Is Ethereum About to Pull a 2017? You Won’t Believe What the Whales Are Up To! 🐋💰

- Ethereum’s price action is doing a rather splendid impression of the 2016/17 pattern that led to a rally.

- The whales, those mysterious sea creatures of the crypto ocean, have been buying 1.10 million Ethereum. Do they know something we don’t? Is a rally on the cards, or are they just hoarding for a rainy day?

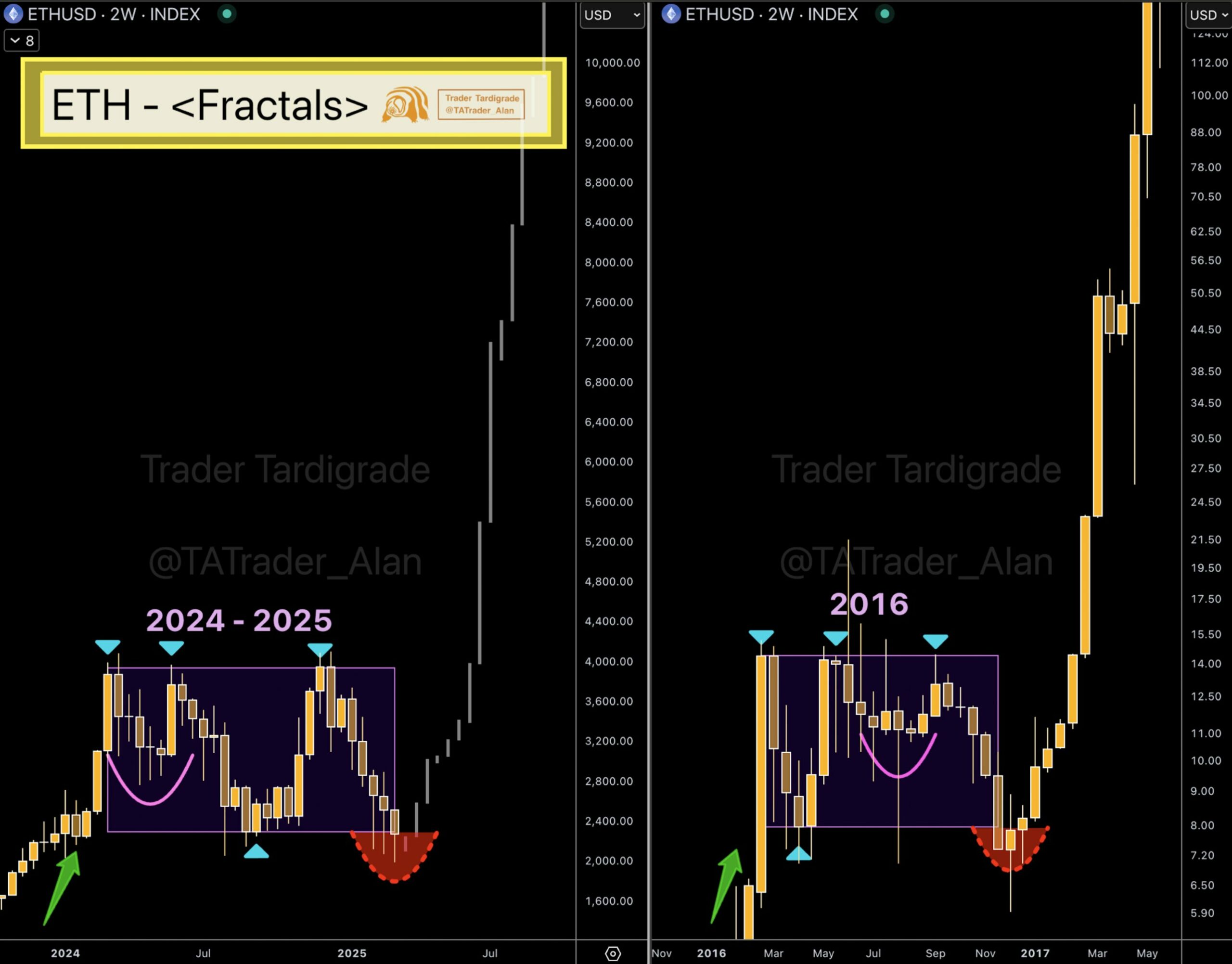

Now, dear reader, let us cast our eyes upon the Ethereum [ETH] price charts of yesteryear—specifically, 2016 and the upcoming 2024-2025. What do we see? A rather intriguing fractal pattern, suggesting a potential rally that could make 2017 look like a mere warm-up act. The price trend back in 2016 was a veritable rollercoaster of lows and highs, culminating in a dramatic spike that had everyone clutching their pearls.

Fast forward to the present, and Ethereum is strutting its stuff with a similar pattern, complete with large price movements and a breakdown that could precede a surge worthy of a standing ovation. In early 2024, ETH took a nosedive to around $2,400, only to bounce back to approximately $4,000. It now finds itself retesting the $2,400 support level, like a contestant on a game show hoping for a second chance.

This fractal pattern, my friends, suggests that if ETH decides to play nice and mirror its historical behavior, the $2,400 support could very well ignite a new bull run. However, should it fail to hold this support, we might witness another round of declines, reminiscent of the sharp short-term sell-offs that had us all reaching for the smelling salts during the previous cycle.

The total move from the 2024 low to the current high is a gain of over $2,000 per ETH. This recent phenomenon of bouncing back from steep drops might be a sign of strength, provided the support levels can withstand the market’s inevitable tantrums.

Considering these trends, Ethereum appears to be gearing up to replicate the price increases reminiscent of its 2017 to late 2016 rally. But, as with all things in life, if the trend is not sustained, we can expect a reversal situation with potential dips that would make even the most stoic investor weep.

How whales could fuel ETH pattern completion?

Now, let’s talk about our aquatic friends—the whales. These behemoths of the crypto sea have been quite active lately, collectively purchasing a staggering 1.10 million ETH. This flurry of activity coincided with a sharp price drop, followed by a quick recovery that had everyone scratching their heads.

Between the 25th of February and the 4th of March, ETH’s price took a tumble to $2,184 before rebounding to approximately $2,284. This whale accumulation may signal that they are anticipating a market rally, or perhaps they just fancy a bit of retail therapy.

Historically, such large-scale buying by market movers often precedes rallies, as they may have access to advanced market analysis tools or insights that would make even the most seasoned analyst green with envy.

Conversely, if these whales decide to reverse their buying spree and start selling, it could create downward pressure that would send prices plummeting faster than a lead balloon. However, if ETH holds steady at its recent rebound level and the whales continue their accumulation, it may signal the start of a bull trend that would have us all dancing in the streets.

On the other hand, a drop below the recent low would confirm bearish sentiment, likely leading to further price declines that would have even the most optimistic investor reaching for the nearest exit. The market is at a critical juncture, and Ethereum’s next move will play a key role in shaping short-term price action. Buckle up, folks; it’s going to be a bumpy ride!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-03-08 07:14