- Galaxy Digital’s net income jumped 40%, with the same attributed to spot Bitcoin ETFs’ impact

- Galaxy Trading also saw a hike in revenue and volumes

As a crypto investor with some experience in the market, I find the recent Q1 results of Galaxy Digital Holdings Ltd. to be quite encouraging. The 40% increase in net income to $422 million is impressive and a testament to the growing popularity of Bitcoin ETFs.

Galaxy Digital Holdings Ltd. has made a notable entrance into the financial sector with a substantial 40% increase in net income, reaching $422 million. Analysts point to the influence of Bitcoin [BTC] ETFs trading on spot markets as the driving force behind this growth.

The trend upward became more pronounced starting from May 14th, which saw a significant increase in investments into Bitcoin ETFs. This came after four consecutive weeks where these funds experienced outflows. Reports suggest that there was a total inflow of $116.8 million during the previous week, indicating a return of investor confidence.

Good day for Bitcoin

As a crypto investor, I’ve noticed that recent inflows might have influenced Bitcoin’s price trend. Just a few days ago, the market showed only red signals. However, Bitcoin has since bounced back with a strong 6% increase in value within the last 24 hours.

The same was confirmed by the Relative Strength Index climbing close to the 50-level on the charts.

Providing further insights into Galaxy Digital’s Q1 results, analyst Joseph Vafi noted,

As a crypto investor, I’ve noticed that approvals for Bitcoin ETFs have significantly boosted market participation. Traditional asset managers and hedge funds, who were previously hesitant, have started or re-entered the cryptocurrency scene as a result.

According to the firm’s first-quarter report,

In the initial quarter, the reported earnings from counterparty trades amounted to $66 million. The major contributors to this increase were a surge in revenues from derivative contracts and advantageous shifts in asset values.

Galaxy Digital’s Q1 report

The report stated that there was a significant increase of 78% in trading volumes with counterparties, contrasting the previous quarter’s figures. Simultaneously, the average loan book grew to reach an impressive size of $664 million.

The role of platforms such as Galaxy Trading in enabling digital asset trading and investment continues to grow more significant.

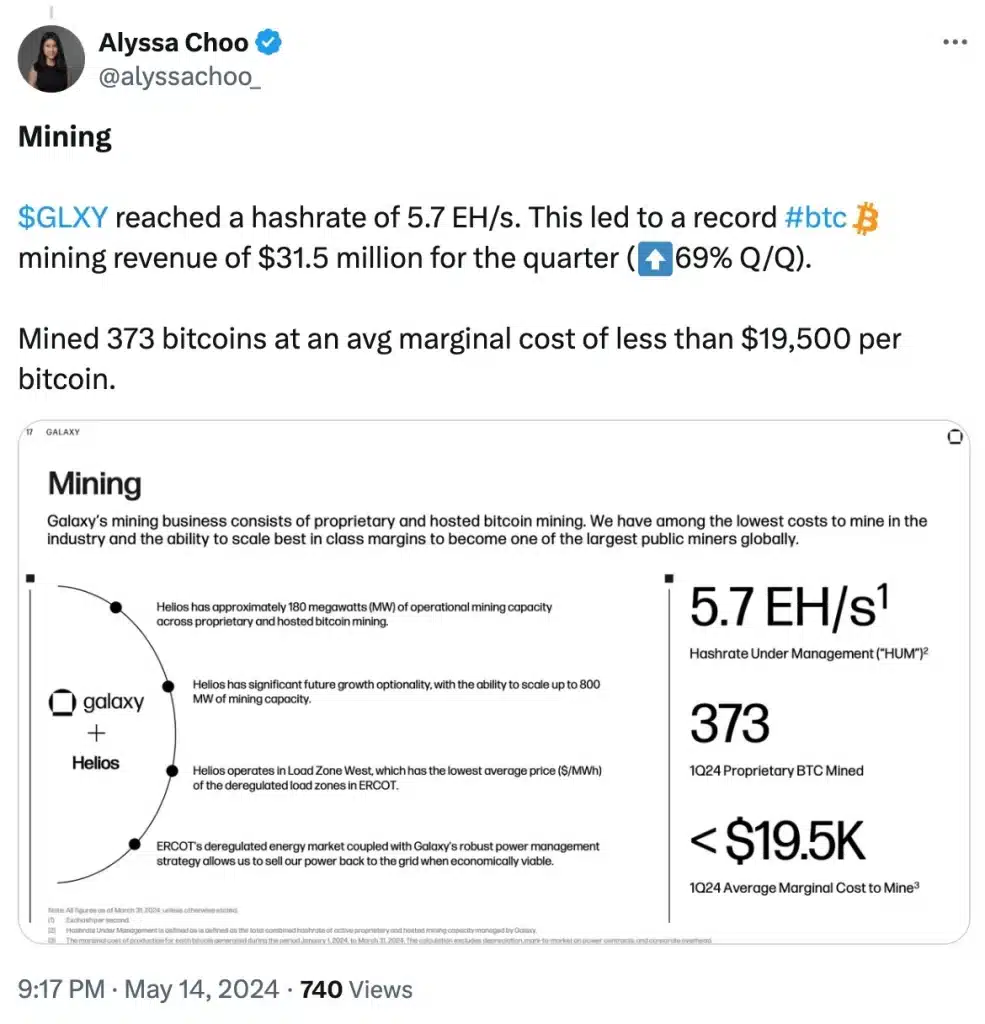

In the latest report, Galaxy recorded an impressive Bitcoin mining revenue of $31.5 million – marking a significant increase of 69% compared to the preceding quarter.

It’s noteworthy that the company managed to mine a total of 373 Bitcoins, with an average cost below $19,500 per Bitcoin. This underscores their effective mining practices.

Remarking on the same, Mike Novogratz, CEO of Galaxy Digital Holdings Ltd, said,

“Our first-quarter results underscore the strength and resilience of our business model.”

To summarize, although there’s optimism in the market, uncertainties continue to be unforeseeable. Nevertheless, the introduction of Invesco Galaxy Bitcoin ETF and two fresh XTrackers Exchange Traded Commodities in collaboration with DWS Group offer an encouraging outlook for the company.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-05-16 09:11