- Ethereum’s price surge to $3,200 draws attention to Ethereum whales and long-term holders.

- Increased whale activity could fuel further growth, but profit-taking by LTHs may limit upside.

As a seasoned researcher with years of experience tracking market trends and analyzing cryptocurrency dynamics, I have witnessed countless rallies and corrections in the ever-evolving digital asset landscape. The recent surge of Ethereum [ETH] to $3,200 has certainly piqued my interest, as it brings us to a critical juncture with long-term holders (LTHs) and whales at the forefront.

🚨 BREAKING: Trump's Tariffs May Rock EUR/USD!

Shocking new analysis predicts massive volatility ahead. Markets brace for impact!

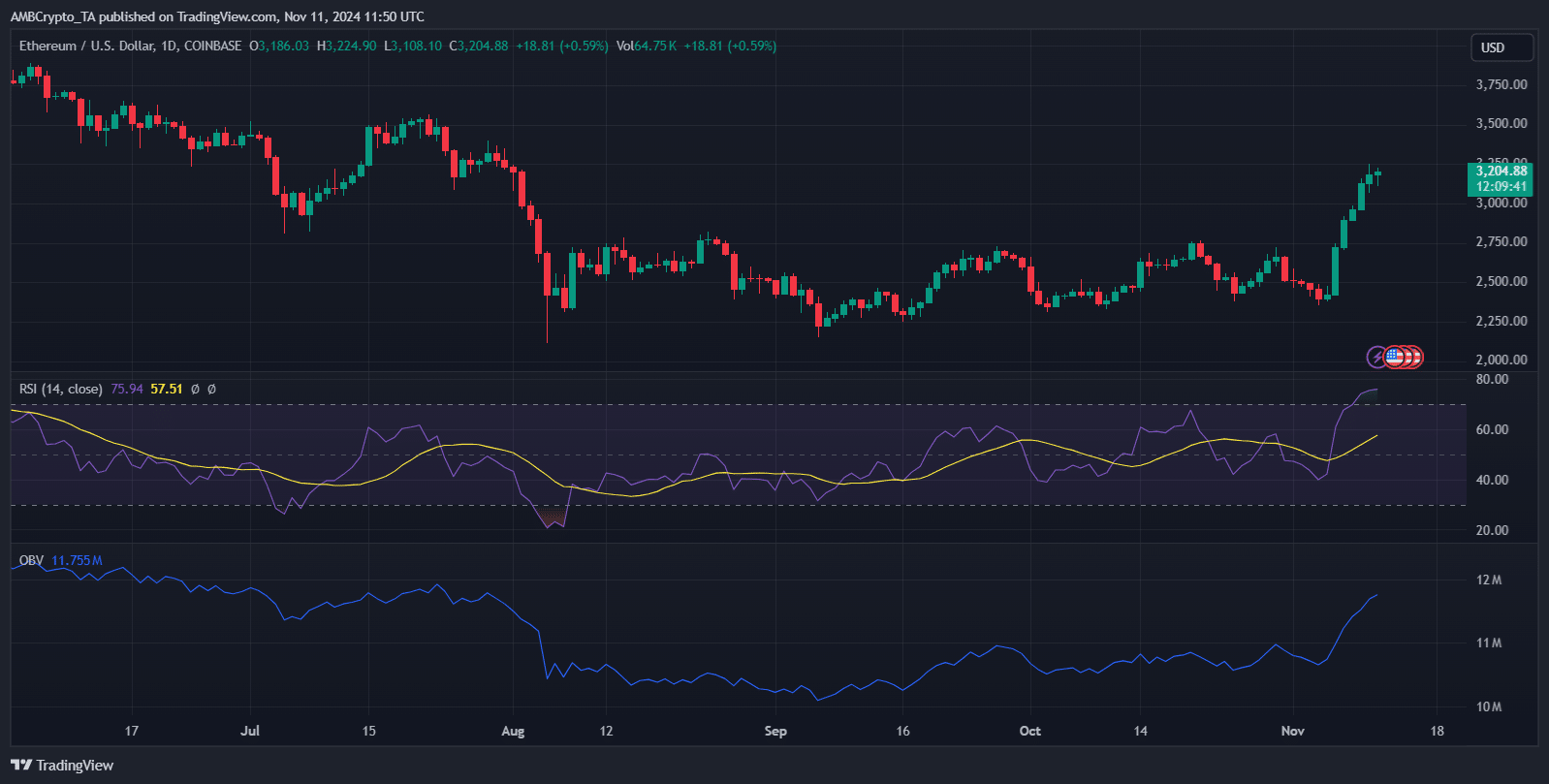

View Urgent ForecastOver the past few months, I’ve been closely monitoring Ethereum’s [ETH] performance, and now, following a substantial increase in Bitcoin‘s value, Ethereum has seen a significant rally. This surge has pushed Ethereum close to a crucial resistance level, currently hovering around $3,200.

Over the next few weeks, it’s crucial to keep an eye on the moves made by long-term investors (LTHs) and significant Ethereum holders (Ethereum whales). The decisions they make could potentially boost Ethereum’s value even further or trigger additional selling, which might challenge the durability of this recent market surge.

Ethereum’s price increase

In simpler terms, the value of Ethereum has been on an upward trend lately, approaching a significant barrier at approximately $3,200 after spending several months hovering near the $2,700 mark.

In simpler terms, the 14-day Relative Strength Index (RSI) was around 76, which typically signals that the market is overbought. This could mean the market might slow down or even experience a drop as traders might choose to cash out their gains.

Conversely, an RSI that is overbought may indicate robust bullish momentum, potentially leading to a breakout when sustained.

The Overbought Volume Indicator (OBV) was showing a significant uptrend, suggesting substantial buying volume that fuels this price surge. This pattern might hint at possible involvement of large investors, potentially boosting the upward trend.

As a crypto investor, I’m keeping a close eye on the substantial buying activity surrounding Ethereum (ETH). This strong demand could potentially help ETH surmount its existing resistance levels and continue its upward trend. If these ‘whale’ investors persist in accumulating more ETH, there’s a good chance we might see it pushing even higher.

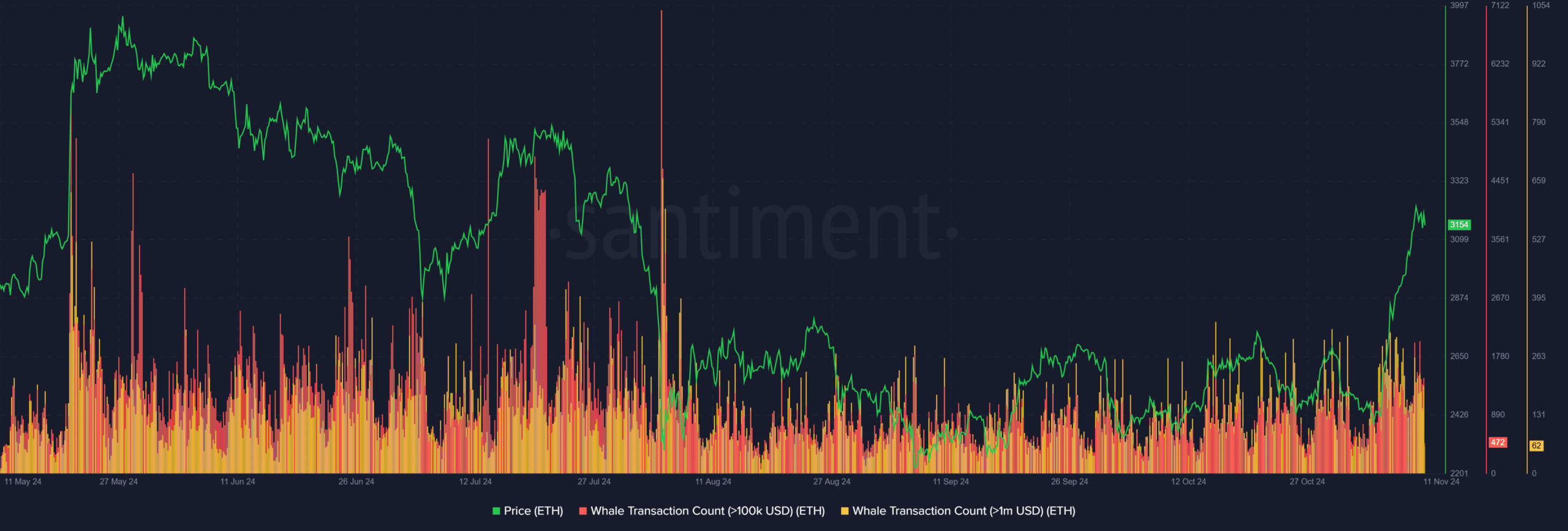

Whale activity and its impact

Whales significantly impact the fluctuations in Ethereum’s value. A notable increase in large transactions by these whales, coupled with consistent accumulation, highlights their power to fuel the rising trend.

Investors with substantial resources frequently placing themselves strategically indicates they are optimistic about a continuous rise. Their ongoing involvement suggests that the current growth trend is solidly backed by significant financial resources, possibly hinting at future price increases.

Role of LTHs in Ethereum price action

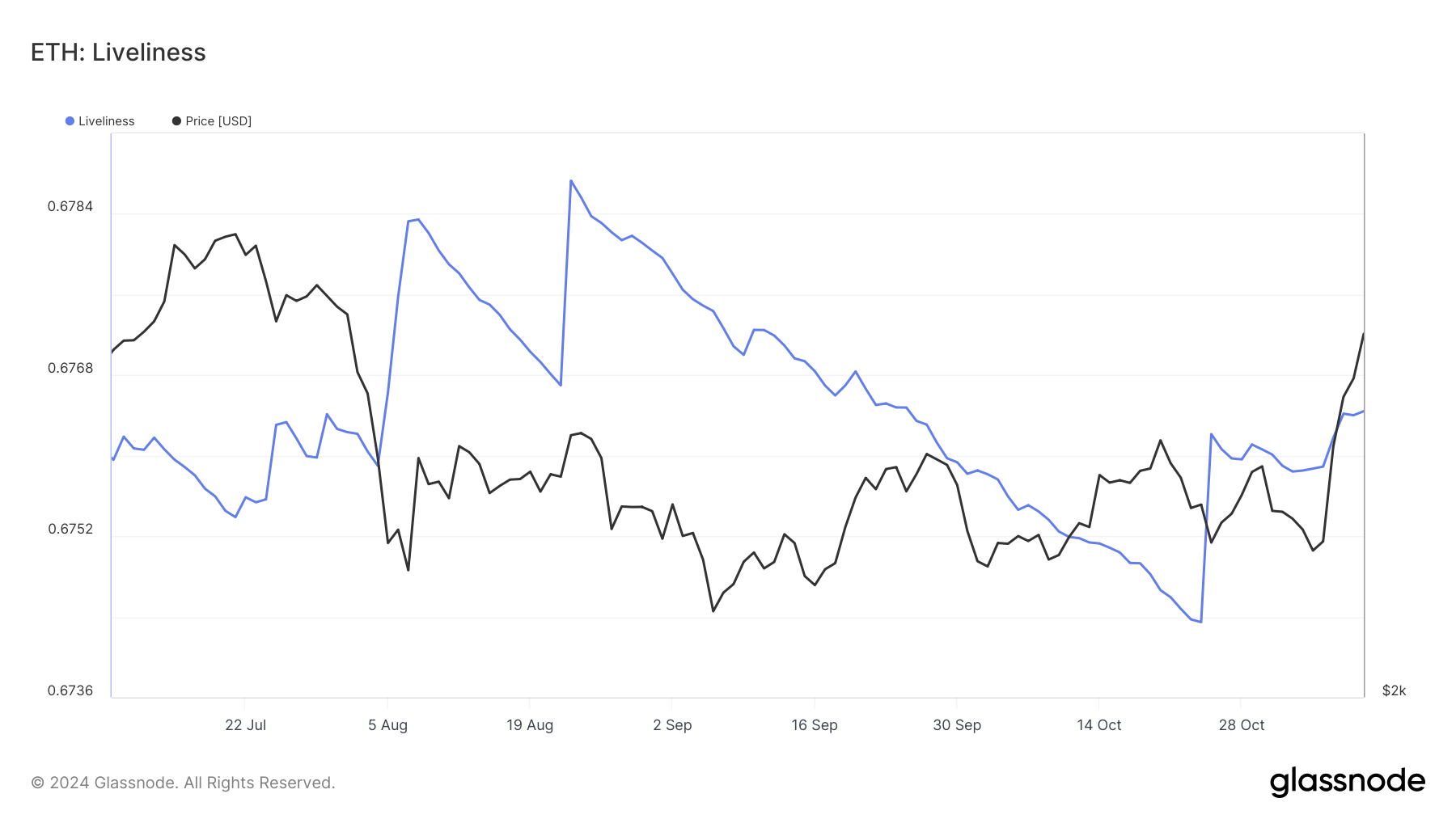

During September and October, there was a continuous decrease in the activity of Ethereum, suggesting that long-term investors (LTIs) were amassing more coins as the market stabilized at lower price points.

Long-Term Holders (LTHs), recognized for their robustness amid market fluctuations, frequently act as a balancing element, taking up supply and lessening severe price declines.

Read Ethereum Price Prediction 2024-25

On the other hand, the increased energy surrounding Ethereum’s rise towards $3,200 suggests that some long-term investors might be cashing out their gains.

As someone who has been closely following the stock market for over a decade, I can tell you that subtle changes can often serve as crucial indicators of shifting market dynamics. In this case, the proposed change could potentially act as a bellwether, signaling a slowdown in the rally’s momentum. This is because an increase in long-term holder (LTH) distribution might introduce renewed supply pressure into the market. Having witnessed several market cycles, I can attest to the fact that such events can significantly impact investment strategies and returns. Therefore, it would be prudent for investors to closely monitor this development and adjust their portfolios accordingly.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-11-12 03:03