- Ethereum has been on the verge of surging past the $3.5k resistance level over the last five days

- Traders can anticipate a rally towards $3.9k, but chances of a bearish reversal thereafter would solidify

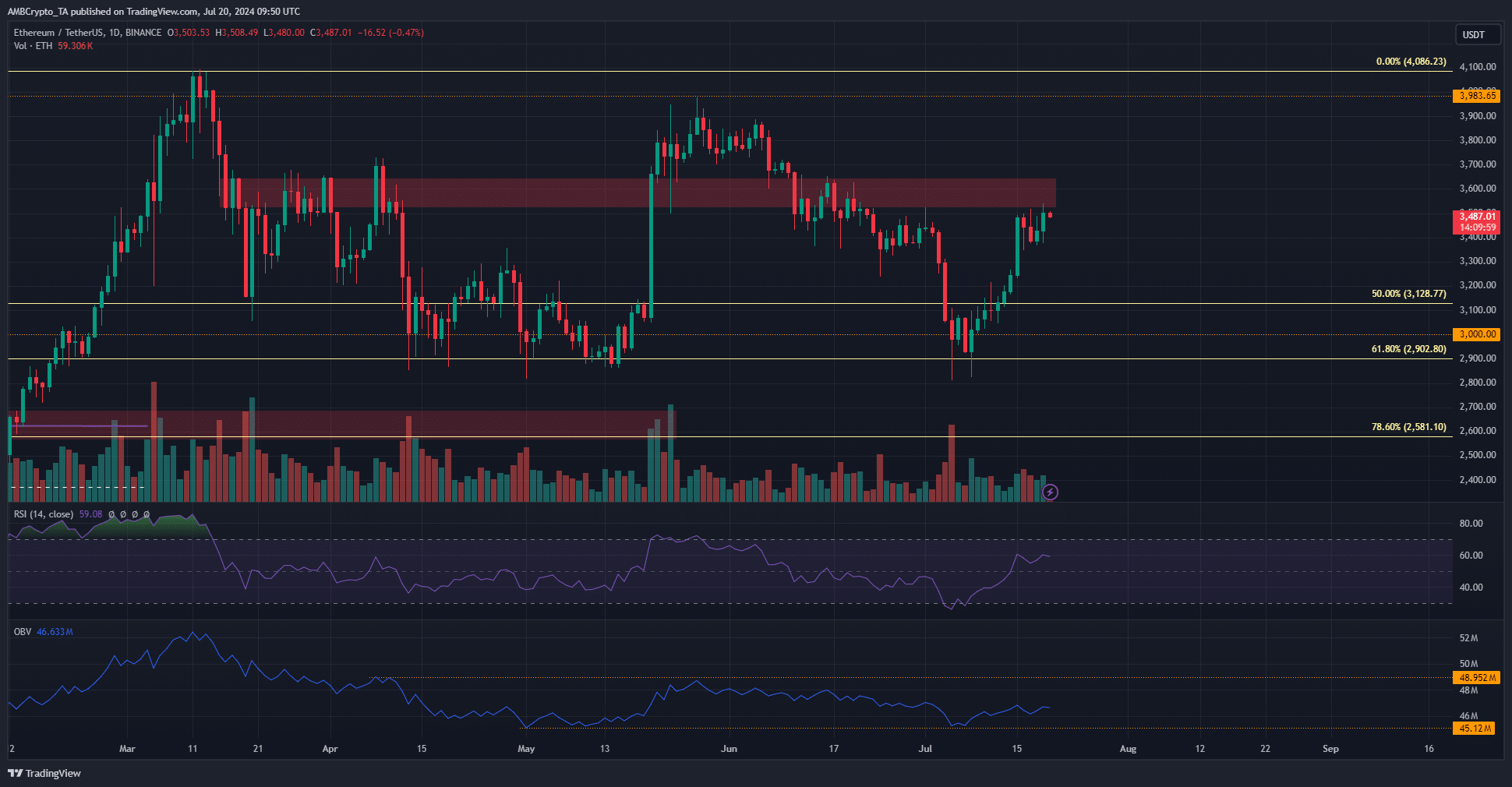

As a seasoned researcher with extensive experience in analyzing cryptocurrency markets, I’ve observed Ethereum’s [ETH] intriguing behavior over the past week. Over the last five days, there have been strong attempts by Ethereum to surge above the $3.5k resistance level. However, this momentum has stalled, leaving traders in a state of anticipation.

At present, Ethereum [ETH] is transacting under the $3,500-$3,600 resistance mark. The coin’s progression has slowed down significantly over the last week. Notably, a recent analysis disclosed that the ratio of taker buyers to sellers has dipped below 1.

This indicated a reduction in buying pressure in recent days.

In simpler terms, the RSI’s daily reading indicated a surge in buying activity, suggesting a bullish trend. However, the On-Balance Volume (OBV) was hovering near its May lows, which wasn’t an encouraging sign for optimistic investors.

Hence, AMBCrypto investigated whether the on-chain metrics leaned bearishly or bullishly.

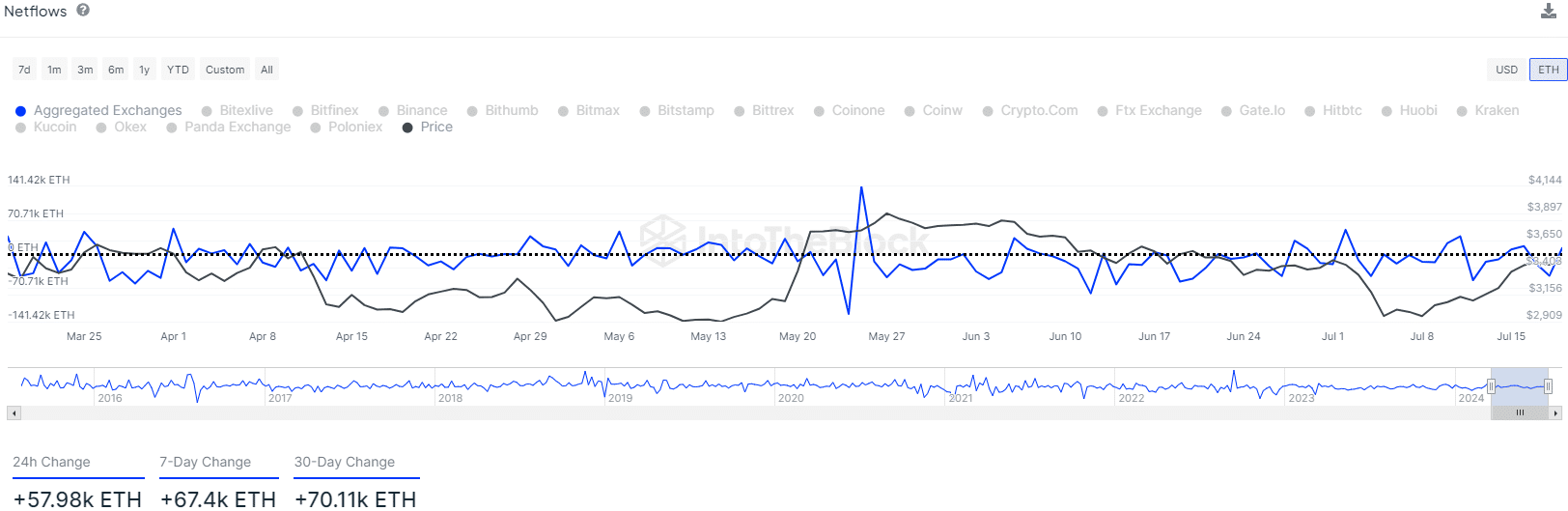

Recent positive netflows explain stalled momentum

Last week, approximately 57,980 Ethereum tokens moved into exchanges. Within the past month, around 70,110 Ethereum tokens have entered these platforms.

With more money coming in than going out, there was a possibility of increased selling pressure for this altcoin’s market as a result.

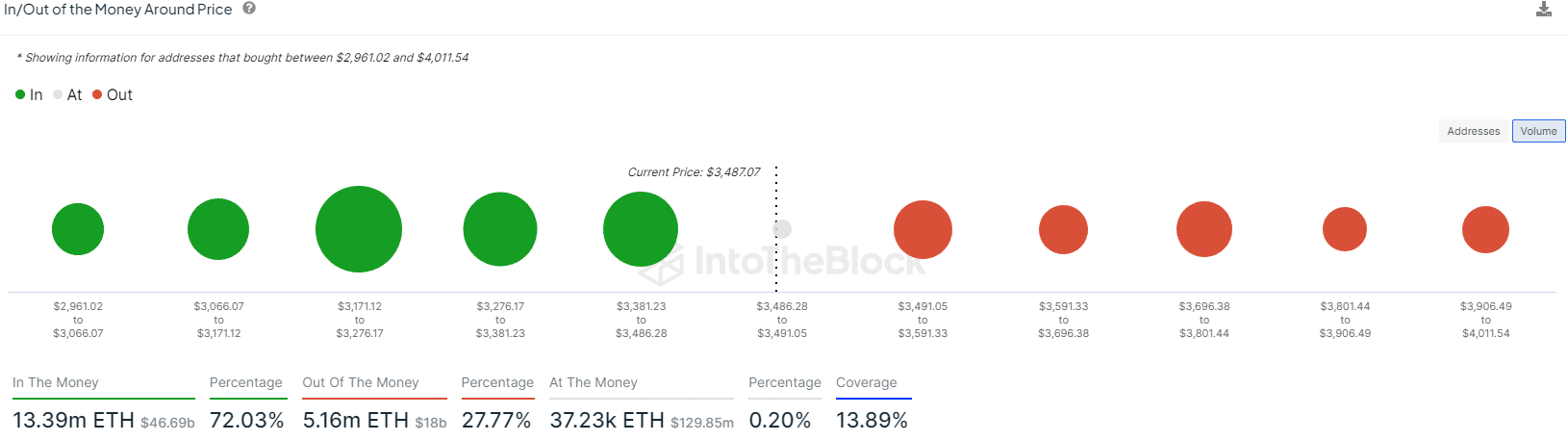

Furthermore, the in-out-money graph indicated that this range between $3171 and $3276 saw the most significant trading activity due to high demand.

Meanwhile, the $3.5k and $3.7k resistance levels might pose as opposition to the market’s bulls.

On-chain metrics underline Ethereum’s stagnancy

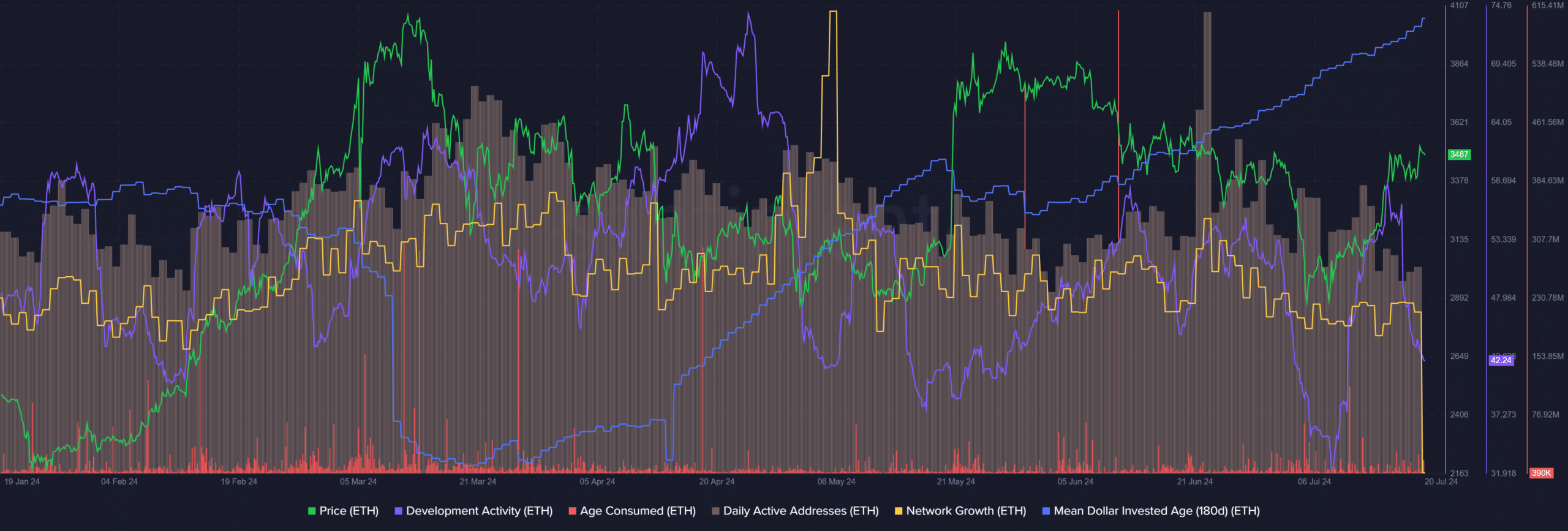

The 180-day average investment dollar age (MDIA) has been on an upward trajectory since April. However, this extended rise is a cause for concern because it might suggest decreased network engagement and potential stagnation of new investments.

Despite ETH‘s fluctuating price trends, the development process has remained strong and active. This is good news for long-term investors.

On June 22nd, there was a significant increase in daily active addresses and network growth. However, these metrics have since decreased. Additionally, the consumption of the product (referred to as “age-consumed”) has been relatively low over the past week.

The data indicated that Ethereum might face significant challenges surmounting the resistance levels at $3.6k to $3.7k.

Read Ethereum’s [ETH] Price Prediction 2024-25

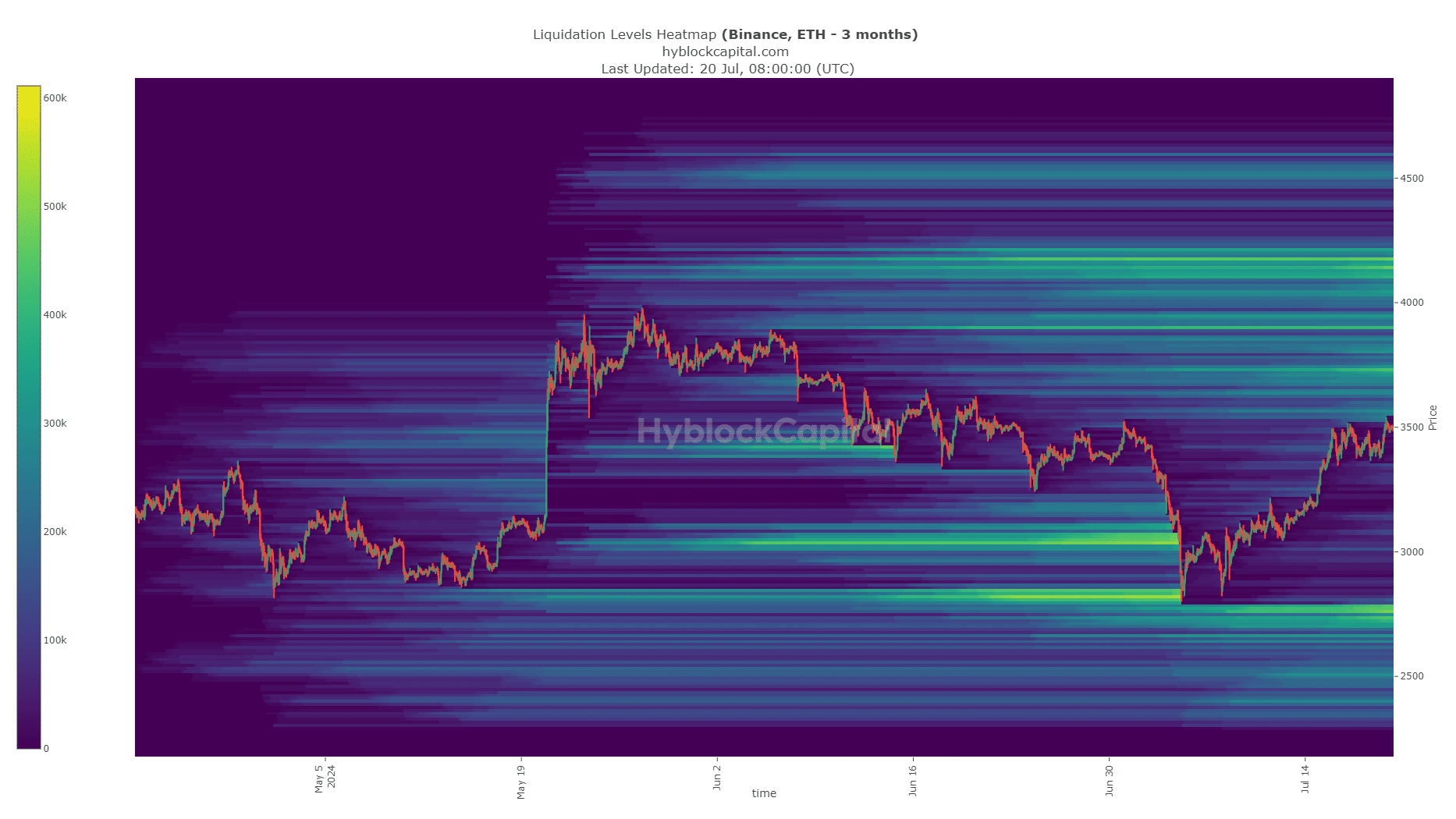

The analysis by AMBCrypto highlighted this notion, as they examined Ethereum’s liquidation heatmap. Following the depletion of its liquidity pool at a price of $2.8k, Ethereum displayed a strong recovery. Two significant clusters of liquidity were noticeable at prices $3.7k and $3.9k respectively.

Buying Ethereum at current prices might spark a price increase and potentially reverse the downward trend, similar to how investors become enthusiastic when Ethereum approaches the $4k threshold, anticipating it to surmount this resistance.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- How to Get to Frostcrag Spire in Oblivion Remastered

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Moana 3: Release Date, Plot, and What to Expect

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

2024-07-21 05:11