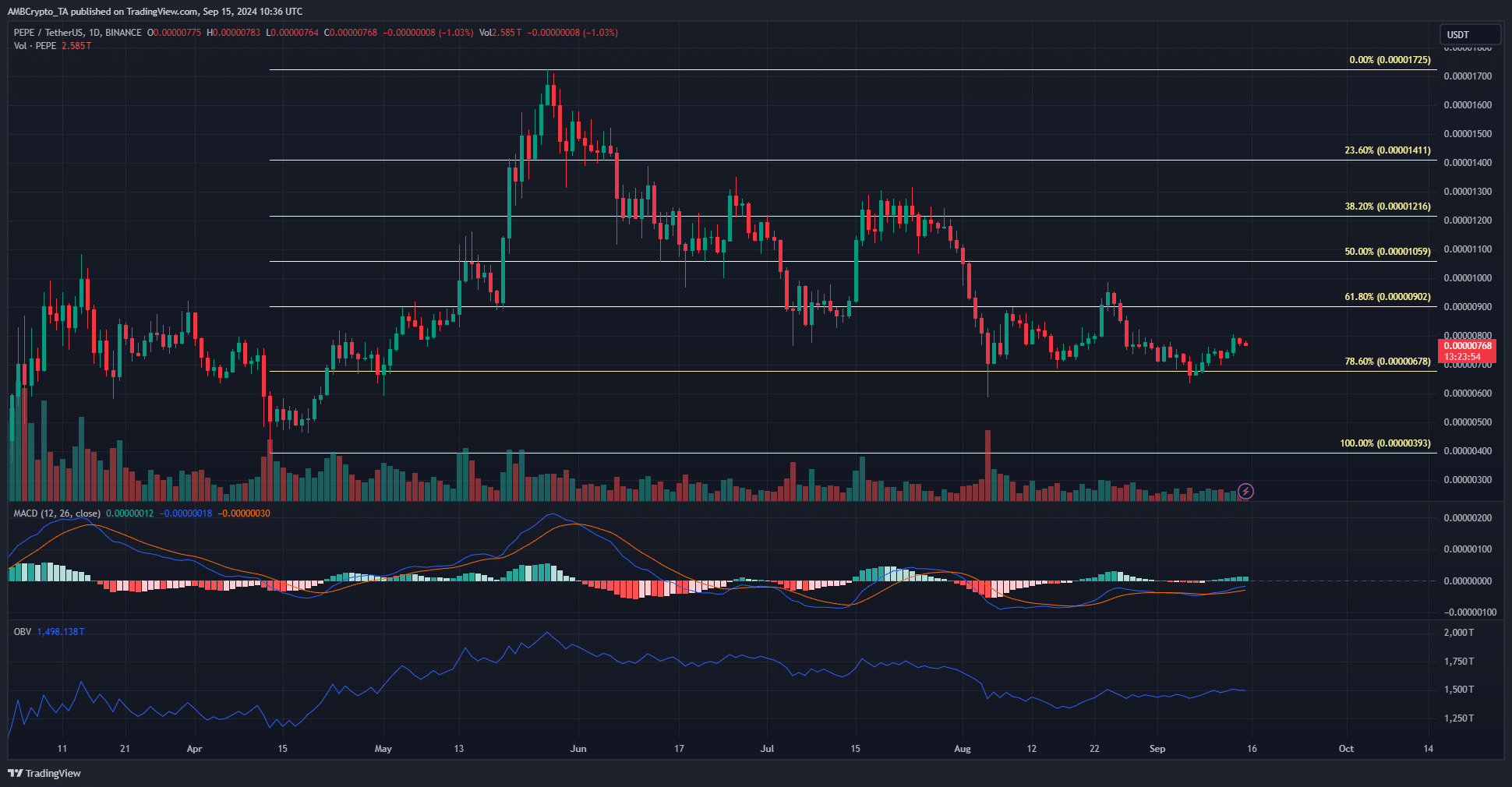

- Pepe bulls continued to defend the 78.6% retracement level.

- The lack of high buying volume meant the momentum was neutral and a strong rally was not yet in sight.

As a seasoned crypto investor with battle-scars from countless market fluctuations, I can’t help but feel a mix of anticipation and caution when it comes to Pepe [PEPE]. The bulls are doggedly defending the 78.6% retracement level, which is a positive sign, yet the lack of high buying volume suggests that momentum isn’t quite there yet for a strong rally.

Over the last few days, PEPE [PEPE] experienced a dip in its on-chain performance metrics, but managed to register short-term profits. The number of active addresses decreased significantly, and trading volume remained relatively low. Additionally, large investors (whales) appeared to be adopting a more cautious approach by moving towards the sidelines.

According to the price chart analysis, the crucial Fibonacci retracement point continues to serve as a support. As far as this support holds firm, fans of Pepe (crypto or meme) maintain their optimism.

Pepe volatility could distress swing positions

In simpler terms, the levels based on the Fibonacci sequence drawn from the April-May surge in prices remained significant. The 78.6% mark where prices should theoretically rebound was holding up well as a floor, even though minor fluctuations occurred temporarily.

This meant that swing traders could enter long positions during a retest of this retracement.

To handle brief price fluctuations at this point, it’s crucial to set their stop-loss orders accordingly. Additionally, the lack of significant momentum and buying activity during the last month indicates that the PEPE stock might be undergoing an accumulation period.

Closing the daily session under $0.000006 suggests that the ‘bears’ (those who believe prices will fall) are dominating the market. However, if we don’t reach this level yet, traders can continue to purchase more PEPE in anticipation of a market recovery.

The OBV has slowly trended higher since August, boosting the chances of a Pepe rally.

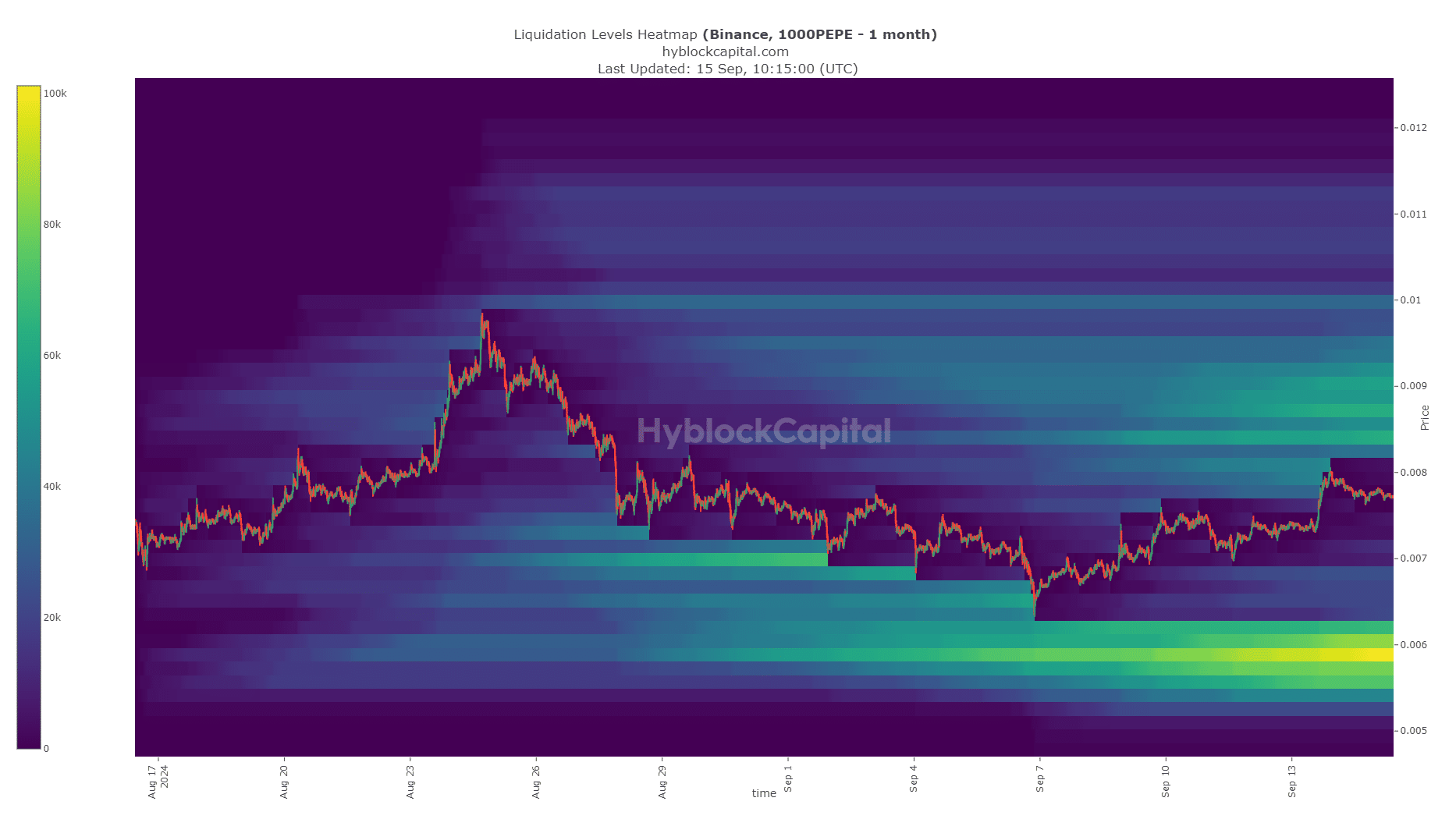

Will smart money try to shake people out of their positions?

Prices tend to gather around areas with high trading activity, known as liquidity pools, and AMBCrypto spotted one such cluster at the 0.000006 level. This price point was also the lowest that the meme token reached on August 5th.

Therefore, traders and investors need to be prepared for a quick downward slump.

At this point, it’s more probable than certain, given that not every source of liquidity has been proven reliable.

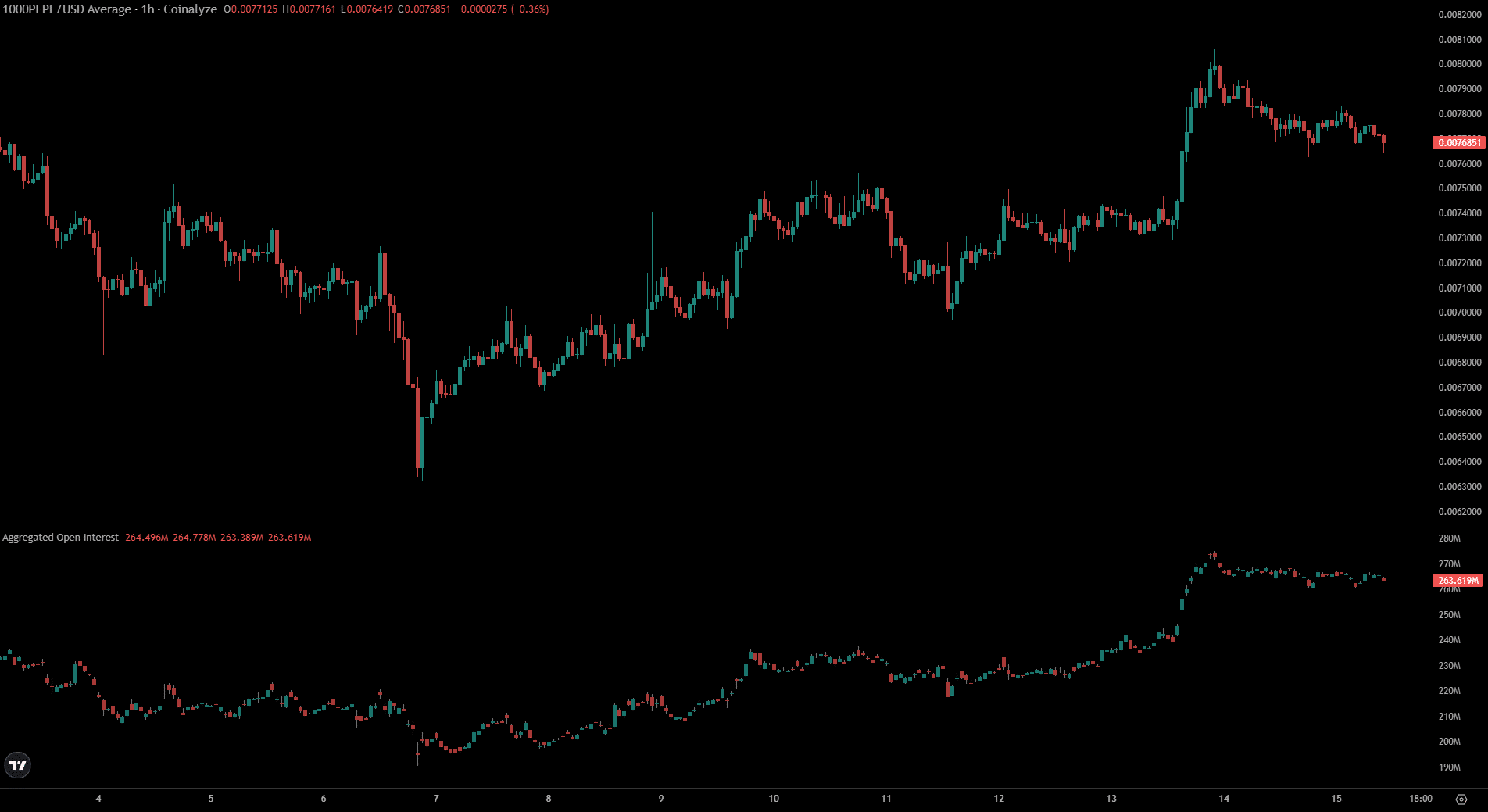

It seemed like investors were optimistic in the near future, as the market showed a bullish trend after the increases recorded on September 13th. Subsequently, the Open Interest surged from $235 million to $273 million.

Is your portfolio green? Check the Pepe Profit Calculator

As an analyst, I’ve noticed a surge of enthusiasm among speculators, with many expressing a strong desire to buy into PEPE, anticipating profits from its movement. This bullish sentiment persists even after a minor price dip, as the Open Interest (OI) hasn’t dropped substantially. This suggests that those holding long positions remain optimistic about potential further gains.

This might hurt them in the coming days in case of a sharp Bitcoin [BTC] correction.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-16 02:15