-

ETH could be close to its bottom after the transaction size failed to spike.

While the price might slip, traders are convinced of a quick recovery.

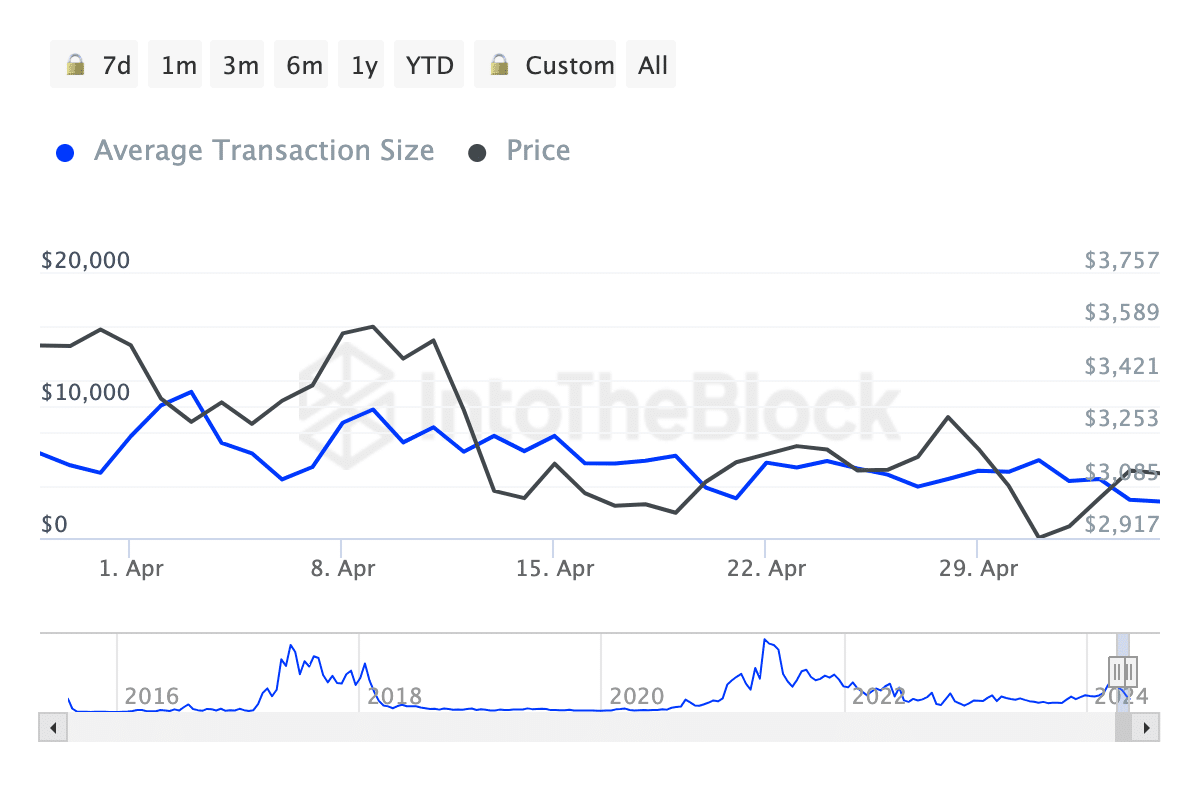

As a researcher with experience in analyzing Ethereum’s market trends, I believe that Ethereum could be close to its bottom after the transaction size failed to spike significantly. The recent decline in average transaction size from $5,893 to $2,767 suggests an absence of institutional interaction and a predominance of retail users. This trend historically indicates potential market bottoms.

On May 19th, according to AMBCrypto’s analysis, Ethereum‘s [ETH] average transaction fee dropped to $2,767. Marking a significant decrease of approximately 54% compared to the figure at the beginning of the month.

At that time, the average transaction size was $5,893, according to data from IntoTheBlock.

For those unfamiliar with the term, the average transaction value in dollars represents the typical worth of a deal for a given asset on a specific day.

From a historical perspective, I have observed that surges in this particular metric are indicative of increased user engagement, particularly from significant investors and financial institutions. Conversely, a decrease in this metric suggests a lack of institutional involvement.

Institutions out, retail in

In simpler terms, the current condition of Ethereum indicates a larger number of individual investors. Additionally, this marker can help pinpoint potential market highs and lows.

Based on the given figure, it appeared that ETH was approaching its lowest point rather than its highest in the current market situation. The price of ETH stood at $3,106 as reported at that moment, signifying a fluctuation within the same price bracket over the previous 24 hours.

Based on the examination conducted, the cryptocurrency’s price may rise significantly in the near future according to this assessment. Nonetheless, it’s essential to take into account additional factors as well.

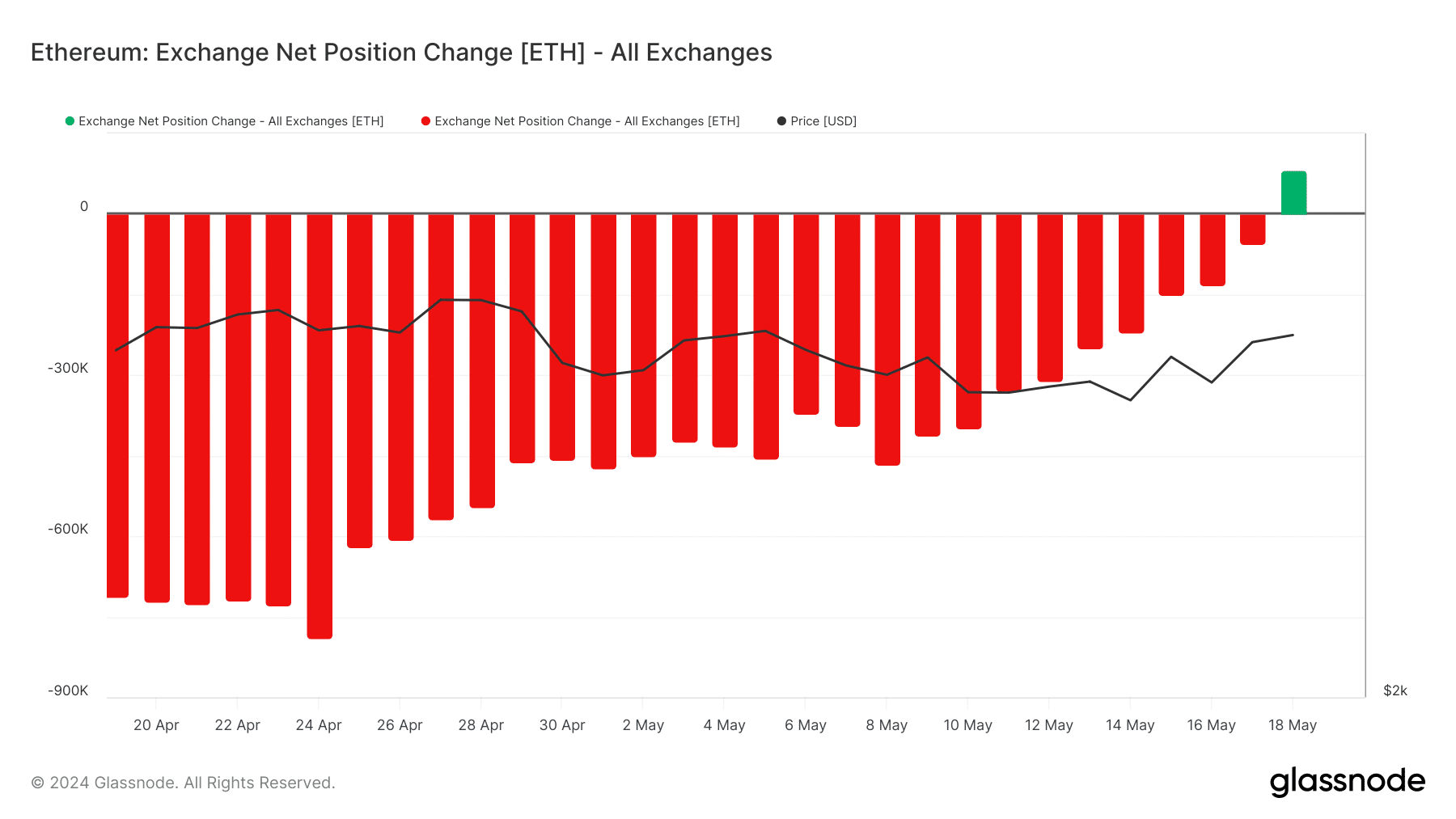

Based on recent findings from AMBCrypto, the Exchange Net Position Change for Ethereum, as reported by Glassnode, has remained negative for approximately the past month.

ETH gets set for a big move

“This measurement monitors the variation in the quantity of coins stored in exchange depositories over the past thirty days. A positive figure signifies an increase in the number of coins being held in exchanges.”

On the other hand, a negative value indicates increased withdrawals from exchanges.

As a crypto investor, I’ve been keeping a close eye on the ETH metric and I’ve observed something interesting. Specifically, on the 18th of May, there was a shift that made this metric positive for the first time. At present, the net position change for ETH stands at 81,715.

A 6.50% rise over the past week might be indicative of Ethereum users cashing in their gains.

Should this figure keep climbing, Ethereum’s price could potentially drop below $3,000 prior to any anticipated rally.

If the number of exchange withdrawals picks up again, there’s a possibility that the price may gradually climb back up to around $3,500. In a very optimistic scenario, it could even reach $4,000.

I analyzed the report published by AMBCrypto on May 17th and discovered that options traders anticipated Ethereum’s (ETH) price would reach a level of $3,600 between May and the conclusion of June.

At the moment of publication, Glassnode’s data indicated no shift in sentiment. This persisted due to the information provided by the Put/Call Ratio (PCR).

Is your portfolio green? Check the Ethereum Profit Calculator

If the PCR is over 0.70, it implies a bearish sentiment and there are more puts than calls.

As a crypto investor, I’d interpret a Put/Call Ratio of 0.35 for Ethereum as a signal that the market is bullish on the cryptocurrency. This means that more traders are buying call options (betting on price increase) than put options (betting on price decrease). Consequently, if this ratio remains below 0.50, it could indicate an even stronger bullish sentiment. However, keep in mind that a reading below 0.50 implies otherwise, and we should always consider other factors when making investment decisions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-19 15:19