- Ethereum‘s new recruits are pouring in like guests at a surreal ball near the Kremlin—nearly 40% more this week.

- ETH’s backstage is bustling, especially with the grand whales taking center stage.

Ah, Ethereum [ETH], the poor creature staggering through the merciless price labyrinth while beneath the surface, its sturdy legs—fundamentals—steadily flex.

Last week, a curious revival happened: Ethereum’s new adoption rate, according to the mystics at IntoTheBlock, surged to a near 40% threshold—like a sneeze escaping a nobleman’s nostril at a solemn feast.

More players flooded the scene, resembling a crowd at a Moscow street performance, which inevitably means growth in user numbers.

One could almost hear the rustle of new wallets as they clamber onto Ethereum’s stage—some 1.83 million unique depositors this past week, as if everyone suddenly decided to join the Tsar’s new dance ensemble.

These newly minted enthusiasts aren’t merely frolicking around; they are engaging—staking, trading on CEXs, or diving headlong into the cryptic rituals of DeFi.

It’s no mere happenstance. When the herd grows, it reflects an old tale: the market isn’t just a casino for speculators but potentially a gentleman’s club for those playing the long game.

Translation: when people stop chasing shadows and start planting flags, you might sniff stability wafting in the air.

The real question twisting like a cunning fox: Does this newfound enthusiasm dare to wiggle the price charts out of their slumber?

The High Rollers and Their Dance with ETH

According to AMBCrypto—our local informants—most activity is generated by the ‘big fish’. Imagine them, lacquered and self-satisfied, wielding their massive bags of ETH like aristocrats with outlandish mustaches.

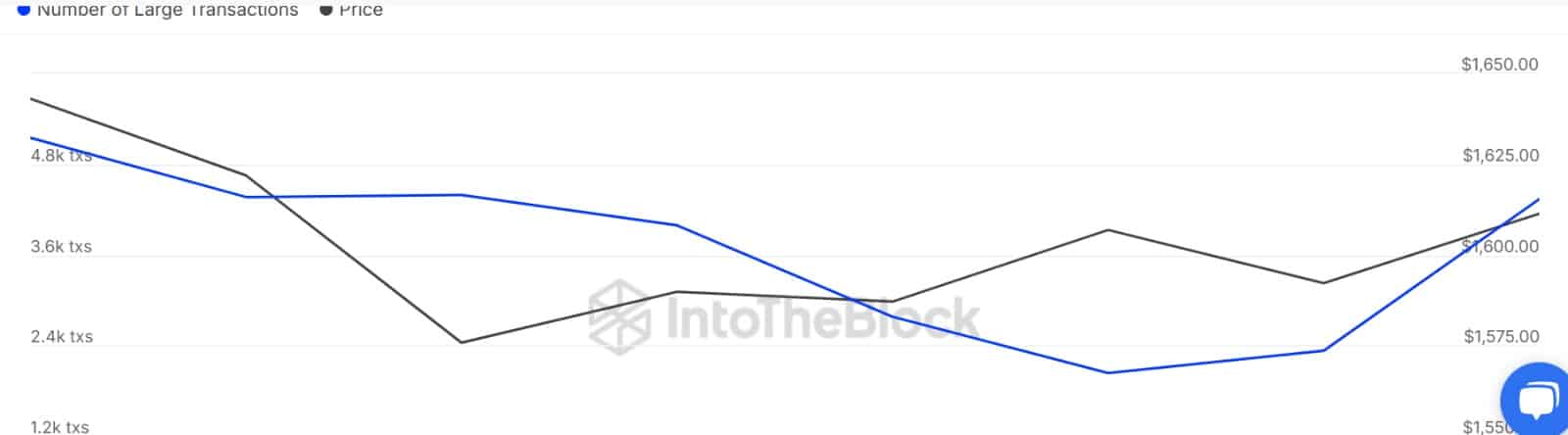

Large holders have revved up their dealings, nearly doubling transactions to 4,340 from a modest 2,330. Clearly, the whales are not merely splashing in the shallows—they are splashing quite extravagantly.

Such bullish frolicking signals madcap antics in either selling frenzy or buying spree, or both, like a theatrical duel of wallets.

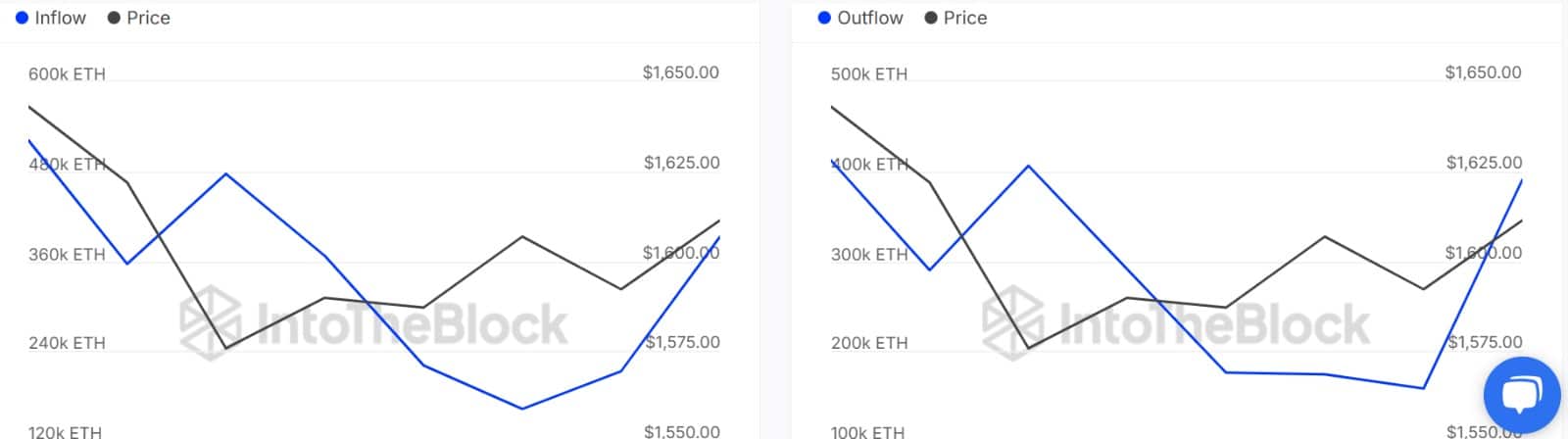

The exchange’s ledger tells a tale of subtle tug-of-war: 392,950 ETH streamed into their pockets while 390,000 splashed out. A net gain of 2,000 ETH—a small but telling trophy wrestled from the void.

Clearly, these leviathans dabble on both sides but tip the scales towards buying, as if whispering, “Fear not, fellows! The altcoin’s resurrection is nigh.”

The newcomers follow suit with starry eyes, expecting Ethereum to shake off its woes and waltz back to glory.

With buying pressure buoying the scene and on-chain omens glowing, Ethereum teeters on the brink of a fanciful comeback.

Ethereum’s user demand looks robust enough to prop up fundamentals and possibly coax a price revival from its cryptic chrysalis.

If this grand ball continues, ETH might cha-cha near $1,660—though a sudden pirouette might bring it down to $1,540, much like unexpected frost in a Moscow spring.

The final act awaits market calm and whether desire for the token shall dance louder than the sellers’ lament.

Stay tuned for more crypto-ballet, dear reader—tickets are free but the drama priceless. 🎭🐋

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2025-04-22 15:07