- Ethereum’s exchange reserve was dropping, signaling high buying pressure.

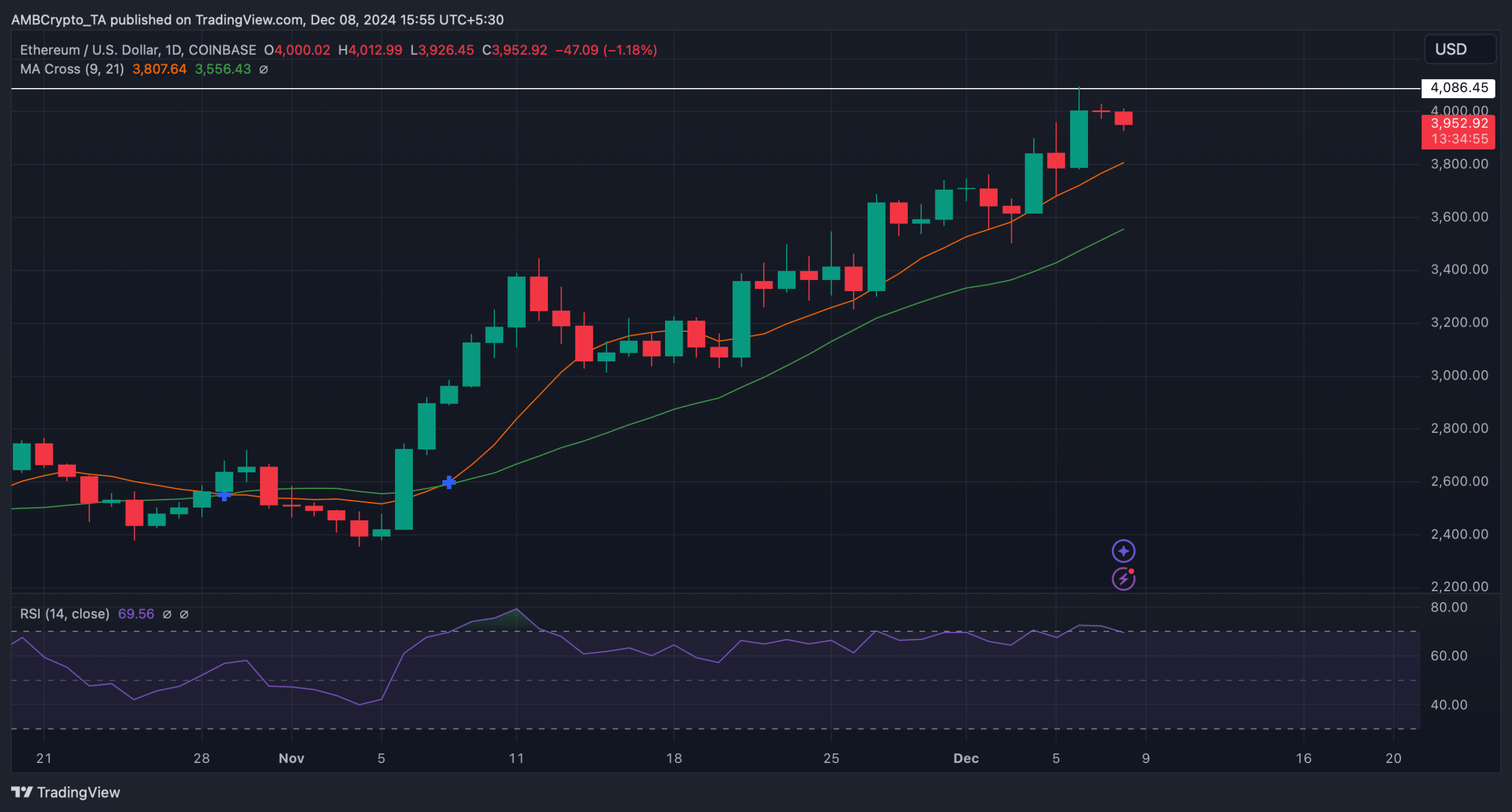

- However, the RSI was resting in the overbought zone.

As a seasoned crypto investor with battle scars from numerous market cycles, I have learned to read between the lines and not blindly rely on any single metric. While Ethereum’s [ETH] price action is indeed intriguing, there are signs of both bullish and bearish trends at play.

As a researcher, I’ve noticed that Ethereum (ETH) has been persistently attempting to surpass the $4k mark, but so far, these efforts have been met with rejection at the resistance level.

As an analyst, I delved deeper into the recent trends of Ethereum (ETH) to ascertain if its trajectory indeed points towards a fresh all-time high.

Ethereum is on the right track

As a researcher, I observed an impressive 7% surge in Ethereum’s (ETH) price last week, propelling its value close to the $4,000 mark. At the moment I am writing this, Ethereum is being traded at approximately $3,050, and it boasts a substantial market capitalization surpassing $476 billion.

For now, well-known cryptocurrency expert, Ali Martinez, shared on Twitter that Ethereum (ETH) might hit fresh record highs without any significant obstacles. The next potential minor barrier lies approximately at $4,540.

But as long as the $3,560 demand zone holds, the odds favor the bulls.

Will ETH touch $4.5k soon?

After Martinez posted a tweet suggesting Ethereum might reach $4.5k, AMBCrypto analyzed its on-chain data to determine if such an increase could occur in the near future.

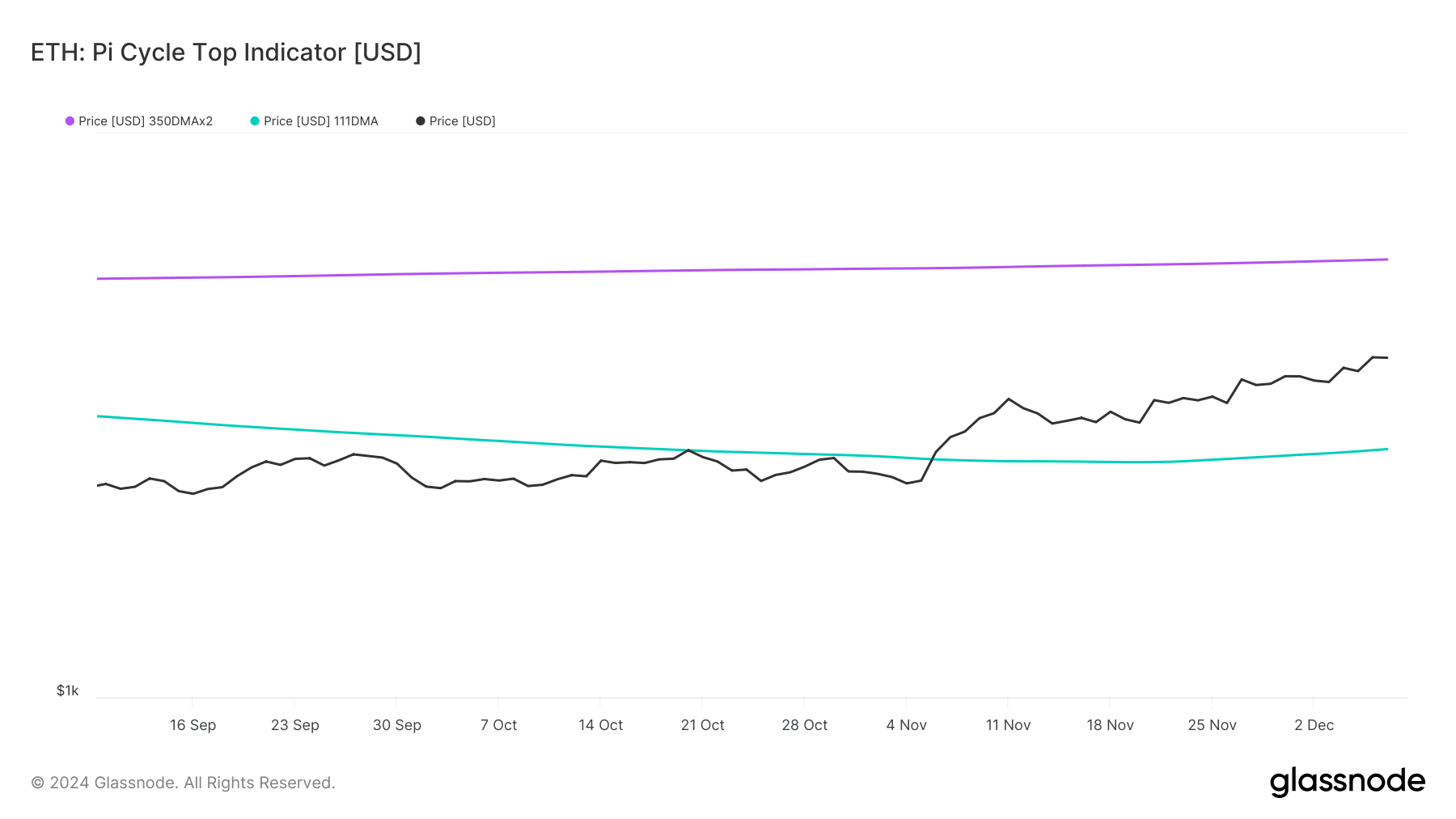

According to ETH’s Pi Cycle Top indicator, Ether was moving within a range near both its market highs and lows. If this reading is accurate, it suggests that Ether might have peaked around the $5.9k mark.

Therefore, it seemed likely for ETH top reach $4.5k soon.

According to CryptoQuant’s findings, there was an increase in demand for the token, as suggested by Ethereum’s decreasing amount held in exchanges.

Moreover, the Coinbase premium for Ethereum indicated a positive trend among U.S. investors, as it was green, suggesting a high demand for buying. Yet, certain indicators showed signs of a potential downturn.

For instance, ETH’s taker buy/sell ratio turned red. Whenever this happens, it indicates that selling sentiment is dominant in the derivatives market. More sell orders are filled by takers.

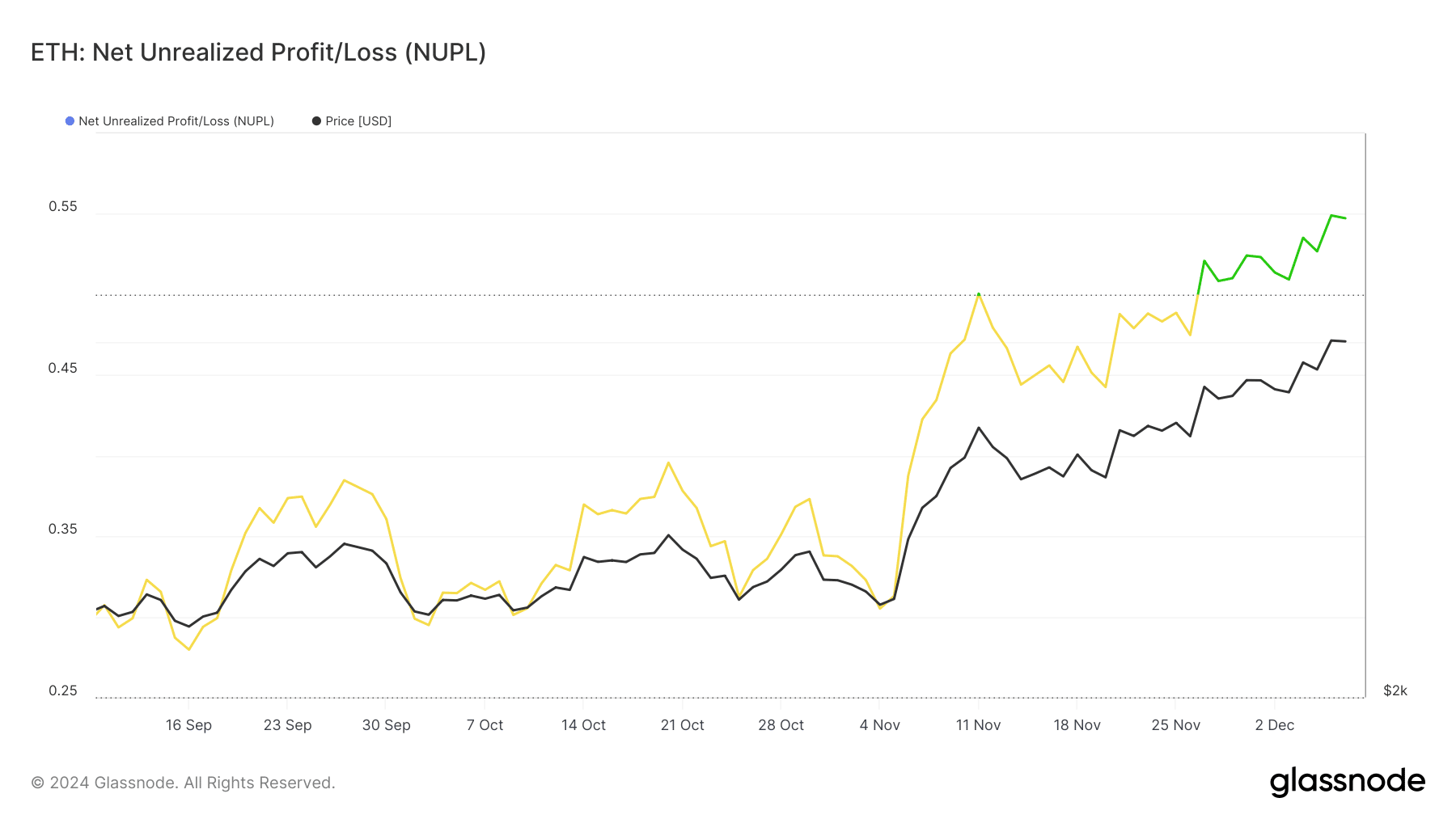

Apart from this, ETH’s Net Unrealized Profit/Loss (NUPL) entered the “belief” phase.

To begin with, I’ve found that the NUPL (Negative Up-Leg to Positive Leg Ratio) signifies the disparity between Relative Unrealized Profit and Relative Unrealized Loss. Interestingly, when this metric hits a certain point in its trajectory, it often precedes price adjustments in the market.

If history repeats, then ETH might not be able to go above $4k in the short-term.

Trouble for ETH was far from over. The token’s Relative Strength Index (RSI) was resting in the overbought territory.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Investor selling could be triggered by this factor, potentially leading to a decrease in ETH’s price over the next few days as they unload their assets.

Nonetheless, the MA Cross indicator supported the bulls, as the 9-day MA was well above the 21-day MA.

Read More

2024-12-09 07:03