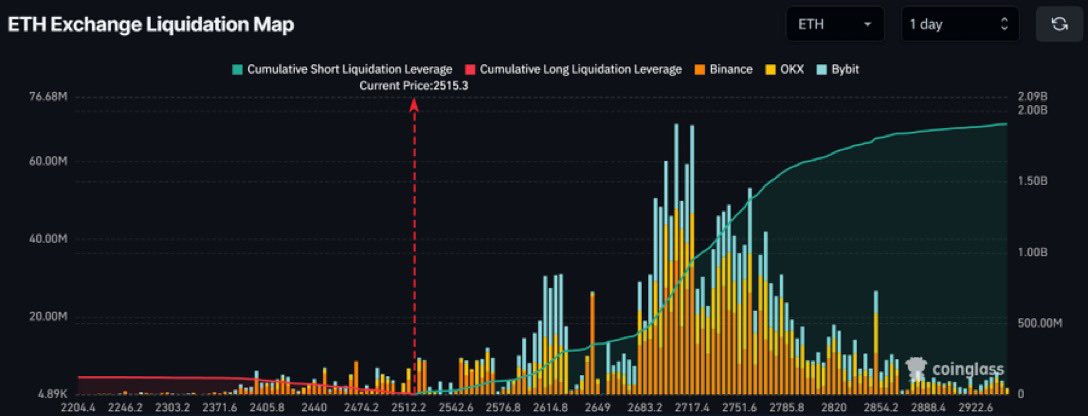

- Ah, the specter of over $2 Billion in ETH shorts, poised to be liquidated should the price dare to ascend to $3,000!

- Ethereum, that capricious creature, is but days away from conjuring a Hammer candle, reminiscent of Bitcoin‘s pre-parabolic dance.

Behold, the Ethereum Exchange Liquidation Map, a veritable tapestry of despair, reveals a staggering accumulation of short positions. Should the price of ETH flirt with the $3,000 mark, a liquidation of nearly $2 billion looms ominously on the horizon.

As the clock ticks, ETH finds itself trading at a mere $2,479.30. The rising tide of cumulative short liquidation leverage whispers of a bearish speculation that hangs heavy in the air, like a dark cloud over a sunlit day.

Should the price of ETH surge to $3,000, the ensuing short squeeze could be a sight to behold! Short sellers, in their frantic scramble to cover their positions, might just send the price soaring to heights unknown, igniting a frenzy of bullish sentiment and buying activity.

Yet, should Ethereum fail to breach this fateful threshold, the shadows of bearish sentiment may continue to loom. Price stabilization or further decline could ensue, a grim fate if the market’s bearish conditions persist.

And lo! The specter of long position liquidations could rear its ugly head, exacerbating the situation, as indicated by the smaller peaks in long liquidation. Oh, the irony of it all!

What does the potential monthly Hammer candle signify?

In a curious twist of fate, a comparative analysis between Bitcoin’s 2021 price action and Ethereum’s current movements reveals that ETH teeters on the brink of forming a monthly hammer candlestick. A pattern that echoes Bitcoin’s own before its meteoric rise!

If Ethereum manages to complete this pattern, it may herald a bullish momentum akin to Bitcoin’s ascent from a humble $10,000 to a staggering $66,000. The audacity!

At present, Ethereum’s price, a paltry $2,479.76, could very well follow a similar trajectory, eyeing the $4,800 level, a point marked by previous resistance in 2021, before daring to dream of $16,000.

Conversely, should the pattern falter and the candle turn negative, Ethereum may find itself testing the lower bounds near $2,150, a grim reminder of past support levels.

This pattern, dear reader, suggests an imminent decision point for ETH. The formation of a hammer candle could ignite a rally, reminiscent of the historical patterns seen in BTC. Will it rise or fall? The suspense is palpable!

The forthcoming trading sessions will be pivotal, determining whether ETH will emulate BTC’s explosive past or meander down a path of despair.

Ethereum ICO whale cashing out

Despite the tantalizing prospect of a rally, another Ethereum ICO whale from the fabled 2015 era has chosen to cash out in grand fashion. This whale, in a fit of financial exuberance, deposited 3,046 ETH worth a staggering $8.16M to Kraken. This follows a previous sell-off of 6,046 ETH, valued at $16.34M, just a day prior, as reported by EyeOnChain.

With a jaw-dropping cost basis of $0.31 per ETH, this profit-taking spree leaves our whale with a mere 1,024 ETH. As the crypto markets grapple with widespread declines and capitulation, this move could very well amplify the prevailing bearish sentiment.

Ah, the large-scale liquidations from early adopters! They often send shivers down the spines of investors, potentially driving ETH prices lower amidst a fragile market confidence. Thus, the fate of Ethereum hangs precariously in the balance.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- BLUR PREDICTION. BLUR cryptocurrency

2025-02-25 13:15