-

SAND’s breakout from a falling wedge pattern signals an 80% price surge if it clears the 100-day moving average.

Bullish momentum is supported by rising active addresses, lower exchange reserves, and short liquidations.

As a seasoned analyst with years of market observation under my belt, I find myself intrigued by The Sandbox [SAND]’s current trajectory. The bullish momentum, supported by rising active addresses, lower exchange reserves, and short liquidations, paints an optimistic picture for this digital asset.

The digital currency SAND has successfully exited its downward sloping triangle formation, generating excitement about a potential substantial price rise. Important milestones have been identified at around $0.31 and $0.40, while market experts are keeping close tabs on the 100-day moving average.

Could a jump past this crucial point lead to an 80% increase in the price? Can SAND maintain this energy and spark a prolonged upward trend?

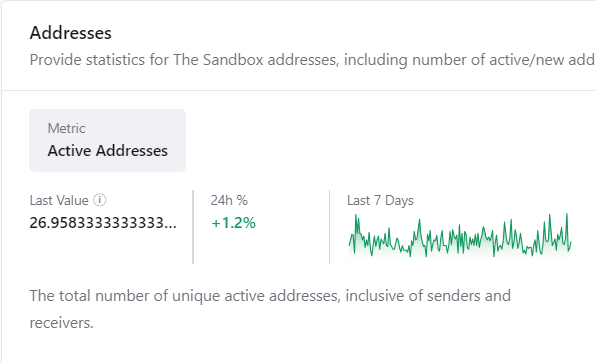

How are transactions and active addresses shaping up?

One of the key indicators of market activity is the number of unique active addresses. At the time of press, SAND has 26.96 active addresses, reflecting a 1.2% increase in the past 24 hours.

Moreover, the upward trend is bolstered by an increase in transaction activity, with CryptoQuant reporting a 1.37% jump to 529 transactions.

The consistent rise in activity suggests that a growing number of people are using the network, possibly laying the groundwork for the expected rise in value.

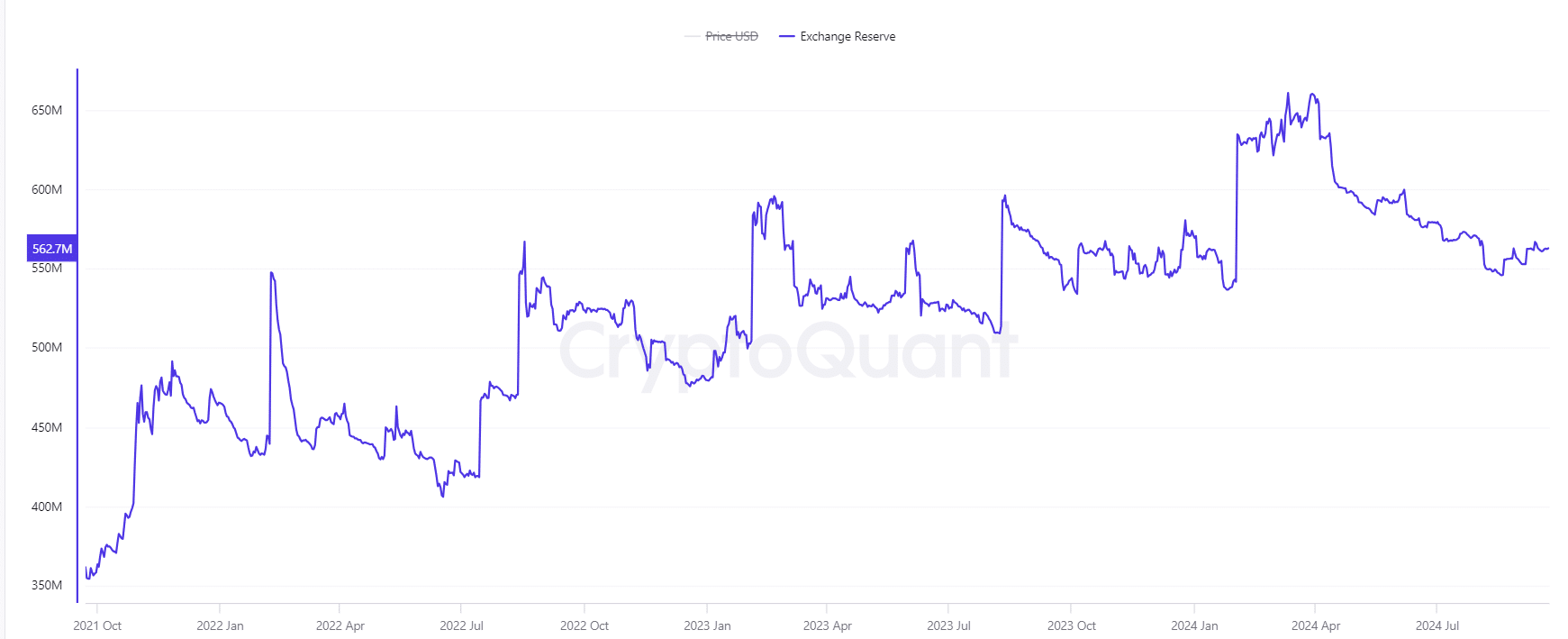

Exchange reserve analysis: What does it mean?

The exchange reserve for SAND currently holds 562.76 million tokens. A slight 0.02% decrease indicates a reduction in selling pressure.

Typically, when a country’s foreign currency reserves decrease (or the value of those reserves falls), it means there are fewer assets for sale. This could indicate that investors are keeping their assets, perhaps because they expect the value to increase in the future.

Therefore, this matches the upward breakout trend seen on the daily graph, increasing the probability of a future price surge.

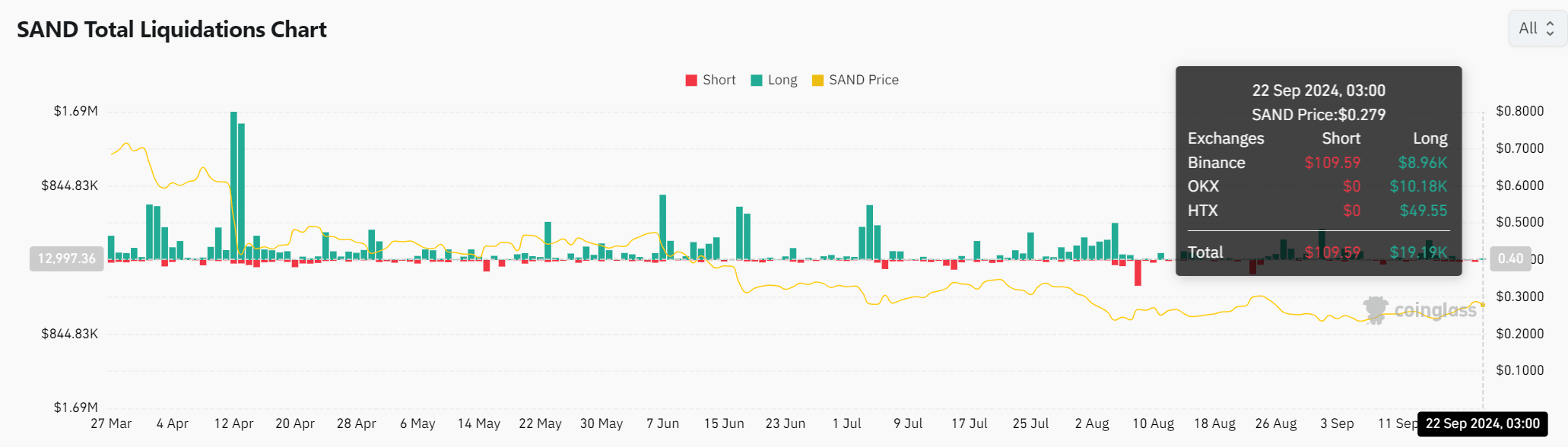

SAND liquidations: Can the bulls take over?

Market pressure is succinctly captured by the data on liquidations. Notably, the latest findings show a significant difference: a whopping $109,590 worth of short positions were liquidated versus only $19,190 in long positions.

This imbalance suggests that those who have been wagering on SAND to weaken are experiencing losses, since the value of the asset is increasing instead.

Currently, the price is approximately $0.279, and if the recent trend of liquidations continues, it could pave the way for more positive movement, possibly propelling SAND towards its predicted target of $0.31 or even higher.

Realistic or not, here’s SAND market cap in BTC’s terms

Will SAND hold its breakout?

As the number of transactions and active addresses grow, while exchange reserves decrease, it appears that the market setup for SAND is favorable for a prolonged price increase. Moreover, the liquidation data adds strength to a positive outlook, as long positions are consistently being forced out.

If SAND manages to breach its 100-day moving average, it might set a strong course towards substantial increases, with potential short-term goals at around $0.31 and $0.40.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-23 02:15