-

There has been a significant shift in Solana’s demand dynamics

May be worth assessing the correlation between SOL’s demand and Solana’s stablecoin marketcap

As a seasoned researcher who has navigated through the crypto wilderness for years, I can’t help but notice the intriguing dynamics at play with Solana (SOL). The shift in SOL’s demand dynamics is as conspicuous as a neon sign in a dark alley.

Is there a connection between the Solana ecosystem and Solana (SOL) failing to regain its position above $200? Despite exhibiting significant demand during the first half of 2024, which helped it rebound swiftly after each dip, SOL’s current performance has not shown similar resilience.

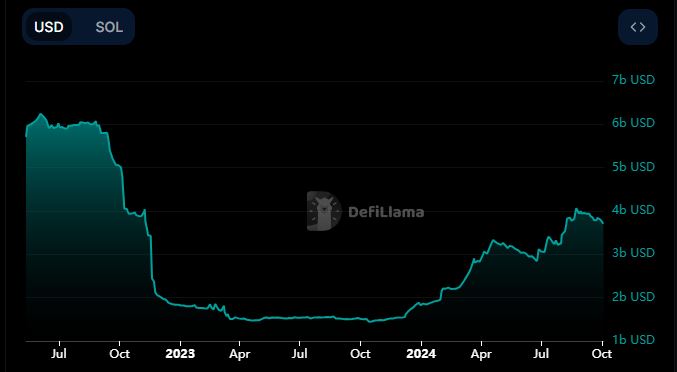

Over the past three months, Solana experienced less resilience in recovering from downturns, which is consistent with certain observations of its network. Notably, the growth in Solana’s market capitalization this year appears to show a striking relationship with the changes in SOL‘s price trends.

In the final week of August, the market capitalization of Solana’s stablecoin momentarily surpassed $4 billion. Yet, it has since experienced substantial withdrawals and currently stands at approximately $3.72 billion. The most recent comparable dip occurred from mid-April to the end of June.

During the span between April and June, the value of the cryptocurrency had difficulty rebounding to reach $200. Additionally, its recent attempts at a bullish trend showed a lack of strong push.

Is Solana network activity slowing down?

The value of Solana’s stablecoin has experienced rapid expansion during periods when market demand has spiked significantly. This growth was primarily fueled by a robust interest in memecoins at the beginning of 2024 for Solana. However, the excitement surrounding memecoins appears to have diminished noticeably, particularly since June.

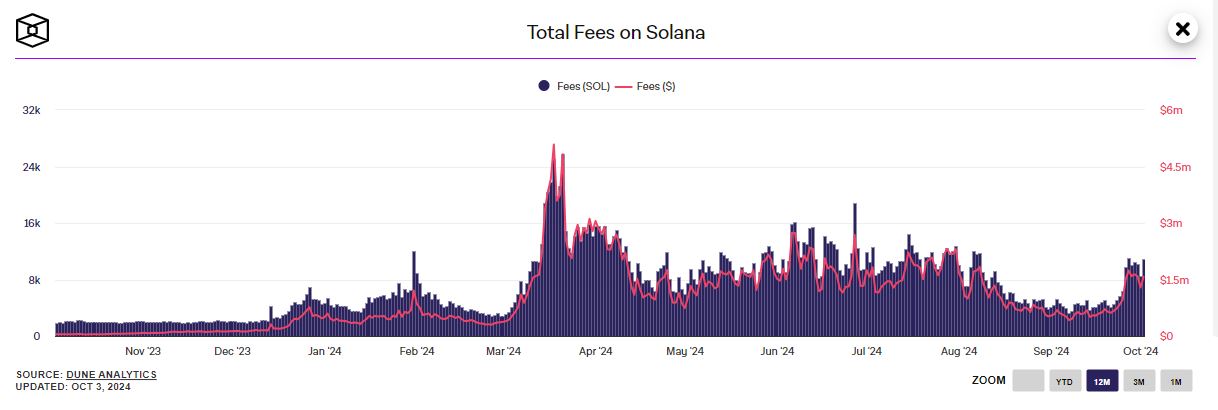

Monitoring a decrease in network activity can be better accomplished by focusing on network transaction fees. Notably, Solana’s transaction fees peaked in March, corresponding with when both network demand and utility levels were also at their height.

The fees for using the network were connected to the value of SOL, which itself could change due to market demand. As a result, these fees might not always give an exact measure of the network’s performance. On the other hand, the market capitalization of Solana’s stablecoin seems to be more closely related to on-chain transactions.

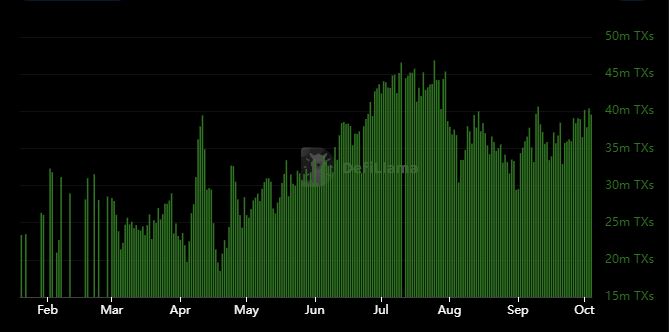

As an analyst, I’ve noticed an interesting pattern in the transaction data. Initially, there was a significant spike in April that marked a high point. After this, we saw a decline, only to experience another peak in July at a higher level. Since then, the number of transactions has been decreasing, indicating a slowdown in network activity, which suggests a potential reduction in its utility.

From the data presented, it appears that the network’s demand has shown signs of decrease, particularly over the past three months. This decline seems to have weakened the organic demand that previously bolstered the value of SOL during the first six months of the year.

This may be the reason why SOL does not seem to bounce back as strong as it used to.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-05 14:15