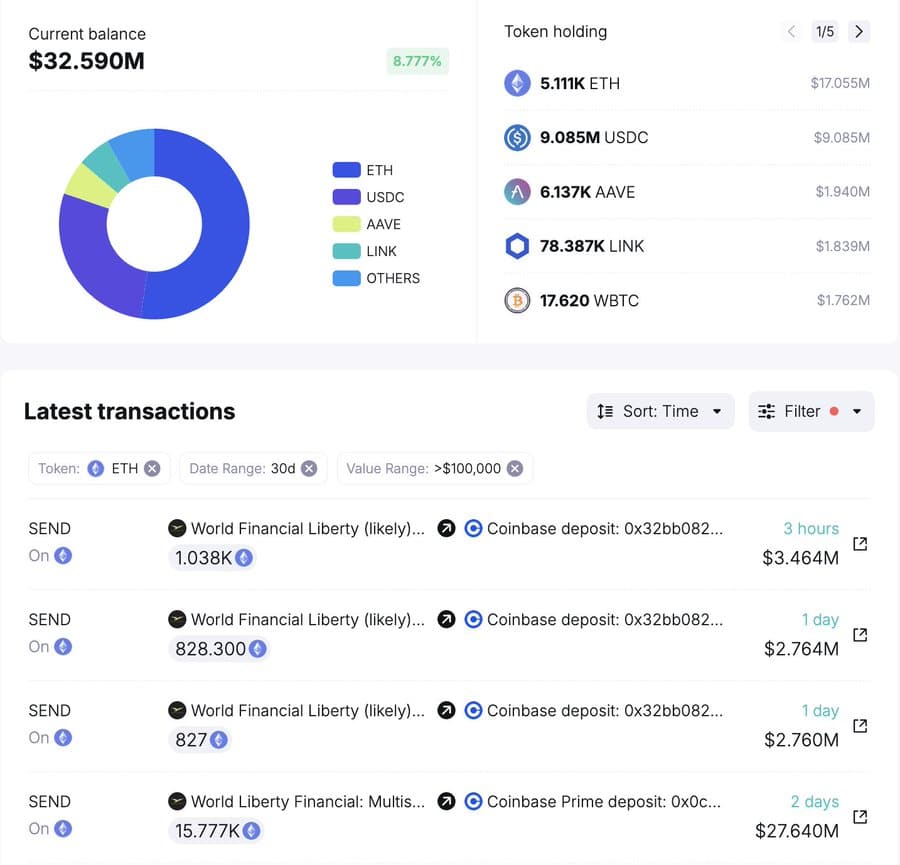

Institutional selling adds pressure

Major financial institutions have been adding to the increasing demand for selling Ethereum, with World Liberty Finance being at the forefront by moving a substantial quantity of Ethereum to trading platforms.

Recently, World Liberty Finance transferred 1,038 Ether (worth around 3.44 million dollars) into Coinbase, leaving them with a remaining Ether balance of roughly 5,111 Ether, which is equivalent to about 17.21 million dollars.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Over the last two days, there has been a significant deposit of 18,536 ETH into Coinbase by the same entity. This repeated transfer suggests a possible selling plan, which, if implemented, might increase the sell-pressure and potentially lower the value of ETH.

With institutions changing their strategies and the overall market mood being uncertain, it’s possible that the value of Ethereum may drop even more in the near future.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-17 16:08