-

The percent of ETH supply on exchanges has dropped to an eight-year low.

ETH rebounded from its decline in the previous trading session.

As a seasoned crypto investor with a keen interest in Ethereum [ETH], I’ve witnessed the ebb and flow of market trends for years. The recent decline in ETH’s price, coupled with the significant decrease in its supply on exchanges, has piqued my attention.

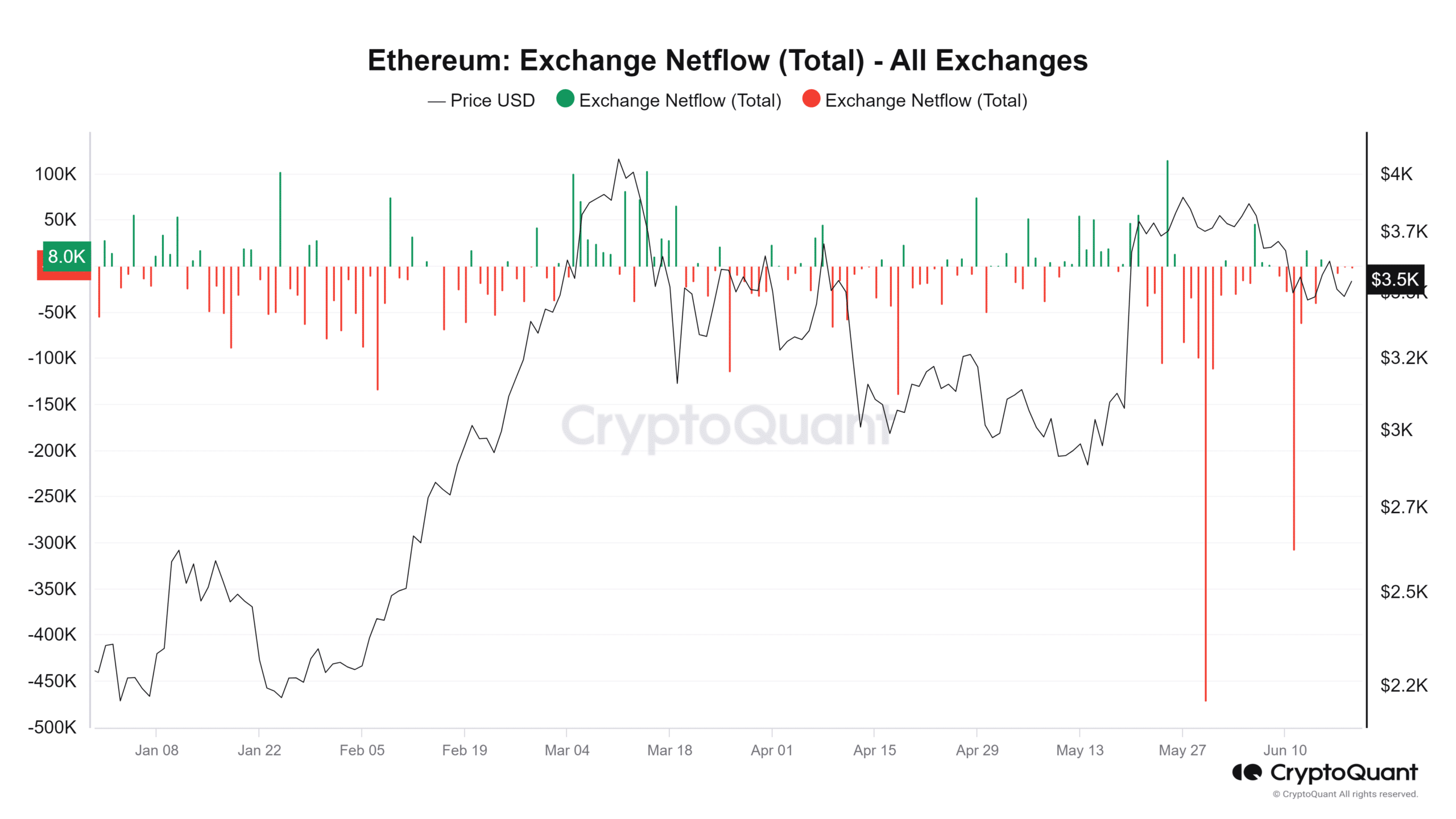

In recent days, both the value of Ethereum [ETH] on exchanges and its price have dropped. This downward trend is consistent with Ethereum’s netflow data, which has shown a preponderance of outflows in the last several days.

What percentage of ETH is left on exchanges?

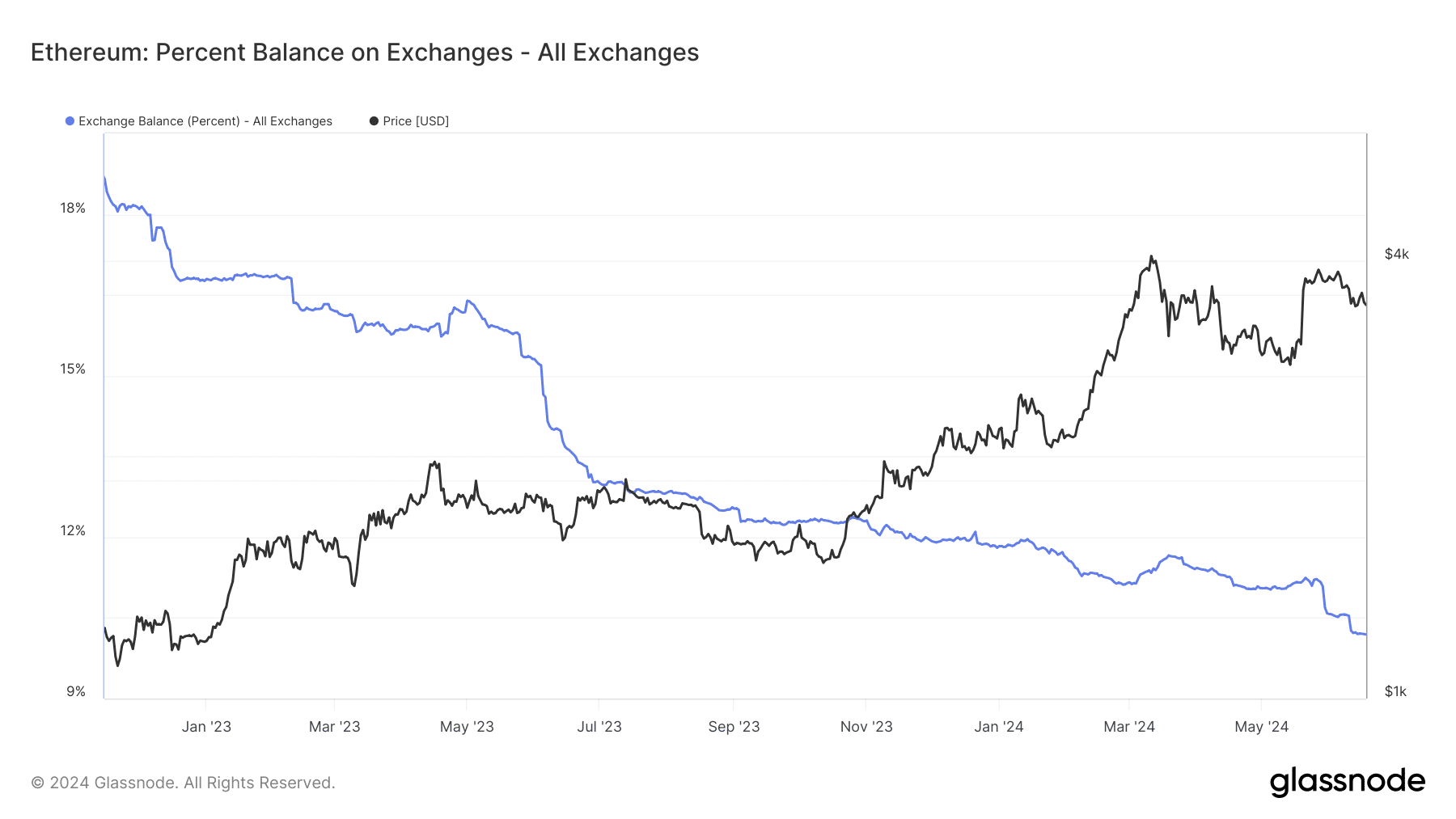

Over the last several weeks, the amount of Ethereum held on exchanges has noticeably decreased, with a more significant reduction occurring toward the end of the preceding month.

An analysis of the chart on Glassnode showed that it recently declined to around 10.19%.

Analysis showed this was the lowest percentage supply on exchanges in about eight years.

An analysis of the data revealed that the Ethereum supply had not been this low since 2016. This decrease suggests that Ethereum investors holding the cryptocurrency on exchanges have withdrawn their holdings.

A reduction in Ethereum (ETH) supply availability over the past few weeks is a promising indicator. This decrease may signal lessened selling activity and potentially growing hoarding by investors.

More Ethereum leave exchanges

In the recent past, there has been a noticeable trend of Ethereum leaving exchanges at a faster rate than entering them. The current net flow stands at a significant deficit of 1,481 Ethereum, signifying a higher volume of outgoing transactions compared to incoming ones.

The ongoing Netflow pattern matches the exchange imbalance, reflecting a decrease in Ethereum holdings across all trading platforms.

Analyzing the ETH price trend

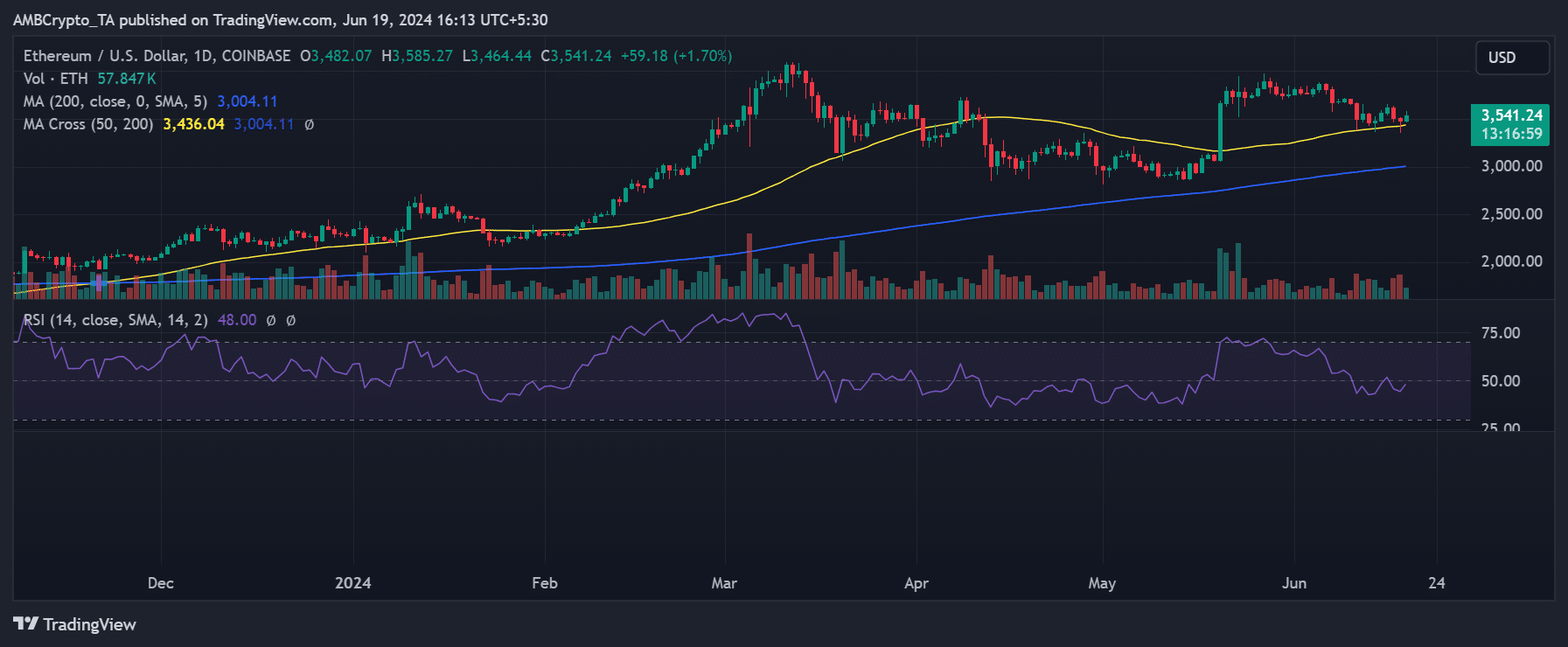

At present, Ethereum is priced roughly at $3,540 in the markets, representing a nearly 1.7% rise compared to before. Upon examining its chart for the day, there’s been noticeable progress since the last trading period.

Read Ethereum’s [ETH] Price Prediction 2024-2025

In my previous analysis, I noted that the price had dipped to $3,400 during the last session, representing a decrease of under 1% compared to the previous price. Following this, there was yet another decline observed in the session prior to the one I just analyzed.

Moreover, the Ethereum RSI analysis, based on charts, signaled a favorable shift. Its Relative Strength Index was approaching the neutral mark, implying that the downward trend may be losing momentum at present.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-20 06:15