- Ethereum’s netflow pattern could see a hike in selling pressure in the coming days. Or not. Who knows? 🤷♂️

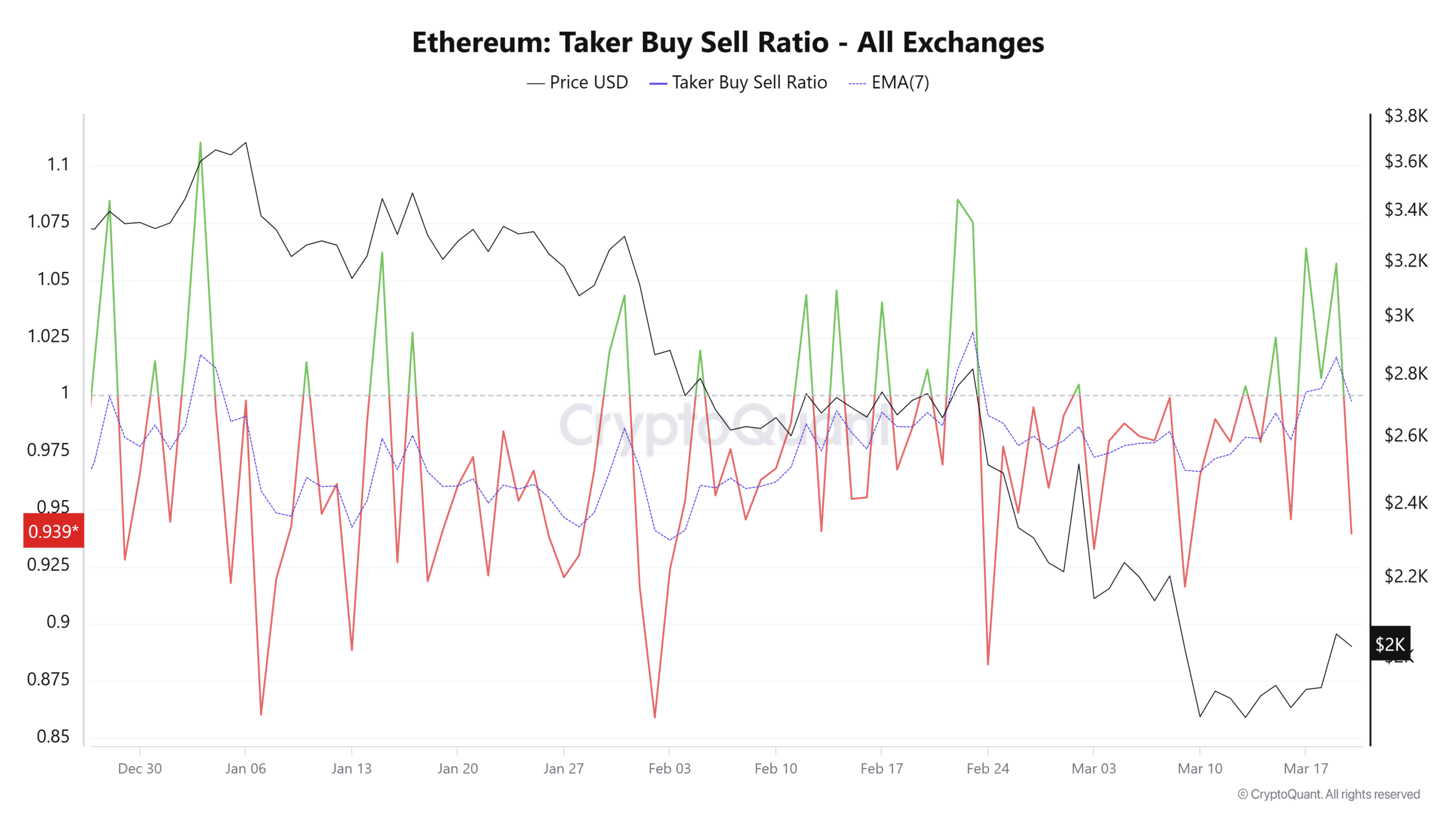

- Data from the derivatives market revealed that taker volume highlighted bearishness in the market. Shocking, right? 😏

So, Ethereum [ETH] decided to bounce back a whopping 10% since Tuesday’s lows. A bounce that, let’s be honest, felt a bit like a cat jumping off a roof—unexpected and slightly terrifying. This little jump happened just before the U.S. Fed Meeting, which, spoiler alert, didn’t reveal any earth-shattering news. Economic growth is slower than a snail on a treadmill, and it seems next year will be just as thrilling. The Federal Reserve hinted at two rate cuts this year, which is like saying, “We might throw you a bone, but don’t get your hopes up.”

But fear not, dear crypto enthusiasts! Bitcoin [BTC] managed to bounce to $87.5k before doing a little cha-cha with a 1.86% retracement. Meanwhile, Ethereum was down 2.36% from its previous day’s high at $2,069. And just when you thought it couldn’t get worse, a recent report revealed that Ethereum’s network activity is at its lowest in 2025. Yes, you heard that right—2025! A delightful warning sign for investors. 🎉

Piecing Together the Clues for Ethereum

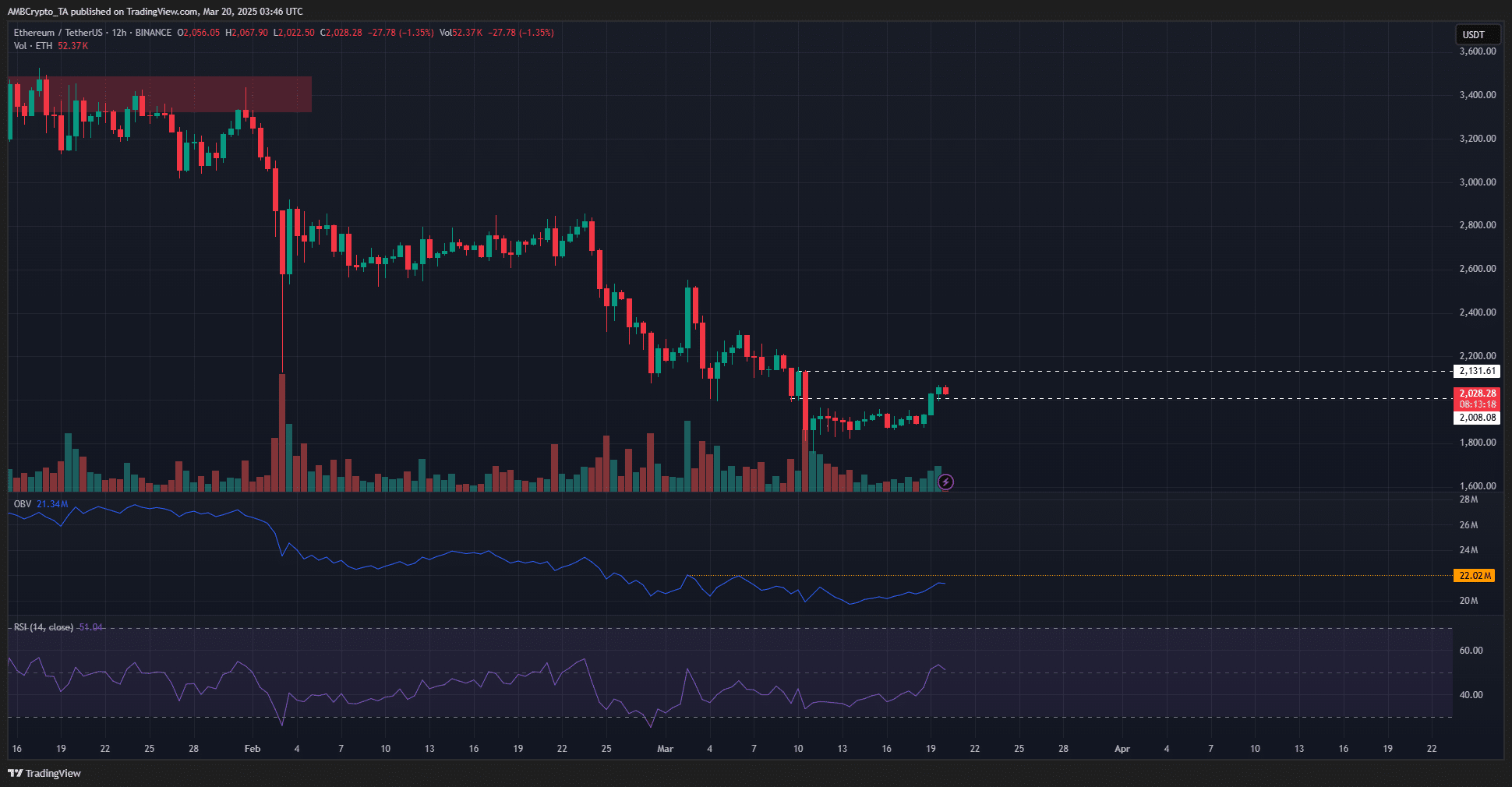

On the 1-day chart, ETH is maintaining a strong bearish trajectory. The OBV is below local highs, which sounds fancy but basically means it’s not looking great. The RSI, however, is waving a little flag that says “bullish shift,” but let’s not get too excited. The move beyond $2k seemed like a bold statement, but it could just be a liquidity hunt—like searching for your keys in the couch cushions.

Given the current structure, it’s likely that the price will head lower again. The buying volume needed to shift this bearish structure is still playing hide and seek, according to the OBV. And let’s face it, market sentiment is about as cheerful as a rainy Monday morning. ☔️

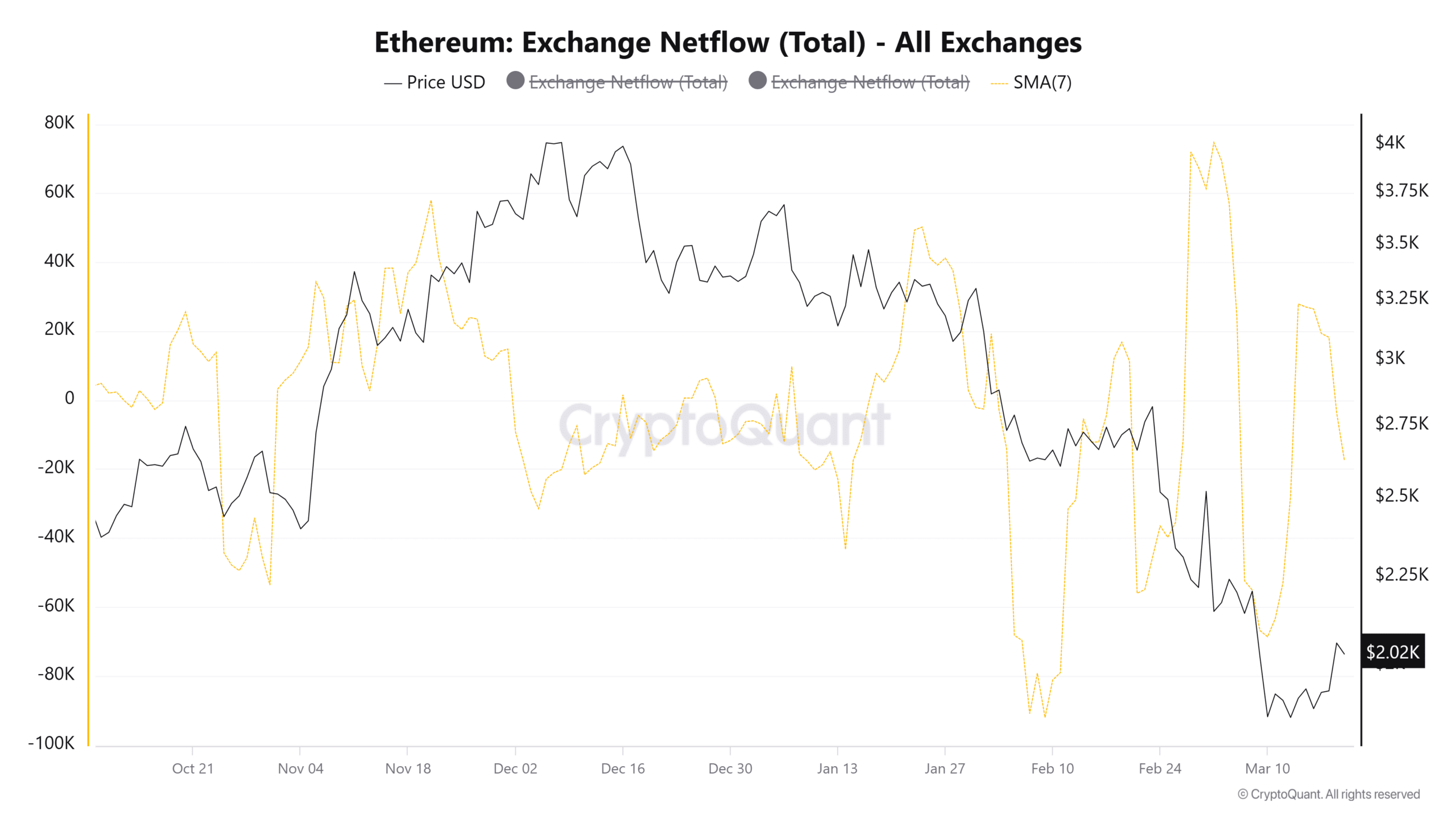

Exchange netflows are like the lifeblood of ETH, tracking the flow of Ethereum into and out of exchanges. It’s the difference between inflows and outflows, smoothed out over seven days to avoid any nasty surprises. Higher inflows mean more selling pressure, while a hike in outflows suggests that people are hoarding ETH like it’s the last cookie in the jar.

Since mid-January, we’ve seen four notable spikes in ETH inflows to exchanges. Local peaks in netflows were spotted on January 24, February 19, March 3, and March 14. The first three spikes were followed by a sharp price drop within days. The early March inflows coincided with Ethereum’s dramatic fall from $2.8k to $1.8k. Talk about a rollercoaster ride! 🎢

If this pattern decides to repeat itself, the worries from the price action front are likely to be spot on. Bears could be gearing up for another price drop in the coming days. Grab your popcorn! 🍿

The taker buy/sell ratio measures the taker (market order) buy volume to sell volume in perpetual trades. A ratio over 1 means taker buy orders are dominant—indicating bullish sentiment. But over the past three weeks, bearishness has been the name of the game. The taker ratio has shown that selling pressure is stronger than a toddler throwing a tantrum.

It began to change over the past two days, which saw the 7-

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-03-20 10:18