- Coinbase Ventures has scooped over $20 million of AERO.

- Will the DEX growth and Coinbase’s move trigger the next upside leg for AERO?

As a seasoned researcher with over two decades of experience in the financial markets and a keen interest in the burgeoning crypto space, I find the recent move by Coinbase Ventures to invest $20 million in Aerodrome Finance’s AERO token quite intriguing.

Coinbase’s investment division, Coinbase Ventures, has increased its holdings in Aerodrom Finance’s AERO token, an action that financial analysts view as a positive indicator for the future of this digital asset.

As a researcher, I’ve learned from Arthur Cheung, the founder of crypto VC firm DeFiance Capital, that Coinbase Ventures recently acquired approximately $20 million worth of AERO tokens – the largest single investment in tokens they’ve ever made to date.

Now, an unprecedented sum over $20 million has been invested in a liquid token, just as any other market participant would do. Ponder upon their optimistic outlook and continued purchases.

Aerodrome Finance’s moat

Cheung pointed out that Coinbase might be optimistic due to Aerodrome Finance’s expanding influence within the Base network.

In the given context, Aerodrome serves as the leading source of liquidity and operates as a decentralized exchange (DEX) within Base, an Ethereum [ETH] layer-2 solution. This platform has garnered significant attention and enthusiasm from institutional investors due to its rapid growth and popularity.

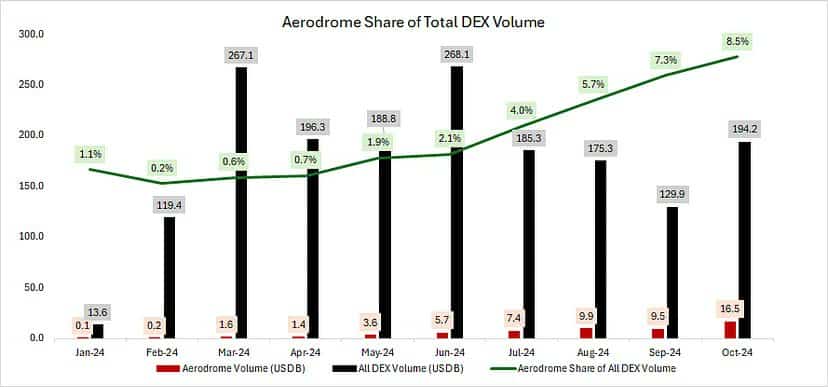

Over the course of just about a year, the share of transactions on the Aerodrome’s Decentralized Exchange (DEX) has significantly increased, climbing from zero to more than 8% as we speak.

David Han, an analyst at Coinbase, pointed out that the significant increase in its value has now made it account for almost half of Base’s Total Value Locked (TVL), as he observed. In simpler terms, this means a large portion of the total value tied up in smart contracts on Base’s platform is associated with this particular entity.

The Aerodrome makes up approximately 47% of the total value locked (TVL) at Base, which is around $1.5 billion out of $3.2 billion. Additionally, it accounts for about 58% of the DEX trading volumes over the past week, representing roughly $7.1 billion out of a total $12.2 billion.

It’s worth noting that the value of the token has been boosted by its growth. Specifically, AERO experienced a remarkable increase of over 1400% year-over-year, with its current value standing at $1.39 as we speak.

Will the projected growth in DEX volume and Coinbase’s move drive further upside traction?

AERO price action

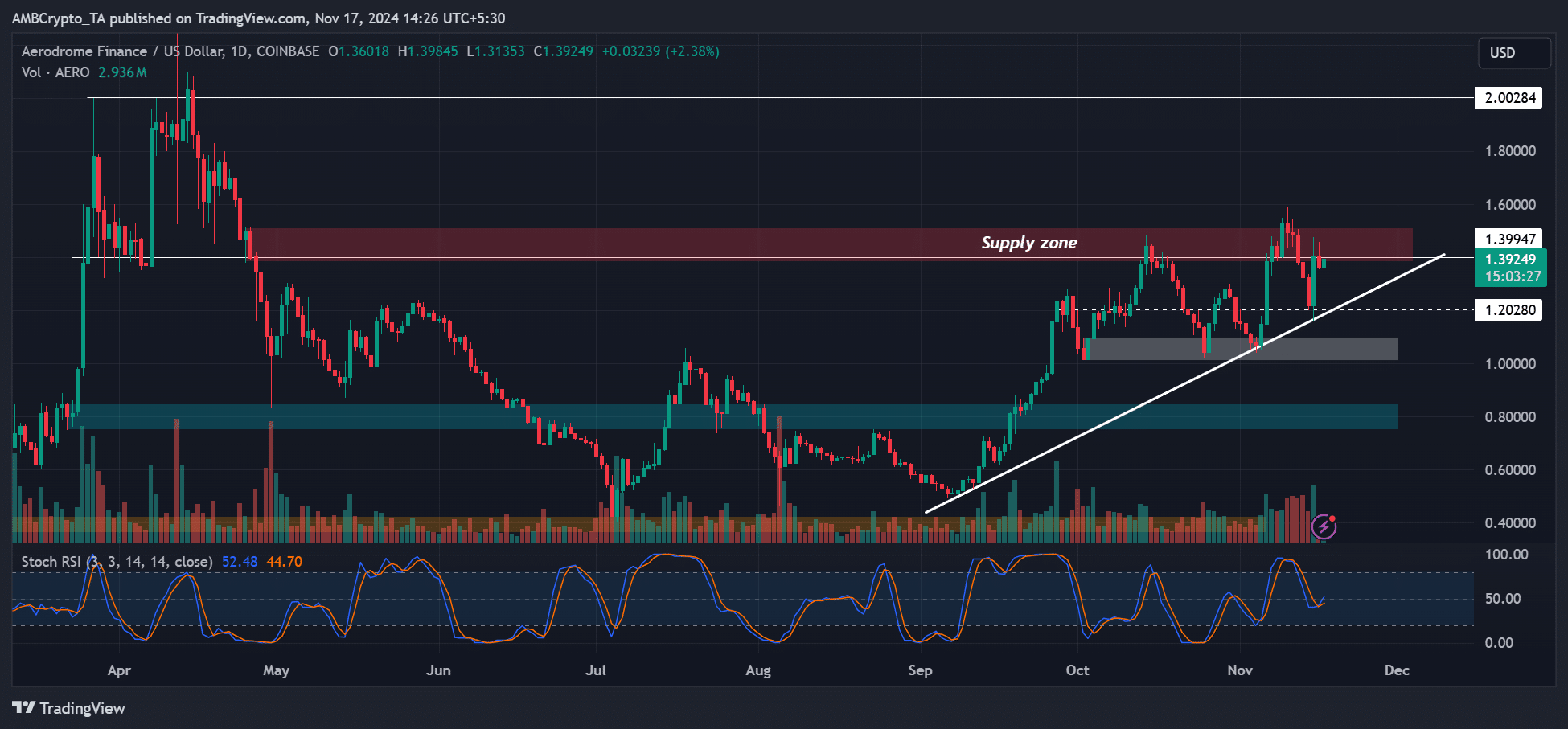

On a day-to-day price graph, AERO has maintained its position above the trendline’s supportive level (depicted by a white line) as well as the Q4 price region that lies above one dollar ($1).

Since October, $1.4 has served as a robust resistance point (or area where the price has often struggled to rise above), but if it manages to break this barrier, the token may look towards reaching $2 and even its record high.

Should AERO reach $2, it would present an appealing risk-to-reward ratio and the possibility of approximately 40% profits if purchased now.

Read Aerodrome Finance’s [AERO] Price Prediction 2024-2025

In simpler terms, if the price falls below the current trendline and support in the fourth quarter, it might weaken the optimistic view on AERO. For traders looking to buy long-term (swing traders), these levels could serve as a point to exit the market, should the price reach them.

Yet, for long-term investors, a possible additional dip might offer opportunities to purchase at reduced prices.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-11-18 02:15