🚨 Ethereum‘s Whale Party: Will It Break the $2,250 Ceiling? 🤔

- Ethereum’s price action has been as steady as a Russian winter, with strong support, whale activity, and cautious investor sentiment.

- Whale accumulation suggests a potential breakout, but the $2,250 resistance zone remains the elephant in the room.

Ethereum’s recent price action has been a tale of two cities, where shifting investor behavior and on-chain movements are creating a market structure that’s as complex as a Dostoevsky novel.

As ETH trades within a tight range, accumulation patterns, whale activity, and exchange flows suggest a market at an inflection point – a moment of truth, where the question on everyone’s lips is: will this be the start of a beautiful friendship between Ethereum and the $2,400 level, or just a temporary truce?

Support builds, but confidence remains measured

Ethereum is sitting on a strong pocket of investor support between $1,886 and $1,944, where over 3 million addresses accumulated 6.12 million ETH – a veritable treasure trove of digital riches.

This cluster now represents a key psychological and technical base – if ETH slips below, it could trigger a broader selling frenzy, à la a Russian aristocrat’s financial woes.

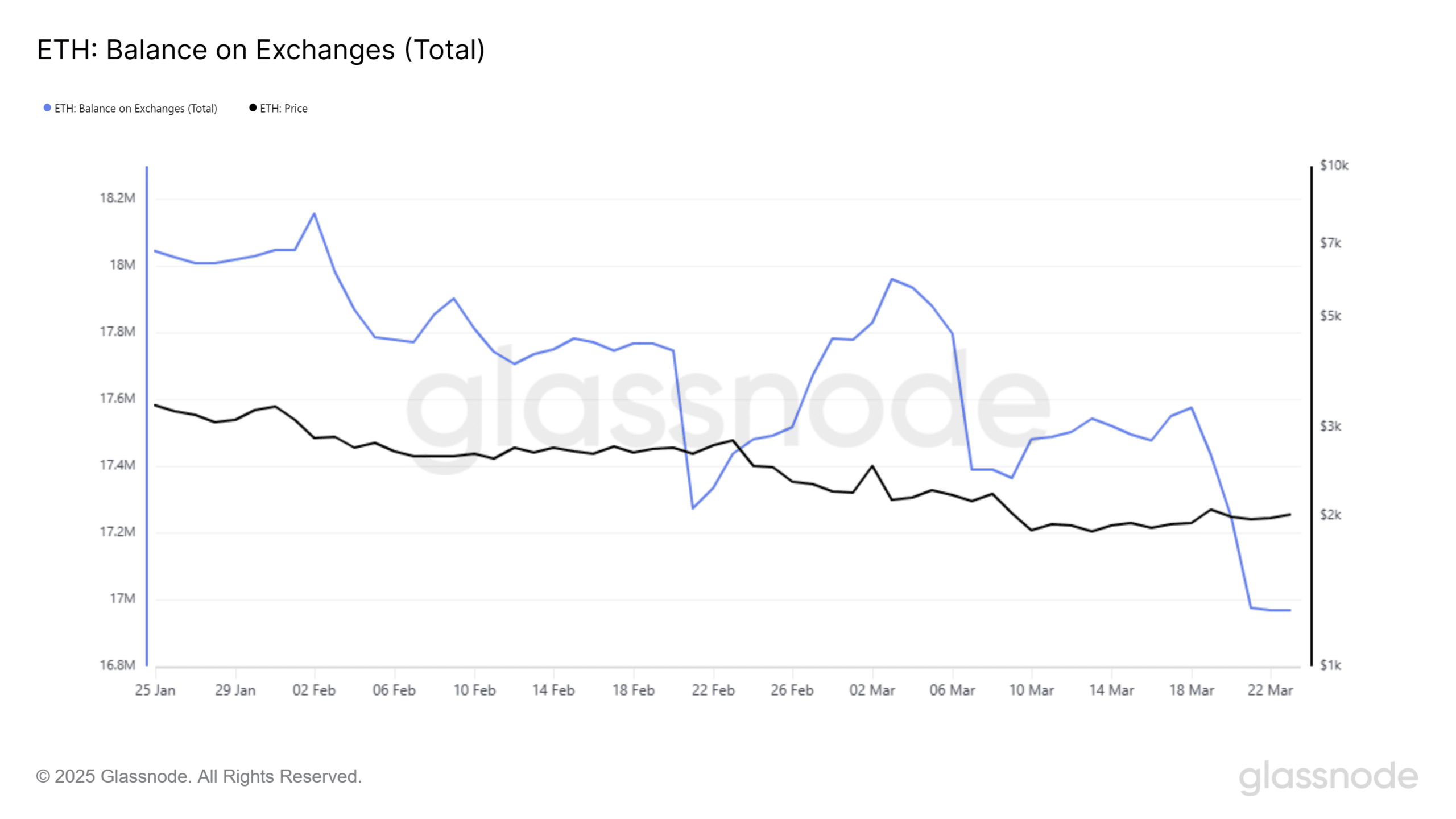

On the supply side, over 1.20 million ETH has quietly moved off exchanges in the past 48 days, suggesting a drop in near-term selling pressure – a development that’s as welcome as a warm cup of tea on a cold winter’s night.

However, price has remained largely rangebound, implying that even as investors hold, they’re not rushing to buy either – a state of affairs that’s as frustrating as a Russian bureaucrat’s paperwork.

Whale accumulation surges as ETH crosses $2K

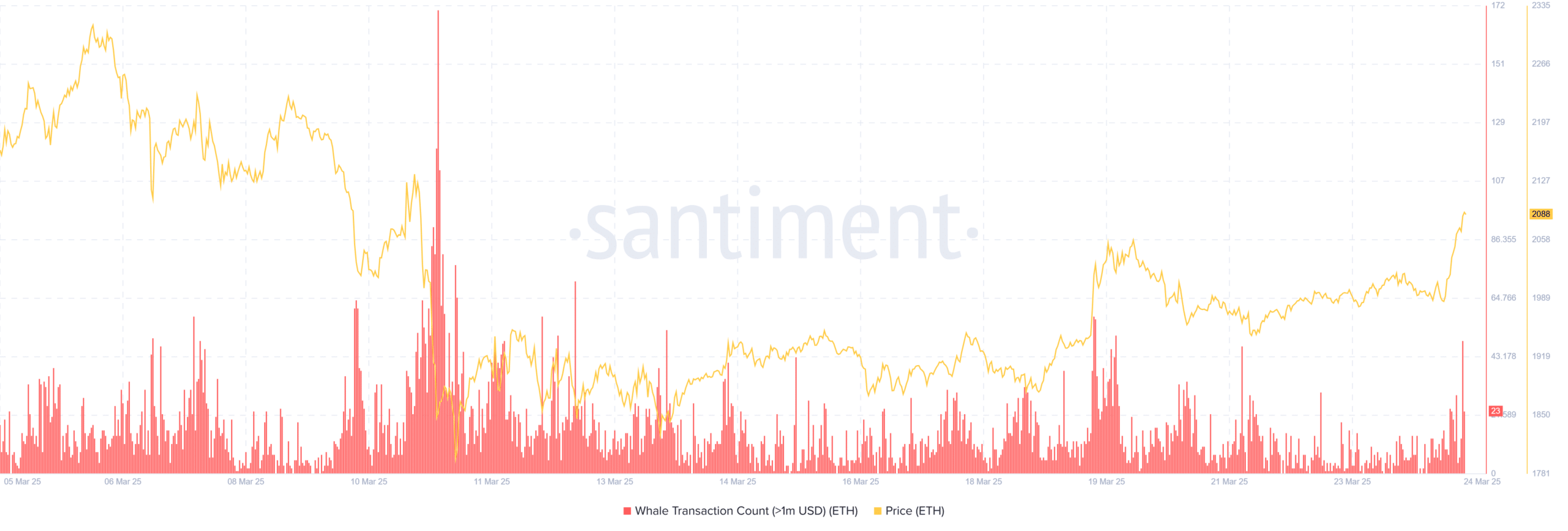

Ethereum whales have stepped up aggressively, scooping up nearly 470,000 ETH over the past week – a development that’s as thrilling as a high-stakes poker game.

This surge in large-value transactions came just as ETH reclaimed the $2,000 mark, suggesting whales are positioning ahead of a potential breakout – a move that’s as bold as a Russian general’s battle plan.

Santiment data showed a sharp uptick in whale transaction count beginning the 19th of March, adding weight to the idea that institutional and high-net-worth players see current price levels as an accumulation zone, not a local top – a notion that’s as reassuring as a warm hug from a Russian babushka.

Ethereum price action hints at recovery, but resistance looms

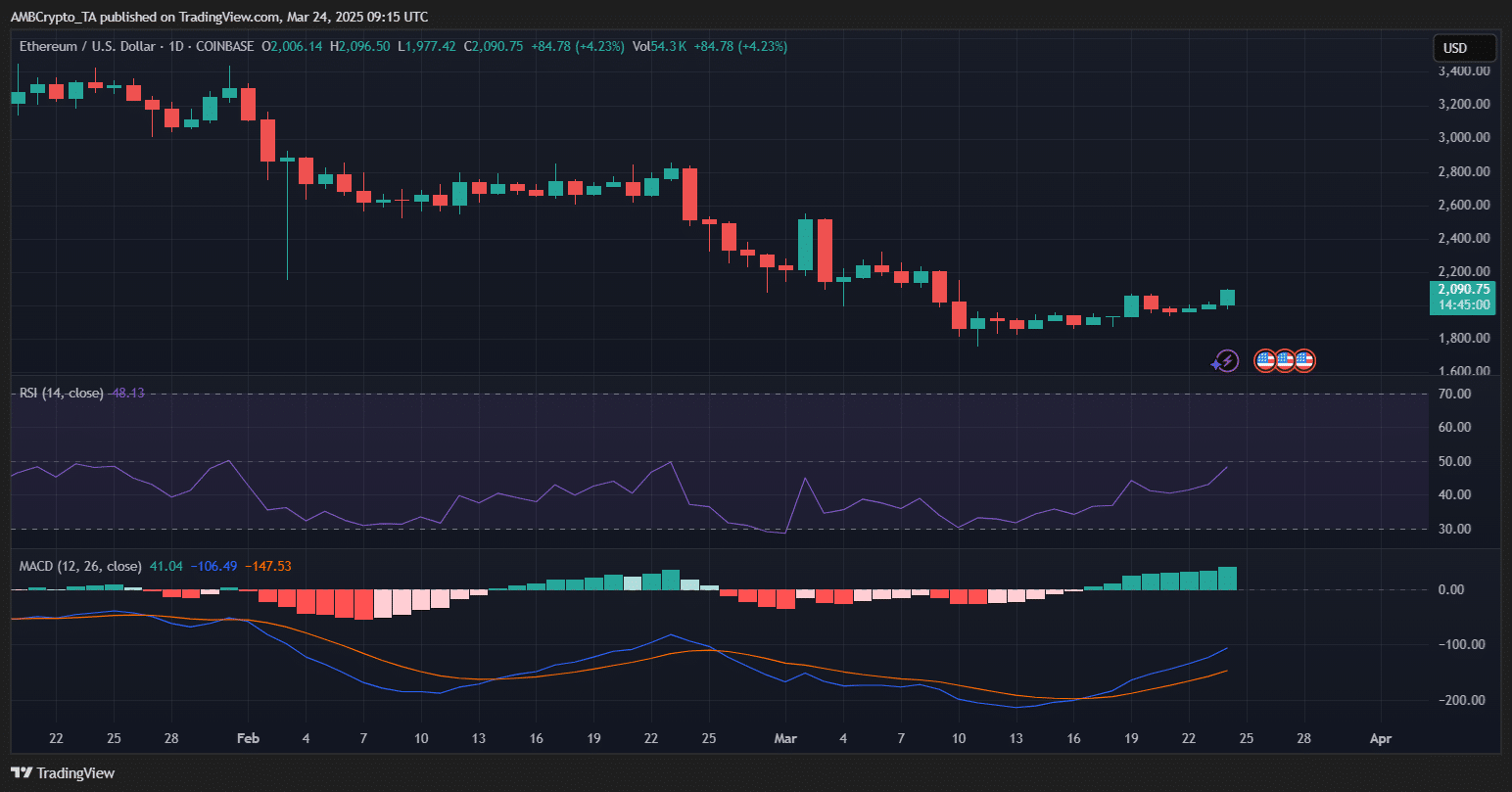

Ethereum posted a 4.23% gain to trade around $2,090, signaling a potential short-term recovery – a development that’s as welcome as a spring thaw in Moscow.

The daily chart shows bullish signals beginning to form: the MACD has flipped into green territory, with the MACD line crossing above the signal line – often viewed as a bullish crossover, à la a Russian folk dance.

Additionally, the RSI has climbed to 48.43, reflecting improving buyer strength without yet breaching overbought conditions – a state of affairs that’s as pleasant as a Russian summer breeze.

Despite these signs, ETH still faces resistance near the $2,200-$2,250 range, last seen in early March – a hurdle that’s as formidable as a Russian fortress.

However, if momentum stalls, ETH could pull back to retest $2,000 as support – a development that’s as sobering as a Russian winter.

For now, whale accumulation and improving on-chain sentiment appear to be giving Ethereum the fuel it needs – but a clean breakout is still needed to confirm a broader trend reversal – a move that’s as thrilling as a Russian space launch.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2025-03-24 18:41