-

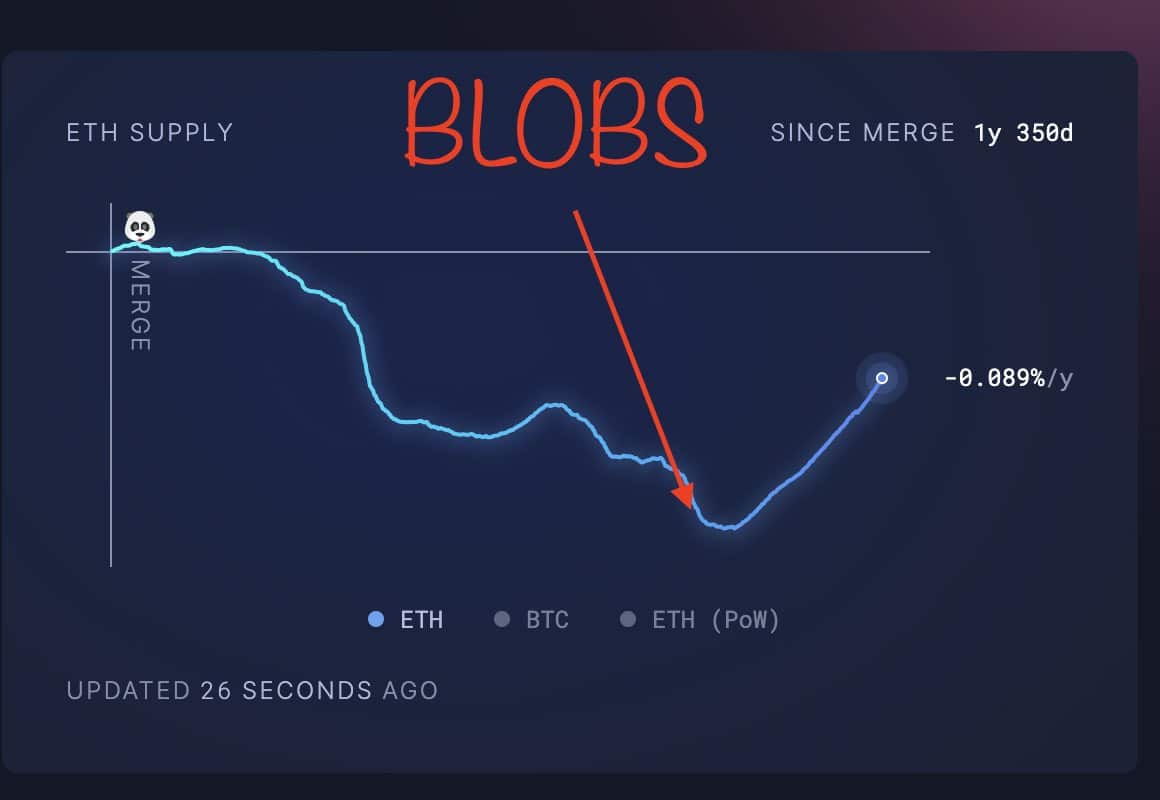

ETH’s inflation remains elevated after the implementation of the blobs in March

Analysts are divided on how to address inflation with the low-cost blobs

As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen countless ups and downs in this dynamic market. The current state of Ethereum [ETH] intrigues me, particularly the inflation issue following the implementation of blobs back in March.

Experts and those in the know are advocating for adjusting the existing structure of Ethereum [ETH], aimed at reducing inflation and enabling the second-largest altcoin to accumulate worth for its layer 2 solutions.

Originally admired for enhancing efficiency and reducing transaction costs within the system, Ethereum’s scalability solutions (L2s) are currently under review due to rising Ether inflation. In fact, analyst Cygaar suggests that the balance between ETH and L2s is skewed at present.

Currently, the balance between Ethereum L1 and its Layer 2s is somewhat skewed. Layer 2 solutions mainly enjoy the protection provided by Ethereum’s security but do not contribute significantly to the value of Ethereum.

The problem with Ethereum blobs

Prior to the introduction of blobs, L2s (Layer 2 solutions) were significant consumers of Ethereum transaction fees, which in turn resulted in a high burn rate due to their heavy gas usage. This burn rate essentially destroyed a portion of the generated ETH, making the overall effect deflationary on the Ethereum network.

Despite blobs performing numerous transactions on Layer 2 networks, which are generally less costly, this has led to a decrease in gas usage on Layer 1. This reduction in gas consumption, in turn, has impacted the burn rate of ETH. Given the reduced ETH burn rate, the asset that was previously deflationary has become inflationary since the introduction of blobs in March 2024.

Owing to the same, Cygaar suggested increasing blob fees in the short term.

“A potential quick fix might involve raising the base transaction fee. L2 systems should be required to contribute a portion of this fee when using Ethereum’s decentralized network…I believe that those chains aiming to truly adopt Ethereum’s security will still shoulder these costs.”

He added that increasing L2 usage could hike the ETH burn rate and help achieve deflationary status in the long run.

If the need and use of Second Language (L2) rise significantly, it could potentially lead us to a point where the Blob Pricing Curve accurately values Data Access (DA) blobs in Ethereum (ETH). This situation might result in an optimal amount of ETH being destroyed on Layer 1 (L1), fostering a healthy ecosystem.

However, on the contrary, the likes of Ethereum community member Ryan Berckmans sees no need to decide on the situation just yet. He claimed,

In simpler terms, we’re just starting out with blobspace and its L2 development – it’s essentially the early stages of launch. The data on L2 growth is impressive, suggesting it will eventually reach a point where blobspace becomes saturated. This saturation could potentially generate substantial income for L1.

Berckmans noted that an influx in requests for blob storage would accelerate the consumption rate and charges on the L1 layer.

In response to speculation, Doug Colkitt, founder of Ambient Finance, expressed caution about the idea that an uptick in blob space demand would boost the Ethereum burning rate significantly. He supported his stance by pointing out the prevalence of small transactions in the lower layers (L2s).

“Unfortunately, blob saturation is unlikely to lead to any meaningful increase in Ethereum burn.”

Introduced just five months ago, these low-cost data availability blobs have sparked some debate. Some, like Berckmans, argue that suggesting changes so soon might be premature. On the contrary, others think it’s crucial to address ETH‘s inflationary nature immediately.

Whether the community will reach a consensus on the way forward remains to be seen.

For now, Ethereum (ETH) is finding it tough to stay above the $2,500 mark. At the moment of writing, Ethereum had dropped by about 38% since its introduction in March.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-09-02 02:16