- APT’s fate rests heavily on whether bulls can successfully defend the $10.35 support

- Traders should watch for a potential bounce, one which could target $13.75, or a breakdown

As a seasoned researcher with years of trading under my belt, I find myself intrigued by the current state of Aptos [APT]. After witnessing its impressive three-month ascent to a 7-month high, it’s now at a critical juncture where its fate hangs in the balance.

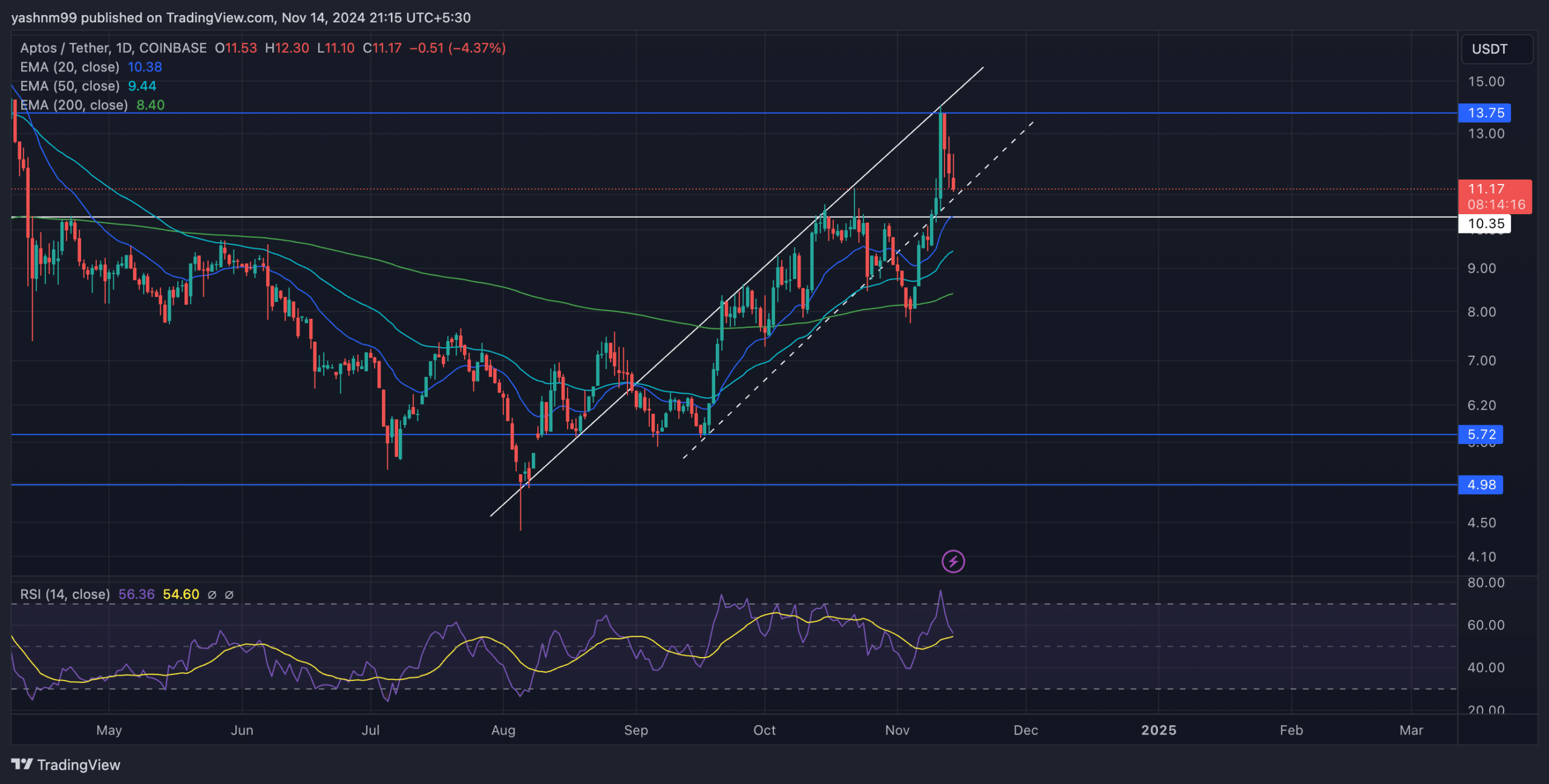

Over the past three months, APT (Aptos) has consistently climbed higher, reaching an impressive peak of $13.75 on November 11, marking its highest point in seven months.

Yet, after it was turned away from the trendline resistance, APT now finds itself in a delicate situation. Bulls are preparing to safeguard a convergence of significant support zones.

APT could go THIS way from its immediate support level

As of now, Aptos was approximately at $11.11 following a drop of about 8.7%. It was testing a significant area of support around $10.35, which includes the horizontal level, an ascending trendline, and the 20-day Moving Average. Whether this test results in a bounce or further decline could determine APT’s future price movement direction.

If APT falls back from the $10.35 threshold, investors might look to quickly challenge the $13.75 resistance, which aligns with the upper boundary of the ascending channel. Should APT manage to close above this level, it could drive APT towards a potential higher goal around the $15 milestone, reinforcing its bullish sentiment.

If the cost falls beneath the combined support level, APT could enter a period of stagnation close to its 50-day Moving Average ($9.43) and its 200-day Moving Average ($8.40). This would imply that buying momentum might be waning, potentially leading to a decline toward the $8 region if the $10.35 support is breached.

In simpler terms, the Relative Strength Index (RSI), which measures trader sentiment, was around 56, showing that traders are undecided. If the RSI drops below 50, it could suggest a resurgence of bearish trends, while a fall below 60 might spark additional bullish momentum.

Analyzing APT derivatives data

The statistics on derivatives for APT showed a blend of optimism and apprehension within the market. The Open Interest dipped by 11.96%, reaching $251.35M, suggesting that traders are likely closing their positions, which could be due to doubt about APT’s upcoming actions. In addition, trading volume decreased by 25.99%, indicating less participation from traders.

It’s worth noting that Binance showed a long/short ratio of 3.07 compared to OKX’s 2.39, suggesting a positive outlook among traders on these key platforms. However, over the past 24 hours, the ratio has been slightly skewed towards short positions with a value of 0.8886, indicating more traders are leaning towards taking short positions.

In the information regarding liquidation, it appears that long positions were prevalent, accounting for approximately $2.36 million in liquidations. This indicates that the bulls are persistently trying to maintain their positions despite the recent drop.

Considering the uncertainty and conflicting opinions surrounding Bitcoin‘s performance and the overall market, it’s crucial to analyze both Bitcoin’s fluctuations and broader market patterns before taking action with APT.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-15 08:39