- Ethereum faces heightened volatility following the latest CPI data, sparking market speculation

- In light of the CPI data announcement, ETH Open Interest spiked to over $6 billion

The recently released U.S. Consumer Price Index (CPI) showed a 0.4% increase in December, pushing the yearly inflation rate up to 2.9%. This rise, largely due to escalating energy prices, carries substantial importance for financial sectors, such as cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH).

Market reactions to CPI data

After the Consumer Price Index (CPI) announcement, Bitcoin’s value increased by 4.12%, reaching approximately $100,510. This surge in price suggests that investors are hopeful about potential reductions in Federal Reserve interest rates. Similarly, Ethereum experienced growth during the previous trading session, with its worth increasing by more than 7% to approximately $3,451.

As a crypto investor, I’ve noticed that the recent fluctuations indicate a positive response from digital currencies towards inflation data. This could be because cryptos are increasingly being viewed as attractive alternatives during periods of high inflation.

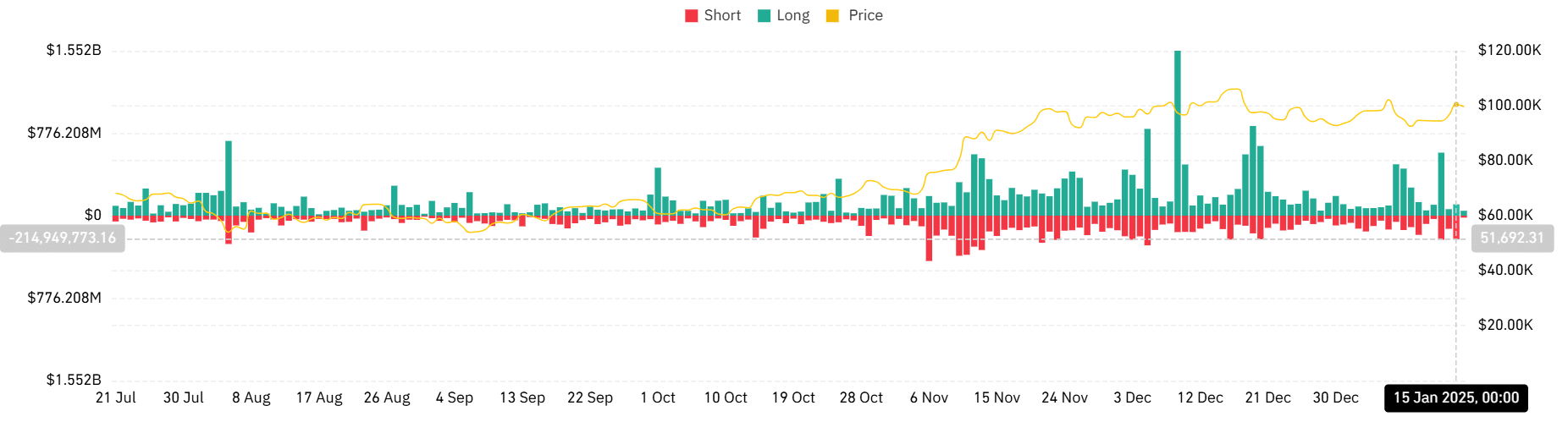

Liquidation dynamics post-CPI release

From the previous trading day’s summary, it appears there was a significant increase in liquidations, which occurred immediately after the release of the CPI data. Upon closer examination, the total liquidated positions amounted to approximately $330 million.

As a crypto investor, I’ve noticed some intense market movements, particularly with Ethereum. The high volume of liquidations, amounting to over $67 million, is a clear indication of the market’s volatility and swift changes in investor positions. This suggests that we should keep a close eye on the market trends.

Additionally, the market saw more short liquidations, with over $223 million in recorded volume.

This trend highlights how vulnerable these resources are to broader economic factors and the tendency for their market to be driven by speculation.

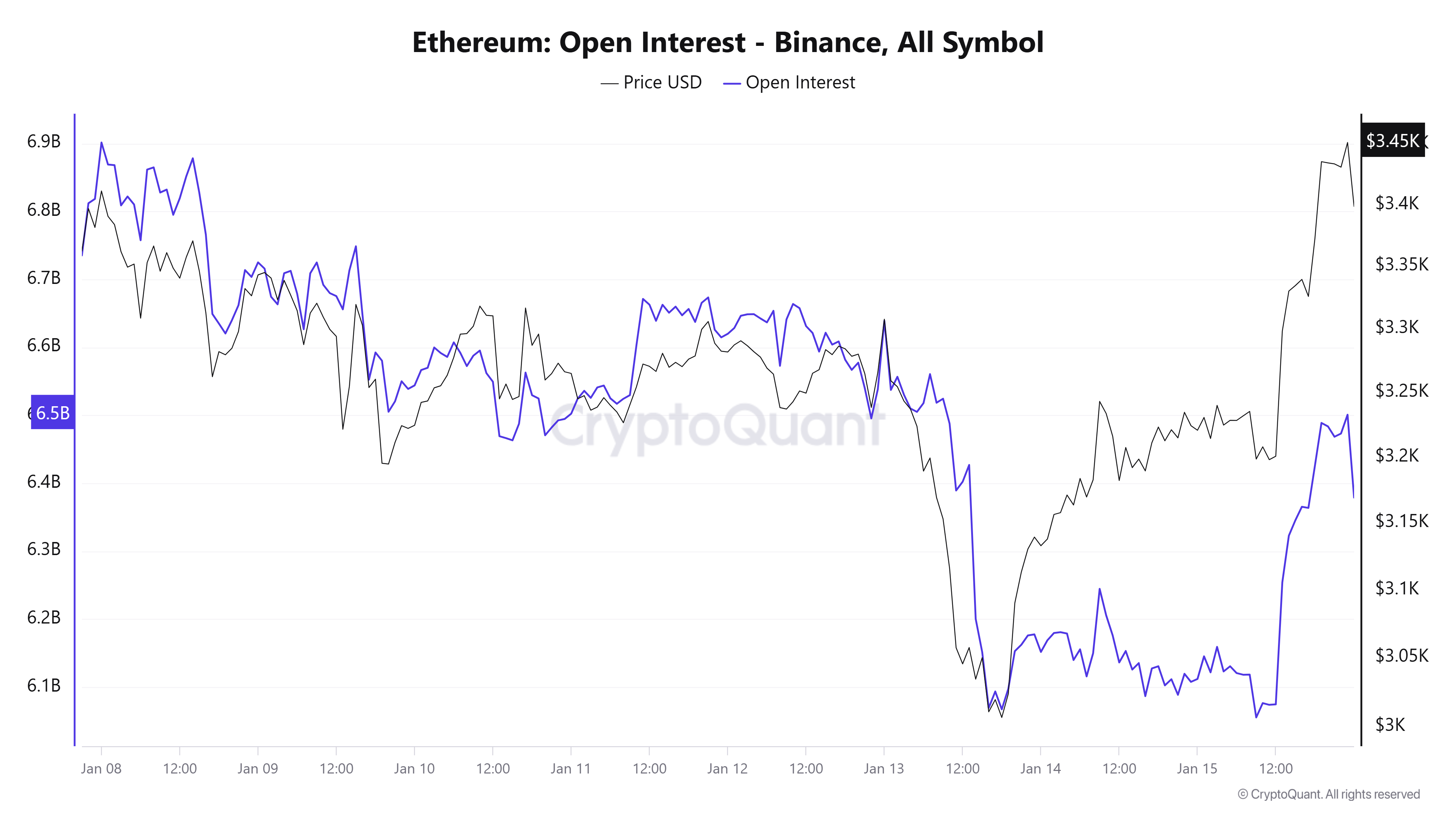

Ethereum Open Interest analysis

The chart showing Ethereum’s Open Interest (OI) indicated a substantial increase in OI after the release of the Consumer Price Index (CPI) data. Upon examination of the OI figures, it was observed that it peaked at approximately $6.5 billion during the last trading session.

It seems like this trend indicates an increase in the amount of capital flowing into Ethereum’s Futures market, possibly due to rising investor curiosity and predictions about future price fluctuations. However, it’s important to remember that a large Open Interest (OI) can also signify higher leverage. This could result in increased market volatility.

Ethereum’s price outlook

The behavior of Ethereum’s price shows an intriguing technical configuration, as its 50-day moving average stands firm at approximately $3,562.47, significantly higher than its 200-day moving average at around $2,980.39. Moreover, the MACD readings (0.53, -55.72, -56.25) hint that momentum may be poised to change direction, though the overall structure remains somewhat fragile.

Due to a 0.4% rise in CPI data last month, the recent fluctuations in the altcoin’s price have propelled Ether towards critical resistance points. The current support area around $3,200 is pivotal for preserving the existing market structure, and any immediate advancement will encounter obstacles at the $3,500 level.

– Read Ethereum (ETH) Price Prediction 2025-26

The way Ethereum responds to these major triggers might determine its short-term price movement. Interestingly, the derivative market indicates growing curiosity, but the evenly distributed liquidations hint at a more nuanced and sophisticated reaction from the market to economic updates, in comparison to past periods.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-01-16 18:15