- Ethereum rebounded and reclaimed a previous support of $3.5k on the charts

- Will positive seasonality trends in January extend ETH’s recovery?

As a seasoned crypto investor with a knack for recognizing market trends and patterns, I find myself quite optimistic about Ethereum’s [ETH] current trajectory. The recent rebound and reclamation of the $3.5k support is a bullish sign that could potentially extend ETH’s recovery.

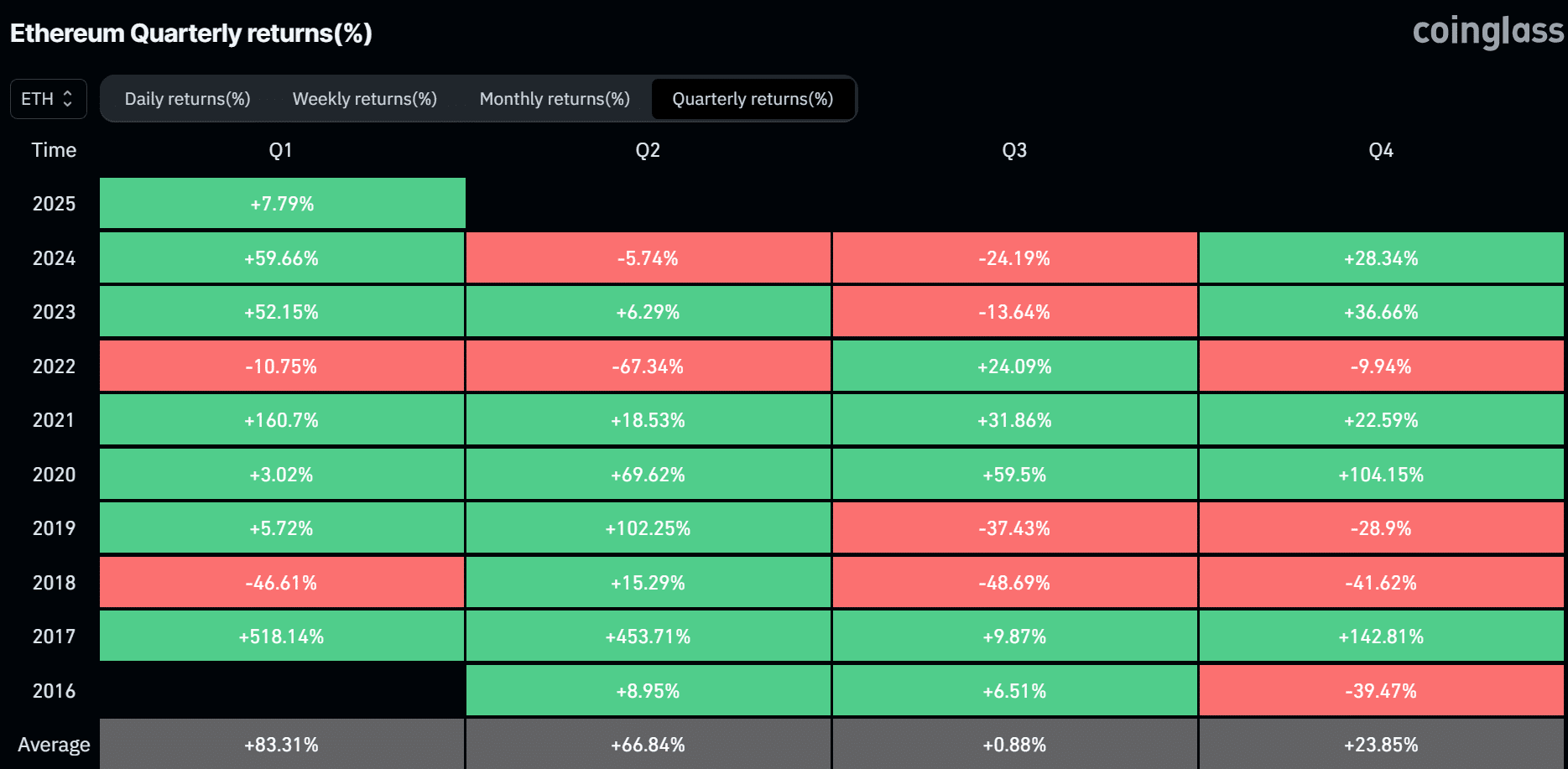

The positive seasonality trends in January have historically been strong for Ethereum, with Q1 averaging 83% gains. If history repeats itself, we might be witnessing explosive growth in the coming days. However, I always remind myself that past performance is no guarantee of future results – it’s just a statistical tendency.

The immediate bullish targets seem to be the mid-range of $3.8K and the upper channel of $4k. If ETH manages to break above these levels, we could potentially see even higher prices. But as always, I keep a close eye on the 20-day, 50-day, and 100-day EMAs for any potential bearish signs.

On a lighter note, let’s not forget that the crypto market is known for its volatility – it’s like a roller coaster ride without the cotton candy! So buckle up, folks, and enjoy the ride! The $3.8k, $4k, and maybe even $5k could be our destinations if we’re lucky, but remember, there might be detours along the way. Happy investing!

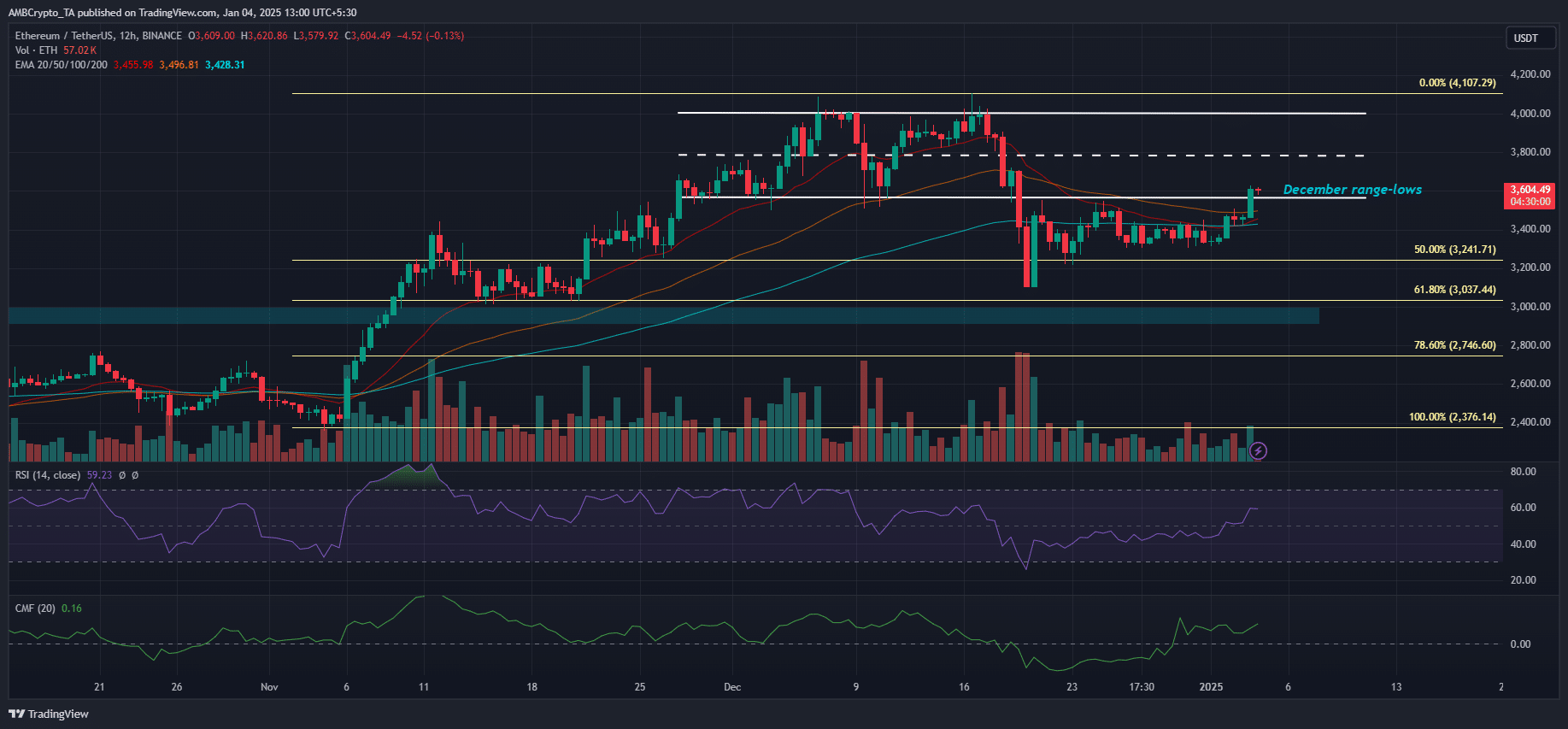

On Friday, Ethereum (ETH) surged by 4%, returning to levels last seen in December. This upward trend suggests a prolonged recovery may be underway as indicated by the chart’s movement.

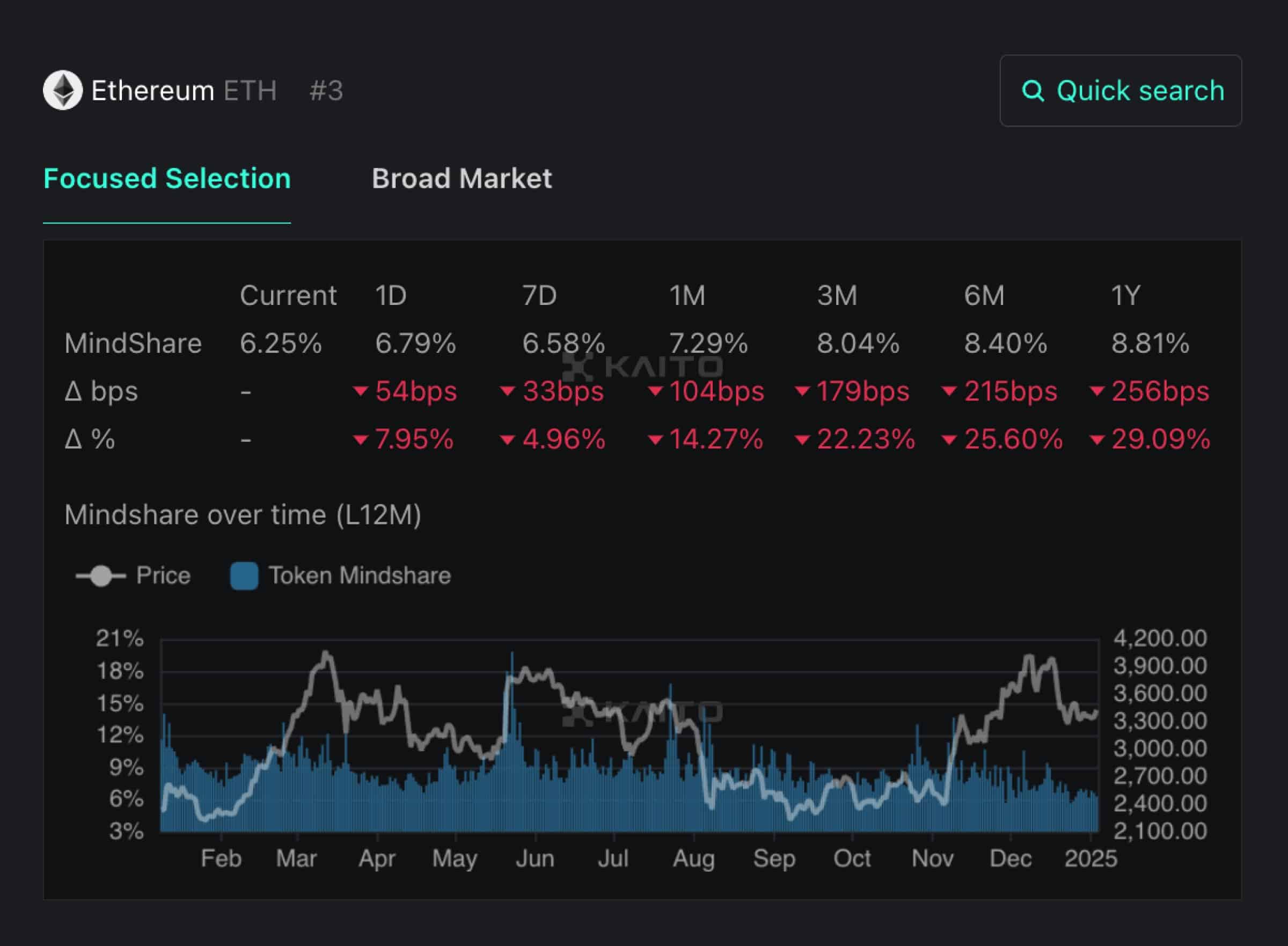

Despite the recent holiday sell-offs, the popularity of the King crypto coin reached a 12-month low.

For the same timeframe, it dropped from more than $4,000 but later stabilized above $3,300 around late December. So, the question arises: Could this downtrend reverse and continue to improve once the altcoin has regained its lowest point in December’s range?

ETH: Is $4k next target?

According to a 12-hour chart analysis, Ethereum (ETH) surpassed its significant moving averages, namely the 20-day, 50-day, and 100-day Exponential Moving Averages (EMA). To put it more simply, on Friday, a powerful breakout occurred that pushed ETH prices over $3.6k. This move also changed the overall market trend to bullish.

This could set ETH for an extended recovery on the charts, at least in the short term.

In simpler terms, the goal for a potential price increase was between $3,800 (mid-range) and $4,000 (upper channel). The Relative Strength Index (RSI) and Chaikin Money Flow (CMF) on the 12-hour chart were both above average values, indicating increased demand and more investment money flowing in.

If the current upward trajectory persists in the coming days, Ethereum (ETH) might reach prices as high as $3.8k, $4k, or even surpass those levels. On the other hand, any downturn that pushes ETH below $3.5K could cast doubt on this optimistic forecast.

It seems that ETH seasonality patterns hint at a promising future as well. Notably, the first quarter has shown the most significant growth, averaging approximately 83%. Interestingly enough, data from Coinglass indicates that January and March have been particularly profitable within Q1, with returns of about 21% and 22%, respectively.

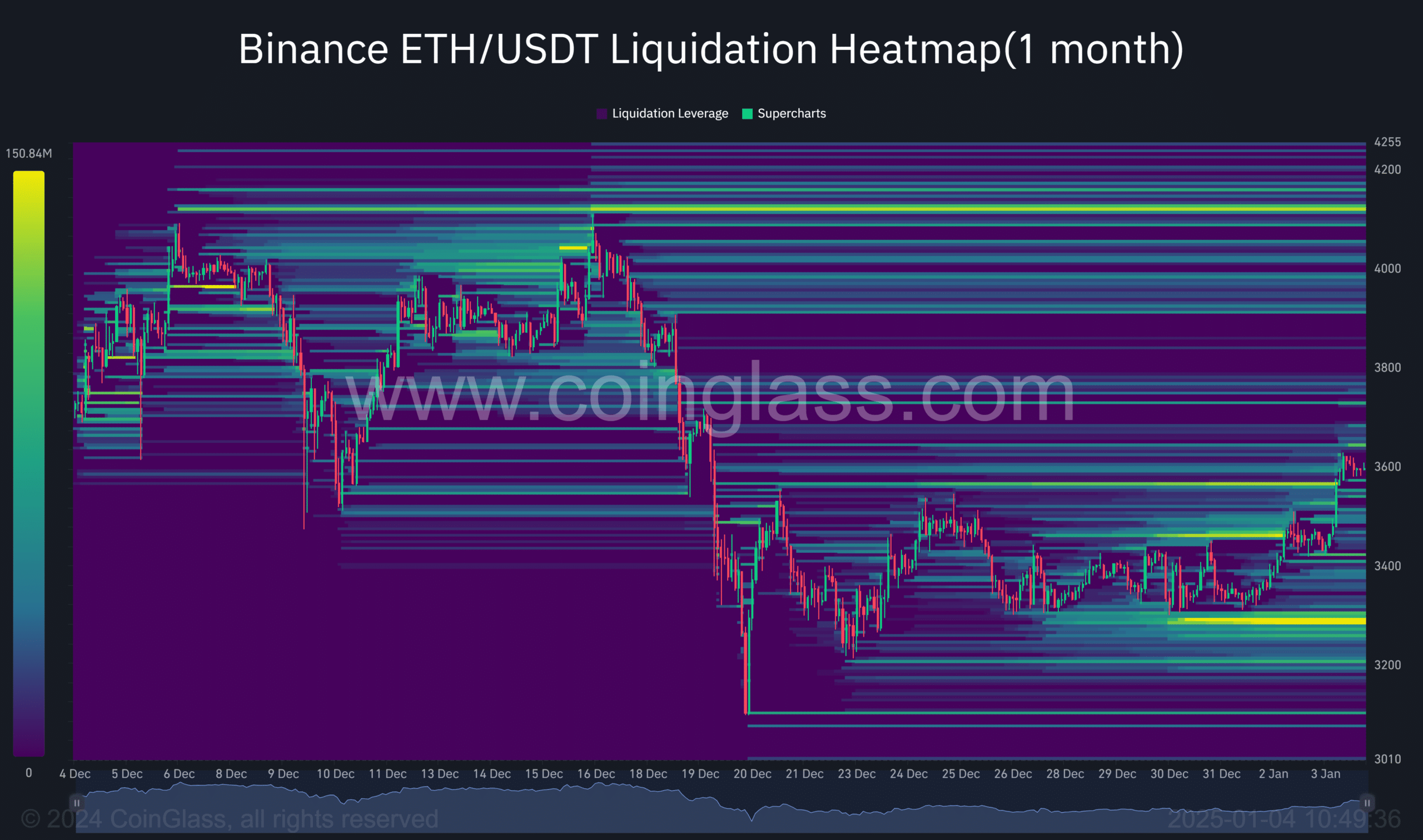

If historical trends persist, Ethereum (ETH) might experience significant growth in January. Notably, the monthly liquidation heatmap suggests potential resistance levels at approximately $3,800, $4,000, and $4,100. On the flip side, a key support level appears to be around $3,300.

If a market rally is triggered by a liquidity sweep, the price levels of around $3,800, $4,000, and $3,300 might be reached as possible goals.

Read Ethereum [ETH] Price Prediction 2025-2026

To summarize, the recent surge in ETH might pave the way for prolonged expansion if historical seasonal patterns reoccur in 2025, potentially pushing prices up to $3.8k and even $4k. On the flip side, a significant decline may find a pause at the crucial short-term support level of around $3.3k in December.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2025-01-04 17:11