There’s a stubborn heart in the land of the free, and it beats in the veins of Ethereum, even as the world’s troubles gather like a storm. The Middle East whispers of war, supply chains groan under their own weight, and the US and China trade barbs like old rivals. Yet here, in the hush of crypto’s dusty corners, the price of ETH holds its breath, a flicker of hope in a world of chaos.

Ethereum Price Analysis: The Daily Chart

On the daily chart, ETH has clawed its way above the broad descending channel, a desperate climb up a hill of dust and doubt. After a fierce bounce from the green demand zone near $2,600 in mid-December, the price dared to reclaim the $3,000 mark, a beacon for the brave. But the rally faltered, just short of the $3,500 resistance band, a cruel mistress that has long held sway over this land. The RSI, once a roaring fire, now flickers low, a warning that the flames may soon die.

If the bulls fail to break through the channel’s iron grip, the price may retreat to the $2,600 support zone, a ghostly haunt of past despair. But a clean breakout above $3,500 could turn the tides, a silver lining in a cloud of uncertainty-though the next supply zone at $4,000 looms like a mountain, unyielding and cold.

ETH/USDT 4-Hour Chart

Zooming in, the 4H chart reveals a symmetrical triangle, a tightrope walk of higher lows and lower highs converging near $3,000. It’s a dance of power between buyers and sellers, but the air is thick with tension. The base of the triangle sits at $2,900, a fragile foothold, while the upper trendline caps the price just under $3,300, a barrier of stone.

The asset retests the triangle’s support after a small pullback, a test of wills. If buyers hold, another attempt at the upper range may come. But a breakdown could send the price tumbling back into the $2,600-$2,500 abyss. The RSI, once a feverish beast, now cools, a weary traveler drifting below 50, a sign that sellers may soon strike.

Sentiment Analysis

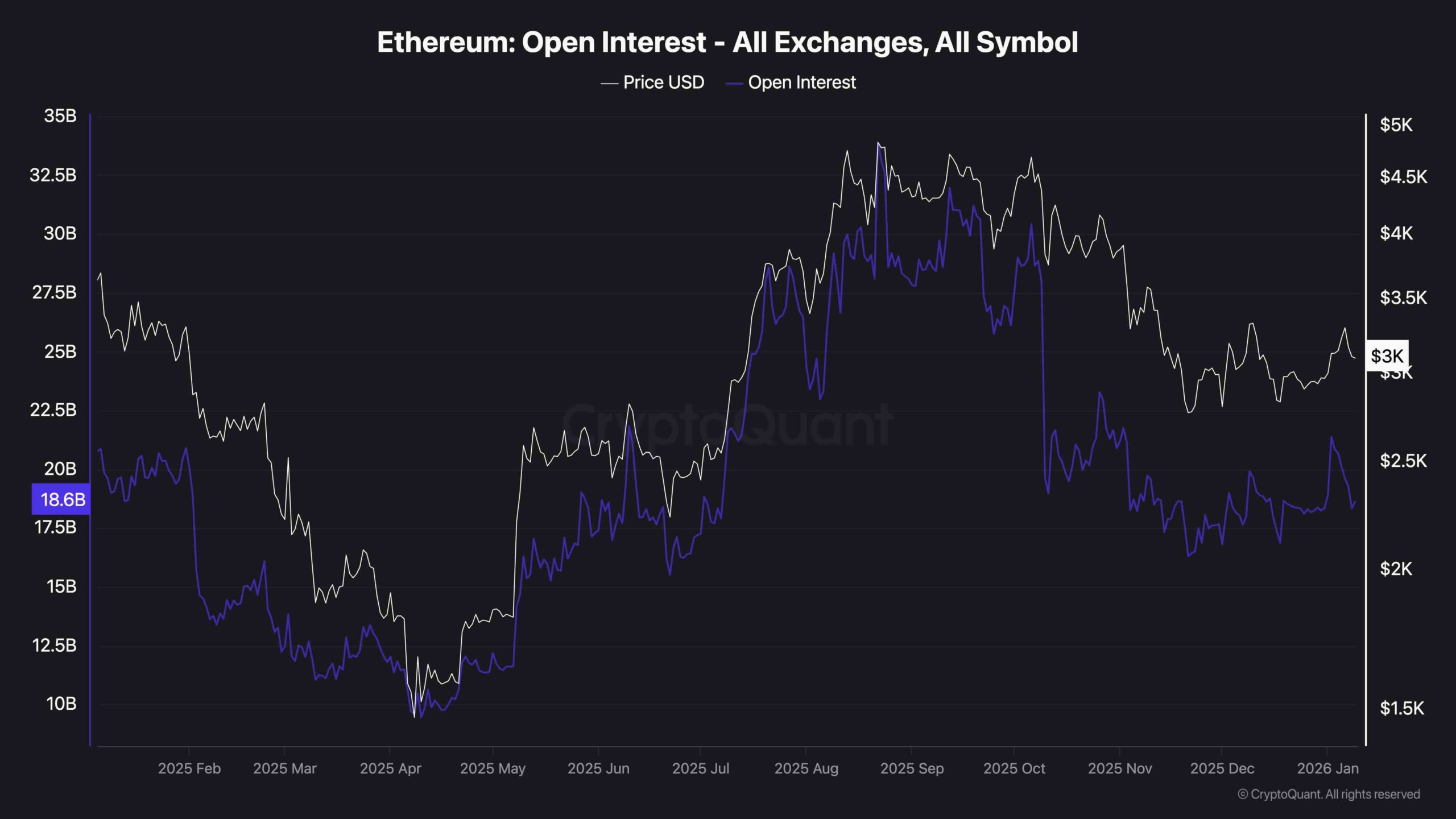

The Ethereum open interest chart, a silent witness to the market’s trials, shows OI hovering around $18B, a shadow of its Q3 2025 peak. Traders still play their game, but with caution, as if fearing the ghost of leverage. The recent rebound from December lows didn’t spark a surge in OI, a sign of healthy restraint-though the specter of forced liquidations lingers like a cold wind.

The market’s sentiment is a fragile hope, a whisper of optimism in a world of shadows. ETH has avoided the long squeeze that plagued others, but BTC’s dominance rises like a tide, and attention shifts to ETFs. Unless Ethereum breaks key resistance with a roar, it may lag, a forgotten dream in the shadow of giants.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Thanos Comics (September 2025)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Goat 2 Release Date Estimate, News & Updates

- Felicia Day reveals The Guild movie update, as musical version lands in London

- The Legend of Zelda Game That Changed the Timeline Forever

2026-01-09 17:02