-

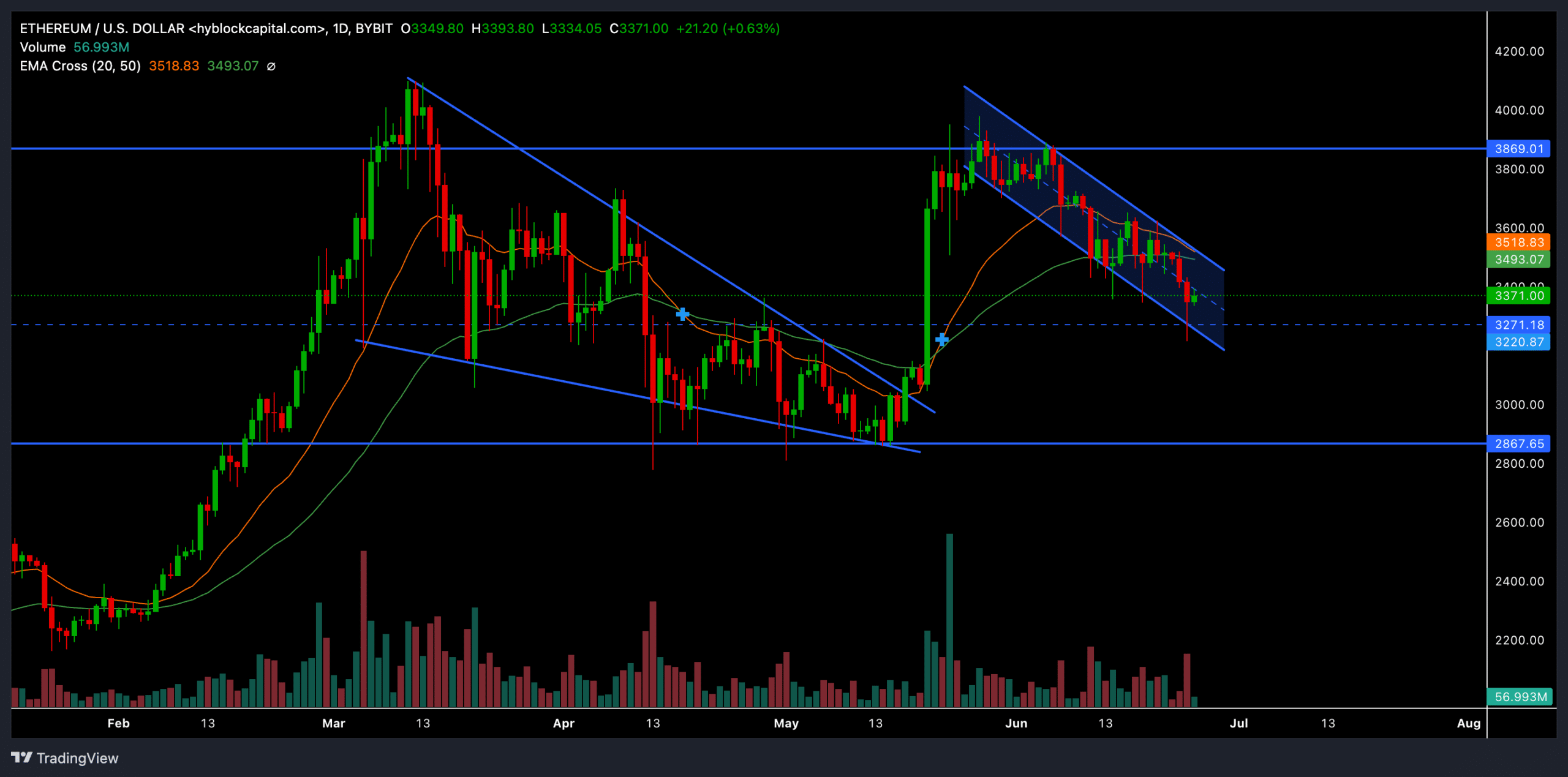

Ethereum chalked out a classic descending channel pattern on the daily chart, confirming a bearish edge.

The immediate support range at the $3,200 level can determine ETH’s near-term trajectory.

As a seasoned crypto investor with a keen eye for technical analysis, I’ve seen my fair share of market fluctuations. Ethereum’s [ETH] recent price action has raised some red flags for me. The altcoin’s consistent failure to break above the $4,000 resistance level and its descending channel pattern on the daily chart are clear signs of a bearish edge.

As an analyst, I’ve observed that Ethereum’s [ETH] break below the $3,900 resistance level during the past month has created a favorable environment for the bearish trend to continue.

As an analyst, I’ve noticed that the Open Interest of this altcoin has been on the rise during this period. This trend raises some concerns for me regarding its capacity to maintain the current support level.

If the sellers persist in applying more pressure past the current price point, Ethereum may call off its bullish trend and instead experience a drop in value. A bounce back from the $3,260 mark could allow the buyers to recover some ground and rebuild their momentum.

At the time of writing, ETH was trading at $3,362, up by nearly 3% in the past 24 hours.

Can ETH bulls reverse the bearish trend?

For approximately three months, Ethereum sellers have maintained a resistance point around the $4,000 price mark. This level prevented Ethereum from advancing by 35% in the previous month and caused its price to dip below both the 20-day moving average and the 50-day moving average.

The resulting price action chalked out a classic descending channel pattern on ETH’s daily chart.

If the resistance line of this falling trendline for Ethereum persists in holding back bullish rallies, it’s likely that ETH will continue to decline in the near future. However, if the price reaches around $2,800, it could potentially trigger a rebound in Ethereum’s price.

From my perspective as an analyst, if the price manages to break above the current pattern, it could pave the way for a bullish rally. Notably, the initial barrier of resistance for the buyers would be around the $3,900 mark.

At the time of composing this text, the Stochastic RSI indicated very subdued or sold levels on the Ethereum chart. It’s recommended that prospective buyers exercise patience and look out for a possible bullish crossover to assess ETH‘s short-term bullish tendency.

As a researcher studying market trends, I’ve observed that when price moves above both the 20-day and 50-day exponential moving averages (EMAs), and there is a bullish crossover on the stochastic relative strength index (RSI), it can serve as a robust buy signal for traders.

Ethereum: Bearish edge emerges

Based on Hyperblockcapital’s data, Ethereum’s Open Interest indicator has been increasing, hitting new highs over the past month.

As a crypto investor, I’ve noticed that the price hasn’t been reaching new highs with each passing bullish candle, instead, we’ve seen lower highs. This pattern is often a red flag for a bearish divergence – meaning more traders are jumping on the bandwagon to sell rather than buy.

The previous day saw a significant surge in net exchange flows, amounting to approximately 140% more than the previous day’s total. This increase serves to underscore the prevailing pessimistic outlook towards the market. It is essential to keep an eye on Ethereum (ETH) as it attempts to bounce back from its support zone at around $3,200-$3,300. A successful break above this range could help shift the narrative and bring about a more optimistic perspective.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-25 22:09