- Ah, the retail traders of Ethereum! Their short positions are rising like a loaf of bread left too long in the oven, while the longs are dwindling like a politician’s promises.

- And what of Binance? It seems to be offloading ETH like a merchant in a market, despite the MACD waving a bullish flag as if it were a parade day!

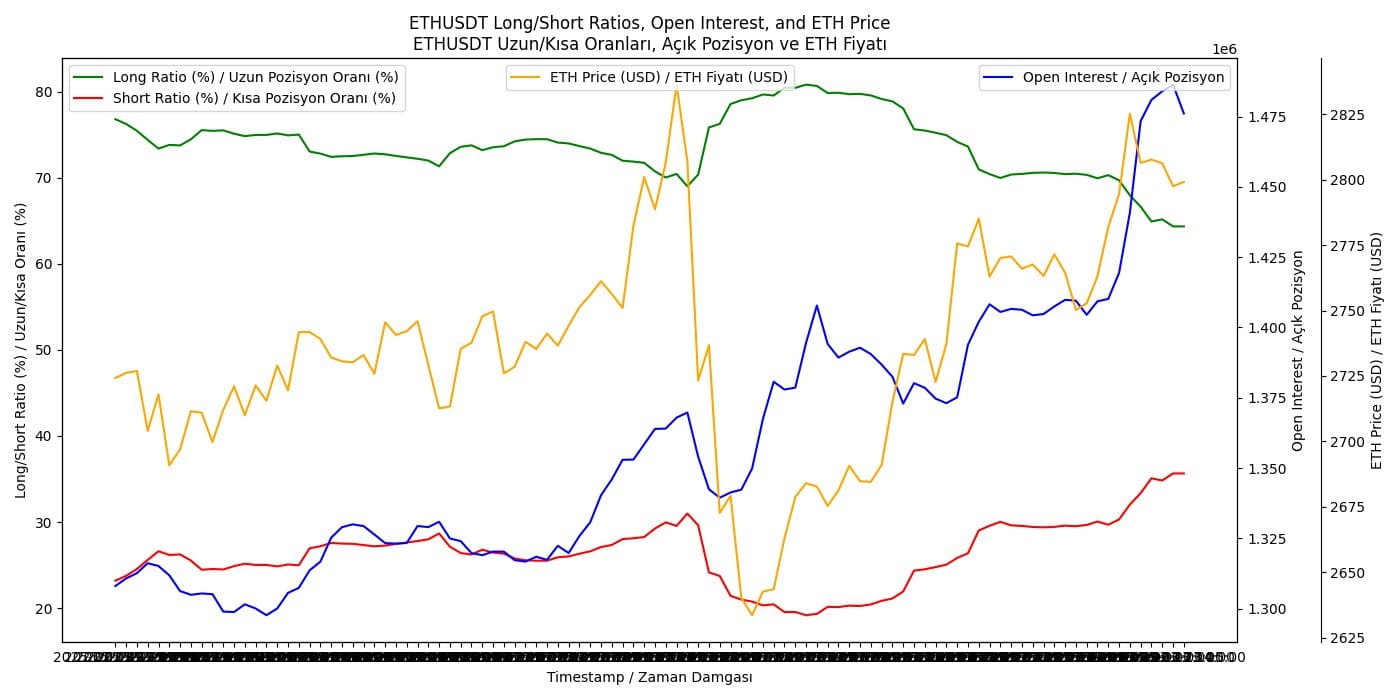

Indeed, the percentage of retail short positions for Ethereum [ETH] has been climbing higher than a cat on a hot tin roof, while the long positions are retreating faster than a thief in the night. The Short Ratio has soared above 30%, while the Long Ratio has plummeted below 75%. What a spectacle!

This curious shift is accompanied by an increasing Open Interest (OI), suggesting that our dear retail investors are placing their bets against Ethereum, as if it were a game of chance at a carnival.

As of the latest news, ETH’s price has risen above $2,775, but if this bearish sentiment continues, we might see a pullback toward $2,700, like a reluctant child being dragged away from a candy store.

On the other hand, if OI keeps rising while shorts get squeezed tighter than a pair of old trousers, ETH could break past $2,825 and aim for the stars! As the long positions dwindle, it may signify a collective apprehension about Ethereum’s near-term growth potential. Oh, the drama!

If this trend continues, ETH could find itself testing lower support levels, like a weary traveler seeking refuge. Conversely, if the market sentiment shifts and long positions begin to rise, we might witness a glorious rebound towards $2800 or higher, like a phoenix rising from the ashes!

Binance’s Grand Offloading Spectacle

The sentiment of retail investors seems to be in perfect harmony with Binance, which has been transferring significant amounts of Ethereum to centralized exchange bridges and market makers. The amounts range from 1.003K ETH worth $2.79M to 1.52K ETH worth $4.25M. Quite the haul!

//ambcrypto.com/wp-content/uploads/2025/02/GkisF0rXUAA9bZS.jpg”/>

On one hand, if these transfers are meant to meet increasing demand on exchanges or for market-making purposes, it could stabilize or even increase the ETH price due to higher liquidity and trading volume. A delightful thought!

However, if this is Binance liquidating its holdings, it could lead to a price drop, like a balloon losing air at a child’s birthday party. The implications are as uncertain as a cat’s next move!

This means further sell-side pressure from exchanges could either confirm a bearish trend or, if met with sufficient buy-side demand, could lead to a bullish reversal. The suspense is palpable!

MACD’s Bullish Crossover: A Sign of Hope?

Yet, Ethereum’s price action has revealed a bullish signal, with the MACD crossing above its signal line, as if it were waving a flag of optimism!

This bullish crossover, combined with stabilization at the key support level around $2,650 after the Bybit hack, suggests potential for a price upswing. A glimmer of hope in the dark!

The immediate target following this bullish signal could be the recent resistance at $3,000. If Ethereum breaks through this barrier, the next critical level could be around $4,000 and beyond. Oh, the heights we could reach!

Conversely, if the bullish momentum wanes and fails to sustain, ETH may retest the support at $2,650, like a weary traveler returning to familiar ground.

A break below this point could lead to further declines, with the next significant support

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

2025-02-25 08:11