-

ETH’s supply crisis intensified as staking demand spiked and exchange reserves fell

ETH fundamentals remained strong despite weak market sentiment

As a seasoned researcher with over two decades of experience in the crypto market, I have witnessed numerous bull and bear cycles, but the current Ethereum[ETH] situation is particularly intriguing. The intensifying supply crisis, coupled with soaring demand for ETH staking, suggests that we might be on the brink of a significant rebound for the world’s largest altcoin.

The ongoing scarcity issue with Ethereum [ETH] is becoming more pronounced, potentially leading to a robust recovery for the foremost alternative coin on a global scale.

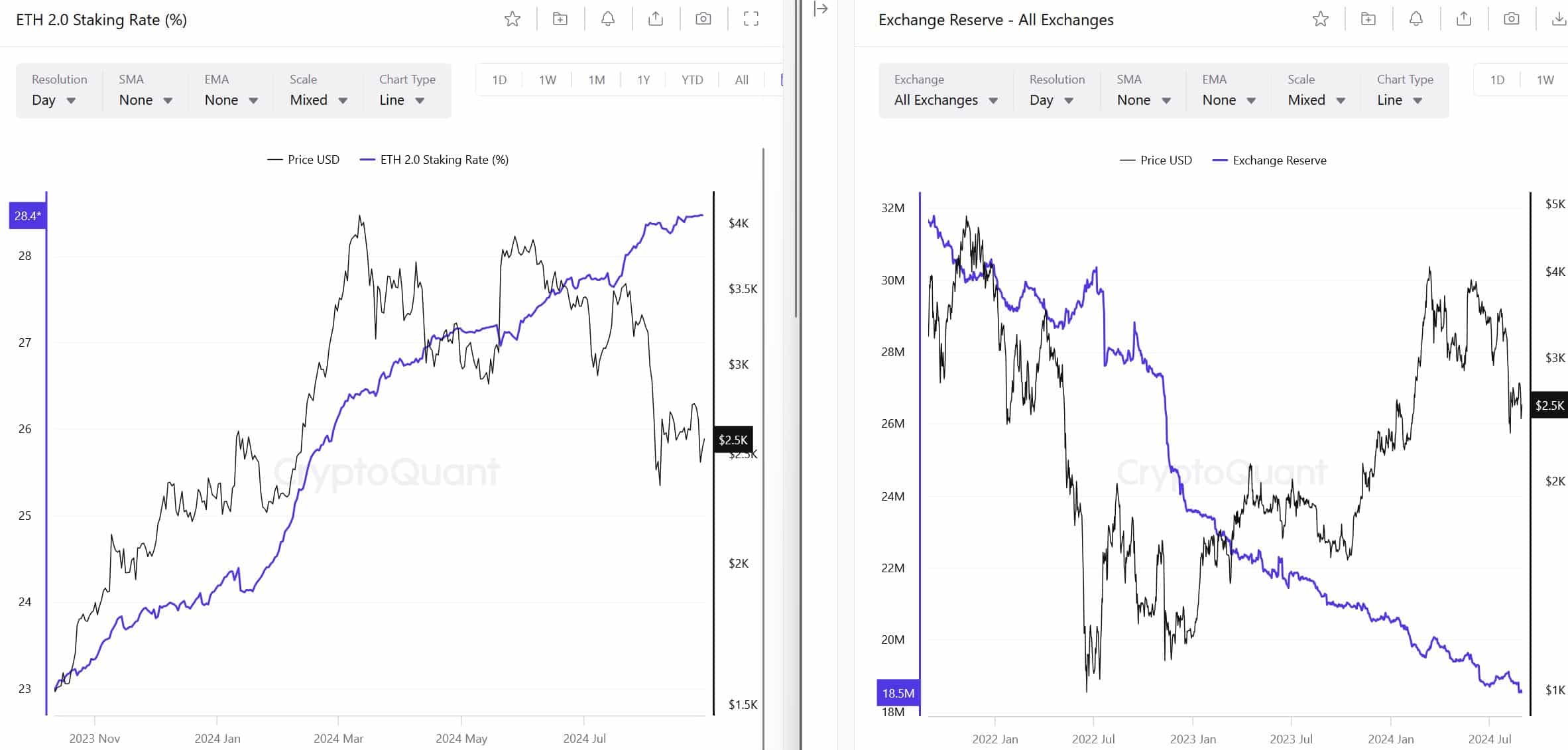

Indeed, as per the analysis of Leon Waidmann, an on-chain expert, the scarcity issue with Ethereum (ETH) has been intensified by decreasing exchange reserves and a rising interest among investors to stake ETH. His prediction is that ETH might soar due to this supply shortage.

“The Ethereum Supply Situation is becoming increasingly severe. As staking rates climb and exchange holdings decrease, once sellers run out and demand rises, Ethereum (ETH) is poised to skyrocket!🚀”

Notably, the Ethereum exchange reserves have dropped to an all-time low of 18.5 million within the past day. This is a significant decrease from the high of 35 million reached in 2020.

ETH fundamentals were strong, but…

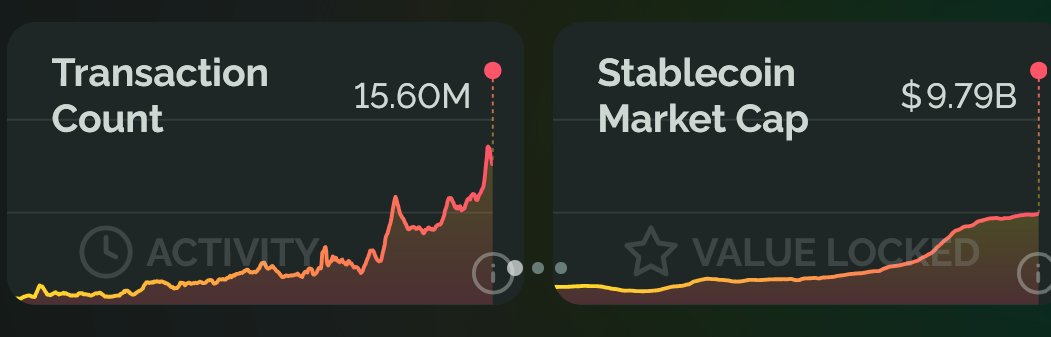

Moreover, the analyst emphasized the robust foundation of the Ethereum ecosystem, pointing out the all-time high numbers of stablecoins and transactions being processed.

“The number of transactions has reached an all-time peak of 15.6 million, and the market capitalization of stablecoins is also at an all-time high of $9.79 billion. These underlying factors have never been stronger!”

In simple terms, this suggests that Ethereum’s expanding network is a good indicator, usually associated with positive outcomes. Under regular conditions, such growth might trigger a surge or upward trend.

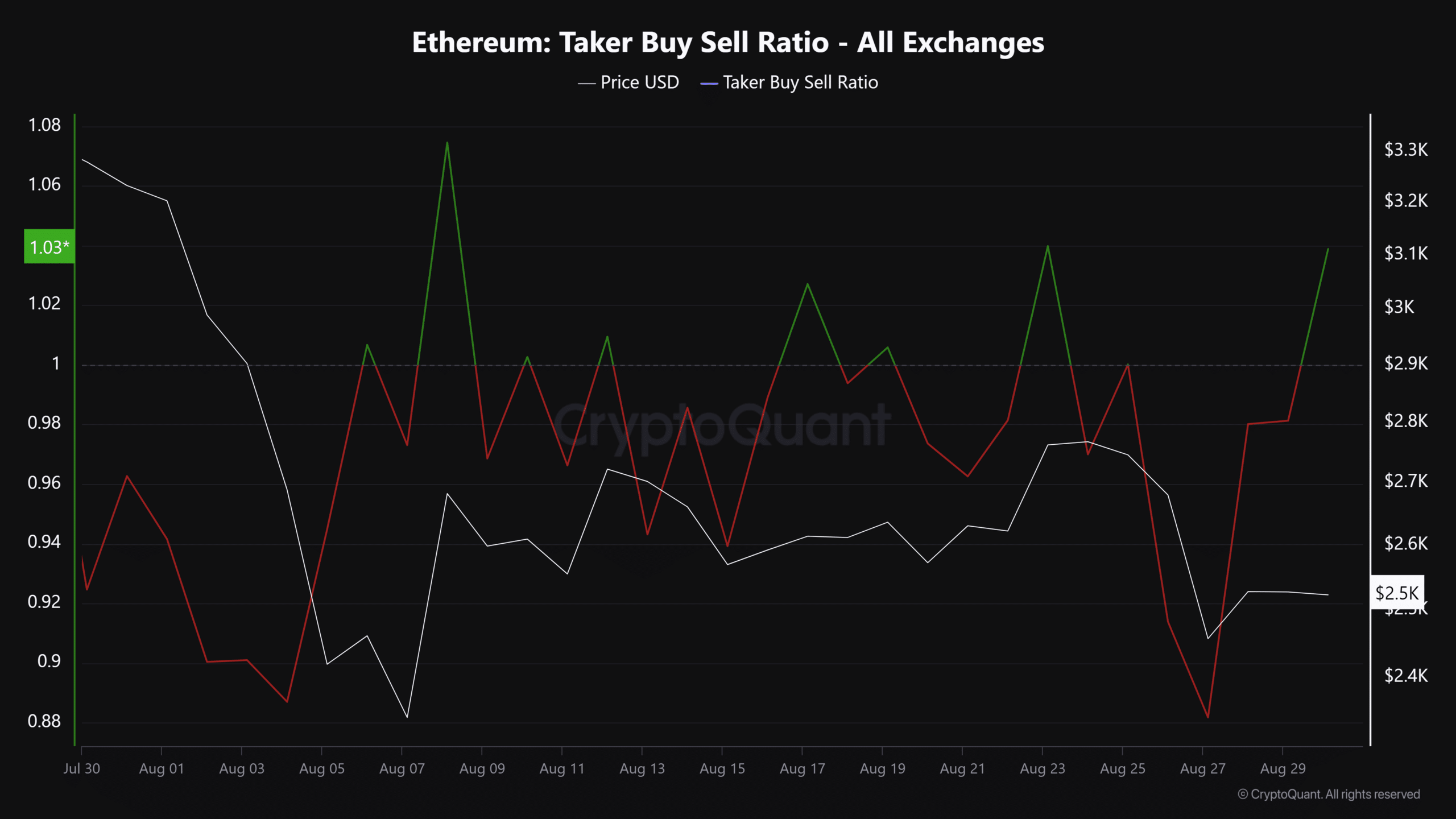

Nevertheless, the altcoin has predominantly been influenced by unfavorable market opinions throughout August, a trend that can be observed in the Taker Buyer Sell ratio. This measure monitors the altcoin’s trading volume on the derivatives market, considering both buying and selling activity.

1. In August, there was a strong indication that buyers were outnumbered by sellers, as suggested by the predominantly bearish market trends. This persistent pessimism might partly account for the subdued price fluctuations seen in the altcoin’s chart.

As a crypto investor, I’ve noticed that some of the pessimism can be attributed to the perceived low fees and inflationary worries within the ecosystem. However, with the advent of ‘blobs’, transactions on the chain have become more affordable, making it a cost-effective investment choice for many, despite initial concerns.

As per statements made by Ethereum community member Ryan Berckmans, an increase in blob utilization is expected to lead to enhanced earnings for the chain.

“For Ethereum L1 revenue, the future is extremely bright.”

As a fellow crypto investor, I’m not the lone voice here. Another analyst shares my optimism, projecting that Ethereum could potentially reach $10k solely based on its blob space utilization capabilities.

Currently, Ethereum (ETH) is being traded around $2,500, which represents a drop of almost 5% compared to its peak price of approximately $2,800 recorded over the weekend on weekly charts.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-08-31 08:08