-

ETH’s price dropped under $3000 on the 30th of April.

The decline will likely continue if bearish momentum climbs.

As an experienced crypto investor, I’ve seen my fair share of market fluctuations, and Ethereum’s [ETH] recent decline below $3000 on the 30th of April is a cause for concern. The surge in social activity surrounding the coin, as noted by Santiment, is often a signal of an impending price correction. However, based on the current chart analysis and technical indicators, it appears that ETH might not be poised for any significant rebound in the short term.

The dip in Ethereum‘s [ETH] price beneath $3000 on April 30th triggered an increase in social buzz around the cryptocurrency, according to Santiment’s recent update.

As an analyst, I’ve noticed a surge in conversation surrounding Bitcoin and Ethereum compared to other assets today. The market has displayed noticeable apprehension, with Bitcoin dipping down to $59,500 and Ethereum reaching a low of $2,900. However, this fear has created an opportunity for counter traders who have been actively buying the dip.

— Santiment (@santimentfeed) April 30, 2024

Based on information from a data provider specializing in on-chain analysis, as of the present moment, the second most talked-about altcoin on social media platforms is not Bitcoin [BTC], but rather another cryptocurrency.

From the 29th to the 31st of April, there was a significant surge in ETH‘s online presence, with a 150% increase in discussions about the coin on Telegram, Reddit, X, and 4Chan.

To rise or fall?

When the price of an asset decreases and there’s an increase in social buzz around it, this situation may indicate an upcoming price adjustment.

Examining the day-to-day fluctuations of the coin’s value, it seemed that Ethereum wasn’t preparing for a substantial bounce back in the near future. Instead, its price could continue to decline.

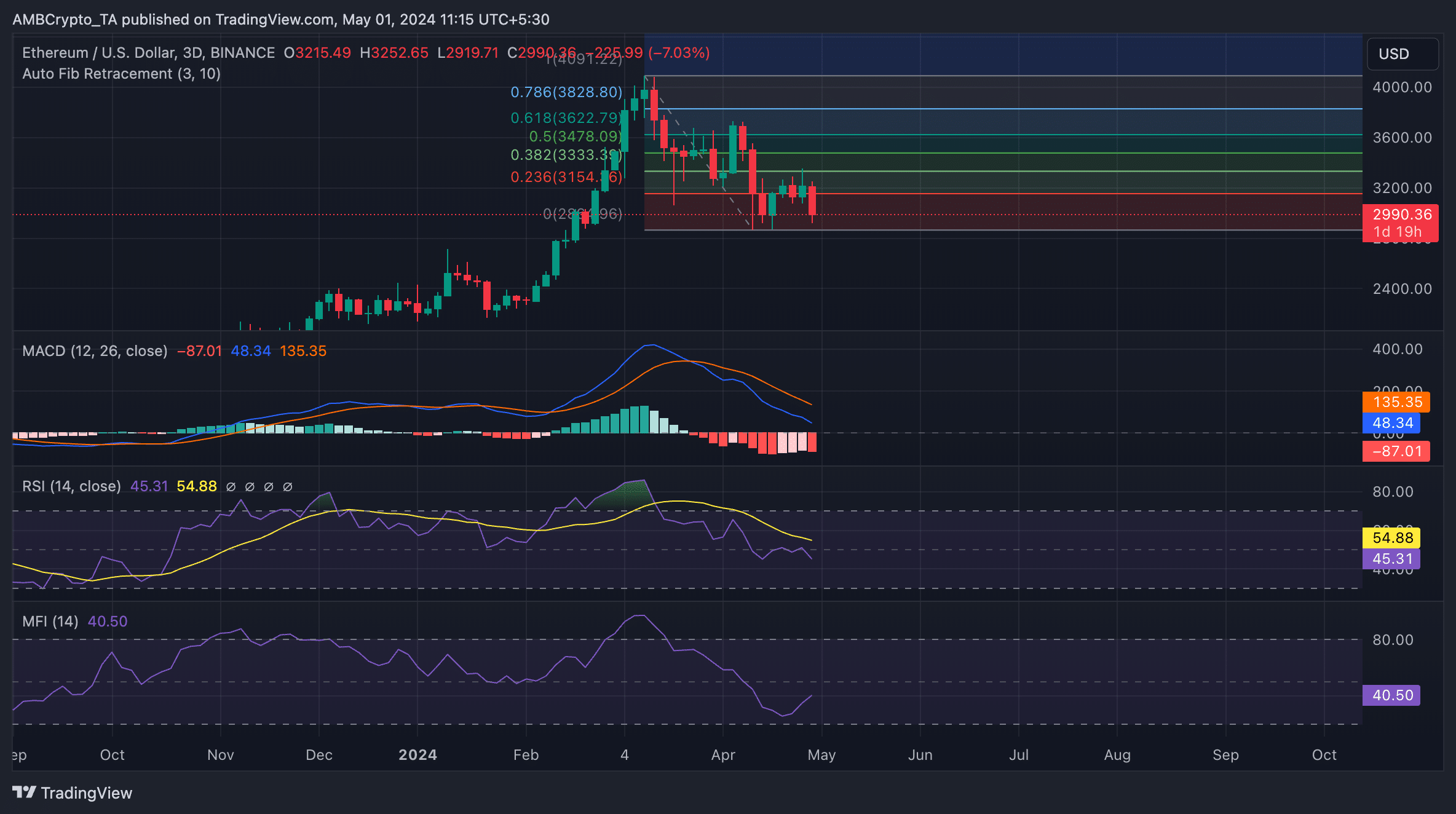

The analysis of the Ethereum coin’s Fibonacci Retracement levels indicated that the dip beneath $3000 signified a significant break of the support level Ethereum had established around $3145 during the previous weeks.

At $2,899 as of the press update, there’s a significant chance for additional drops in price due to waning demand from traders for the top altcoin.

At the time of analysis, ETH‘s key momentum indicators took a bearish stance with their values situated beneath their respective thresholds. The Relative Strength Index (RSI) stood at 45.31, and the Money Flow Index (MFI) was reported at 40.50.

At these values, the indicators signaled a preference for coin distribution over accumulation.

Additionally, at the current moment, the MACD line for the coin, represented by the blue line, was situated beneath the signal line, depicted in orange, and was moving closer to the zero line.

When the MACD line of an asset sits beneath its signaling line, this signifies increasing bearish energy. It’s possible that the asset’s price is currently declining or will face significant selling pressure imminently.

Traders often interpret it as a potential sell signal.

Read Ethereum’s [ETH] Price Prediction 2024-25

If bearish momentum climbs, ETH’s next price point might be $2867.

As an analyst, I would rephrase it as follows: Should the buying pressure intensify and trigger a price surge, the coin’s trajectory could change course, bouncing back from its current position at $3145 to test resistance around $3300.

Read More

2024-05-01 13:11