-

SUI’s price surged past $2, with strong resistance at $2.135, as bullish momentum built on the charts

Rising Open Interest and positive funding rates indicated sustained confidence in SUI’s upward trajectory

As a seasoned analyst with over two decades of experience under my belt, I must admit that the recent performance of Sui [SUI] has piqued my interest. The explosive growth in TVL and the price surge have left me intrigued about this project’s potential for broader ecosystem expansion.

As an analyst, I’ve observed a staggering surge in the Total Value Locked (TVL) of Sui [SUI]. In just under two weeks since August 5, the TVL has tripled, reaching an astounding $1.03 billion. This meteoric rise in TVL aligns with SUI’s price skyrocketing to $2.01 – a significant 10.77% increase as I pen this analysis.

As a result, the increase in TVL (Total Value Locked) and the price jump have fueled discussions about Sui’s possible growth within a wider ecosystem.

Can SUI hold above key resistance levels?

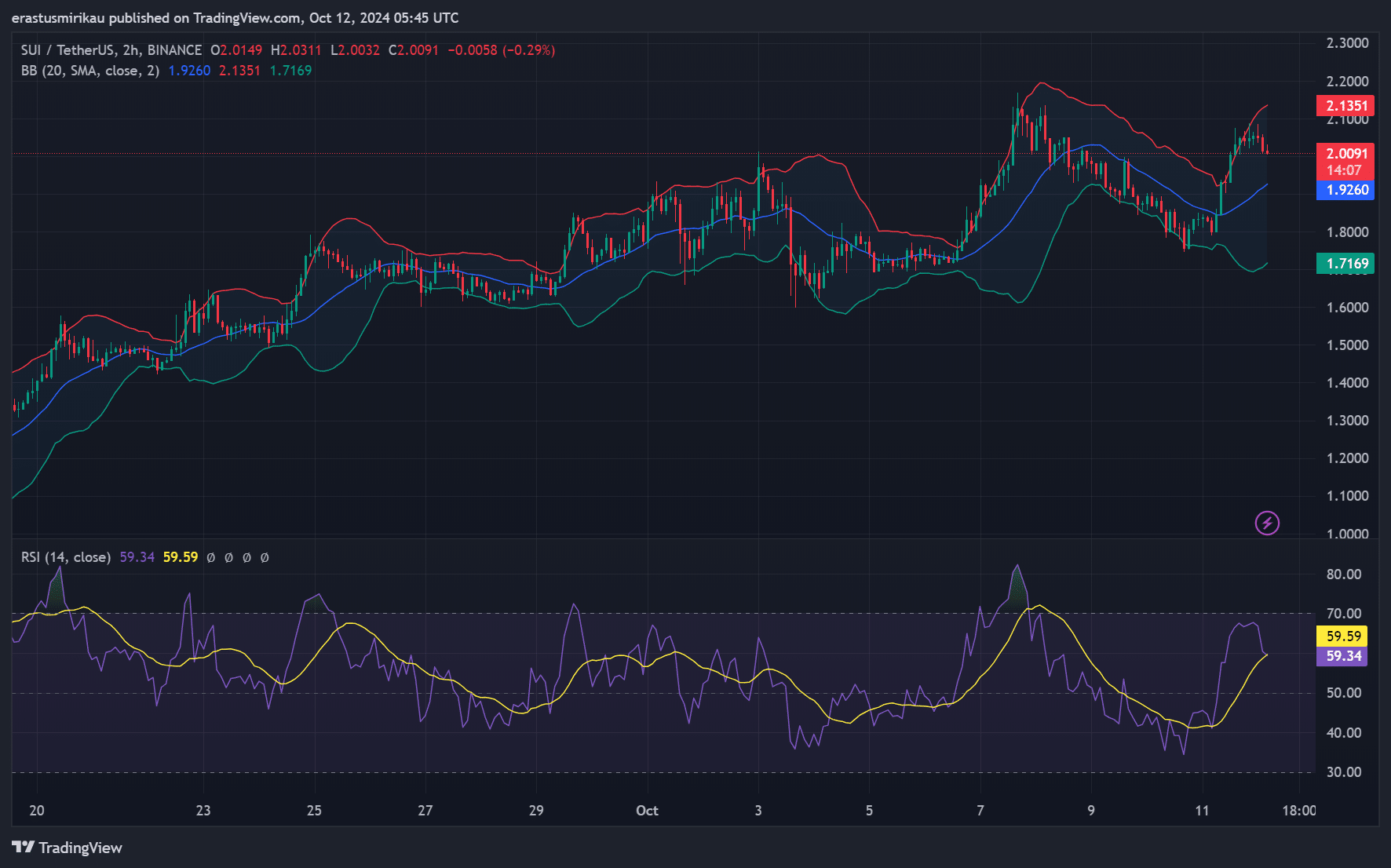

SUI broke through key resistance levels, and traders are now watching for a possible breakout. At press time, the next resistance was positioned at $2.135 based on the Bollinger Bands, which have been showing some signs of narrowing volatility. Additionally, the RSI level of 59.34 suggested the market is still bullish, but not yet overbought.

In simpler terms, when the Relative Strength Index (RSI) nears 70, it suggests that a temporary decline might occur. Keep a close eye on this and similar technical indicators to determine if Swiss Franc (SUI) will continue rising or encounter a brief setback instead.

Top holders and their influence – Will whales support the rally?

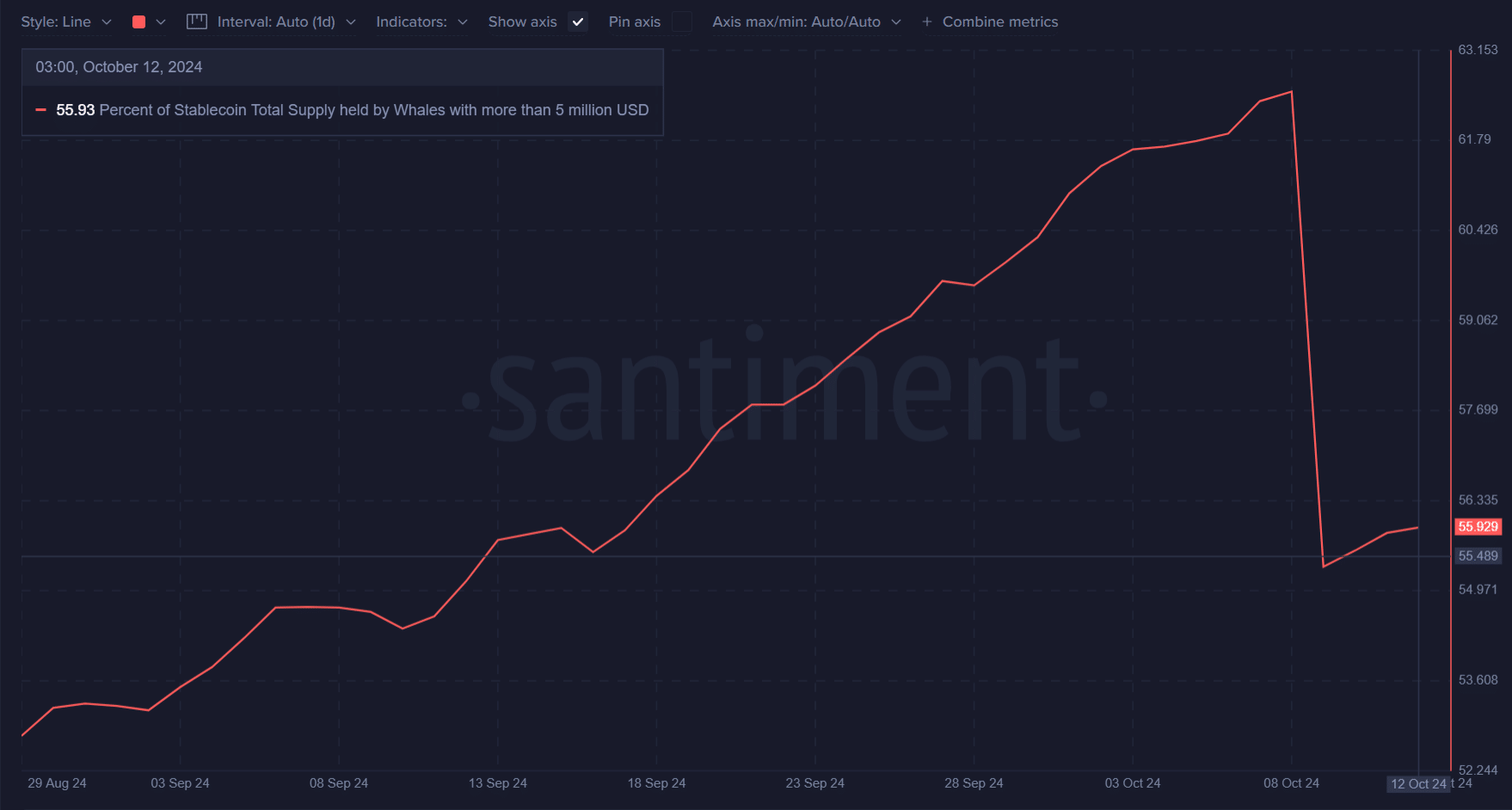

Currently, when this information is being compiled, the largest holders of SUI own approximately 55.93% of the currently available tokens, as demonstrated by the accompanying data. While whale activity has dipped compared to previous periods, they continue to maintain a substantial share of the total supply.

Consequently, the decisions made by these whale investors are expected to significantly influence the direction of SUI‘s price trend. Will these large investors maintain their holdings, thereby possibly stabilizing prices, or will they choose to sell, which might lead to increased market volatility?

SUI’s rising Open Interest – What does it mean for SUI’s price?

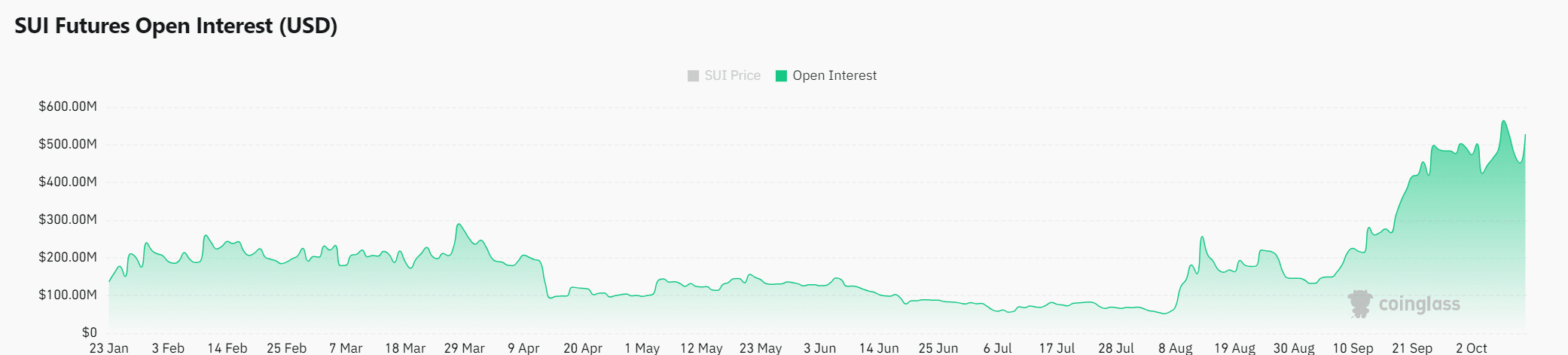

Additionally, Open Interest for SUI increased by 15.36% to reach approximately $518.27 million, indicating an upward trend in market confidence and heightened speculation regarding the token.

Furthermore, a larger volume of Open Interest usually contributes to increased market liquidity. This can potentially sustain current price levels and prolong the upward trend.

OI-weighted funding rate – Is the market favoring the bulls?

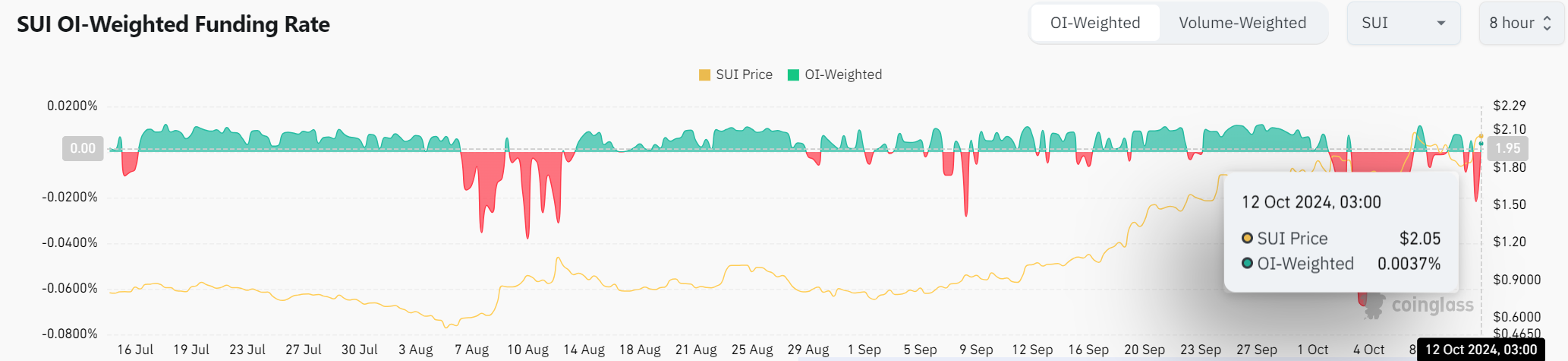

Ultimately, the OI-adjusted funding rate for SUI moved to a favorable 0.0037%. This positive shift indicates growing optimism among traders regarding the token’s potential increase in value. As investors are currently paying more for long positions, it usually signifies a strong belief in the asset’s upward trend.

On the other hand, this situation may result in excessive borrowing, potentially causing a rush of sell-offs if forced liquidations take place.

Read Sui’s [SUI] Price Prediction 2024–2025

Is SUI ready for its next breakout?

As a researcher examining the SUI market, I’ve noticed an exciting development: The Total Value Locked (TVL) in SUI has been climbing steadily, accompanied by robust Open Interest and attractive funding rates. These factors suggest that the token could be primed for continued growth. Yet, it’s crucial to surmount the resistance at $2.135 for SUI to maintain its upward trajectory effectively.

If market conditions remain favorable, SUI could be on the cusp of a significant expansion.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-12 14:15