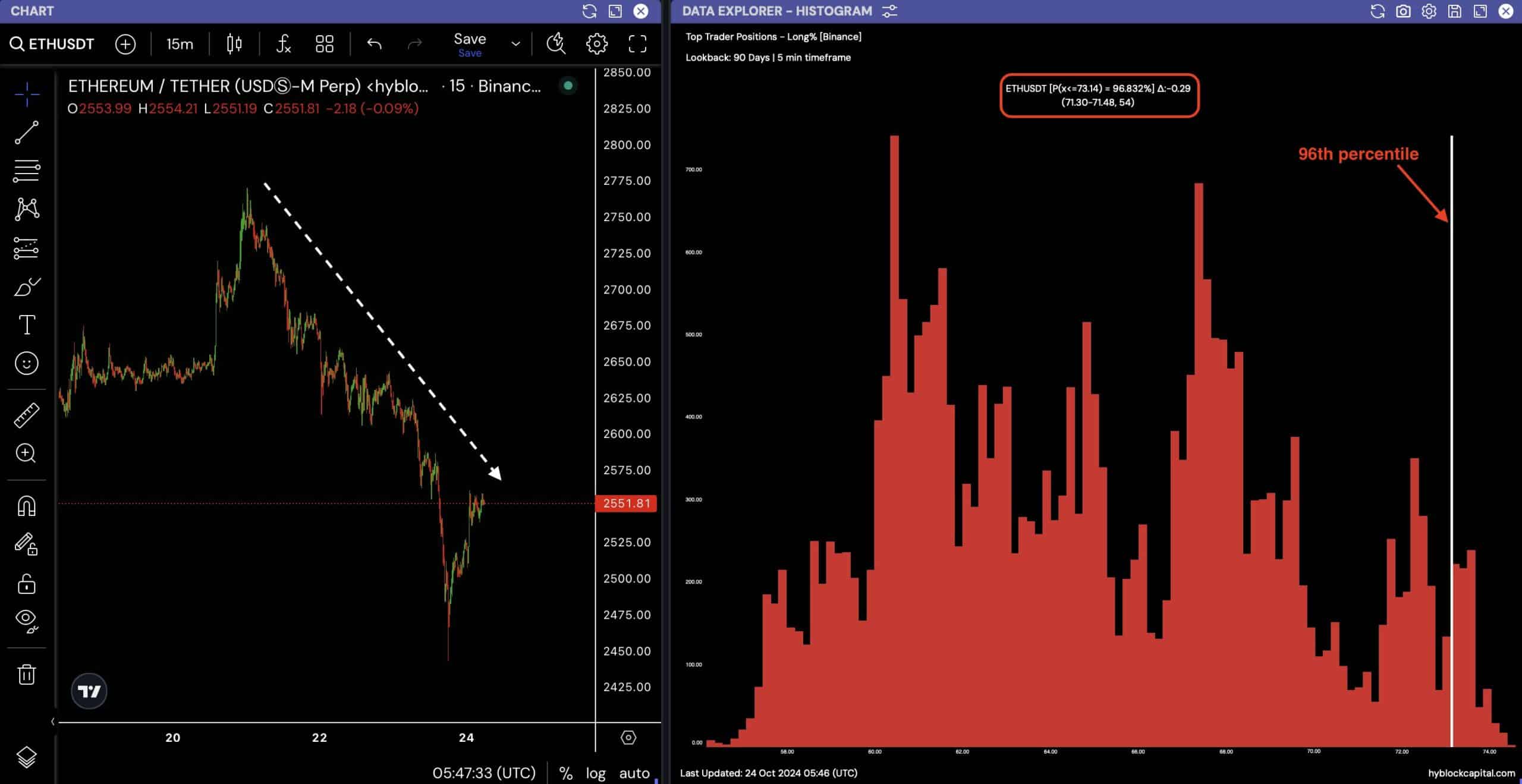

- Ethereum mirroring past patterns is an indication of a potential drop.

- More than 73% of ETH whales are still holding their positions.

As a seasoned crypto investor with a memory that stretches back to the early days of Ethereum, I must say that the current market patterns are reminiscent of 2016 – a year that taught us all a lesson or two about patience and resilience in the face of volatile markets. The repeated drops in April, August, and December have been a familiar sight this year, leading me to suspect that we might be in for another dip before the end of 2024.

As we move towards the end of 2024, Ethereum [ETH] seems to be following historical market trends, causing keen investors to stay alert and ready for any possible price decreases.

In 2016, ETH saw significant drops in April, August, and December.

2021 has seen two notable drops in the value of cryptocurrencies, first in April and then in August. Some financial experts are predicting that another significant decrease might occur by the end of this year, potentially as early as December.

As an analyst, I’m keeping a close eye on the trendline, which seems to indicate a potential drop. However, the crucial point to focus on is the resistance level at $2,800. If Ethereum manages to surpass and maintain its position above this threshold, it might help us dodge a deeper decline.

If ETH doesn’t progress towards the $2800 level, it might instead encounter resistance at the $2300 and $2000 levels before the end of the year.

ETH/BTC pair’s inability to break above the 50-day SMA

One important point to consider is that the ETH/BTC exchange rate has been struggling to surpass its 50-day moving average.

Previously, when the Ethereum to Bitcoin (ETH/BTC) ratio surpassed the Simple Moving Average (SMA), it was often accompanied by a robust uptrend. However, this event has not occurred as of now, indicating that the bottom may not have been fully established yet.

Historical trends suggest that traders tend to be overly optimistic in switching to a bullish stance, sometimes before they have enough confirmation.

Right now, rival platforms such as Solana and internal system difficulties are putting downward pressure on Ethereum by making it less attractive compared to these alternatives.

Based on the current price action, Ethereum may have further downside ahead.

Traders looking to capitalize on this could consider short positions, as more declines seem likely.

Simultaneously, the Ethereum Foundation has been cashing out some of its holdings, and a recent sale of 100 Ether has added to the prevailing pessimistic market mood.

Whales remain long

Although they share some resemblances, Ethereum has experienced significant transformations since 2016, such as The Merge and the 4844 update, which have resulted in its fundamental differences.

Despite the ongoing downtrend, whale activity shows little change.

According to data from Binance, about three out of every four Ethereum account holders are maintaining a long-term investment stance on Ethereum, suggesting their faith in its future potential.

Although the immediate perspective appears pessimistic, their substantial holdings indicate a lingering faith in a future revival.

After the prices have settled down and the lowest points for ETH/USDT and ETH/BTC are reached, traders might discover promising long-term investment opportunities.

As a crypto investor, I’m keeping an eye on Ethereum, anticipating that there might be another dip by the close of 2024. However, my long-term perspective continues to be hopeful and optimistic about this digital currency’s potential.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Investors might want to exercise caution in the immediate future, but there’s optimistic scope for a rebound that could be advantageous for those planning to invest when a clear bottom point has been reached.

The trajectory of Ethereum’s (ETH) price is a subject of intense interest within the cryptocurrency market, with the end of the year approaching.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-10-24 19:04