- Ethereum has declined 2% in the past week, with the key resistance at $2,850 signaling potential recovery.

- On-chain data showed increased active addresses, hinting at renewed interest and potential price stabilization.

As a seasoned crypto investor with a knack for navigating the tumultuous seas of digital assets, I’ve learned to expect the unexpected and embrace volatility as part of this exciting journey.

The second most valuable digital currency, Ethereum (ETH), has been experiencing a prolonged decrease in value that started in August and is currently carrying over into September.

Currently, Ethereum (ETH) is being exchanged for approximately $2,338, having experienced a 1.3% decrease within the last day and a 2% fall over the last seven days.

Over the past few weeks, this investment hasn’t shown much growth, causing some uncertainty among investors regarding its near future direction.

Long road ahead

Noted cryptocurrency expert, Dean Crypto Trader, has expressed his views on Ethereum, indicating that the current downturn could continue for some time. In a recent update on platform X, he made this observation.

So far, ETH has rebounded strongly from its support level. Yet, it seems likely that volatility will persist as long as the price remains between $2,100 and $2,850.

He further emphasized that the key resistance level for Ethereum is $2,850, adding,

“The bulls know what they need to do to get things going, but it’s going to be a long road.”

As a researcher, I’m hinting at a potential roadmap for recovery, but it seems we might need to be patient as Ethereum navigates its way out of the present trading band and rebuilds its bullish trajectory.

Assessing Ethereum’s fundamentals

Despite the bearish sentiment in Ethereum’s price action, some underlying metrics provide a glimmer of hope for potential recovery. One crucial factor to consider is the level of retail interest in the network.

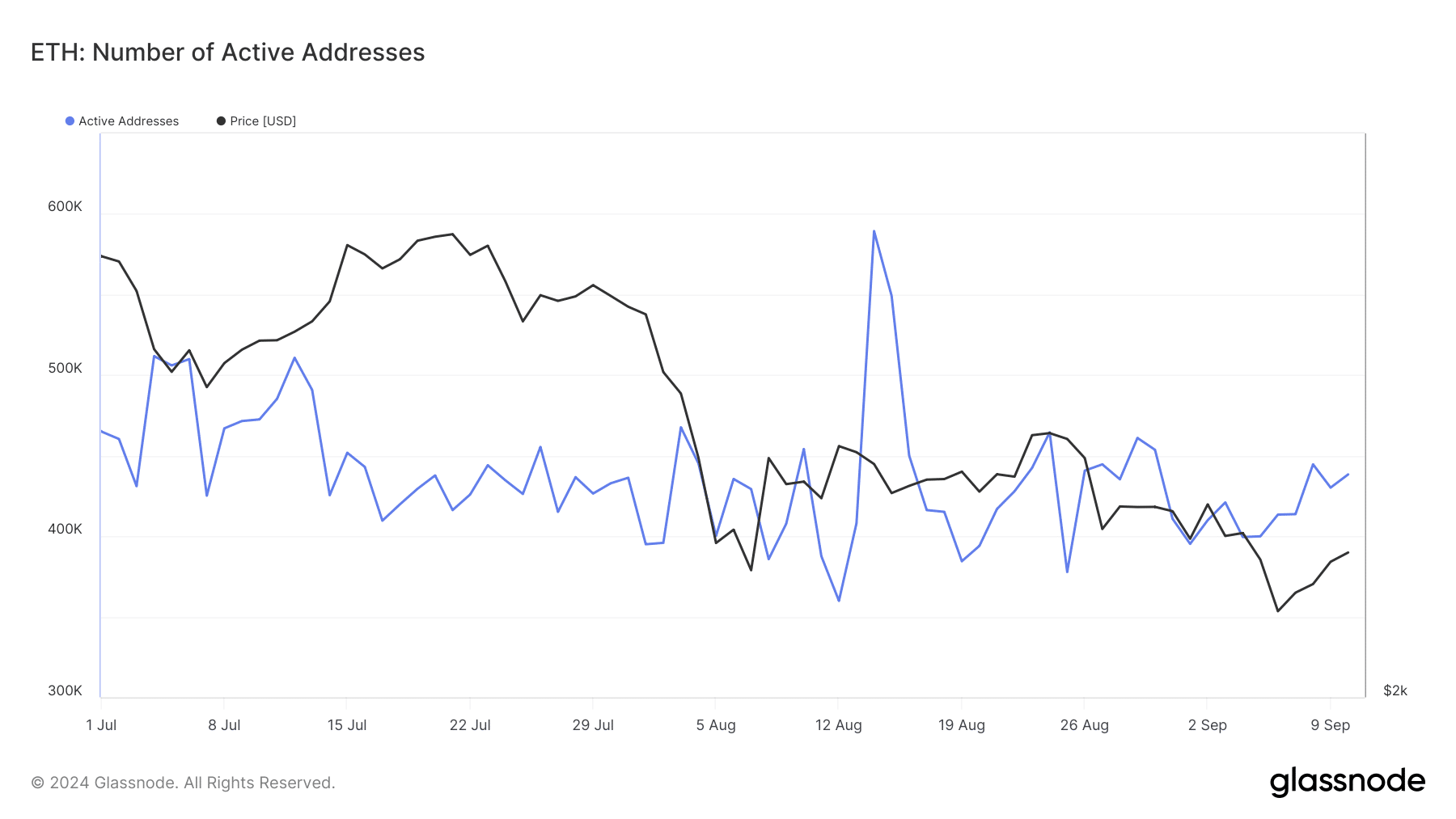

According to Glassnode, Ethereum’s active user count hit approximately 589,000 on August 14th, however, it has subsequently experienced a substantial decrease, dropping down to around 377,000 by the end of the month.

Ethereum Active Addresses

Starting from early September, we’ve seen a continuous rise in active addresses, with the current number exceeding 438,000.

This increase in active addresses could indicate renewed interest from retail investors, potentially supporting the asset’s price in the coming weeks.

As a crypto investor, I’ve noticed that an uptick in active addresses generally signals higher network activity. This surge of activity can boost the demand for Ethereum (ETH), providing support to maintain its price levels.

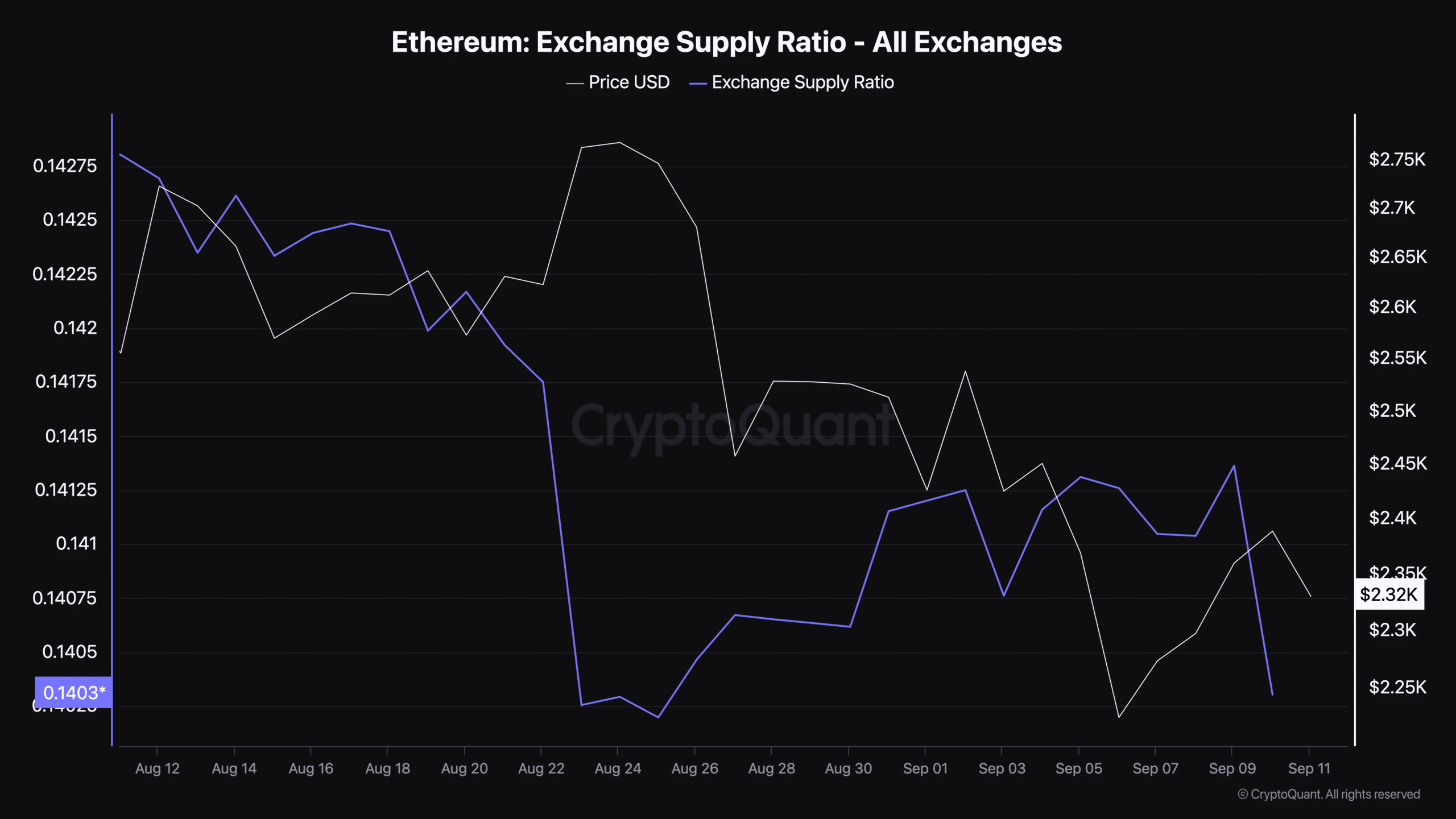

As a researcher, I find it crucial to delve into the Exchange Holding Ratio of Ethereum, a key indicator that quantifies the proportion of the overall Ethereum supply kept on trading platforms.

According to CryptoQuant, this ratio currently stands at 0.141 as of today.

Read Ethereum’s [ETH] Price Prediction 2024–2025

A smaller exchange-to-storage asset ratio often implies that investors are transferring their funds from exchanges to cold storage, suggesting they’re less inclined to make quick sales.

This might lessen the urge to sell ETH, leading to a more consistent price. It’s crucial to keep a close eye on this indicator though, as any substantial change may indicate a shift in market opinion.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-09-12 02:16