-

Ethereum’s funding rate has remained positive despite recent declines.

The ETH trend has also remained bullish despite the price declines.

As an experienced financial analyst, I have been closely monitoring the Ethereum market and its various metrics in recent weeks. While the news of the ETH spot ETF approval was a significant catalyst for heightened sentiment and social volume, the subsequent decline in both areas is understandable given the broader market conditions.

Following the announcement of Ethereum [ETH]’s approved spot ETF, there was initially a surge in positive sentiment. However, as the excitement died down, the overall feeling towards Ethereum became more subdued, reflected in its decreased weighted sentiment. Nevertheless, other indicators hint that Ethereum could experience a bullish trend once regular trading commences.

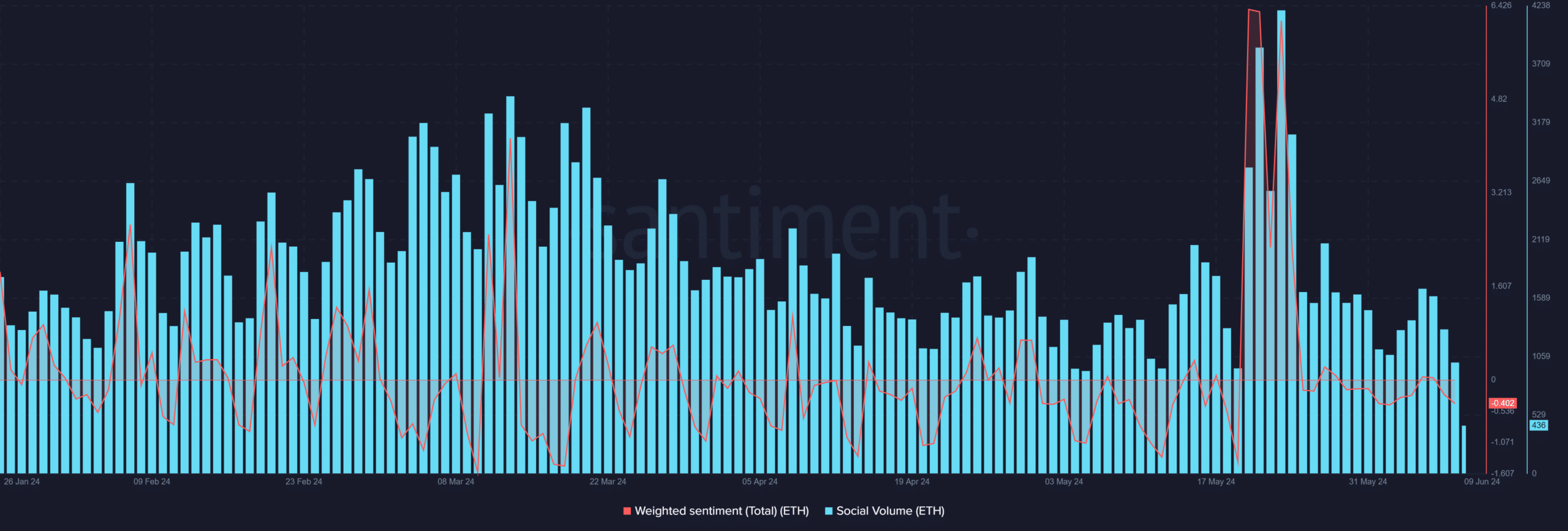

Ethereum’s sentiment and social volume declines

As a researcher studying the cryptocurrency market, I observed a significant shift in the sentiment towards Ethereum based on the Santiment sentiment chart’s findings. The chart displayed a noticeable drop in Ethereum’s sentiment following two spikes on the 20th and 21st of May. These spikes reached over 6% in weighted sentiment, suggesting heightened investor interest or strong market movements. However, this positive trend appeared to reverse, resulting in the decline in overall sentiment for Ethereum that I observed.

The decline started around 2%, but it quickly dipped lower. However, this downturn was short-lived as the figure surged past 6% on May 23rd. This significant increase can be attributed to the announcement of ETH spot ETF approval, which generated intense discussion and positive sentiment within the market.

After the significant increase in sentiment, there have been successive decreases, leading to a current negative weighted sentiment with a reading of approximately -0.4.

The current feeling towards Ethereum is more negative than the positive sentiment it had a few weeks ago.

An examination of the social media activity revealed peaks aligning with heightened positive and negative sentiment. The graph demonstrated a significant uptick in overall social mentions reaching 4,197 during these instances.

Just like the previous weighted sentiment, it has experienced a substantial decrease. Currently, the social media buzz hovers around the 415 mark.

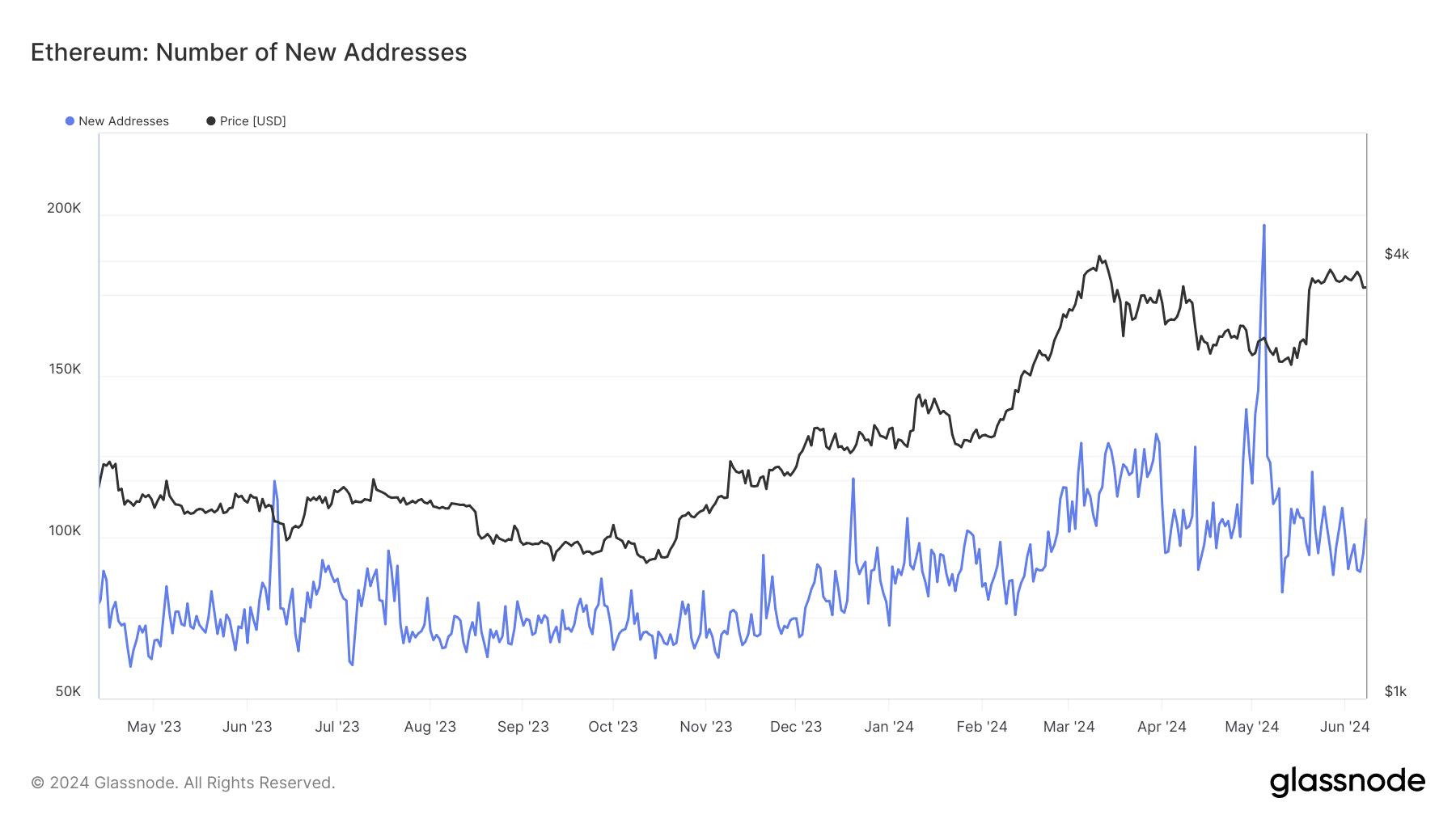

Ethereum’s trend of new addresses continue

The chart of new addresses on Glassnode indicates a persistent influx, with over 105,000 newly created addresses as of now, contrary to the prevailing weak market sentiment.

Despite some initial decreases early in the month, a noticeable upward trend has emerged. This suggests an increase in the formation of new Ethereum addresses preceding the commencement of ETH spot trading.

The number of addresses could further increase once trading starts.

Ethereum remains positive on the derivative side

As a researcher studying the cryptocurrency market, I conducted an examination of Ethereum’s weighted funding rate on Coinglass. Surprisingly, I found that this rate, which reflects investors’ collective positioning and funding costs, has managed to stay positive despite recent market downturns.

Based on the current data from the chart, the funding rate stands at approximately 0.092%. This implies that demand from buyers outweighs supply from sellers, indicating a robust conviction among market participants that Ethereum’s price will increase in the future.

– Read Ethereum (ETH) Price Prediction 2024-25

ETH sees slight increases

From my perspective as a researcher, at the current moment, Ethereum is priced approximately at $3,690 following a minimal 0.4% growth. Based on AMBCrypto’s examination of its daily chart, there have been slight upward trends over the previous two days.

After a significant drop of over 3% on June 7th, Ethereum experienced modest upticks that took it out of the $3,800 price range.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-10 09:11