-

The number of new ETH staked daily has dropped on the charts

This can be attributed to the altcoin’s meek price performance

As a crypto investor with some experience in the market, I’ve seen my fair share of price fluctuations and market trends. The recent drop in the number of new ETH staked daily is a concerning sign for me, especially given that this figure has reached a year-to-date low.

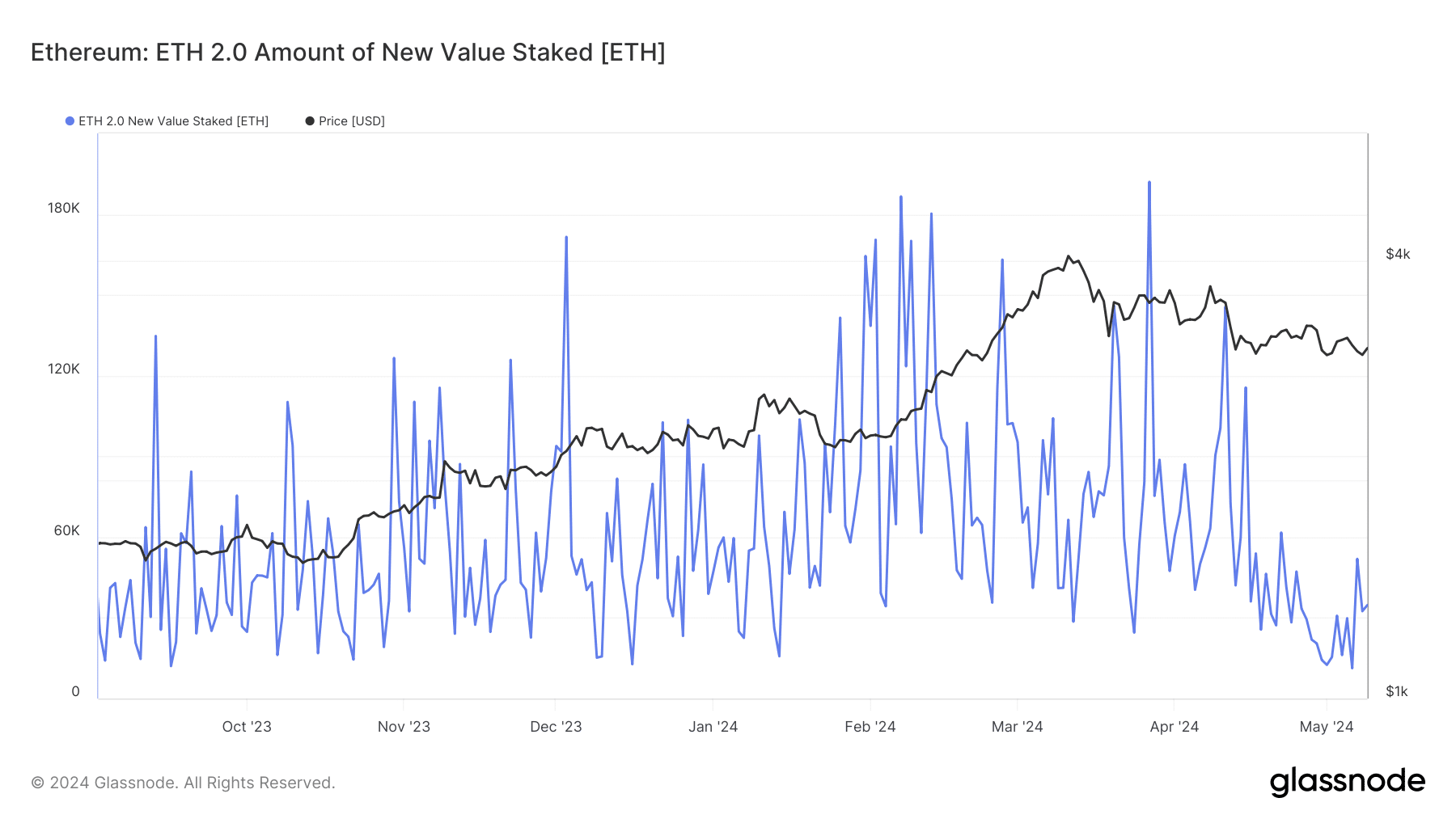

On May 6th, based on Glassnode’s data, the daily quantity of new Ethereum [ETH] staked reached a new low for the year.

As an analyst examining the on-chain data, I uncovered that exactly 11,285 Ether tokens were transferred to the staking deposit contract address on that specific day, equivalent to around $34 million. This figure represents a significant decrease of nearly 92% compared to the YTD high on March 28th when a massive 192,008 ETH coins were staked.

Based on a 30-day moving average, the rate at which new Ethereum was being staked began declining on February 29th, dropping by more than 85% since then.

Fall in ETH’s price to be blamed?

The decrease in the daily Ethereum (ETH) staking rate can be explained by the cryptocurrency’s price fluctuation. Specifically, ETH was worth $3,033 at the current moment, representing a 14% drop in value compared to 30 days prior. (CoinMarketCap’s data was used as reference.)

When Ethereum (ETH) investors securely bind their tokens during staking, they usually receive payouts in ETH once the lock-up period ends or matures. Consequently, if ETH’s worth decreases, so does the value of those rewards in US dollars.

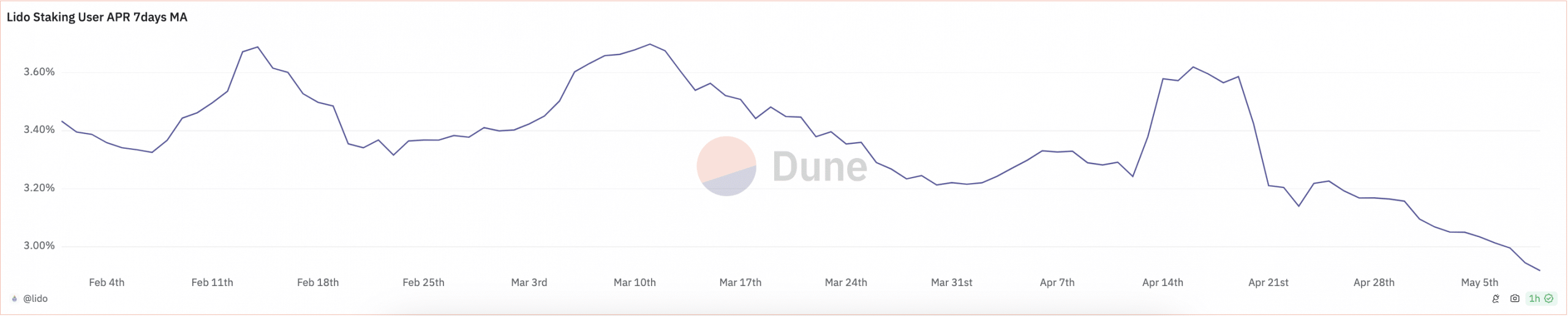

On the prominent decentralized staking platform Lido Finance (LDO), the staking Annual Percentage Rate (APR) has been declining since April 19th. Currently, it stands at approximately 2.9%, representing a decrease of nearly 19% compared to the previous figure reported by Dune Analytics.

This can make staking a less attractive venture to new investors seeking returns.

Additionally, the volatile short-term investors, who significantly influence price fluctuations on a daily basis, are prone to panicking and selling their Ethereum (ETH) when faced with even minor issues. Consequently, they might be dissuaded from staking their ETH holdings if the cryptocurrency’s value keeps decreasing, leading them to sell instead.

Read Ethereum’s [ETH] Price Prediction 2024-25

Network validators are unmoved by low price action

Although ETH‘s current achievement may not be impressive, the number of voluntary departures by its network validators has significantly decreased. As reported by Glassnode, the figure reached a Year-to-Date high of 2000 on April 2nd, but since then, there has been a decline of approximately 61% in the daily count of validators who have chosen to leave the network.

The count of operational validators on the Ethereum network has persistently risen, reaching a total of 994,000 at the current moment.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-11 02:15