In the labyrinthine corridors of the digital bazaar, where fortunes rise and fall with the whims of the invisible hand, the so-called “analysts” whisper of Ethereum‘s destiny. They proclaim, with the gravity of oracles, that ETH may yet ascend to the hallowed grounds of $3,400-$4,000, provided the fickle gods of support hold their ground. Yet, the momentum, like a drunken bear, staggers uncertainly, and the broader market, ever the capricious mistress, offers no clarity. 🌪️

The Great Sell-Off: A Comedy of Errors and Unfilled Voids

Ethereum, that proud stallion of the crypto stables, has recently stumbled, leaving behind unfilled imbalance zones across timeframes as varied as the moods of a tyrant. From the fleeting 15-minute charts to the ponderous weekly structures, these zones stand as monuments to inefficiency, beckoning liquidity like sirens to a shipwreck. 📉

“Historically, ETH gravitates back to areas of high volume that were left unfilled,” intones Lucas Meier, a crypto strategist whose pronouncements carry the weight of a prophet. “In August 2022 and January 2024, similar imbalances led to recoveries of 6-12%, as liquidity rushed to fill the voids like lemmings to the sea.” 🧙♂️

The short-term targets, etched in the tablets of technical analysis, include:

- $3,328-$3,398 (15-minute vector candles)

- $3,411 (30-minute imbalance)

- $3,447 (45-minute inefficiency)

- $3,658 (1-week imbalance)

- $3,866-$3,891 (3-5 minute clusters)

- $4,075 (higher-timeframe inefficiency)

Traders, armed with RSI, MACD, and stochastic indicators, pore over these ranges like alchemists seeking the philosopher’s stone. 🔮

Market Sentiment: A Circus of Opinions

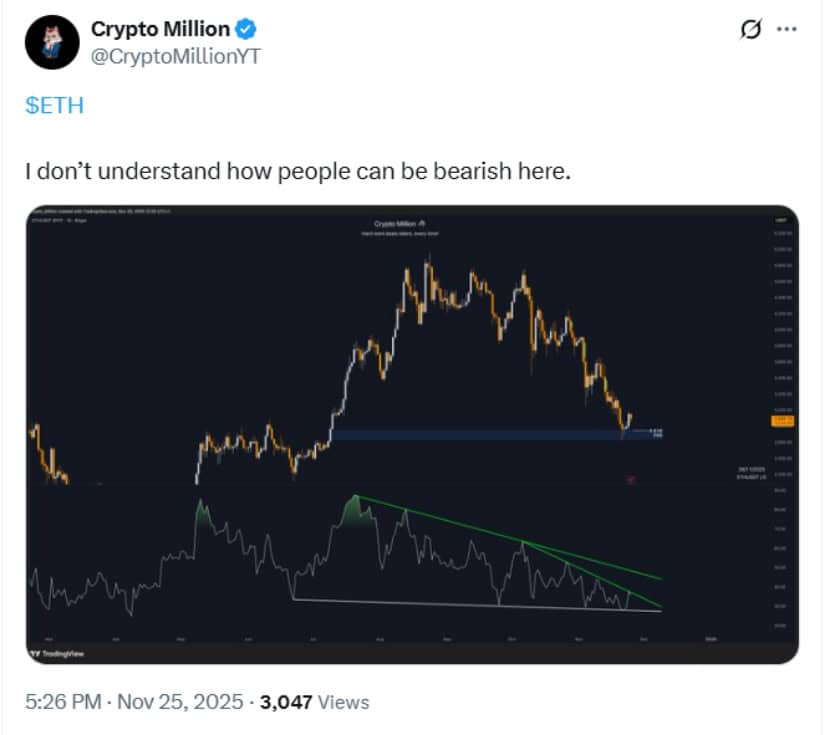

The market, ever the theater of the absurd, is divided. CryptoMillionYT, a Swiss analyst with the air of a soothsayer, declares ETH has broken above a descending trendline, its price hovering near $2,900. Yet, many traders, scarred by repeated rejections below $3,000, remain skeptical, while others cling to the hope of upside potential. This cacophony of voices reflects the chaos of a market in search of direction. 🎪

ETH’s Rebound: A Tale of Institutional Greed and Caution

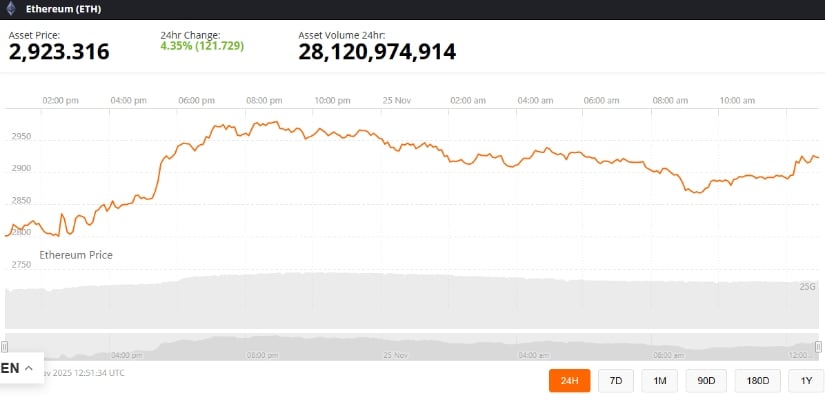

Ethereum, like a phoenix from the ashes, rebounded 4%, trading near $2,910 after bouncing from the $2,850 support level. This recovery, coinciding with institutional accumulation, saw BitMine Immersion Technologies add 69,822 ETH to its treasury-a move as bold as it is baffling. 🦅

BitMine’s holdings now stand at 3.63 million ETH, or 3% of the circulating supply, making it the largest corporate Ethereum treasury. Yet, buying pressure near $3,000 remains as tepid as a lukewarm borscht, and momentum, though positive, is as feeble as a sickly goat. 🐐

Technical Indicators: The Grim Reapers of Momentum

The oscillators, those harbingers of doom, paint a picture of weakness:

- RSI near 36: buying strength as subdued as a Russian winter. ❄️

- MACD in negative territory: trend support as weak as a wet paper bag. 🧻

- Stochastic %K in lower ranges: demand as soft as a marshmallow. 🍡

Traders, ever the optimists, are advised to wait for confirmation before declaring a reversal-a caution as wise as it is ignored. 🕊️

Moving Averages: The Chains of Correction

The moving averages, those implacable jailers, remain above ETH’s price, highlighting the corrective forces at play. The gap between spot price and trend levels is as stark as a Siberian gulag, emphasizing the selling pressure ETH endures. This setup explains why $3,000-$3,100 remains a fortress, reinforced by the 20-day EMA at $3,133. 🏰

ETH Outlook: Between Hope and Despair

Immediate resistance levels loom like specters:

- $3,000: a psychological barrier as formidable as the Berlin Wall. 🧱

- $3,100: a ceiling reinforced by moving averages, as unyielding as a Soviet bureaucrat. 🧑⚖️

A move above these zones could signal bullish momentum, aligning with recovery targets of $3,400-$4,000. Conversely, failure to hold $2,850 may send ETH tumbling toward $2,300, a fate as grim as a winter in Vostok. 🌨️

Long-term projections, dependent on network upgrades, institutional flows, and macroeconomic conditions, remain as uncertain as a Russian novel. Yet, the imbalance zones and structural support offer a glimmer of hope in this sea of chaos. 🌟

Read More

- Best Controller Settings for ARC Raiders

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- DC K.O.: Superman vs Captain Atom #1 Uses a Fight as Character Study (Review)

- “I’m Really Glad”: Demon Slayer Actor Reacts to Zenitsu’s Growing Popularity

2025-11-25 23:25