- Ethereum garnered the top spot as the highest earning blockchain

- There remains a close relationship between fees and transactions

As a seasoned crypto investor who’s seen the rise and fall of countless digital assets, I can confidently say that Ethereum’s dominance is more than just a passing trend. Over the past year, it has consistently outperformed its competitors in terms of fee revenue, solidifying its position as the go-to smart contract network in 2024.

As someone who has been closely following the cryptocurrency market for several years now, I must say that the latest stats on blockchain revenue have left me quite impressed. The Ethereum network has consistently proven its dominance in the field, even amidst growing competition. In my opinion, this is a testament to its robust infrastructure and innovative smart contract capabilities.

Over the past year, Ethereum generated approximately $2.7 billion in fee earnings, surpassing its main competitor, Bitcoin, which earned $1.43 billion. This significant gap showcases Ethereum’s dominance over other networks in the market.

In 2024, Ethereum’s leading role in charging higher transaction fees indicates that it continues to be the go-to platform for smart contracts. Being an early leader in this area has kept Ethereum as the preferred network for a majority of decentralized applications (dApps) and users.

As a crypto investor, I’ve noticed that the surge in popularity of layer 2 solutions might be a sign that they’re effectively addressing Ethereum’s limitations on its mainnet. In other words, it seems like these secondary networks are stepping up to the plate and making improvements where the mainnet was falling short.

What’s driving up Ethereum fees?

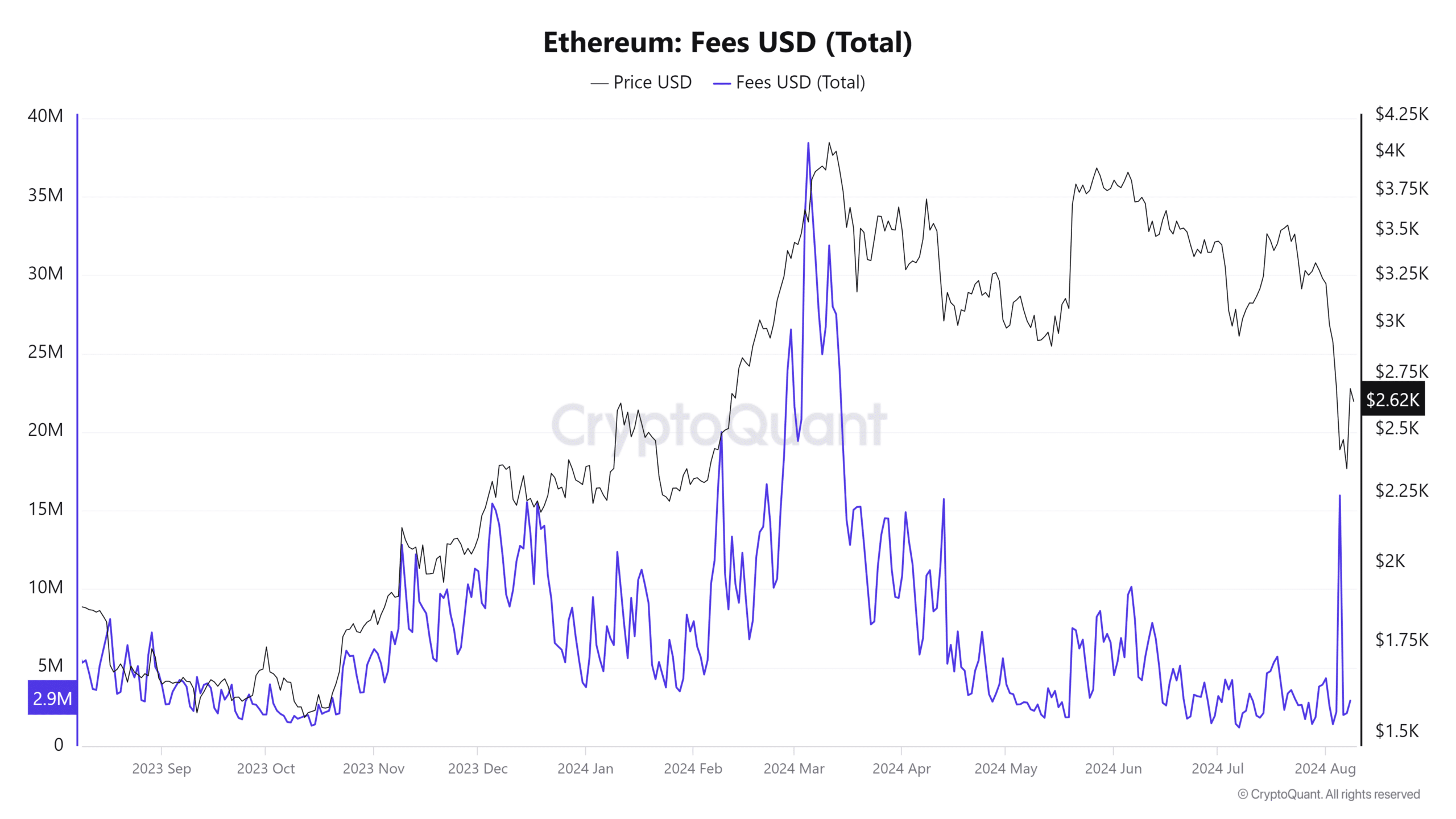

By examining Ethereum’s daily fee chart for a full year, it becomes evident that the cost of Ethereum transactions (fees) follows a direct relationship with the value of Ether (ETH).

As a researcher, I discovered that the maximum daily revenue our network accrued within the past 12 months was an impressive $38.42 million, which happened on the 5th of March.

As a researcher, I’ve noticed an intriguing pattern: Just before, Ethereum was on a significant upward trajectory, and a notable surge happened around its projected 2024 peak. This coincidence supports my observations that the demand for Ether within its ecosystem often increases during bull markets, suggesting strong practical value. Interestingly, this spike occurred on one of the market’s most volatile days.

In a similar fashion, we noticed a significant increase in Ethereum transaction fees not long ago during the most recent market downturn. On August 5th, these fees hit a record high of approximately $15.97 million. This surge in fees coincided with the market’s extreme volatility, where the bulls managed to reverse the bearish trend.

The lowest amount of network fees recorded on a single day was on 7 July at $1.19 million.

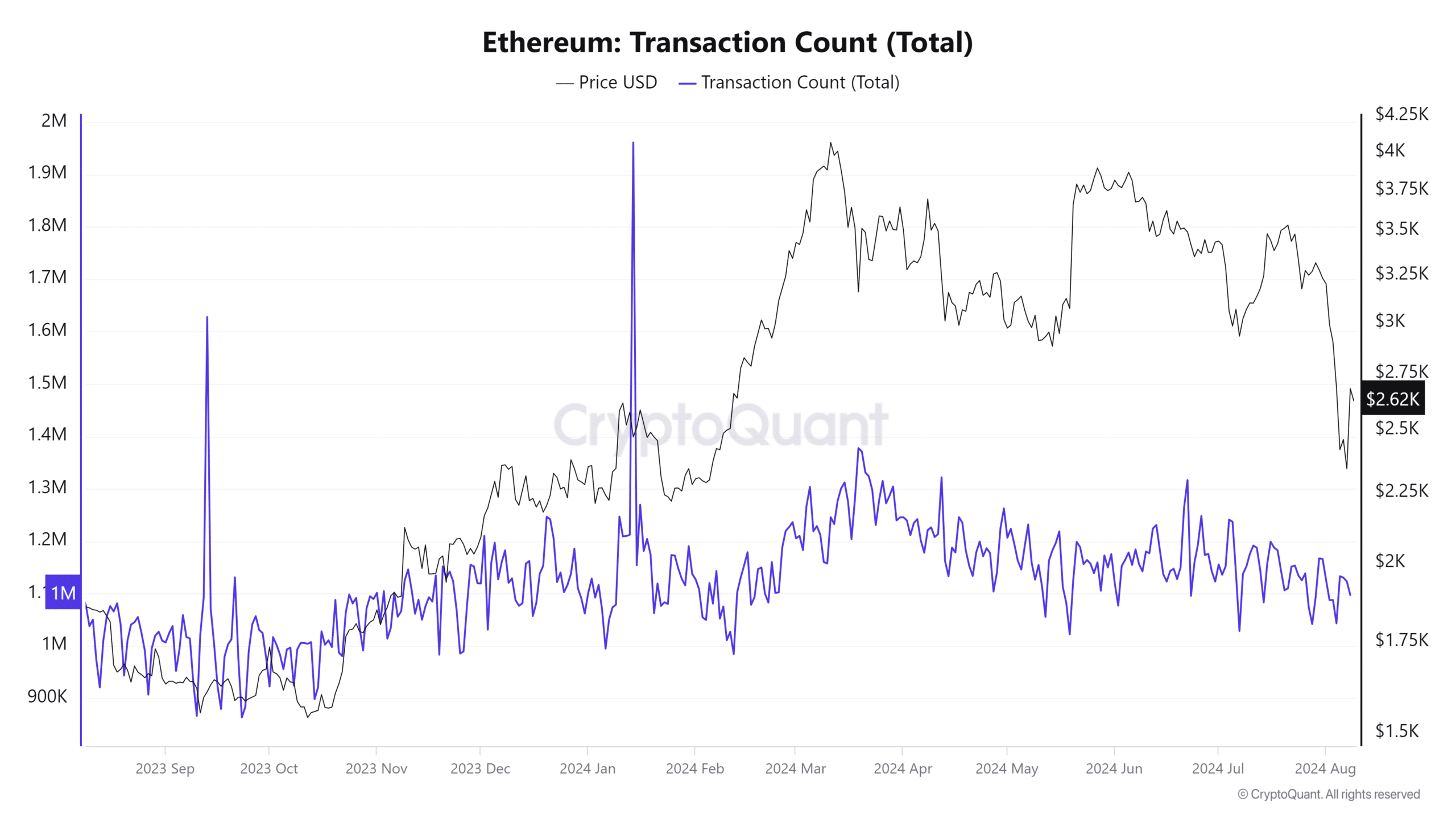

Transactions on the Ethereum network are often accompanied by fees, and here’s a look at how they have fluctuated over the past year: The highest daily number of transactions in the last twelve months reached a peak of approximately 1.96 million on June 14th. Conversely, the lowest number for this period was about 863,000 transactions on September 23rd.

On the contrary, there wasn’t a strong link between transaction activity and fees. This was predominantly due to the fact that the highest fees were typically seen on days when Ethereum prices were at their peak.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-08-10 12:07