-

ETH has continued to decline on the charts

Significant inflows to exchanges suggested many traders are selling off the altcoin

As a seasoned crypto investor with battle-tested nerves and a portfolio that’s seen its fair share of market highs and lows, I can’t help but feel a sense of familiarity as I watch Ethereum (ETH) continue to slide on the charts. The recent break below crucial support levels has set off alarm bells for many traders, myself included.

In the latest trading session, Ethereum experienced a significant decrease in value, dropping below its essential support thresholds. This potential breakthrough might be interpreted as a bearish indication, possibly triggering a wave of panicked selling among traders. If these traders, who own ETH at these levels, become anxious and decide to liquidate their holdings, it could intensify the downward trend, leading to a vicious cycle of declining prices.

Ethereum breaks below support levels

Over the past four days, a substantial decline in Ethereum’s daily price trend was observed, with the steepest drop taking place on August 2. On this particular day, Ethereum experienced a notable decrease of roughly 6.71%, causing its value to fall from around $3,200 to approximately $2,985.

Over the past four days, a total drop of more than 10.5% has occurred, and the latest trading day played a significant role in this negative trend.

As I analyze the current Ethereum market trends, it’s clear that the initial support level of approximately $3,200 has been surpassed due to recent market fluctuations. The new potential support zone now lies within the range of $2,900 to $2,700.

Additionally, our examination found that the Relative Strength Index (RSI) stood approximately at 34. This figure indicates a robust downward trend, as an RSI lower than 30 is deemed ‘oversold’, suggesting the market may be overextended in the bearish direction.

If the point where a key support level is broken, it might result in additional drops if the newly established support areas are unable to prevent price decreases.

Fate of Ethereum’s price lies here

It’s clear that the drop in Ethereum’s value over the past period has noticeably impacted the earnings of its investors, according to the data provided by IntoTheBlock.

Initially, ETH‘s $3,000 price point served as a significant support level, as approximately 1.7 million wallets had bought Ethereum under that cost. But due to the recent decline in cryptocurrency markets, that number has decreased.

As ITB reports, around 15.12 million Ethereum addresses currently hold Ethereum that were purchased at a higher price than the current one. This means that more than 64% of all Ethereum addresses are in a situation where the cost basis (the price at which they bought their ETH) is higher than the current market price.

On the other hand, approximately 8.08 million addresses found themselves in a profitable position, making up around 34.51% of all holders. This group purchased their Ethereum during the price range between $2,600 and $2,900 per ETH.

In this current scenario, Ethereum’s market find themselves in a delicate state. Those investors who bought below the current market price (the “in-the-money” holders) are at a crucial point because while their investment is still yielding a profit, it’s approaching the level they initially paid for it.

If these holders start to rapidly sell their Ethereum due to fear of additional losses, it might cause a chain reaction, leading to an even steeper decline in Ethereum’s price.

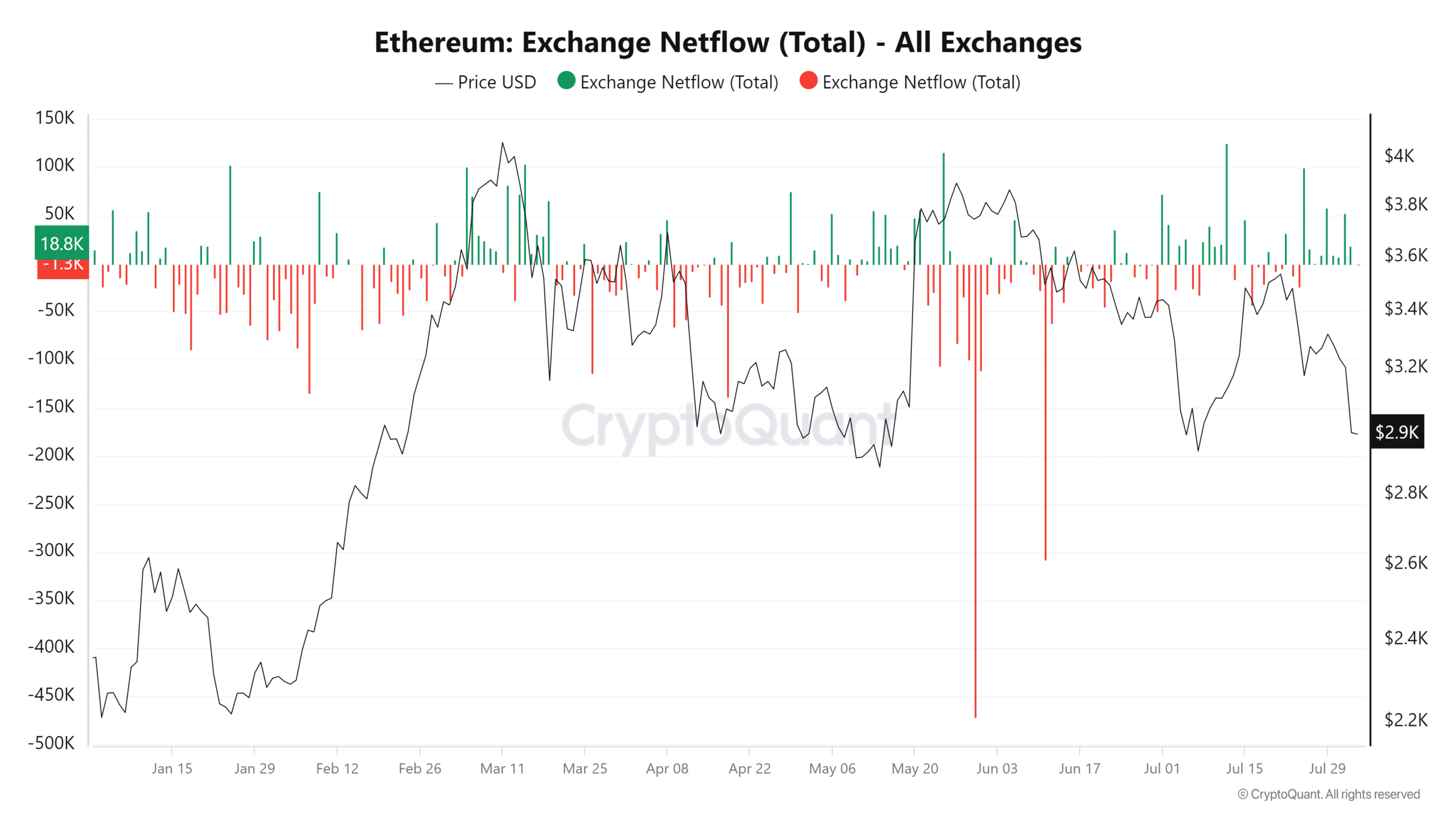

What do the ETH netflows say?

Analysis of Ethereum’s net transfers from CryptoQuant shows a prominent increase in deposits into exchanges. As AMBCrypto reports, there were positive net transfers amounting to nearly 53,000 on August 1 and almost 19,000 on August 2. This implies that around $216 million worth of Ethereum was shifted to exchanges within the first two days of this month.

A significant number of traders chose to cash out their investments in the exchanges due to these influxes, possibly aiming to profit from present market rates or minimize losses. This mass selling could intensify the existing selling force within the market, potentially triggering a sequence of falling prices.

– Read Ethereum (ETH) Price Prediction 2024-25

To maintain stability for Ethereum’s price, it’s important that the current pattern of funds flowing into exchanges starts to reverse instead.

Read More

2024-08-03 20:07