Ethereum (ETH), that most capricious of digital coins, dances aimlessly in the market’s embrace, trapped beneath the mythical $4,000 threshold like a moth fumbling against a flame. Its attempts to soar upward are met with the cold indifference of investors, who now regard it with the skepticism of a peasant eyeing a noble’s hollow promises.

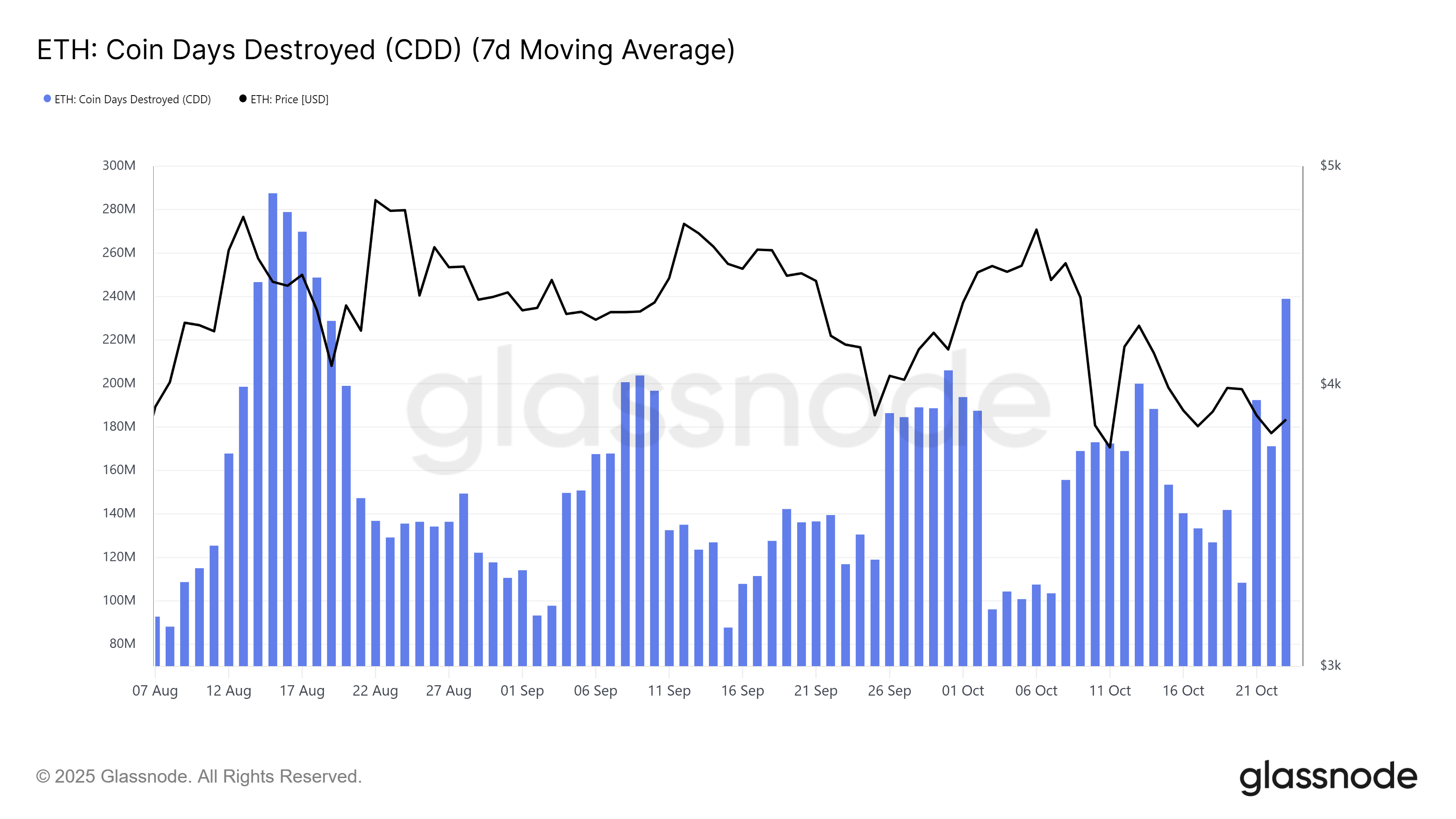

The air grows thick with dread as long-term holders (LTHs), once the steadfast pillars of this crypto realm, now shuffle like nervous merchants at a flea market, whispering of liquidation. Their coins, once hoarded with the zeal of a miser, now spill from their grasp like sand through an hourglass-rapidly, relentlessly. The Coin Days Destroyed metric, a ghoulish tally of their despair, spikes with the ferocity of a dragon’s roar, marking the largest such outburst in two moons.

Ethereum Holders, Now Unshackled?

Behold! On-chain data reveals a tempest of activity: LTHs, those once-proud titans of patience, now flee their posts with the urgency of a man spotting a bear in a sauna. This exodus, the largest since the Great Merge of 2022, signals not just doubt, but a full-blown panic. When the mighty sell, the weak tremble, and the price quivers like a leaf in a crypto storm.

LTHs, you see, are the aristocracy of this coin kingdom, their wealth enough to fund a hundred Davincis. When they sell, it’s not merely a transaction-it’s a declaration of war on hope itself. Their exit triggers a domino effect, toppling bullish spirits and leaving ETH gasping in the dust. One might almost pity the poor investors, now left clutching nothing but the ghost of gains past. 😢

Craving more crypto chaos? Subscribe to Editor Harsh Notariya’s Daily Newsletter-where fortunes rise and fall like a poorly coded smart contract.

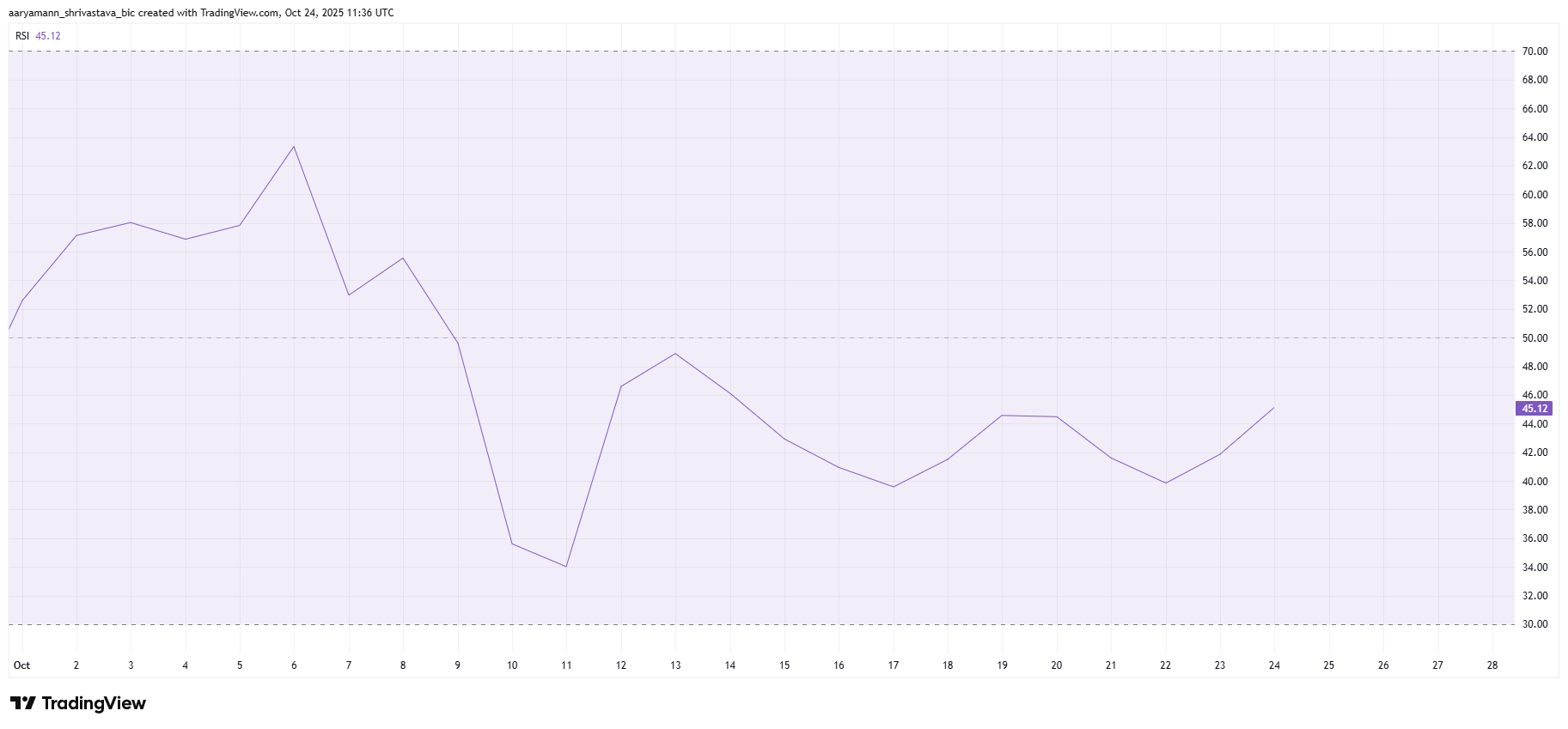

Ethereum’s technical indicators, once the proud banners of its bullish army, now hang in tatters. The RSI, that fickle oracle of momentum, slinks below 50.0 like a beggar at a banquet. Buyers, once bold as knights, now cower in the shadows, their enthusiasm as fleeting as a crypto influencer’s integrity.

This RSI slump is no mere blip-it’s a death knell for optimism. With the broader market wheezing like a drunkard with pneumonia, Ethereum’s prospects dim as a candle in a hurricane. One might ask, “Can this coin recover?” But the answer lies in the stars-or rather, in the wallets of those who fled.

ETH’s Desperate Gamble: To Surge or to Perish?

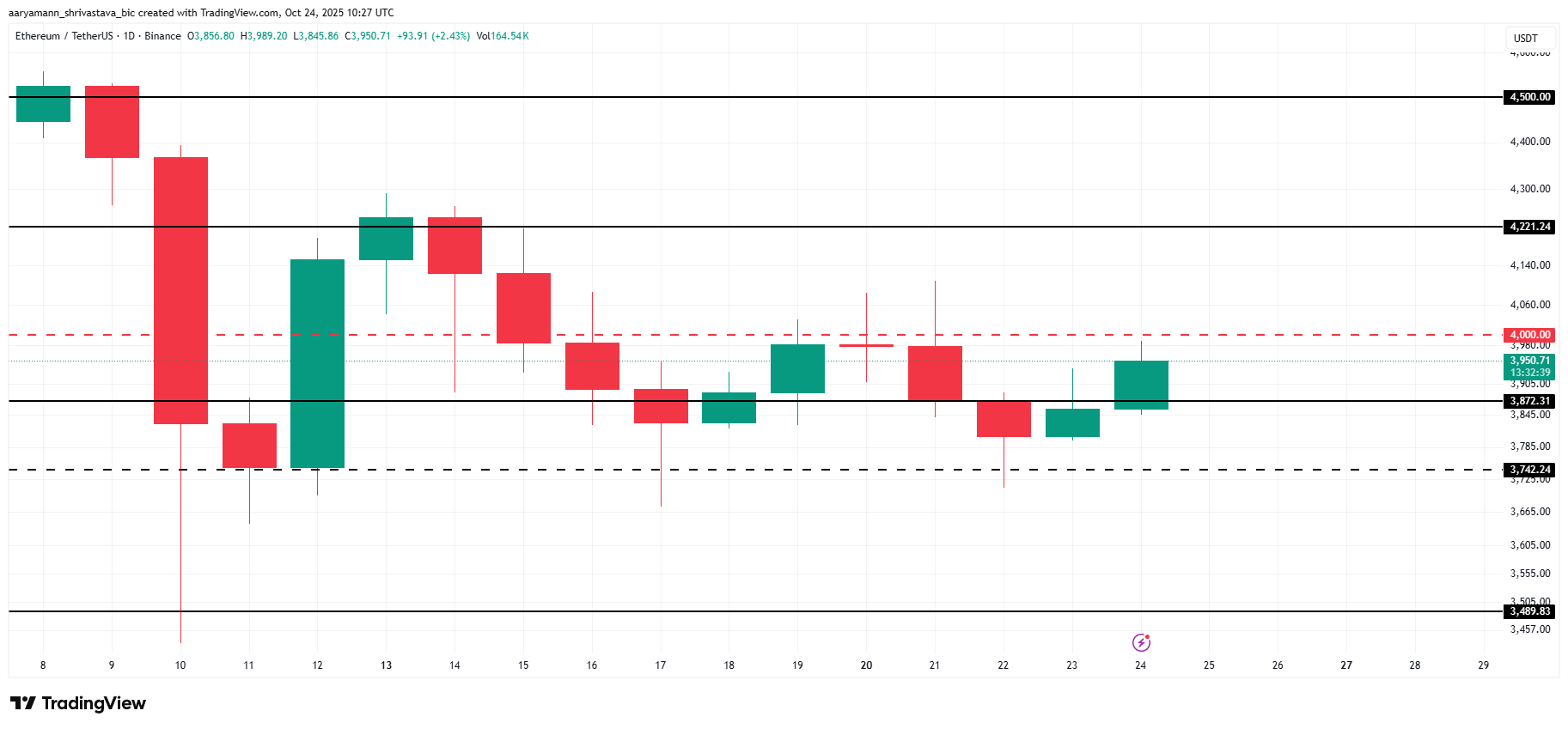

Ethereum clings to life at $3,950, a price so pitiful it could make a broke student weep. It wobbles between $3,872 and $3,742 like a drunkard on a tightrope, searching for direction but finding only the abyss. The market, ever the fickle lover, offers no comfort-only the cold stare of consolidation.

Should ETH falter and fall below $3,742, it may yet plunge to $3,489, a descent as inevitable as a crypto meme losing relevance. But if buyers, spurred by some divine madness, rally and push past $4,000, perhaps Ethereum might yet defy gravity. Yet who would bet on such a miracle? The gods of crypto are cruel, and their dice are loaded. 🎲

In the end, Ethereum’s fate rests not on charts or algorithms, but on the whims of investors who treat this market like a casino. Some will win, some will lose-but all will be left wondering, “Was it worth it?” Ah, the eternal question. 😂

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- These Are the 10 Best Stephen King Movies of All Time

- Meet the cast of Mighty Nein: Every Critical Role character explained

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Best Controller Settings for ARC Raiders

- Silent Hill 2 Leaks for Xbox Ahead of Official Reveal

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

2025-10-24 19:20