Ah, mes amis! In this grand spectacle of tariffs and trade, our dear cryptocurrency market has taken quite the tumble! Ethereum (ETH), that illustrious second-born of the crypto family, teeters on the brink of a most unfortunate crash! 🎭

According to the wise sages at CoinMarketCap, our beloved ETH has shed nearly 25% of its value in a mere five days of trading! A veritable tragedy, I say! It has reached a level that could either be its salvation or its doom! 😬

Ethereum (ETH) Price Action and Technical Analysis

Upon scrutinizing the weekly chart, one cannot help but notice that our dear asset has lost its cherished support from the ascending trendline, a loyal companion since July 2022. Alas, what a betrayal! 😢

After this calamitous breakdown, ETH has been on a steady decline, losing two vital support levels at $2,200 and $1,830, and now finds itself at a precarious support level of $1,530. Oh, the drama! 🎭

Ethereum Price Prediction

According to the so-called experts, if this downward spiral does not cease, we may witness a crash of epic proportions! 📉

The daily chart reveals a dire warning: should ETH fail to cling to this support level and close a daily candle below $1,450, it could plummet another 30% to a dismal $1,000! Mon dieu! 😱

As the price continues its descent, ETH now languishes below the Exponential Moving Average (EMA) across all timeframes, signaling a most bearish trend. A tragedy worthy of a Shakespearean play! 🎭

Current Price Momentum

As we speak, ETH hovers around $1,550, having lost nearly 10.50% of its value in the last 24 hours. Yet, in a twist of fate, trading volume has surged by a staggering 550%! Traders and investors are flocking like moths to a flame! 🔥

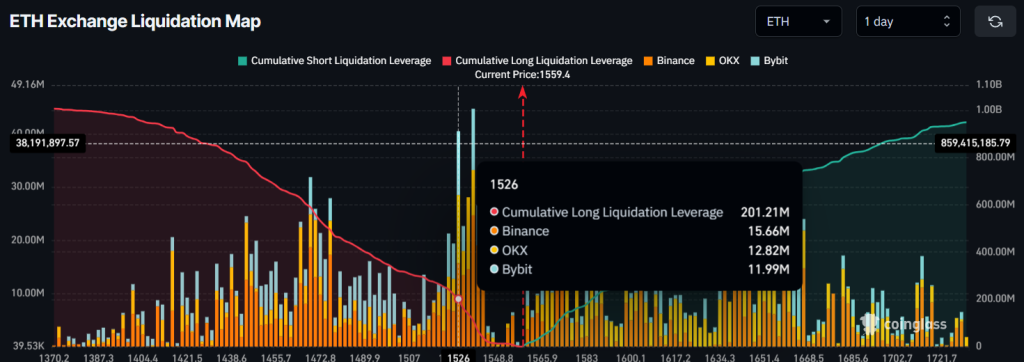

$200 Million Worth of Bullish Bet

This remarkable surge in trading volume includes the liquidation of both short and long positions, a veritable dance of investors accumulating or selling off their ETH! 💃

Despite the catastrophic price drop, traders remain optimistic, placing their bets on the bullish side, as reported by the oracle of on-chain analytics, Coinglass. What folly! 😂

Data reveals that traders are currently over-leveraged at the $1,526 support level, having amassed a staggering $201 million in long positions. Meanwhile, at $1,571, another over-leveraged level, traders have built $100 million in short positions. What a tangled web we weave! 🕸️

As we ponder these levels and the positions of our dear traders, it appears the bulls are currently in charge, poised to liquidate $100 million worth of short positions. Yet, should the market sentiment remain unchanged, we may witness the liquidation of long positions as well! Quelle surprise! 🎭

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2025-04-07 20:52