The dream of Ethereum soaring to $4,000 in August seems to have hit a rocky shore, as the big fish and institutions that once propelled it to a July peak of $3,800 are now swimming away.

With the crypto sea turning colder, our beloved altcoin finds itself in a tougher tide, struggling to swim back to the $4,000 mark. It’s like trying to catch a fish with a broken net—hard and frustrating.

ETH Futures Sink to $6.2 Billion: Did the Big Boys Lose Interest? 🤔

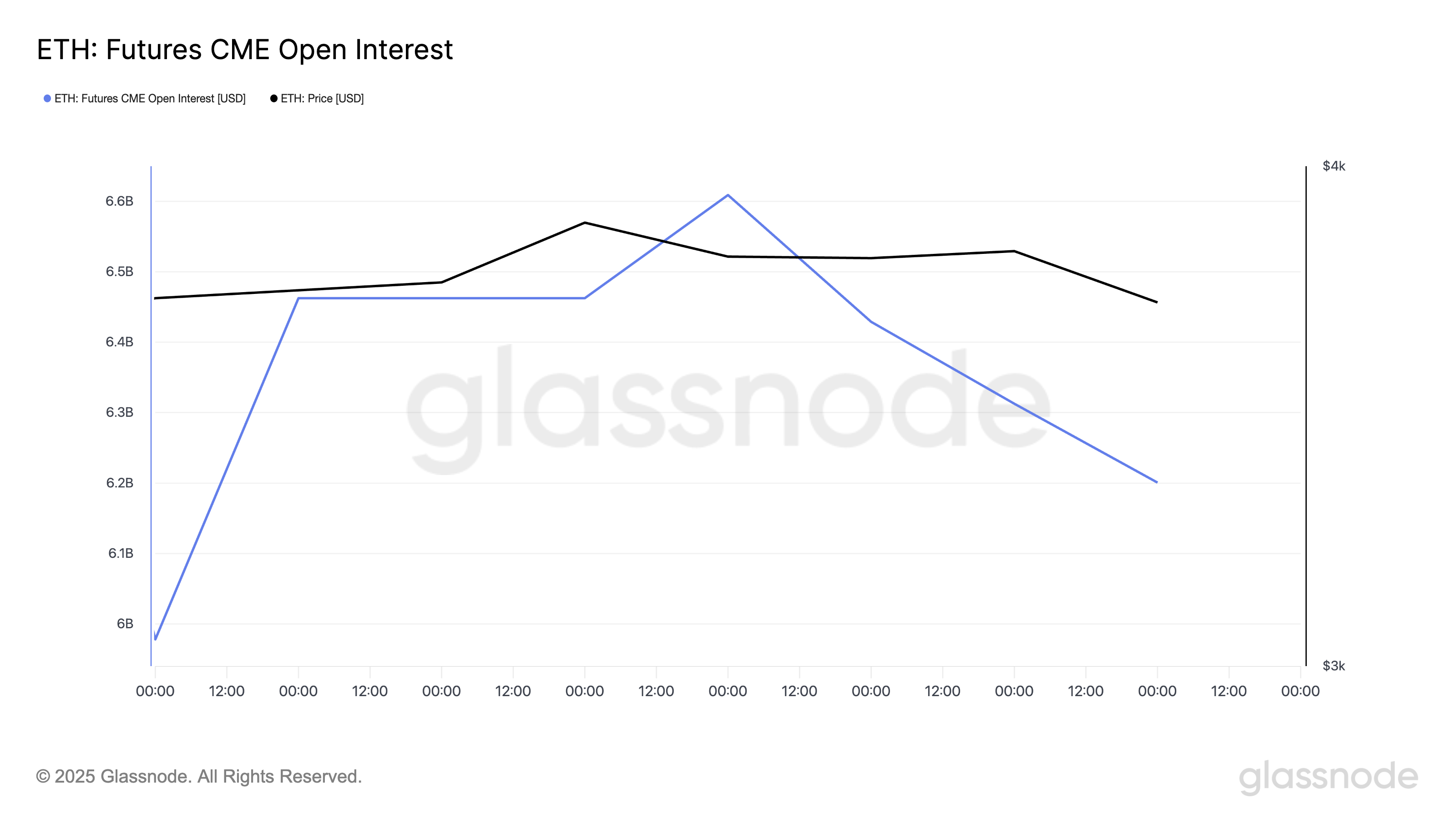

The waters are getting quieter, with on-chain and derivatives data showing a significant drop in activity among the market’s largest swimmers. For instance, the open interest in ETH futures contracts on the Chicago Mercantile Exchange (CME) has taken a nosedive, closing yesterday at a five-day low of $6.2 billion.

For token TA and market updates: Dive deeper into the crypto ocean with Editor Harsh Notariya’s Daily Crypto Newsletter here.

This plunge is a big deal, folks. The CME’s ETH futures market is where the whales go to play in a regulated pool. Lower open interest means these big boys might be cashing out, leaving the little fish to fend for themselves.

Without the big boys splashing around, the upward current on ETH’s price might slow down, making it easier for the price to drift downward. 🌊📉

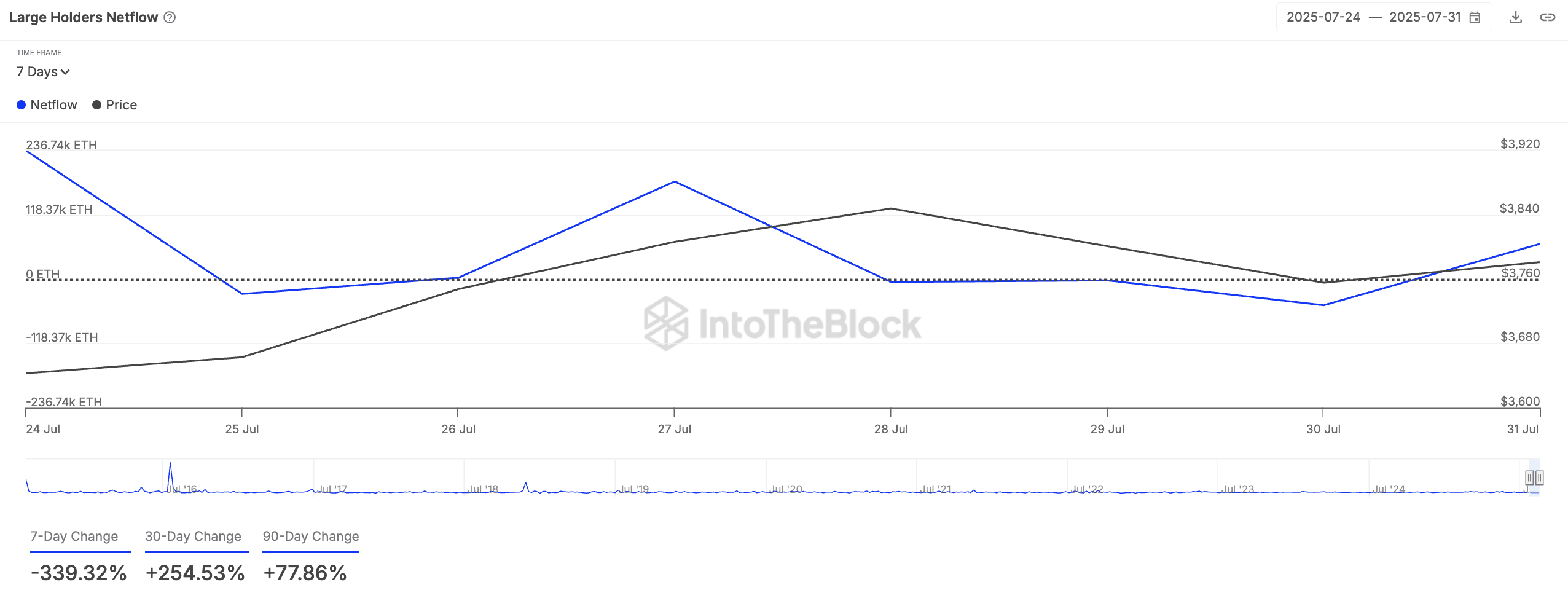

And it’s not just the institutions; the whales are also taking a breather. A peek at the on-chain activity shows a whopping 339% decrease in large holders’ netflow over the past week.

Large holders, those with more than 1% of the circulating supply, are the big sharks in the crypto sea. Their netflow tracks how many coins they’re buying versus selling. When the netflow goes up, it’s like the sharks are gorging themselves, signaling good times ahead. But when it drops, it’s like they’re fasting, and the price support weakens. 🦈🚫

Ethereum Tanks 10% as Selling Pressure Surges—Is $3,314 the New Beach? 🏖️

As of now, ETH is trading at $3,620, down about 10% over the past day. The trading volume has spiked by 17%, creating a negative divergence. It’s like everyone is running to the beach while the tide is going out, signaling increased selling pressure. 🏃♂️🌊

If this keeps up, ETH’s price could sink to $3,524. If that floor breaks, we might see a deeper dive to $3,314. But hey, if the bulls come back, ETH could still make a splash and climb to $3,859. 🐂🌊

But for now, it looks like the crypto sea is a bit choppy. Stay tuned, and maybe bring a life jacket. 🛥️🌊

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Best Werewolf Movies (October 2025)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Goat 2 Release Date Estimate, News & Updates

- 10 Movies That Were Secretly Sequels

- Pride and Prejudice’s latest adaptation has ‘stubborn, vulnerable’ Elizabeth Bennet, reveals BAFTA winner

2025-08-02 01:27