-

Ethereum’s bullish divergence has been invalidated

Institutions are now selling ETH, with trading volume decreasing too

As an analyst with over a decade of experience in the crypto market, I must admit that I have seen my fair share of bull and bear markets. The current trend for Ethereum (ETH) is giving me some deja vu, as it seems to be following a familiar path towards the bearish side.

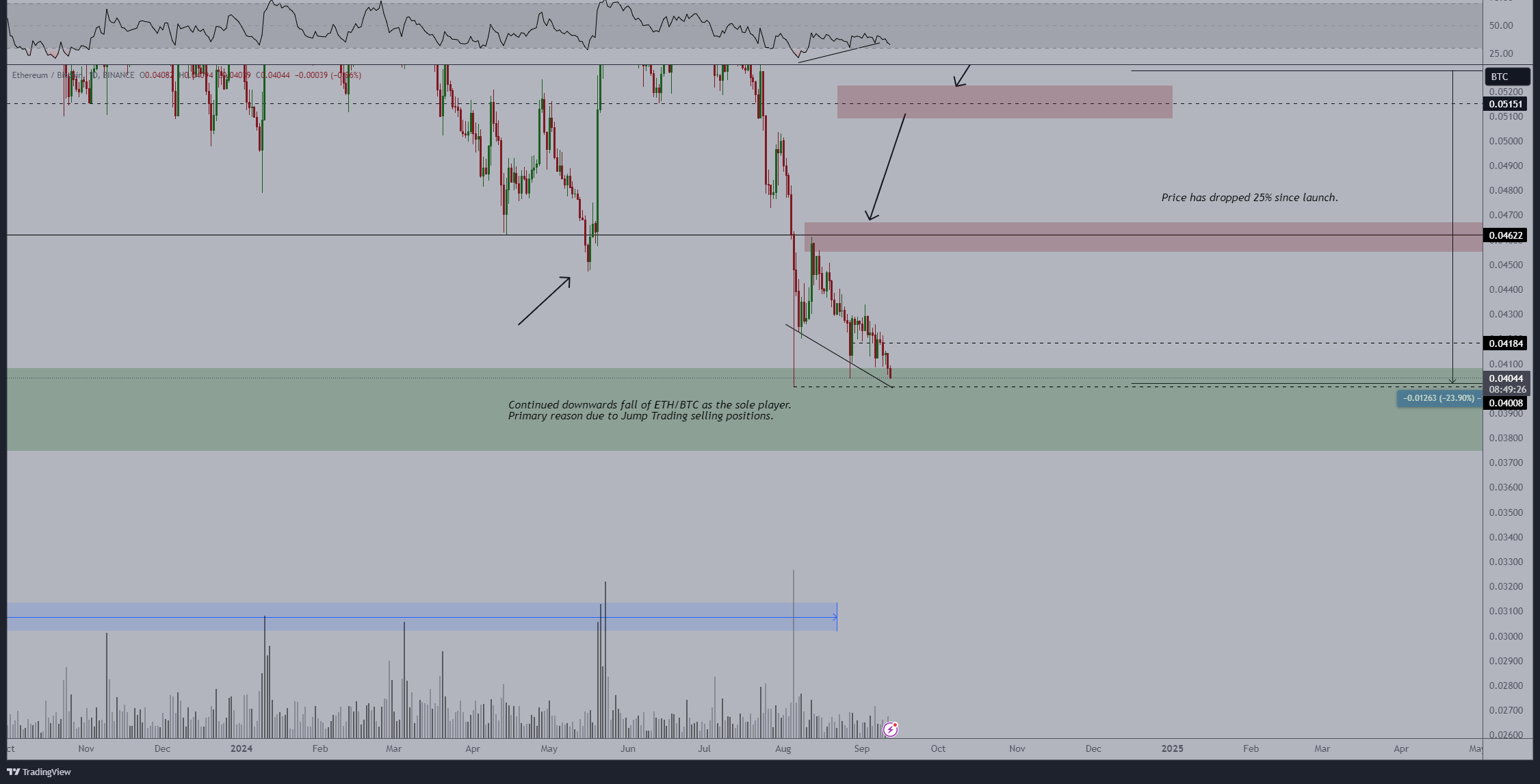

Currently, Ethereum (ETH) appears to be struggling relative to Bitcoin (BTC). The graph indicating their price action is displaying a downward trend, or red in color. Moreover, the bullish trend for ETH seems to have lost its validity as it nears the 0.04 BTC value.

If Bitcoin maintains its upward trend and reaches between $61,000 and $62,000 following a recovery at $57,000, it is likely that Ethereum may experience a further decline.

At present, Ethereum (ETH) doesn’t have a strong base of support, so traders should be patient for more favorable market circumstances before expecting a substantial recovery. Nevertheless, incoming capital could potentially strengthen ETH again. For the time being, however, ETH is still less robust compared to Bitcoin.

the prices were dropping, but the RSI was making higher bottoms. This could be an indication that a change in direction (potential reversal) might occur.

As a researcher observing the market trends, I’m noting the gradual decrease in Ethereum’s (ETH) volume, which could indicate a potential drop below the 0.04 Bitcoin (BTC) level. If Bitcoin were to weaken further, this situation might offer an opportunity for Ethereum to rebound. However, until there are signs to the contrary, the bearish trend for ETH appears to be the most probable scenario at this point.

Global institutions are selling ETH

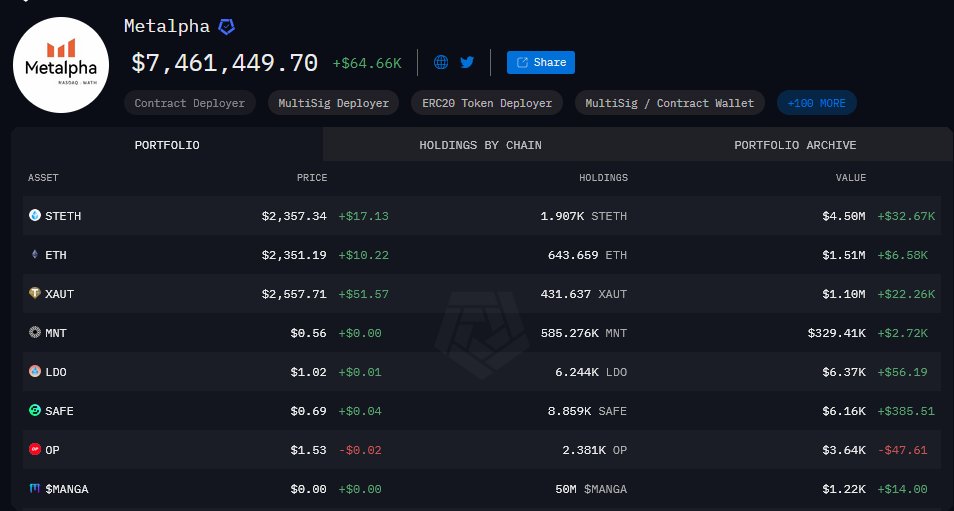

Moreover, a notable shift is underway, as leading international organizations are choosing to part ways with their Ethereum assets, according to Lookonchain’s latest update.

To illustrate, within the past six days, Metalpha has added 6,999 ETH, equivalent to approximately $16.4 million, to Binance. This contributes significantly to their total ETH deposits, which now stand at around 62,588 ETH, or roughly $145.1 million.

Currently, their Ethereum holdings amount to approximately 23,500 ETH, equating to a value of about $55 million. Additionally, Metalpha has disposed of its Layer 2 tokens like Optimism (OP), and has also decreased its staked ETH holdings to 1,907 stETH.

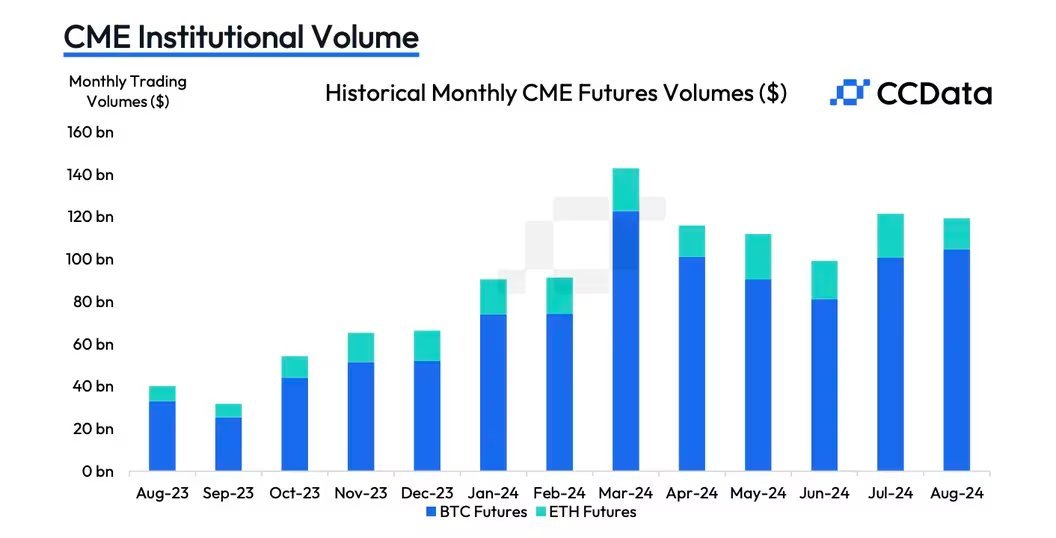

Ethereum CME trading volume

Furthermore, Ethereum (ETH) may continue to be weaker relative to Bitcoin (BTC), given the decrease in Futures trading volume on the Chicago Mercantile Exchange (CME). Specifically, this volume dropped by a significant 28.7% to $14.8 billion in August, reaching its lowest point since 2023.

As a researcher, I’ve been observing the market trends and here’s what I’ve found: So far this year, Ethereum’s price has dipped below the starting point, with its exchange-traded funds (ETFs) showing a consistent outflow of investments. To add to the downward pressure on the price, the Ethereum Foundation has been selling ETH as well.

This means that ETH may continue to decline before potentially rebounding, possibly in Q4 2024.

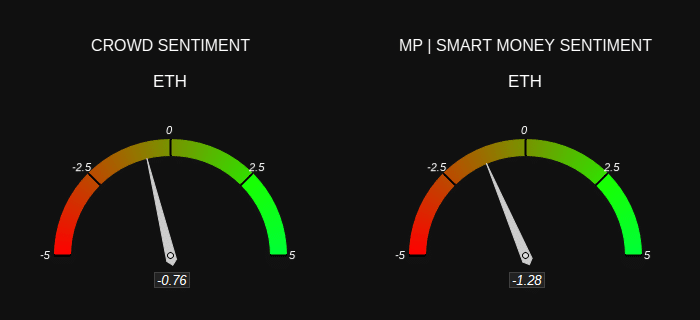

Crowd and smart money sentiment

Ultimately, the collective feeling among both ordinary traders and sophisticated investors was bearish towards ETH. In the present market situation, there is a general consensus that ETH is showing bearish tendencies.

The harmony among both small and big participants implies that Ethereum’s decline might continue unless the market conditions change or a substantial factor arises which could boost its price rebound.

Therefore, it’s anticipated that ETH will likely continue to be less strong compared to Bitcoin. This is primarily due to the fact that the overall cryptocurrency market conditions need to stabilize first.

Read More

2024-09-13 23:03