Following a powerful surge that took Ethereum to a temporary peak of $2,730, the asset has experienced a drop exceeding 10%, testing crucial support points as the market experiences a cooling phase. This adjustment follows several days of intense buying activity and mounting anticipation for an extended altcoin season. Nevertheless, this recent dip has ignited discussions among analysts and traders, as opinions are now divided between those forecasting further growth and those preparing for a more substantial correction.

🚀 EUR/USD to Explode? Trump Trade Shocks Incoming!

Don't miss the crucial analysis before the market reacts!

View Urgent ForecastSome people think it’s beneficial and essential for Ethereum to take a break before resuming its upward trajectory. On the other hand, some argue that ETH may revisit lower regions, particularly if Bitcoin continues to move within a certain range. Top analyst Daan offered his perspective by focusing on the ETH/BTC pair, noting that after its significant rise, Ethereum now encounters resistance around the 0.026 Bitcoin value.

In simpler terms, if Ethereum continues to trade below its record high and is stuck in a large price range, the upcoming days could be crucial for determining whether this dip is temporary or the start of a larger decline. The current state of Ethereum will significantly influence the direction of the market trend as we move into the next phase.

Ethereum Holds Critical Support As ETH/BTC Pair Faces Key Resistance

Ethereum stands firm even amidst current market turbulence, keeping its value above $2,400. This region now serves as a significant support point, and it’s crucial for bulls to safeguard it to sustain the overall positive trend. The pace of price increase has slowed after reaching $2,730, but ETH continues to be one of the more robust assets in the market, holding its ground effectively amidst growing apprehension and speculative investments.

A significant portion of present enthusiasm revolves around Ethereum compared to Bitcoin’s performance. If Ethereum (ETH) consistently exceeds Bitcoin (BTC), analysts predict it might initiate the anticipated altcoin boom—a market period where altcoins significantly outshine Bitcoin. Daan provided insights on this relationship, emphasizing the ETH/BTC ratio, which has shown considerable strength in recent trading sessions.

As Daan explains, ETH has encountered resistance around the 0.026 mark following a strong surge. To maintain bullish momentum, it’s crucial for ETH to stay above 0.0224. If it falls below this critical support level, there could be a gradual decline that might undo the entire recent upward trend. Conversely, a decisive leap over 0.026 could pave the way for a move towards 0.03 and even higher levels.

Essentially, whether Ethereum can sustain itself above $2,400 and continue showing resilience compared to Bitcoin will largely determine its immediate future trend. If these two factors hold true, the chances of an extended altcoin surge become much more promising.

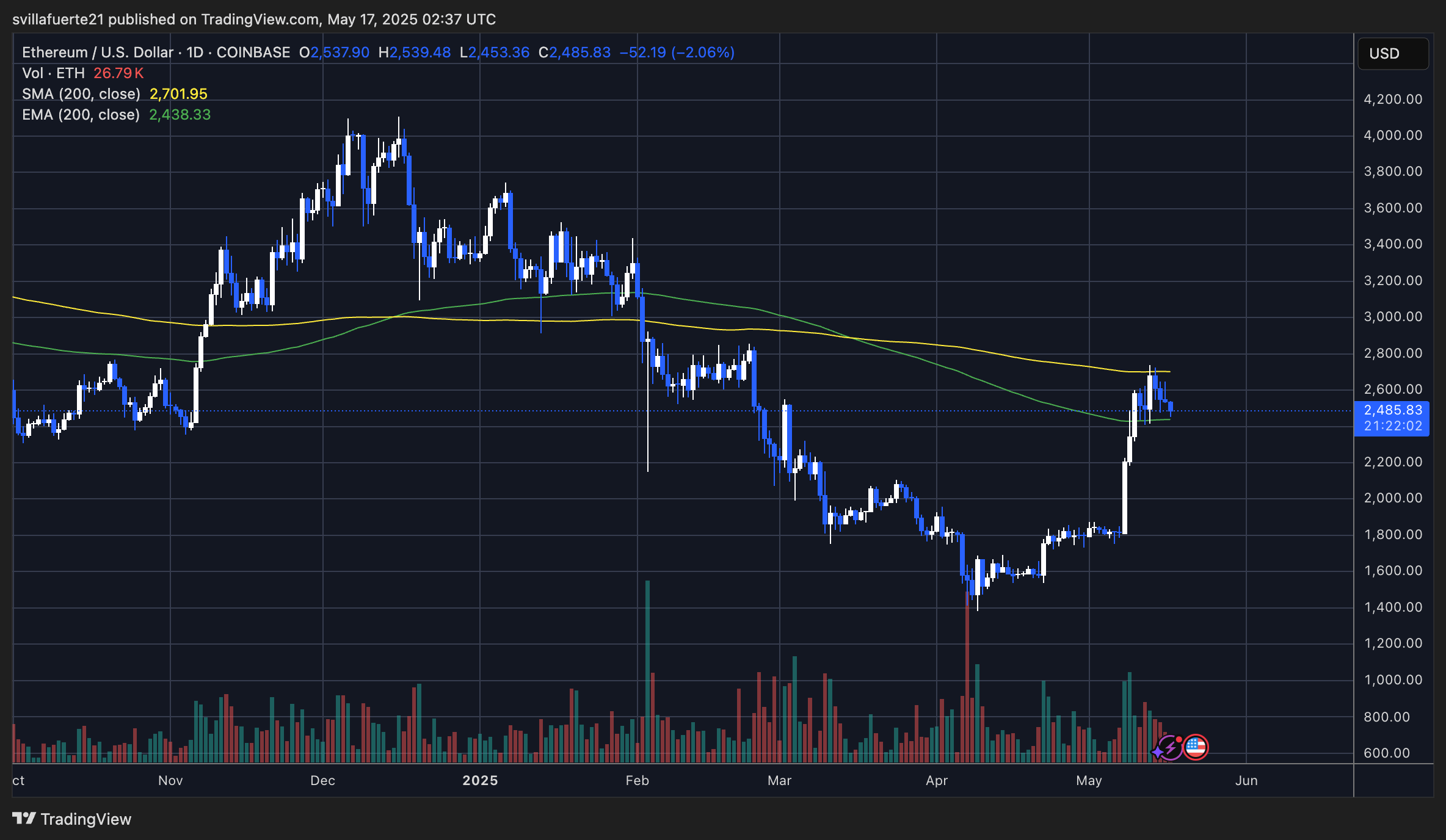

ETH Pulls Back Into Support After Failing To Break $2,700

Currently, Ethereum is being traded at approximately $2,485, marking a significant decrease from its recent peak of about $2,730. The graph indicates that Ethereum could not maintain its position above the 200-day simple moving average (SMA) at roughly $2,701, which proved to be a strong barrier for price increase. After several days of consistent upward movement, this rejection has caused the price to move back toward the 200-day exponential moving average (EMA) around $2,438 – an essential level that now functions as immediate support.

The level of activity, whether from buyers or sellers, has remained high during this period, indicating an ongoing engagement between both groups. Even though Ethereum was turned away by its 200 Simple Moving Average, it’s holding firm above the breakout point from early May where a significant rise occurred from below $2,000. If buyers manage to protect the Exponential Moving Average and keep the price above $2,400, it could potentially result in a lower low formation, paving the way for another push towards retaking the $2,700–$2,800 region.

If ETH falls below the $2,400 mark, the advantage may swing towards the bears, possibly leading to a more significant downtrend. At present, Ethereum is in a holding pattern within an overall bullish trend. The upcoming daily closes will be crucial for determining whether this pullback is normal or indicative of a deeper issue.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-05-17 13:20