-

ETH, at press time, was testing the 0% Fibonacci level

Its daily active addresses have remained above 400,000 too

As a seasoned researcher with years of experience observing the crypto market, I have to admit that Ethereum (ETH) is currently at a critical juncture. The recent price action and technical indicators are painting a mixed picture, which can be both exciting and nerve-wracking for any investor.

Over the past few weeks, I’ve noticed a significant dip in Ethereum‘s [ETH] value, causing its price to plunge below the $3,000 mark – a level it had held steady for quite some time. Although there has been a recent surge, this upward trend hasn’t been enough to push the price back above that key threshold yet.

Considering the trend of other indicators and market dynamics, ETH may have some volatility ahead.

Ethereum sees a death cross

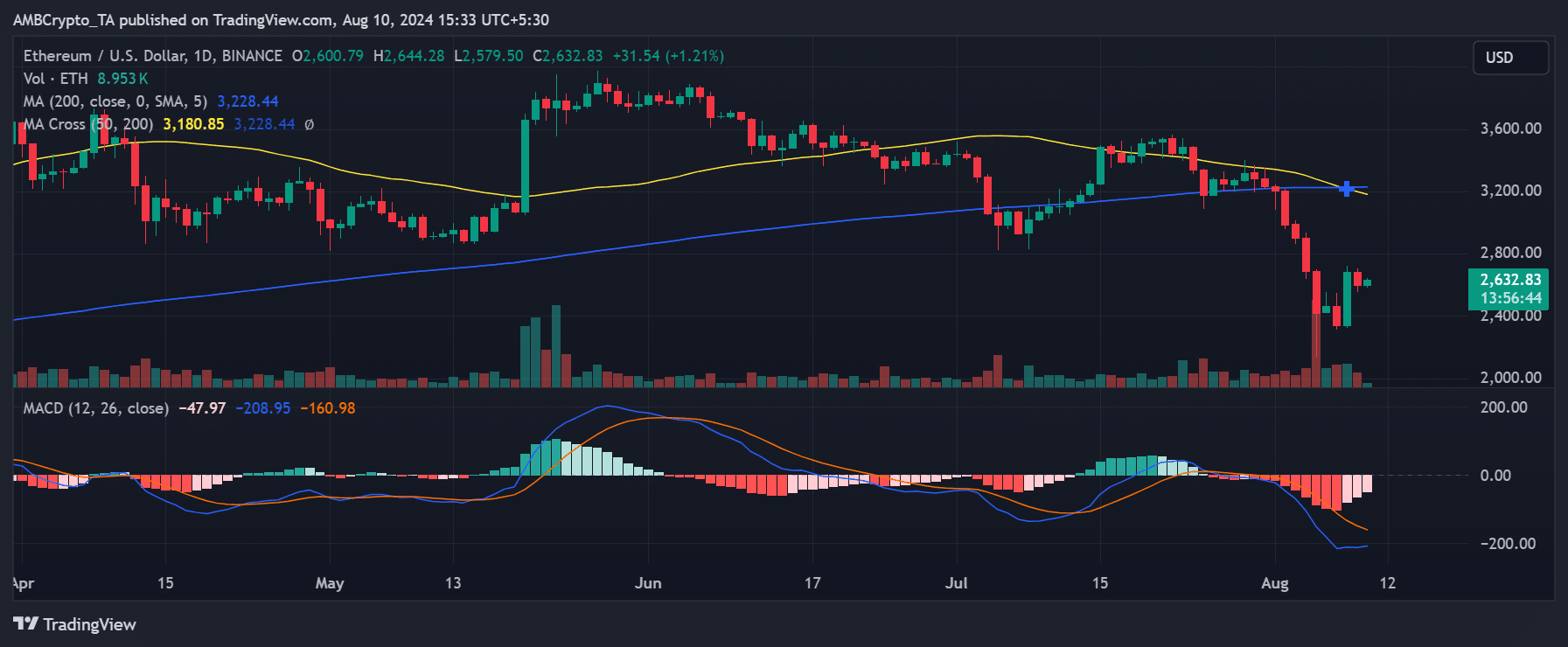

Although Ethereum saw an impressive surge of 14.56% on the 8th of this month, this rise has sparked a worrying technical pattern called a “death cross.”

After a 3.10% drop on August 9th that lowered the price to around $2,601, a “death cross” occurred. This happens when a shorter-term moving average (represented by the yellow line) falls below a longer-term moving average (the blue line), suggesting possible long-term bearishness in the market.

Furthermore, the Moving Average Convergence Divergence (MACD) analysis suggested that Ethereum’s trend was declining. Specifically, at the time of this writing, the MACD line was situated beneath the signal line, indicating a downward momentum for ETH.

It appears that the trend is showing some signs of weakening, as the MACD histogram indicates a possible convergence, where the red bars are becoming less intense. This could suggest a decrease in bearish strength, potentially paving the way for a market turnaround.

The bear and bull case for ETH

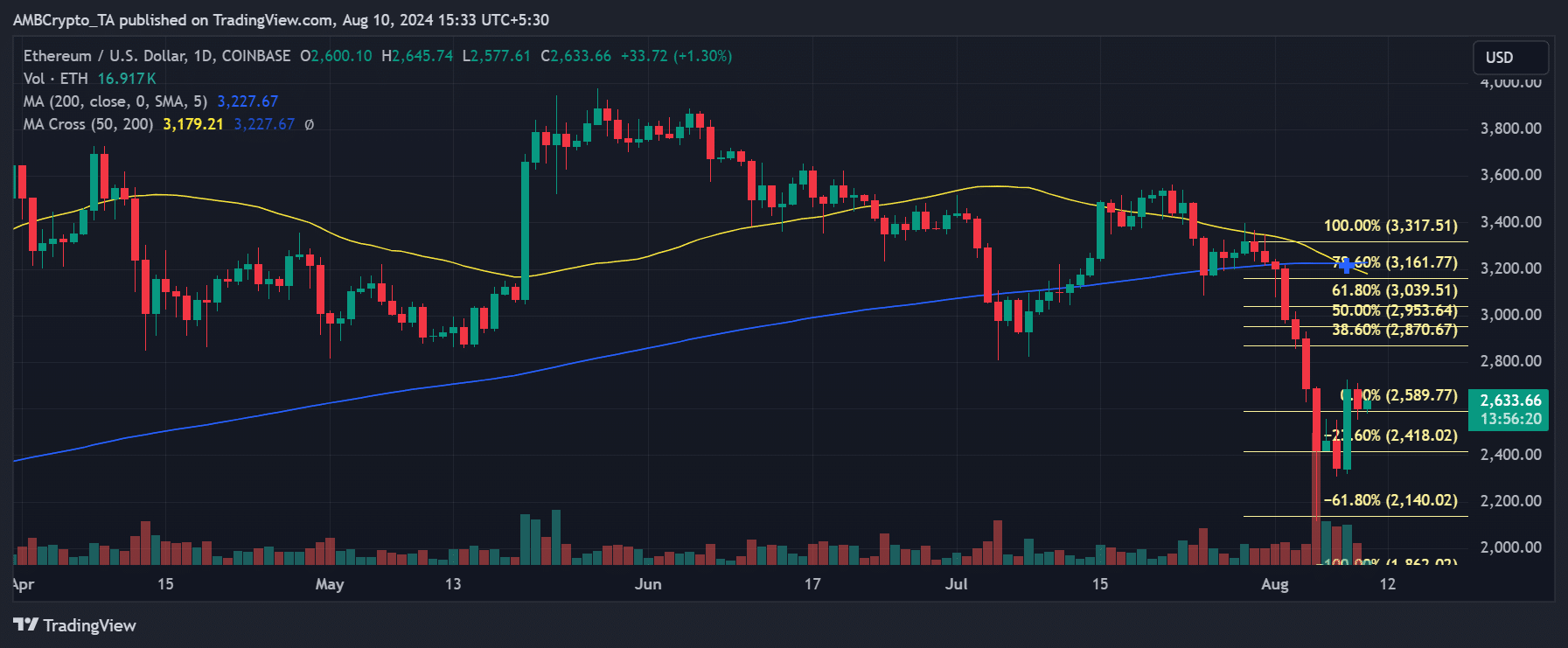

A look at Ethereum’s price movements using the Fibonacci Retracement tool revealed possible future price patterns. At the moment of writing, the price had rebounded from around $2,140 – a key support level identified by the -61.8% Fibonacci retracement. It was currently attempting to break through the 0% Fibonacci retracement level, which stood roughly at $2,589.77.

If the cost continues to be higher than 0% ($2,589.77), it might challenge the subsequent resistance levels at approximately $2,870.67 (which represents a 38.6% pullback) and $2,953.64 (indicating a 50% pullback). Furthermore, a successful surge above the 50% level could trigger additional growth toward the 61.8% retracement level at about $3,039.51, with potential further advancements thereafter.

If the price can’t sustain above the 0% Fibonacci level and gets turned down, there’s a chance it could return to previous lower support areas instead.

A decrease just below $2,418.02 (representing about a 23.6% pullback) could pave the way for another attempt to reach the recent minimum around $2,140. If the bearish trend gains strength, Ethereum may even dip below $2,140, potentially leading to even lower lows.

Ethereum’s death crosses in the last three years

It’s important to note that Ethereum has experienced a ‘death cross’ three times in the past three years. The first instance was on January 27, 2022, when Ethereum was valued around $2,500. After this death cross, the price dropped to around $1,500 over the following months, but then rebounded with a ‘golden cross’ on February 10, 2023.

On September 2, 2023, the second “death cross” occurred as Ethereum’s value hovered approximately at $1,600. But this cross proved temporary, as Ethereum swiftly rebounded and formed a “golden cross” on November 21, 2023.

As I observed following the golden cross event, Ethereum experienced substantial upward momentum, propelling the altcoin to reach approximately $4,000 by early 2024.

Ethereum active addresses stay decent

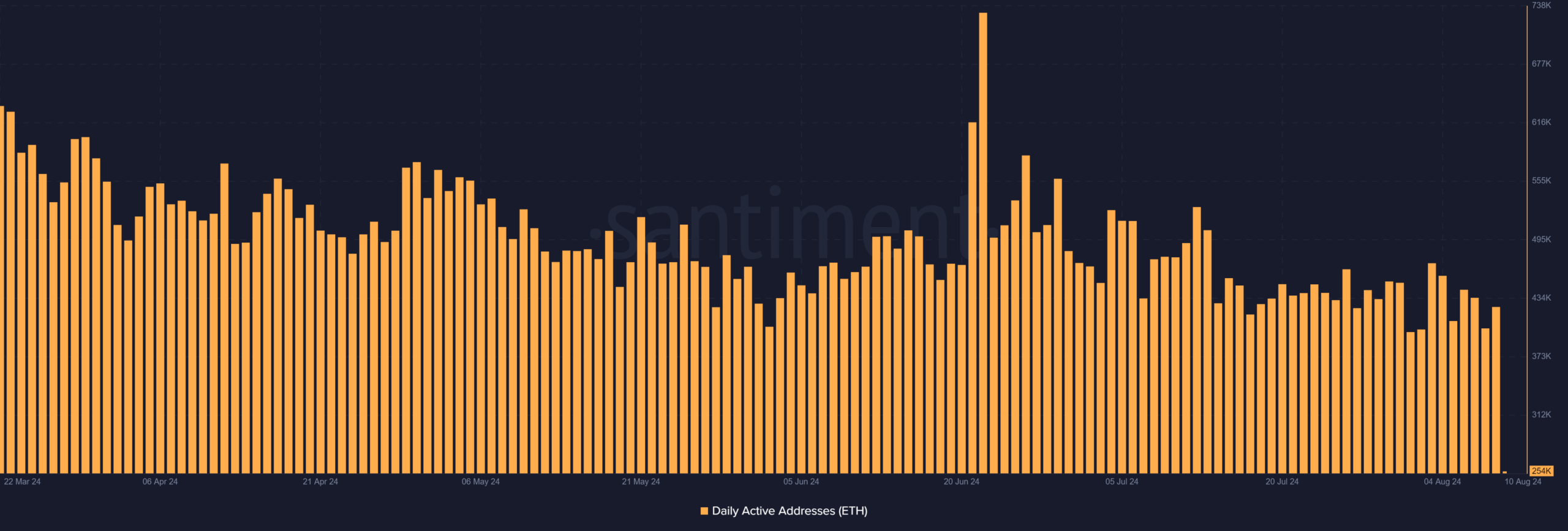

A look at the daily active Ethereum addresses graph from Santiment indicates a minor drop off in activity during the last few days.

Regardless of the decrease, it’s worth noting that the count of active addresses has consistently stayed above 400,000. Specifically, on August 3rd, there were more than 470,000 active addresses, but by August 9th, this figure had dropped to roughly 425,000. As of the current moment, the number of active addresses exceeds 230,000.

– Read Ethereum (ETH) Price Prediction 2024-25

Should the number of daily active addresses persistently drop, it might result in reduced network usage, potentially intensifying the price trend’s descent.

If active addresses increase or stay steady and the price surpasses crucial resistance points, it’s likely that Ethereum will experience a prolonged period of growth.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-08-11 08:08