Ah, the eternal dance of the Ethereum network, a spectacle as grand as the proletariat’s struggle, yet as absurd as a capitalist’s dream of infinite profit! 🌪️ Behold, the on-chain activity has surged to heights unseen, a testament to the toil of decentralized laborers, while the long-term technical structure whispers sweet nothings of “upside continuation.” 🤑 Is this mere sideways shuffling, or the dawn of a new era? The data, my dear comrades, hints at sustained demand and a price behavior as constructive as a socialist utopia. 🏗️

Ethereum’s Daily Transactions: A New High in the Circus of Crypto

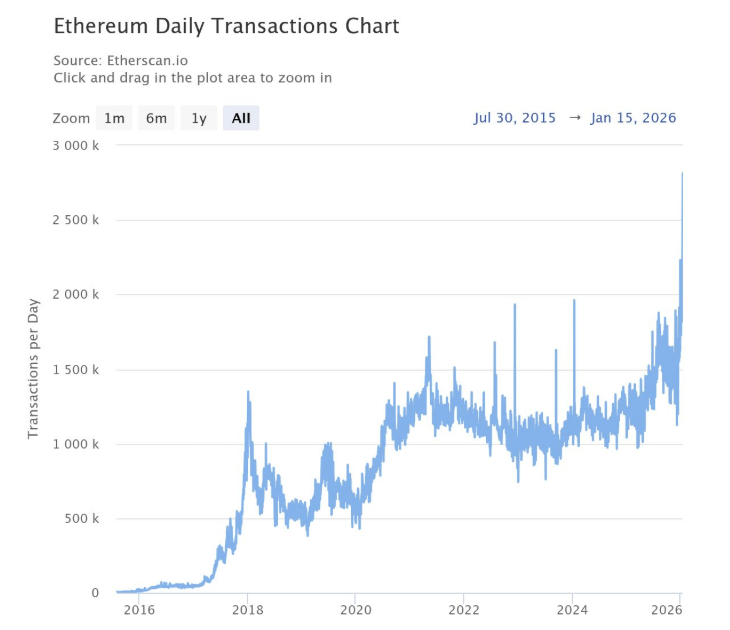

The price of Ethereum, that fickle mistress, has turned bullish, climbing with the steadiness of a revolutionary’s resolve. But what’s this? On-chain data reveals that this ascent is built upon a foundation of steady activity, not mere speculation. Daily transactions have soared to 2.8 million, a record that mocks the peak of the 2021 bull market by a staggering 64%! 📈 And yet, in the grand theater of blockchain, this is no mere spectacle-it is a sign of real usage, from decentralized finance to stablecoin settlements, a network humming with life. 🎭

Compare this to 2021, when Ethereum was the darling of altcoin seasons and NFT frenzies, and you’ll see the difference. Back then, it was all glitter and hype; now, it’s the grind of utility. The chart from Sentora, a progression as steady as the march of history, shows Ethereum’s transaction count rising like the hopes of the oppressed, spiking in early 2026. 📊

But let us not be blinded by numbers. The fact that Ethereum processes more transactions now than in its speculative heyday proves that it has transcended the whims of gamblers. It is no longer a toy for the rich; it is a tool for the many. 🛠️

Ethereum’s Reaccumulation: A Macro Uptrend or Capitalist Illusion?

Now, let us turn to the technical analysis, that cold, calculating gaze of the market. On the three-week candlestick timeframe, Ethereum’s market cap holds steady, a zone of stability in a world of chaos. Egrag Crypto, that modern-day soothsayer, declares Ethereum is in “reaccumulation within a macro uptrend.” 📉 But what does this mean, comrades? It means the market cap clings to the 21 EMA like a worker to their last ruble, respecting the rising trendline, printing higher highs and higher lows, and compressing under historical resistance. This is no weakness; it is the quiet before the storm. 🌩️

History, that great teacher, tells us that when Ethereum’s market cap holds above the 21 EMA, expansion phases follow. But when it falls below, bear markets reign. At present, the EMA support is defended like a fortress, and the odds favor continuation over collapse. A breakthrough in resistance could unleash a 70% to 75% bullish continuation, a feast for the bulls! 🐂

Yet, let us not forget the bears, those gloomy prophets of doom. If the price action loses the 21 EMA, a 25% to 30% correction could ensue, a plunge toward the lower trendline. But fear not, for this scenario is as likely as a capitalist sharing their wealth-unlikely, but not impossible. 🐻

So, what is the truth of Ethereum’s wild ride? Is it a revolution in the making, or just another capitalist circus? Only time will tell, comrades. But one thing is certain: in the world of blockchain, as in life, the struggle continues. 🚀

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 10 Movies That Were Secretly Sequels

- USD JPY PREDICTION

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Uncovering Hidden Order: AI Spots Phase Transitions in Complex Systems

2026-01-18 20:13