-

BlackRock holds more ETH than the Ethereum Foundation now

BlackRock’s ETHA now on track to hit $1B mark in net inflows

As a researcher with years of experience in the crypto space, I have seen numerous events that have shaped the landscape of digital assets. The recent developments involving BlackRock and Ethereum are certainly noteworthy. The fact that BlackRock now holds more ETH than the Ethereum Foundation itself is a testament to the institutional interest in Ethereum.

BlackRock continues to lead in the realm of Ethereum Exchange-Traded Funds (ETF), mirroring its impressive success in U.S spot Bitcoin ETFs. Notably, their Ethereum holdings now exceed 318,000 units, making them the largest holder even surpassing the Ethereum Foundation’s 308,000 coins.

BlackRock eyes $1B net inflows – Will ETH’s price follow?

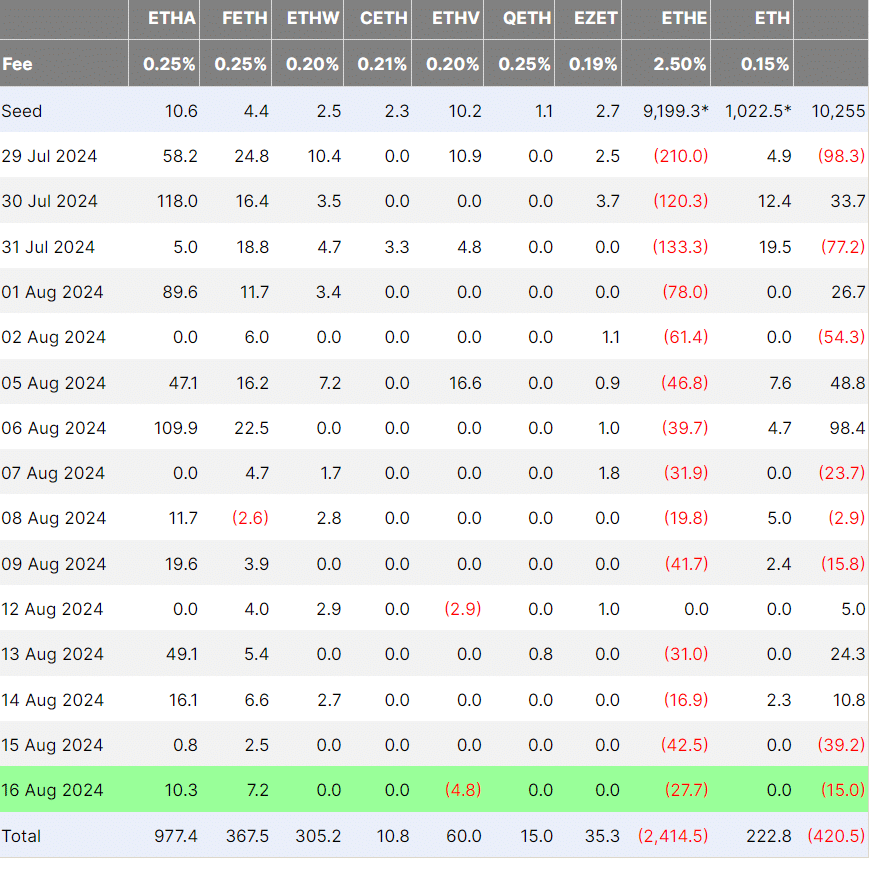

In addition to potentially doubling Ethereum Foundation’s ETH holdings, BlackRock is on track to surpass $1 billion in cumulative inflows for its ETHA product. As of August 16, this product had amassed a total of $977 million in net inflows and was the only one exceeding half a billion dollars.

This performance was achieved in less than a month.

It’s worth mentioning that during the start of the week, there were inflows into ETH Exchange-Traded Funds (ETFs). This observation was made by analysts at Coinbase in their latest report and could be seen as a favorable factor influencing ETH’s price.

As a researcher examining Ethereum’s performance, I’ve observed that the analysts have pointed out a potential complication for price recovery: the dip in ETH gas fees to their lowest point in five years, which seems to indicate subdued network activity.

Speaking of which, Ryan Lee, who serves as the Chief Analyst at Bitget Research, recently shared with AMBCrypto his viewpoint: The drop in Ethereum’s gas fees might indicate that Ethereum’s short-term price floor has been reached.

Historically, when ETH gas fees reach their lowest point, it’s frequently been an indicator of a short-term price bottom. In the following period, ETH prices have typically shown significant growth and recovery.

Lee mentioned that the decline in Ethereum’s gas fees is particularly advantageous considering the anticipated reduction in the Federal Reserve interest rates in September.

“If this instance lines up with a period when interest rates are decreased, the market’s impact on wealth becomes ripe with opportunities. Consequently, we are keeping an optimistic perspective regarding this development.”

Regarding the fluctuations of this altcoin’s value during the past week, it has mainly moved within a narrow band, ranging from around $2500 to $2750. The technical indicators have been providing ambiguous or conflicting signs as well.

Therefore, the future price fluctuations of the altcoin could be significantly influenced by the upcoming trend of Bitcoin’s [BTC] price as depicted on the charts.

Read More

2024-08-18 01:11