- Ah, the grand spectacle of hedge funds, with their record +500% ETH shorts, clashing against a staggering $2B Ethereum inflow—truly, the market is poised for a dramatic upheaval, is it not?

- In this theater of extremes, the audacious short bets stand in stark contrast to the institutional accumulation, leaving ETH teetering on the precipice of a monumental shift—upwards or downwards, who can say?

Lo and behold, Ethereum’s [ETH] short positions have surged by a staggering +500% since the fateful month of November 2024, marking the zenith of bearish sentiment against this digital currency. In the mere span of a week, short positioning has risen by +40%, as chronicled by the ever-watchful Kobeissi Letter.

It appears that Wall Street hedge funds, in their infinite wisdom, are engaging in a fervent shorting of Ethereum, even as its price languishes in a state of relative stasis. Ah, the irony!

This spike in short exposure emerges amidst the gnawing fears of Ethereum’s underwhelming performance when juxtaposed with Bitcoin. Since the dawn of 2024, Bitcoin [BTC] has outshone Ethereum by nearly twelvefold. A tragedy, indeed!

Analysts, those modern-day soothsayers, speculate that hedge funds are either bracing for a bearish outlook on Ethereum or, perhaps, attempting to suppress its price. Such cunning machinations!

$2B inflows suggest…

Yet, in a twist befitting a Dostoevskian narrative, despite the overwhelming short positions, Ethereum has witnessed a remarkable $2 billion in fresh ETF inflows within a mere three weeks, with a record-breaking $854 million weekly inflow, as reported by the ever-reliable Kobeissi Letter.

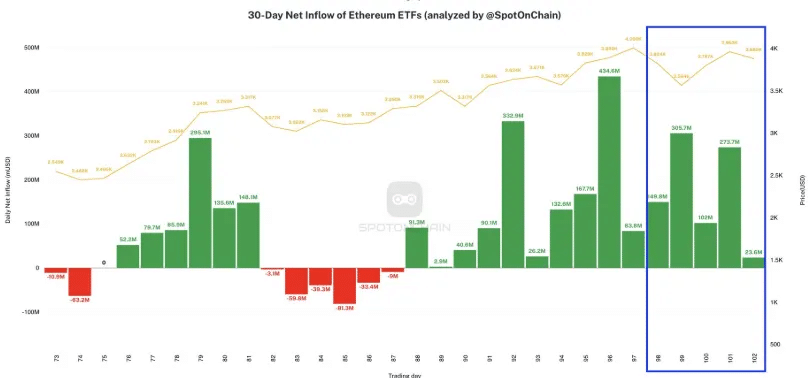

The chart shared by Spot On Chain corroborates this data, illuminating a consistent accumulation that began in the waning days of December 2024. A curious phenomenon, indeed!

Noteworthy inflows were recorded on Day 97 ($434.8M) and Day 100 ($275.7M), signaling a robust institutional interest during this period. Yet, Ethereum’s price remains largely stagnant, raising the specter of concern that this influx of funds may be counterbalanced by the heavy hand of shorting activity.

Analysts, with their keen insights, observe that this tug-of-war between accumulation and bearish positioning could herald a tempest of volatility in the weeks to come. How delightful!

The flash crash wiped out over $1T

On the fateful 2nd of February, Ethereum experienced a cataclysmic 37% price drop within a mere 60 hours, erasing over $1 trillion in crypto market value. A tragedy of epic proportions!

Remarkably, this flash crash transpired without any significant news catalyst, drawing comparisons to the infamous 2010 stock market “flash crash.” Oh, the absurdity of it all!

The Kobeissi Letter posits that this event may have been influenced by extreme short positioning and the thin veil of liquidity. Volume spikes were observed around pivotal events, such as the crash on the 2nd of February and Inauguration Day. A conspiracy, perhaps?

This signals that the titans of finance might be actively positioning themselves for monumental market moves. How thrilling!

Could Ethereum be headed for a short squeeze?

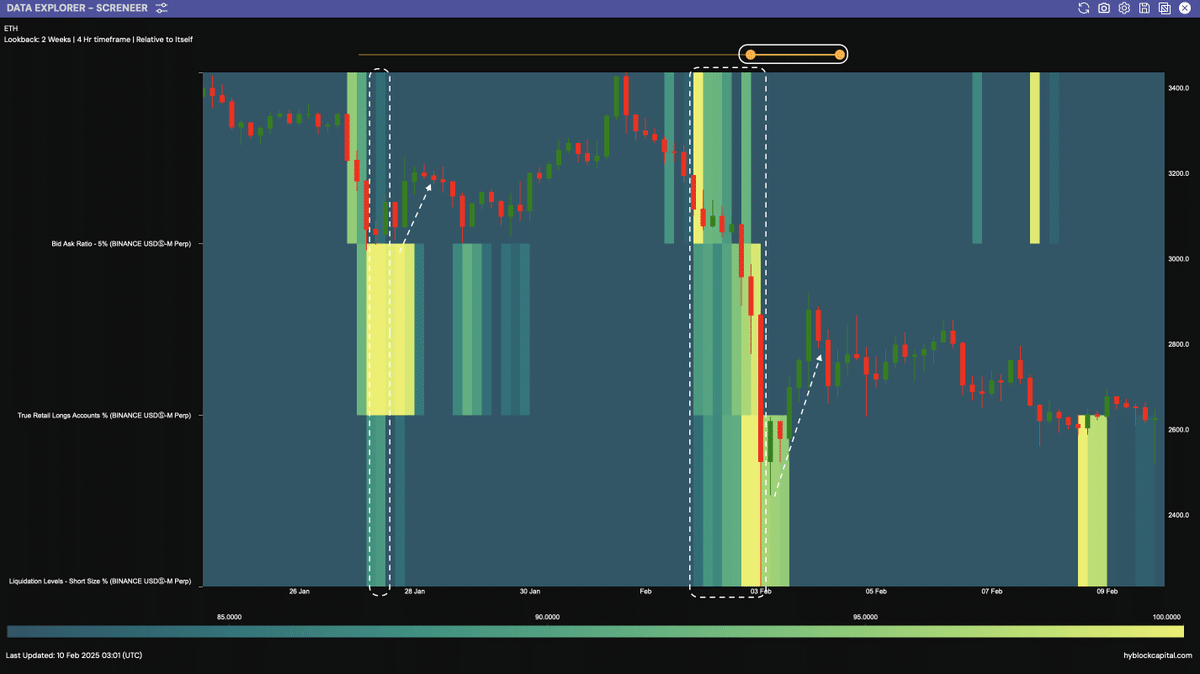

Crypto analytics firm Hyblock Capital, in their infinite wisdom, notes that Ethereum is now approaching levels where multiple indicators align, including the Bid-Ask Ratio, Retail Long%, and Short Liquidation Levels. A veritable symphony of metrics!

Historically, when these metrics reach such extremes, Ethereum has trended upward. A glimmer of hope amidst the chaos!

Moreover, a TD Sequential

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2025-02-10 19:07