Ah, dear reader, let us dissect this grand spectacle of Ethereum’s price performance with the precision of a poet and the detachment of a bemused spectator. One might say the market’s current structure resembles a Wave 2 correction-how delightfully dramatic! A mere retracement, they whisper, but one that precedes “strong medium-term trend continuations.” How reassuring, like a butler promising tea after a storm. Beneath the chaos, however, institutional interest simmers like a pot of lukewarm porridge, offering stability to those who dare to sip. 🍵

Ethereum Slides Below $2,800: A Descent into Madness?

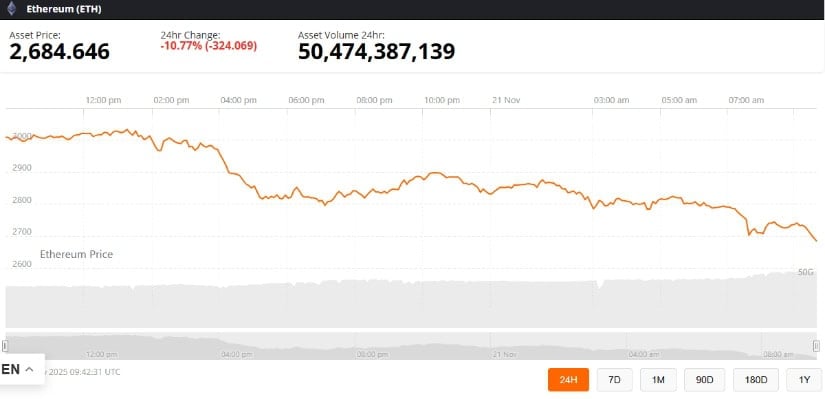

As of November 21, 2025, Ethereum clings to life near $2,845, having suffered a 10% weekly decline that left leveraged traders gasping. Coinglass’ liquidation dashboards gleefully reported $950 million in woe-a veritable feast for volatility. One might call it a “market correction,” but I prefer to think of it as a grand prix for panic. 🏁

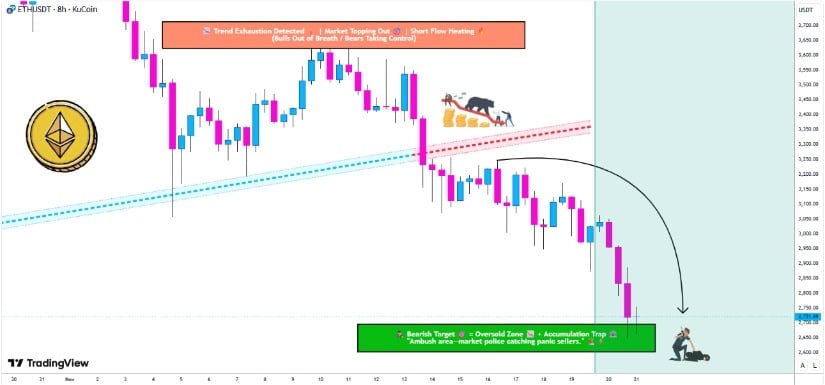

ETH recently breached the sacred $2,800 threshold, plummeting to $2,650-a move that whispers, “Darling, you may yet fall another 5-10% unless you reclaim your dignity.” A volume-based trader, with the gravitas of a Victorian lecturer, declared: “If ETH remains below $2,800, it risks drifting toward the $2,500 demand zone, where spot momentum fades like a candle in a hurricane.” How poetic, if slightly terrifying. 💡

Technical indicators, those fickle flirts, now suggest caution. Past cycles teach us that once ETH loses a major support cluster, it often consolidates or retests lower levels-like a lover returning to an ex, hoping for a miracle. 🤵

Wave 2 Correction: Elliott’s Whimsical Waltz

Ethereum’s structure now mimics a Wave 2 pullback, a concept so delightfully abstract it could only be devised by someone with a fondness for triangles and a disdain for reality. A market analyst, clutching their Fibonacci retracement chart like a holy grail, noted ETH’s proximity to the $2,748 “pivot zone.” How thrilling! Wave 3 projections whisper of $8,000-$9,000 targets, but let us not confuse hope with certainty. 🎩

These lofty dreams rely on macro conditions, ETF inflows, and network activity-three musketeers of optimism. Yet, they remain hypothetical, like a bet on a horse named “Hope.” 🐴

Technical Analysis: A Game of Inches

Let us now survey the battlefield of support and resistance zones:

- $2,830-$2,900: A reclaim target so modest it could fit in a teacup. 🫖

- $2,681: A liquidity zone tested by past corrections, like a ghostly echo. 👻

- $2,606: A deeper support area, where downward momentum reigns supreme. 🛑

Indicators such as RSI suggest oversold conditions, a signal so faint it might be mistaken for a sigh. Candlestick formations, meanwhile, hint at stabilization-if only volume would return, like a long-lost friend. 🕯️

Whale Activity: The Silent Dance of the Titans

On-chain data reveals that large ETH holders have grown quiet, their accumulation slowing as prices dipped below $3,000. Addresses holding 1-10 million ETH now resemble statues, frozen in existential doubt. The MVRV ratio, that fickle barometer of profitability, has hit a four-month low-proof that even long-term holders are questioning their life choices. 🤷

Yet, institutional demand persists, a stubborn flame in the dark. CoinShares’ ETF flow data suggests steady capital rotation, while regulatory developments in 2026 offer a “structural foundation” for future upside. How reassuring, like a bridge made of promises. 🌉

Short-Term Outlook: A Gambler’s Guide

Traders, those modern-day gamblers, now employ layered entry strategies, using $3,200-$3,000 ranges as reference points. These are not signals, but rather the desperate hope of those who cling to charts like lifelines. Bitcoin and Solana, those capricious companions, also influence ETH’s direction. If Bitcoin falters, altcoins often follow, like children chasing a shadow. 🕳️

Long-Term Forecast: The Bull’s Last Stand

Despite the drama, long-term signals remain “constructive” (a word as vague as a foggy mirror):

- Accumulation in spot markets: A noble effort to absorb sell pressure, like sponges soaking up champagne. 🥂

- Fibonacci convergence: A multi-month demand zone so precise it could rival a watchmaker’s obsession. ⌚

- Analysts’ targets: $3,800, $4,400, and $5,100-numbers so lofty they belong in a fairy tale. 🧸

These projections depend on liquidity, regulation, L2 adoption, and staking activity. But should ETH fall below $2,470, the bullish outlook collapses like a soufflé. 🥚

Final Thoughts: A Tale of Two Markets

Ethereum’s $2,800 loss exposes its short-term vulnerability, a vulnerability as fragile as a porcelain doll in a tornado. Technical data, whale behavior, and market structure all conspire to paint a cautious near-term picture. Yet, institutional interest and ETF participation persist, like a stubborn lullaby. Investors will watch price action, reclaim levels, and macro developments with the patience of a cat watching a mouse. 🐱🐭

Read More

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- How to Build a Waterfall in Enshrouded

- Rod Stewart’s Albums Ranked: Every Release & Biggest Hits You Forgot About

- The Sci-Fi Thriller That Stephen King Called ‘Painful To Watch’ Just Joined Paramount+

- DWTS: Zac Efron Makes First Appearance to Support Brother Dylan Efron

- Goat 2 Release Date Estimate, News & Updates

- PS5, PS4’s Vengeance Edition Helps Shin Megami Tensei 5 Reach 2 Million Sales

2025-11-21 23:36