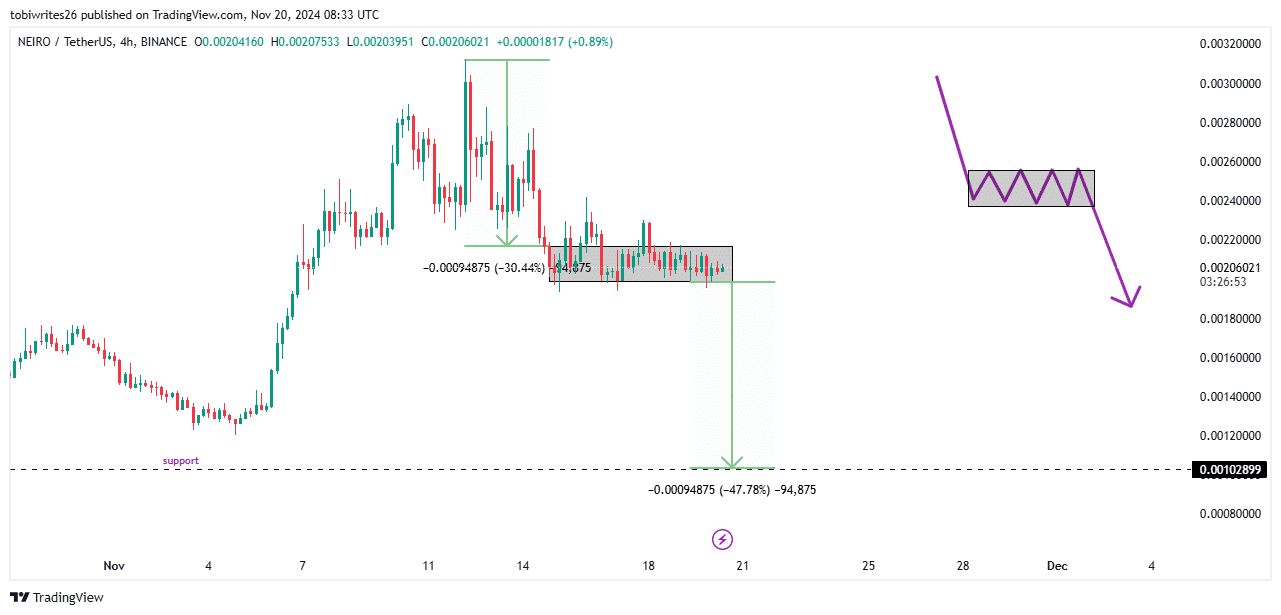

- After a significant price drop, the token entered a consolidation phase

- Market sentiment turned increasingly bearish, with many traders actively selling NEIRO

As a seasoned crypto investor who has weathered numerous market cycles, I find myself standing at the precipice of another potential storm with NEIRO. After witnessing its impressive rally during October, the recent 13.73% drop and subsequent consolidation phase is concerning. The charts suggest that we might be on the verge of a significant decline, potentially erasing all November gains if the current bearish pattern unfolds.

For the last seven days, NEIRO has encountered some challenging moments as its value dipped by 13.73%. However, it quickly rebounded with a 1.33% increase, currently moving in an accumulation stage on the charts.

As reported by AMBCrypto, the current downtrend for NEIRO may align with the wider market’s recent price drop, indicating a potential increase in downward pressure on NEIRO in the near future.

NEIRO trades within a classic bearish pattern

Currently, NEIRO appears to be exhibiting a common bearish trend. This involves an initial drop in price, followed by a period of stabilization or consolidation, and finally another potential decrease. After experiencing a dip in value as shown on the charts, the altcoin has seemed to pause for a moment before potentially continuing its downward trajectory.

Following the consolidation period, it’s anticipated that NEIRO might experience a substantial decrease, similar in magnitude to its initial drop but possibly dropping by approximately 47.78%. This decline could lower its price to the crucial support point at 0.000102899.

As an analyst, I noticed that NEIRO last transacted at a similar price point during a significant surge in October. Should the current situation persist, it’s possible that NEIRO could wipe out all the positive movements it made in November.

At the time of writing, the altcoin had accrued gains of 11.86% over the month.

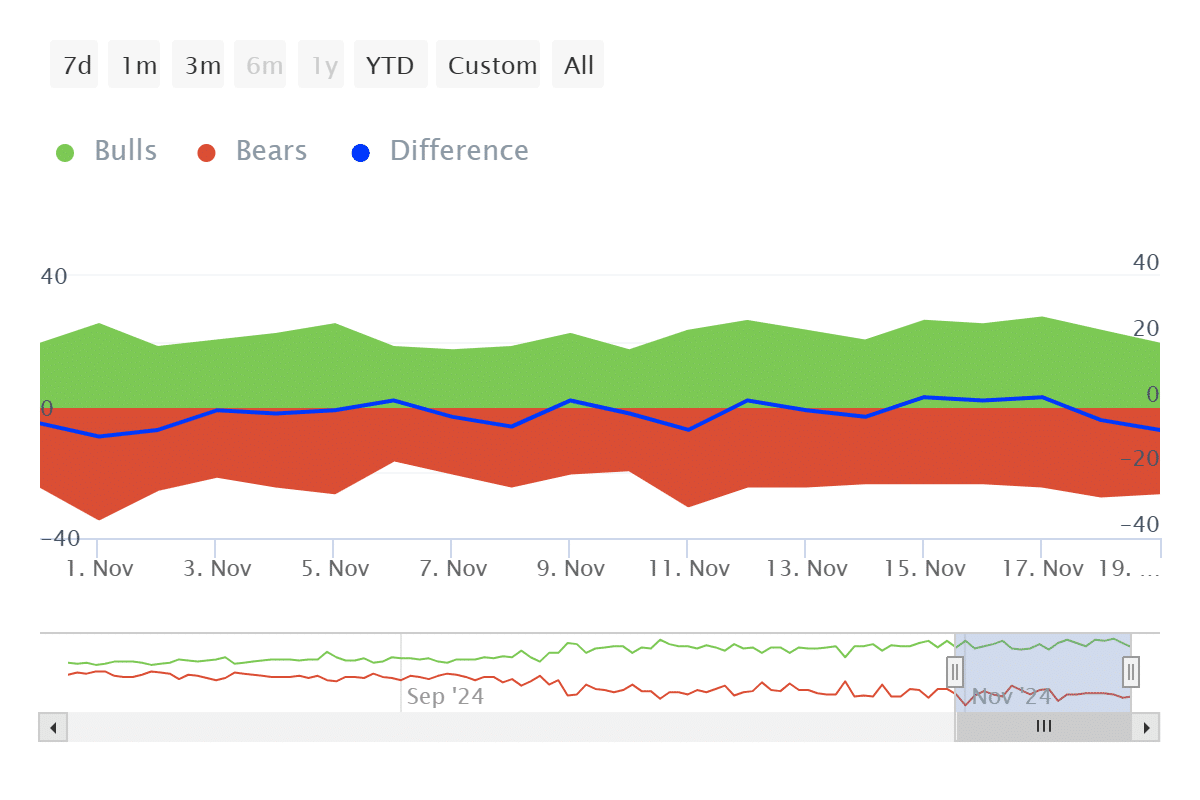

Bears take over as participants sell for profit

According to data from IntoTheBlock, there appears to be a shift in market trends towards bearish sentiment. In the past week, the count of sellers (bears) has increased to 70, whereas buyers (bulls) have stayed steady at 63.

As a researcher, I’ve been examining the market dynamics using IntoTheBlock’s unique indicator. This tool assesses the dominance between bulls and bears by identifying entities transacting more than 1% of the total trading volume. Recently, my analysis has shown that the bears have been in control, suggesting a significant increase in selling activity.

As a researcher observing the Neiro cryptocurrency, I noticed an interesting trend: The total number of addresses holding Neiro increased while its price was declining. This implies that although they continued to hold the asset, many of these addresses have likely been gradually offloading their holdings, thereby exerting downward pressure on the market and contributing to the overall price decrease.

If these trends persist, NEIRO may soon break out of its consolidation phase and decline further.

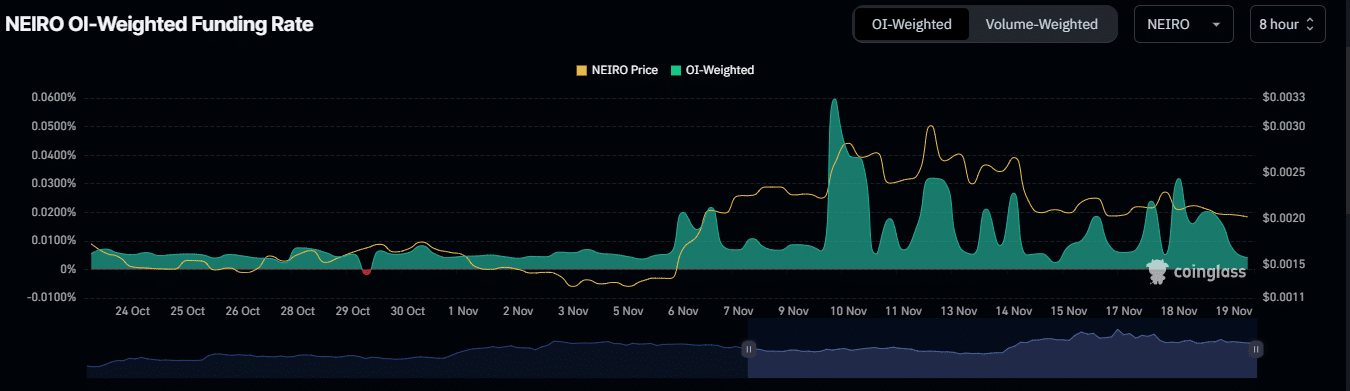

Weighted sentiment drops, pushing buyers out

In summary, the data from Coinglass showed a decrease in the OI-weighted funding rate to 0.041%, as displayed on the 8-hour graph.

In simple terms, the OI-adjusted funding rate alters the cost for holding open positions in perpetual futures contracts according to the balance of Open Interest (OI) between buyers (long positions) and sellers (short positions).

In this specific scenario, a decrease in the funding rate signaled a change in market attitude becoming more pessimistic, or bearish. Essentially, it suggested that the market was causing more sellers to enter and fewer buyers to stay, thereby giving sellers an edge in the current circumstances.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-11-21 01:43