- Ethereum has a bearish market structure on the daily chart but still targets the next key resistance zone.

- The volume has been sub-par in recent days, hence a retracement next week is possible.

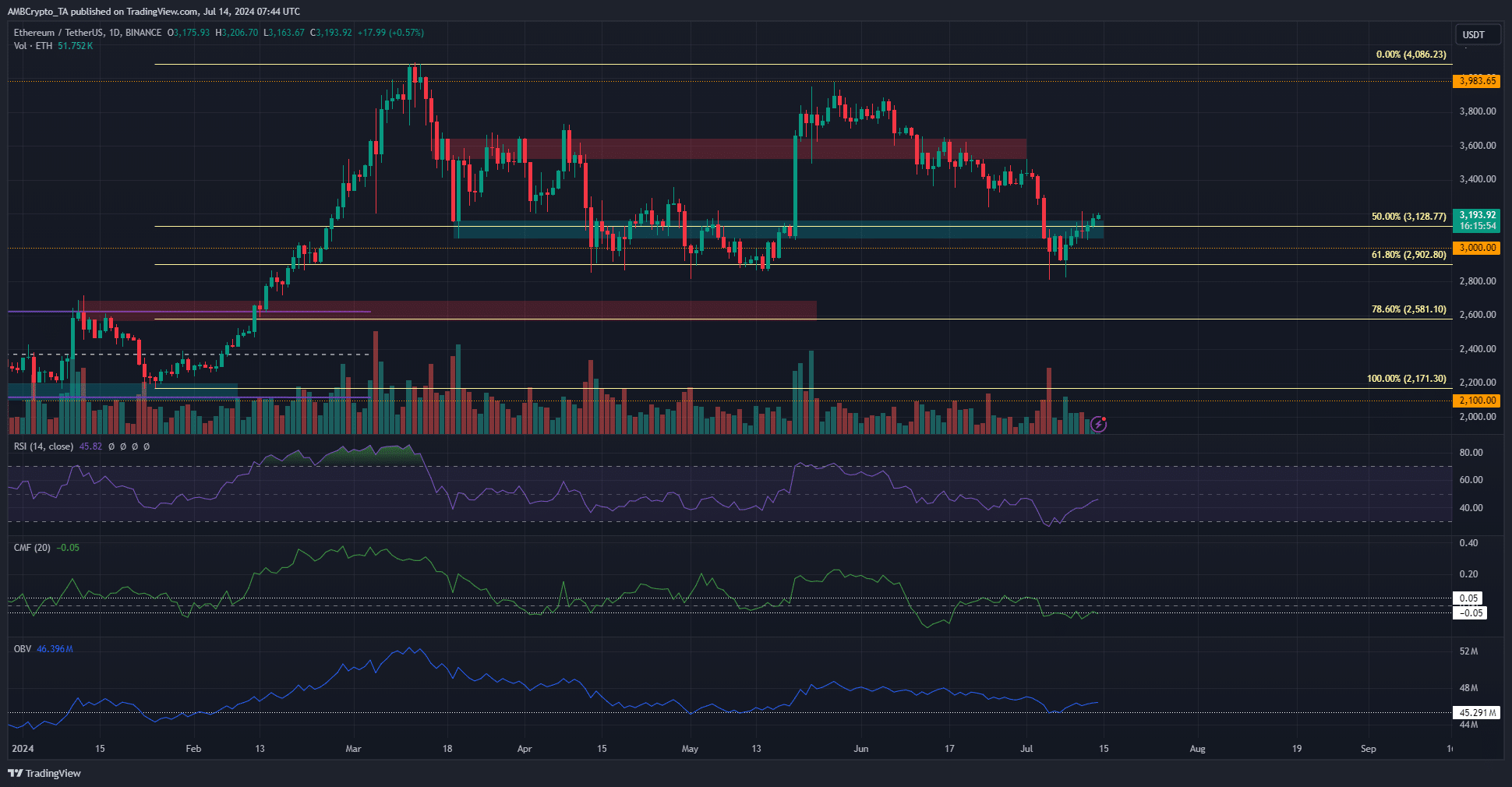

As an analyst with a background in studying Ethereum’s price action and market trends, I have closely monitored its recent developments. While Ethereum managed to break above the $3.1k resistance zone and flipped it into support, the overall market structure and momentum remain bearish on the daily chart.

Intriguingly, Ethereum [ETH] regained ground to surpass the $3,000 mark once more. Notably, a shift in fortunes for the bullish camp occurred as the previous resistance at $3,100 transformed into a newfound source of support.

As an analyst, I’ve been closely monitoring the interplay between whale deposits and exchange reserves. Recently, new deposits have entered the scene, but they pale in comparison to the significant outflows experienced over the last two months.

The gas fees on Ethereum’s network dropped to their lowest point in May, indicating decreased transaction activity. This trend was unfavorable and suggested a decrease in on-chain demand and sluggish growth.

Volume indicators ambivalent despite the breakout

On the 13th of July, Saturday, Ethereum concluded its daily trading at a price of $3,201, surpassing the resistance level around $3.1k. Nevertheless, the larger chart setup and market trends indicated bearish tendencies in the Ethereum market within the daily timeframe.

As a crypto investor, I’ve been closely monitoring the market indicators, and I noticed that the Moving Average Convergence Divergence (MACD) gave a reading of -0.05. This suggests that there was significant capital flowing out of the market, which is a red flag for me. Additionally, the On-Balance Volume (OBV) failed to initiate an uptrend over the last ten days. The buying volume wasn’t strong enough during this period, and as a result, I’m not taking it as a clear signal of bullish strength yet.

From my perspective as a researcher, the daily Relative Strength Index (RSI) for Ethereum was at 45, indicating bearish momentum. However, over the past week, this value has inched up. Consequently, Ethereum may not be prepared for a significant price increase until we observe an influx of trading volume in the market.

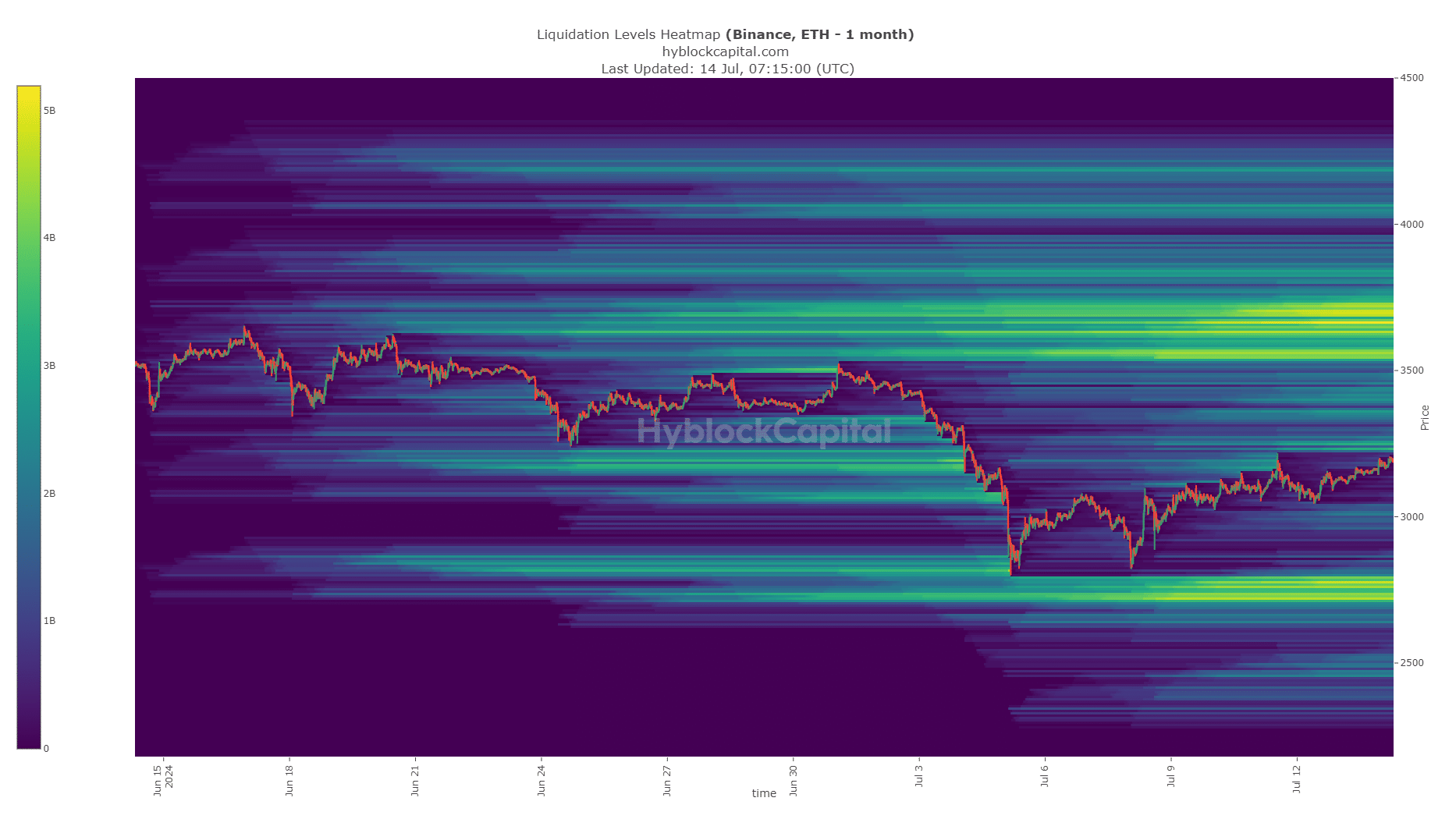

Liquidation heatmap’s clues on the next resistance

The region south of $2.7 thousand to $2.8 thousand offered an alluring reservoir of funds. It underwent a preliminary test during the initial week of July, yet didn’t fully experience a surge in demand.

After the price jumped up above $3.1k, the next group of buyers would likely aim for the price range between $3.5k and $3.7k.

Is your portfolio green? Check the Ethereum Profit Calculator

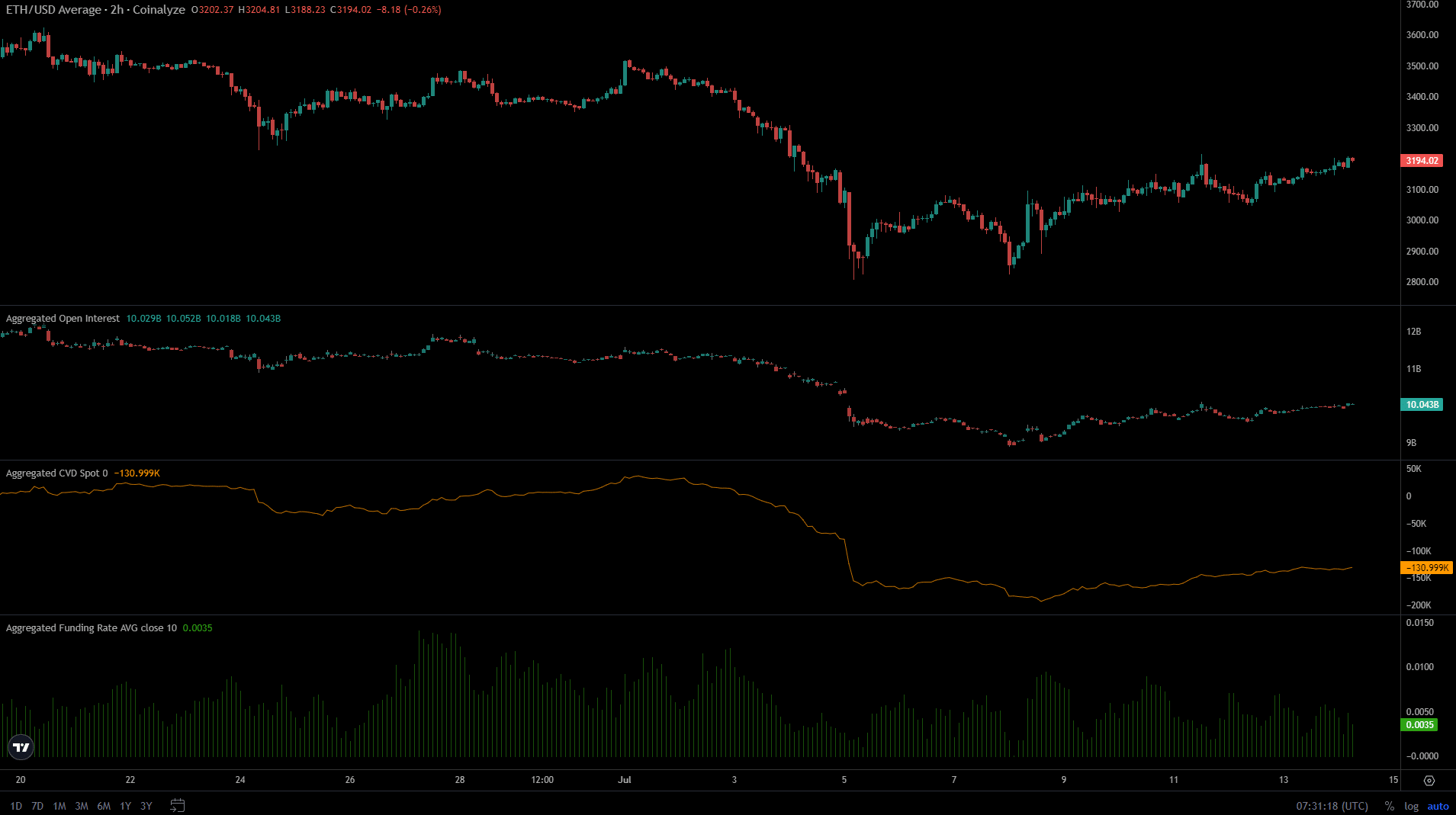

Open interest has risen in tandem with prices, and the funding rate displayed a favorable position. The bullish attitude among traders was robust, while the spot Contango Value (CVD) showed signs of improvement as well.

If the trend remained intact, the chances of an ETH move toward $3.6k would become healthier.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-07-15 02:15