- REEF crypto fell by 80% in 48 hours

- Is a rebound likely as weighted sentiment hits a monthly high?

As a seasoned crypto investor with a knack for navigating through the stormy seas of the digital asset market, I’ve learned to be both patient and adaptable. The recent 80% plunge of REEF in just 48 hours has left me with a familiar mix of apprehension and excitement.

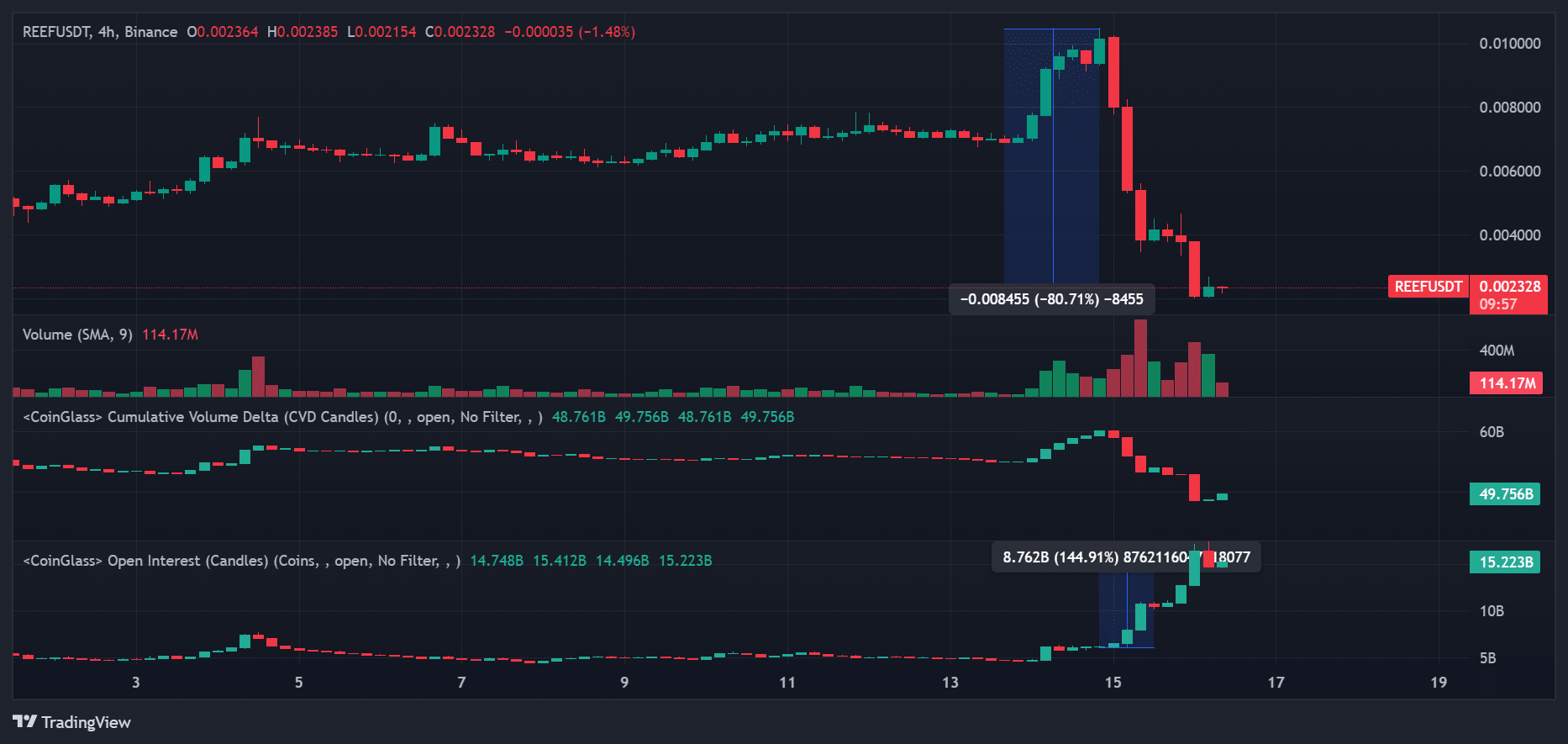

Over the course of two days, the value of REEF cryptocurrency, which is tied to the Reef chain, experienced a significant 80% decrease from its mid-week levels. This drop caused concern among investors, particularly those who had only recently purchased the token as it fell from $0.01 down to $0.002.

In simpler terms, a significant drop in REEF’s price was primarily due to heavy use of leverage. The number of open contracts (Open Interest) increased by an impressive 8.7 billion, indicating that many traders took on more leveraged short positions. This surge in short selling pushed the price of REEF even lower on the charts, suggesting that these speculators were betting against REEF.

Speaking of which, REEF has experienced an astonishing comeback since last September, skyrocketing a staggering 1500% following its removal from Binance‘s spot trading in August. Given this impressive performance, let’s examine what insights the data provides about its future prospects.

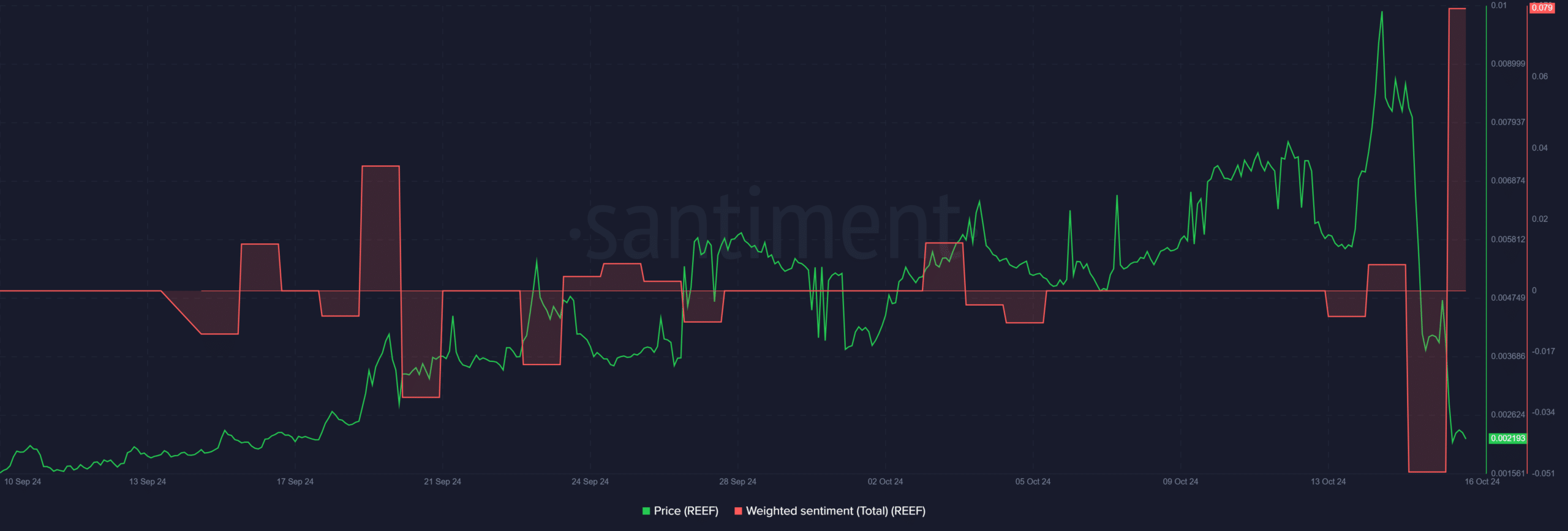

REEF’s sentiment hits monthly high

Currently, REEF’s Weighted Sentiment has turned around and reached a new peak this month. This indicates that speculators are optimistic about the token’s future growth prospects following its recent decline. In other words, there might be a possible change in the token’s price trend.

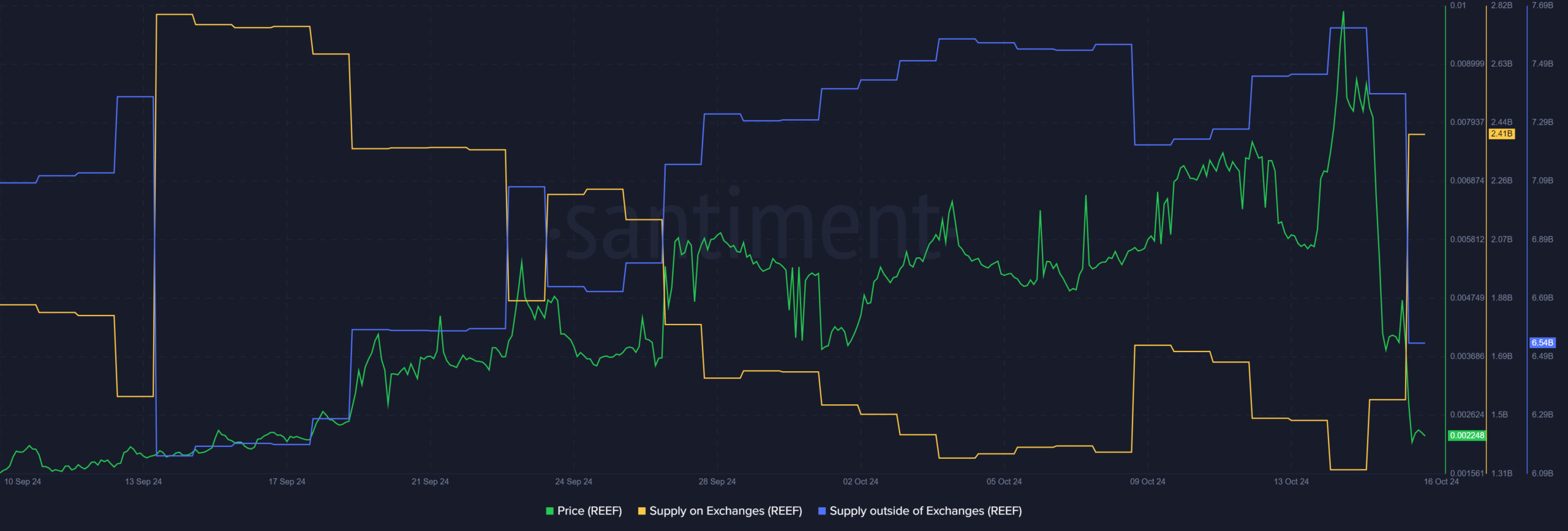

Nevertheless, there remained pressure on supply within the exchanges. Interestingly, Santiment’s data indicated a surge in supply on these platforms, suggesting that a substantial amount of REEF tokens had been transferred to centralized exchanges for selling purposes, presumably during the market downturn.

Furthermore, external trading activity decreased – Indicating a less robust accumulation pattern for the token. With reduced demand and increased supply pressure, there was little evidence of a significant price recovery for REEF, as of the current reporting period.

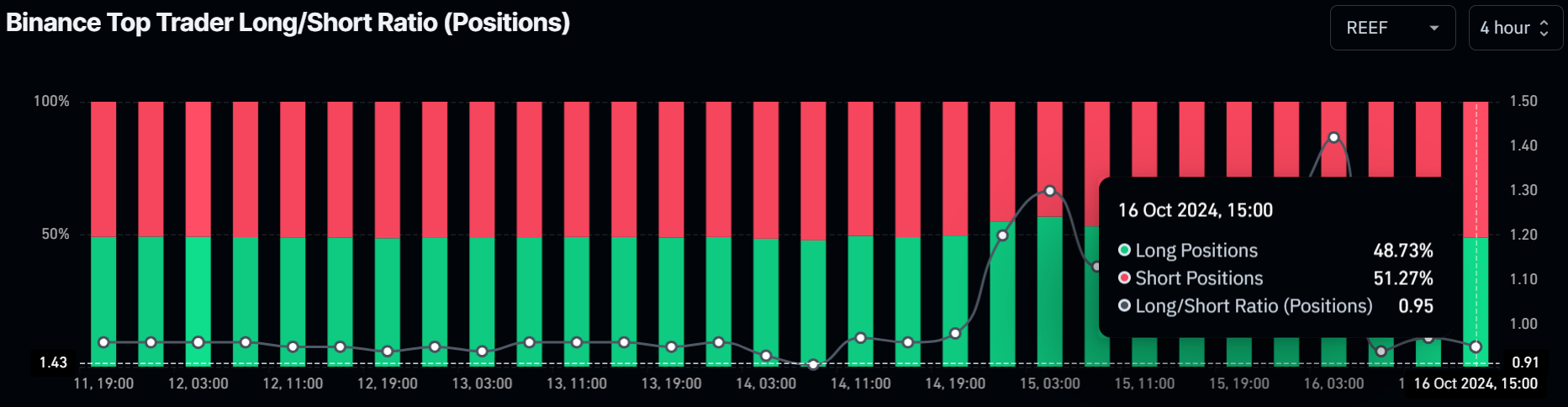

On the Binance exchange, it was noticeable that short-term selling pressure from ‘smart money’ was prevalent. As per the Long/Short position ratio by top traders, about 51% of their positions were betting against the asset.

In simpler terms, even though the overall market feeling is becoming more positive, traders remain cautious about a significant recovery due to their current investment strategies.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-17 07:03