Ethereum trudges along, stubborn as a mule, refusing to jump the resistance hurdle after weeks of corrections. The scene? A market playing hide-and-seek, bouncing here and there, yet the overall posture remains as uncertain as a cat on a hot tin roof. Signs of recovery flicker like a candle in the wind, but the bigger shift-if it ever comes-remains elusive. It’s like waiting for your coffee to brew, only to realize it’s decaf-false hope, wrapped in a thin veneer of optimism.

Technical Analysis (Because Charts Never Lie-or Do They?)

By Shayan-with a dash of skepticism and a smirk that says, “I’ve seen this show before.”

The Daily Chart: The Long, Dragging Saga

There’s ETH, still stubbornly beneath that relentless descending trendline, acting as the gatekeeper to higher realms. It recently bounced off the $2,700 support-like a pinball, bouncing but not flying-yet it’s trapped within the wedge, side by side with the 100- and 200-day moving averages, all converging ominously near $3,600. A bearish crossover-because what’s life without a little chaos?-could plunge us deeper into despair. Meanwhile, for bullish hopes to breathe anew, ETH must punch through the $3,500-$3,700 zone, starting with a breakout from that pesky falling trendline. Easier said than done, of course.

The 4-Hour Chart: The Short-Term Soap Opera

On this shorter frame, ETH dared a false breakdown below $2,750 but quickly reclaimed the territory-reminding us that markets love to tease. Now, it’s testing the magical $3,000 level that once triggered a sell-off faster than a gossip at a tea party. If buyers can flip that level into support, a bullish trail towards $3,400-$3,500 might appear, but fail, and it’s back down toward $2,900-or worse, into the abyss. RSI? Rising steadily, but not overexcited-yet. The market is alive, but not out of the woods, just yet.

On-Chain Analysis: Numbers Don’t Lie… Usually

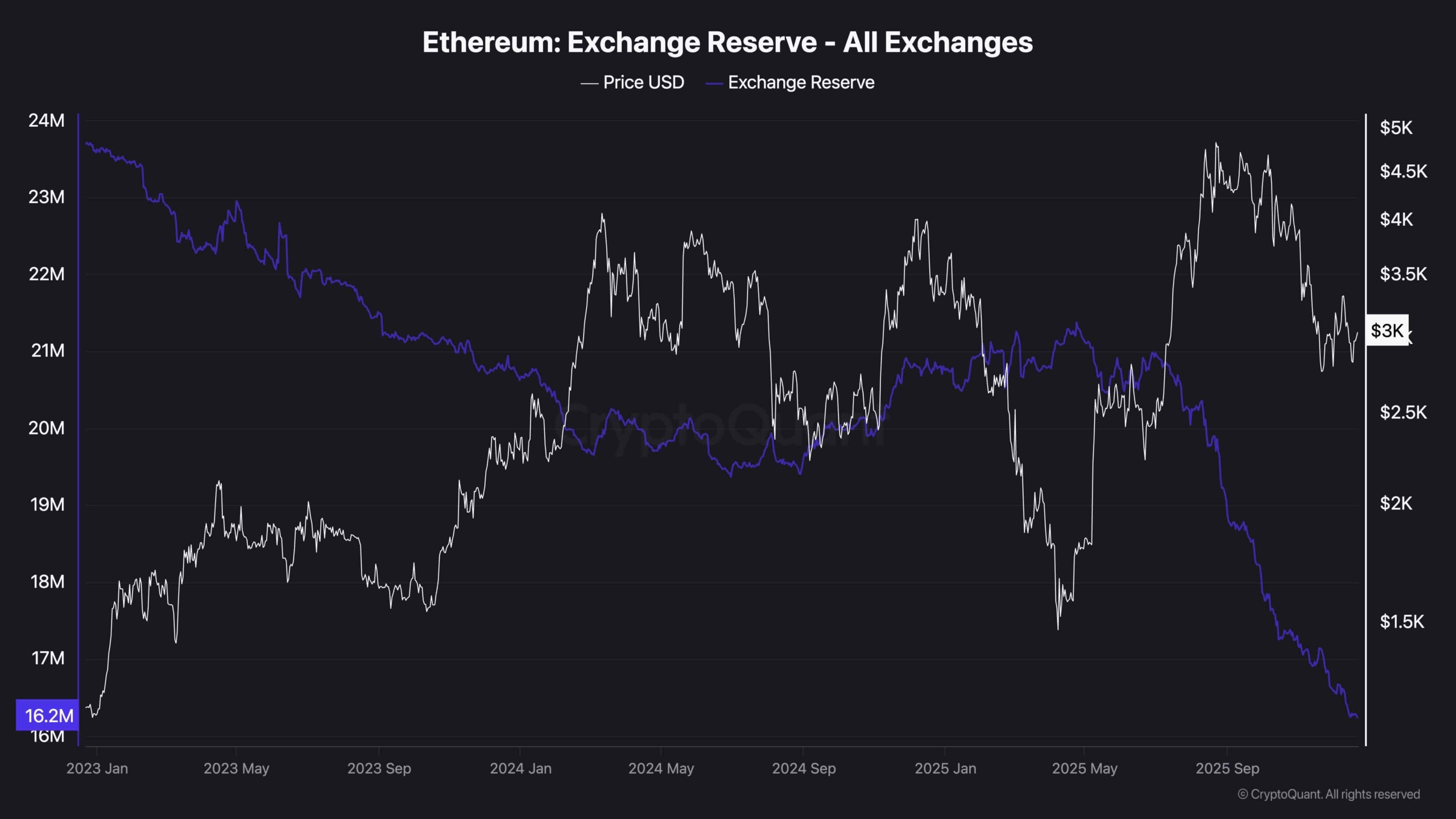

Exchange Reserves: The Silent Decline

Ethereum’s exchange reserves are evaporating faster than your paycheck after a weekend getaway-down to 16.2 million ETH, the lowest in years. This suggests people are hoarding, stashing away for a rainy day, and reducing sell-side pressure. Historically, this is bullish-a classic case of “less supply, more hope”-but the market hasn’t caught on just yet. Maybe traders are waiting for some grand macro event or their coffee to kick in before making a move. Or perhaps they’re just indecisive-who can blame them?

While the on-chain data paints a rosy picture for the long haul, right now, the technicals remain as fragile as glass slippers on a cobblestone street.

Read More

- Best Controller Settings for ARC Raiders

- The Best Members of the Flash Family

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Dan Da Dan Chapter 226 Release Date & Where to Read

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- TikToker Nara Smith Reveals Husband Lucky Blue Doesn’t Let Her Drive

2025-12-22 18:08